Beyond the hype: Realistic guide to meme coin investing

Meme coins are high-risk, high-reward cryptocurrencies inspired by memes, viral trends, and celebrities. Despite their playful origins, some reach billion-dollar valuations — yet investors should proceed with caution. Below, we explore the pros and cons of adding such tokens to your portfolio.

What are meme coins?

Meme coins (or memecoins) are cryptocurrencies with a light-hearted appeal, typically launched as a joke or as a representation of cultural trends, animals, and internet memes. Their value is largely driven by community enthusiasm, without any specific intrinsic utility.

Meme coins thrive on speculation and social media hype. This makes them dramatically different from Bitcoin, which emerged as digital money, or ether, which powers decentralized applications (dApps).

On the surface, these digital assets may seem fundamentally useless. Yet their market caps can grow to billions of dollars, with millions of users inspired by the underlying vision. Community spirit is the key driver of value — which is why meme coins live and die by it and require extra caution from investors.

Who launches meme coins?

Today, thanks to the availability of technical tools, anyone can launch a token with zero technical skills. Aside from potential financial returns, projects may create these cryptocurrencies to build communities, test blockchain development skills, conduct marketing campaigns for brands, or experiment with tokenomics.

Meme coin generators like the Solana-based Pump.fun simplify token creation. No profound knowledge of smart contracts, liquidity setups, or even blockchain infrastructure is required — users only need a token name, image, and symbol. With one click, a new meme coin is minted and ready for launch.

Where to trade meme coins

Typically, meme coins emerge outside of centralized exchanges. It is only after gaining substantial community traction that they are finally listed. The most common blockchains are Ethereum and Solana, with decentralized exchanges like Uniswap and Jupiter taking center stage in their promotion.

