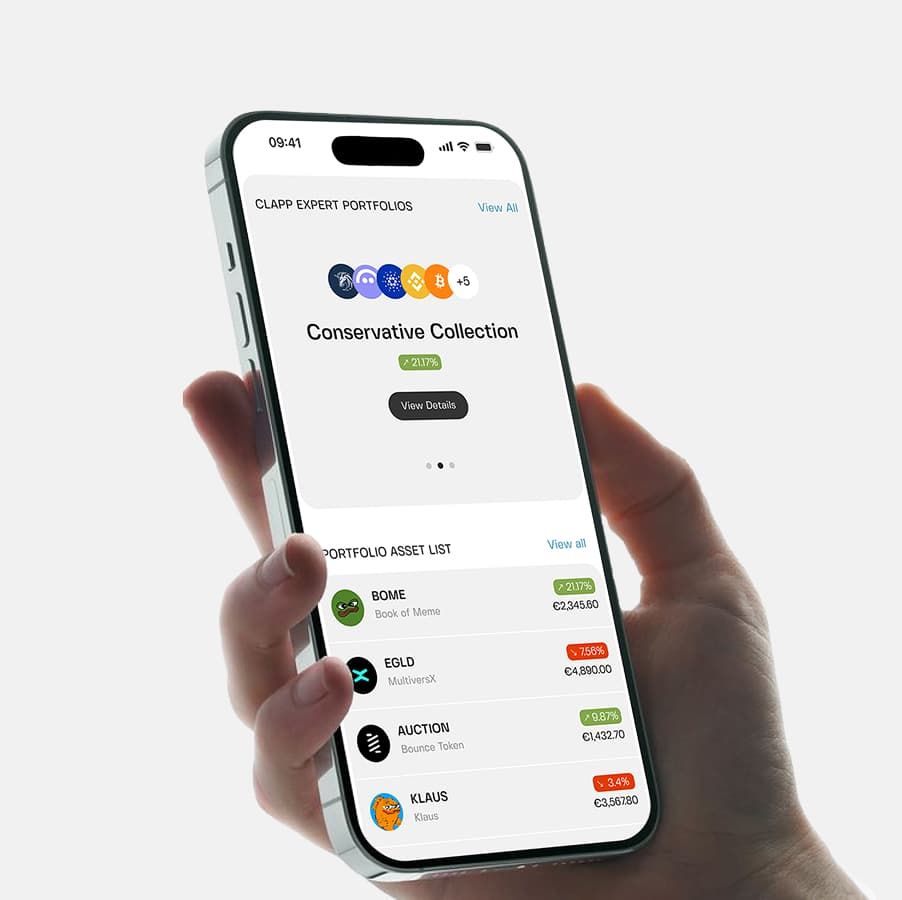

Speed Up Results

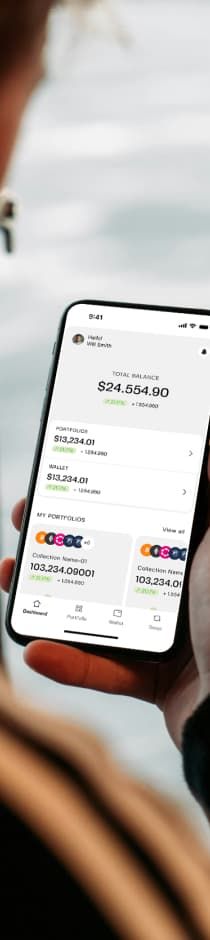

Why wait? Build your crypto portfolio in a snap! Forget about slow, complicated processes. All you need is your Clapp account for instant, seamless investing.

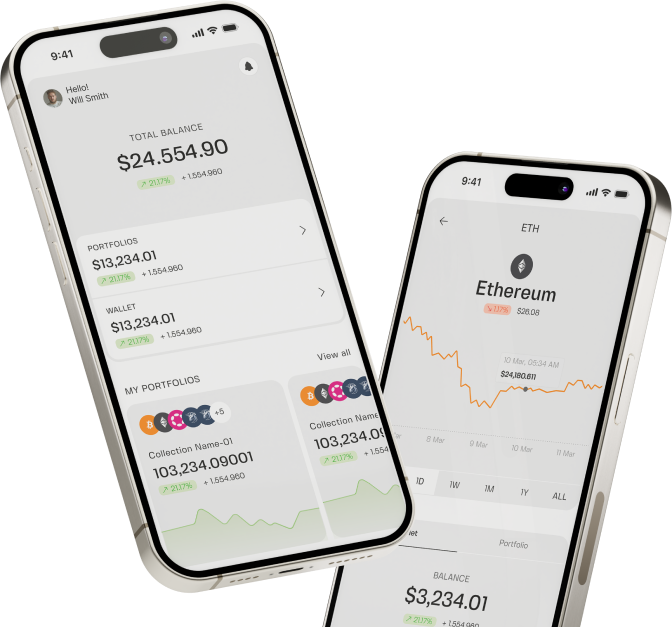

Manage All Crypto

Whether you're a newbie or a pro, Clapp offers unmatched speed and ease. With just one Clapp account, you can manage and grow your digital assets without hassle. Everything you need, right at your fingertips.

Exchange Instantly, Invest Smarter

No more waiting around — Clapp is your shortcut to smarter investments. We empower you to act fast in the fast-moving crypto world. Swiftly build and adjust your portfolio whenever the market moves.