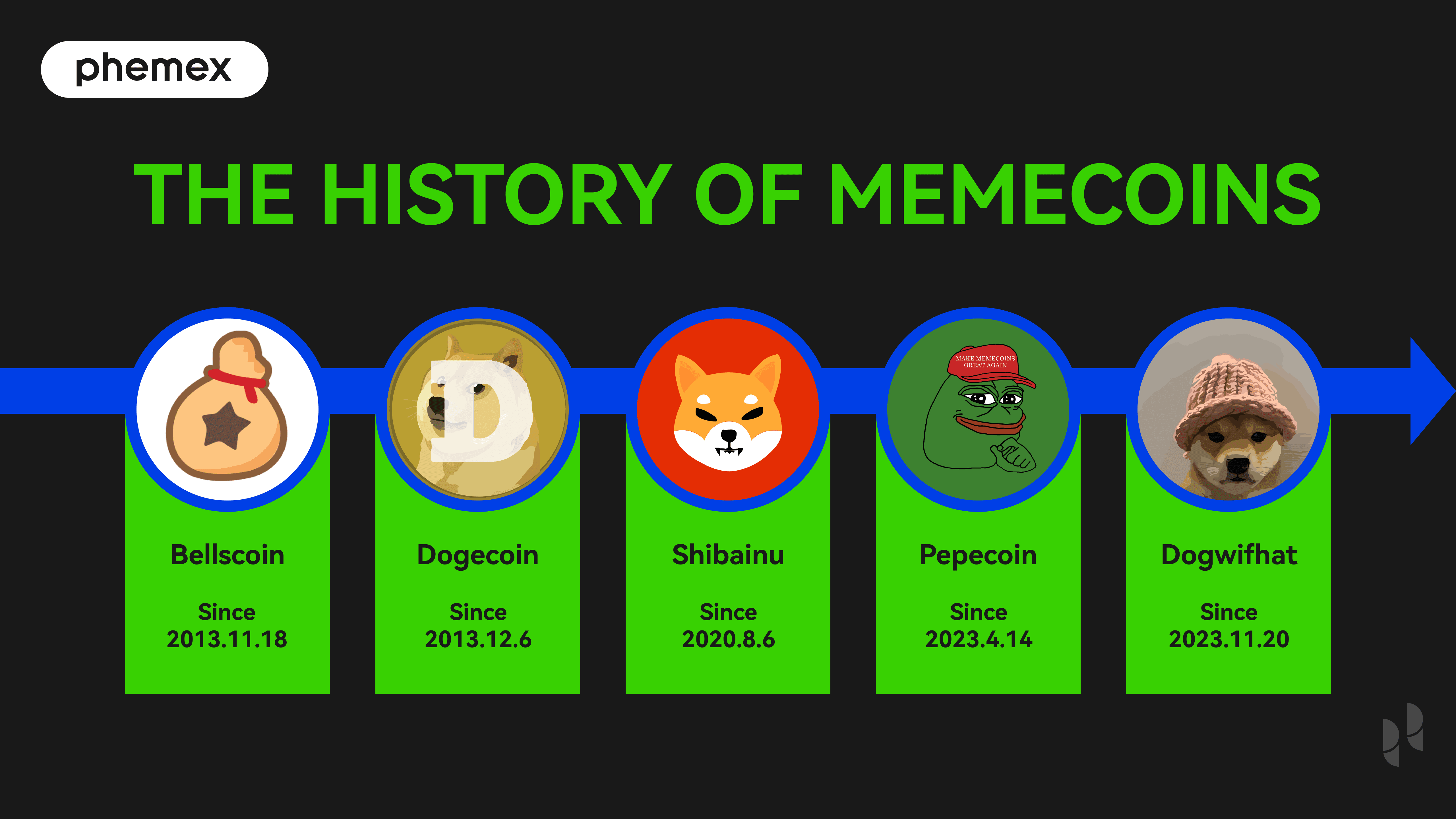

Examples of popular meme coins

Meme coins come in all shapes and sizes, from dog-themed tokens to satirical takes on finance. Below are some of the most well-known examples, each with its own unique backstory and community-driven appeal.

Dogecoin (DOGE)

The first popular meme coin, created in 2013 as a fun alternative to Bitcoin (BTC) and inspired by the “Doge” Shiba Inu dog meme. Today, it is gaining traction as a means for tipping, microtransactions, and real-world payments.

Shiba Inu (SHIB)

Emerged as a playful response to DOGE, using the same dog breed as a mascot. Use cases include NFTs, the Layer-2 Shibarium blockchain network, and an upcoming metaverse.

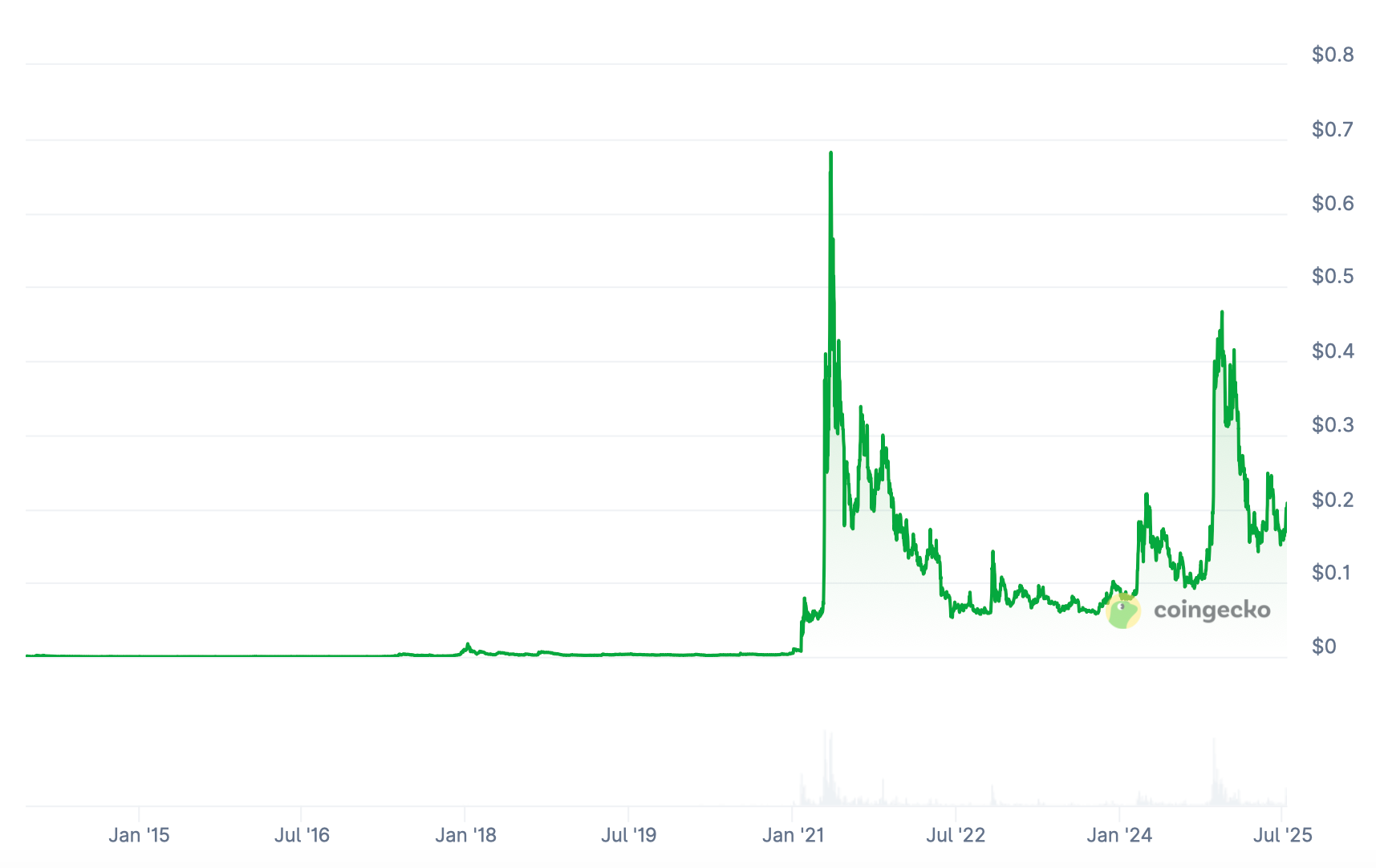

Pepe (PEPE)

Inspired by the popular internet meme Pepe the Frog, this token functions as a cultural symbol for meme fans, with its value largely driven by community interest. PEPE remains a speculative asset without real-world utility.

Bonk (BONK)

A community-driven coin with a significant portion of its initial supply airdropped to Solana users. Inspired by other dog-themed tokens, it is now integrated into DeFi platforms, NFT marketplaces, and other Solana-based applications.

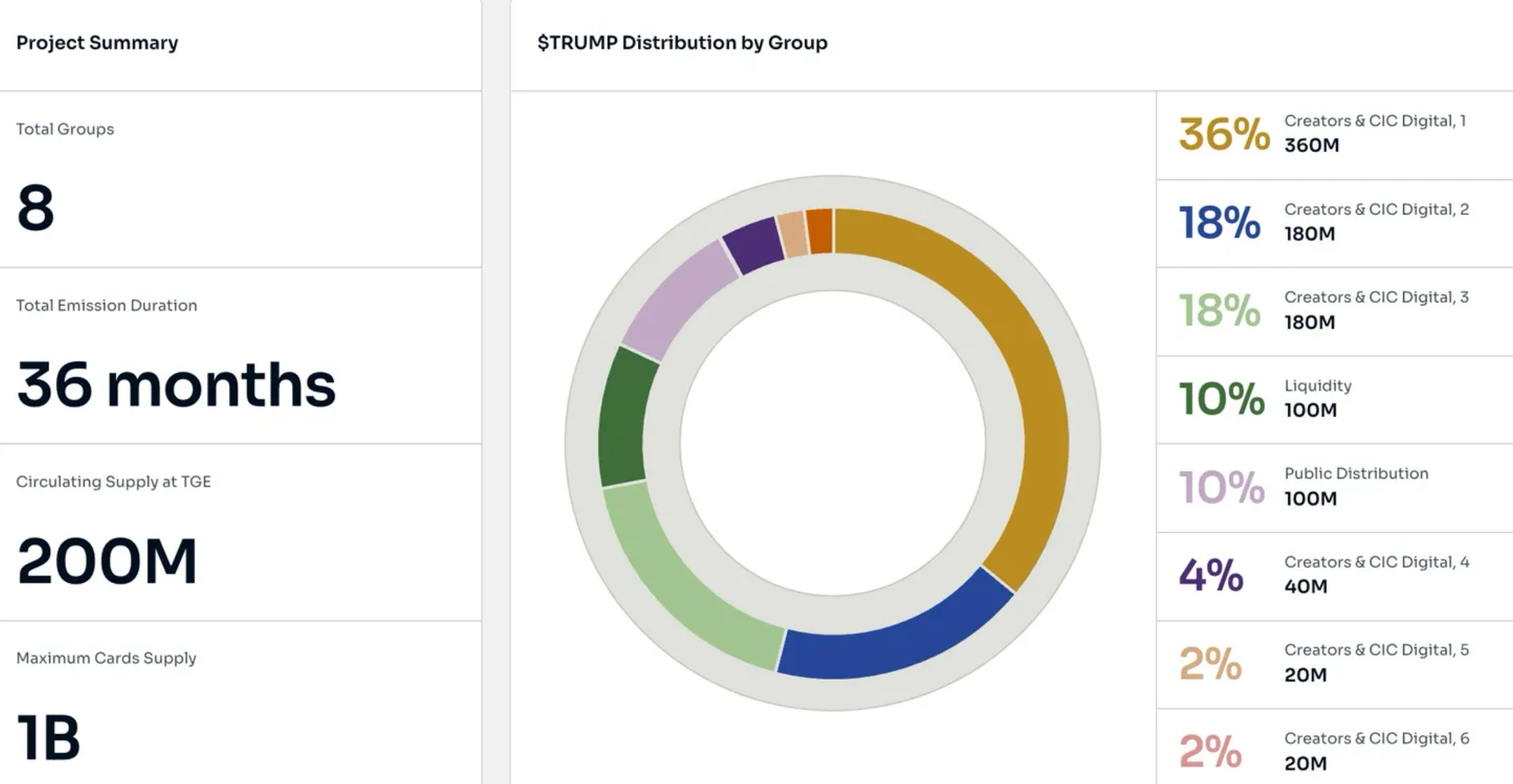

Official Trump (TRUMP)

A token associated with former US President Donald Trump, lacking inherent use cases. Of the 1 billion coins originally created, 800 million are held by Trump-affiliated companies, and 200 million were sold in an ICO in January 2025.

SPX6900 (SPX)

A satirical token playfully aiming to "overtake" the S&P 500 index. While it references traditional stocks with humor, it serves no practical purpose beyond trading.

Vetting a meme coin before buying

Always conduct your own research (DYOR). Beware of social media hype fueling FOMO (fear of missing out). Use tools like DexScreener or Birdeye to analyze key metrics before investing. Pay attention to the following factors:

- Token creators. Avoid projects with anonymous founders. Legitimate teams are usually transparent and have active developers.

- Tokenomics. Be cautious of tokens with excessive supply (e.g., trillions of coins), as this can lead to rapid value dilution.

- Utility. While meme coins don’t need strong fundamentals, healthier projects offer additional features like staking, community rewards, or real-world integrations.

- Liquidity pool (LP) mechanics. Check if LP tokens have been burned or locked. Unlocked liquidity is a red flag — developers could drain funds abruptly.

- Holder distribution. Avoid tokens where a single entity holds a majority of the supply, as large sell-offs can crash prices.

- Community engagement. Look for organic discussions (X, Telegram, Discord) rather than bot-driven hype.

Understanding popularity drivers

For meme coins, social media is the primary marketing engine. Their value depends on the meme’s virality and the strength of its community.

Projects often rely on platforms like X, TikTok, and Reddit to spread hype. To gauge a coin’s potential, engage with its community and assess sentiment.

Managing risks in meme coin trading

Lack of utility makes meme coins prime targets for scams. Even experienced traders can fall victim to manipulation or sudden crashes.

Focus on CEX listings

Rug pulls, exploits, and liquidity drains are major risks. Centralized exchanges (CEXs) offer some protection, as they vet projects before listing.

Therefore, stick to meme coins with higher market caps and listings on reputable CEXs (e.g., Binance, Coinbase), but remember — even listed coins can crash unexpectedly.

What is a rug pull?

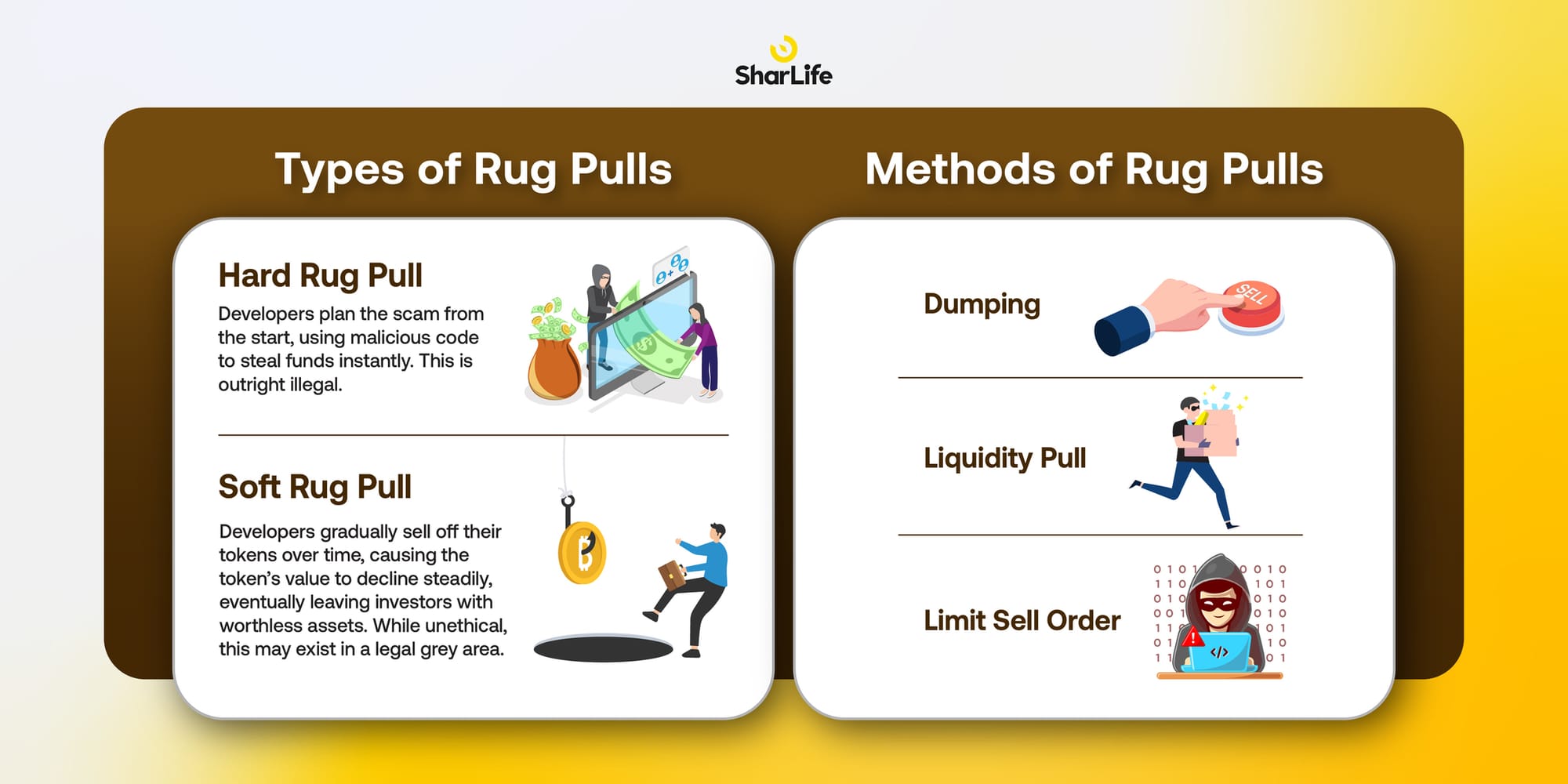

A rug pull occurs when developers abandon a project after stealing investors’ funds, leaving tokens worthless. Common types include:

- Liquidity pulls (removing pooled funds)

- Pump-and-dump schemes (artificially inflating prices)

- Team exits (developers suddenly selling holdings)

To avoid rug pulls, research the team, check for audits, and monitor community trust.

Tips for successful meme coin trading

Meme coins are far more volatile than large-cap cryptos like Bitcoin or ether. Follow these guidelines:

- Accept total loss risk. Volatility and lack of utility makes meme coin investment particularly risky. Your assets can drop to zero overnight.

- Treat them as entertainment. Invest for fun, not long-term gains. One cannot plan their long-term financial future based on high-right/high-reward bets.

- Diversify your holdings. Allocate only a small portion of your portfolio to meme coins while spreading the overall investment across different crypto sectors.

- Think short-term. These are speculative trades for potential quick gains, not investments.

- Ignore hype. Avoid FOMO-driven buys and always verify trends.

Optimal portfolio allocation

Never invest more than you can afford to lose. Experts recommend 1-5% of your portfolio for meme coins, but those with low risk tolerance should allocate <1% or avoid them entirely.

Wrapping up: Navigate meme coins with caution

Meme coins represent one of the most volatile yet fascinating corners of the crypto market. While their viral nature can lead to explosive gains, their lack of intrinsic value also makes them highly susceptible to scams and sudden crashes.

For those willing to take the plunge, cautiousness is key — scrutinizing tokenomics, liquidity security, and community authenticity instead of blind hype-chasing. Yet even with established track records, reputable exchange listings, and organic communities, risk is high, so treat meme coins as speculative bets, not foundational investments.