From stocks to meme coins: Guide to internet capital markets (ICMs)

In traditional capital markets, businesses issue stocks to raise funding or promote their products and services. Now, they leverage blockchain to launch meme coins instead — faster, easier, and without intermediaries. Here’s our deep dive into these peculiar digital-native instruments.

What are ICMs and corporate meme coins?

The advent of corporate meme coins marks the era of Internet Capital Markets (ICM). While controversial and unregulated, they have already seen asset valuations skyrocket. For instance, the market cap of Vine Coin — issued by the old-school video platform Vine — peaked at over $400 million in January 2025.

Traditional markets have existed for decades, allowing investors to become stockholders and reap rewards in the form of dividends — or sell their shares at a profit. ICMs move this process on-chain, replacing equity with tokens and relying on rising valuations for profit.

The most striking difference is utility. Corporate meme coins typically lack it entirely, acting as purely speculative assets driven by hype. In contrast, equity represents a share of a business, often offering specific privileges or dividend returns.

Meme coins offer a globally accessible alternative to stocks, bonds, and commodities. According to Pump.fun co-founder Alon Cohen, this new space is “one of the most significant and original meta-narratives in crypto… representing the ability to efficiently crowdsource liquidity on decentralized rails.”

How it all started

AI projects first leveraged token hype in 2024, with many launching cryptocurrencies for funding. High-profile businesses adopted meme coins when Solana’s launchpad Pump.fun rose to prominence.

Vine’s Vine Coin (VINE), launched on Pump.fun in January 2025, saw its market cap approach half a billion US dollars on day one. A follow-up waitlist fueled relaunch rumors, drawing more attention to the TikTok predecessor.

Even Elon Musk hinted at “looking into” reviving Vine’s defunct app — later acquired by xAI. The VINE token’s price more than doubled on the news.

Yet, the meme coin that sparked all this hype has delivered zero utility. At press time, its price is down 92.5% from its all-time high.

Vine’s token pioneered ICMs, sparking a wave of similar launches early this year. Since then, competitors like the Believe app have tailored their offerings to ICMs.

Launched in May 2025, Believe revived the trend, with valuations fluctuating wildly:

- Product-finding tool Dupe’s token (DUPE) hit a $79 million market cap before dropping 78% to $17 million ($18.5 million at press time).

- AI social media assistant Creator Buddy (BUDDY) peaked at $23.5 million — then fell 76%. It currently stands at $1.79 million (self-reported).

- No-code Web3 builder Uber.fun (UBER) reached $13.7 million — before sinking 99% from its ATH. CoinGecko currently defines it as a low-liquidity pool.

Challenges of TradFi fundraising

Building a capital-intensive business requires connections, resources, and lengthy processes. Startups typically turn to venture capitalists (VCs), who take equity in exchange for funding. Finding a VC can be difficult and slow, especially without industry connections.

Traditional early-stage funding is also constrained by local regulations. In the U.S., only accredited investors can fund a company pre-IPO. Meanwhile, ICMs let anyone launch tokens for a global audience — from amateurs to professionals. As a result, internet-native projects leverage crypto for new opportunities.

Launching tokens on ICMs

ICM platforms integrate with social media to simplify token issuance. For example, X.com users can launch a token just by posting in a specific format. Deployment is automatic, with a bot handling the on-chain process.

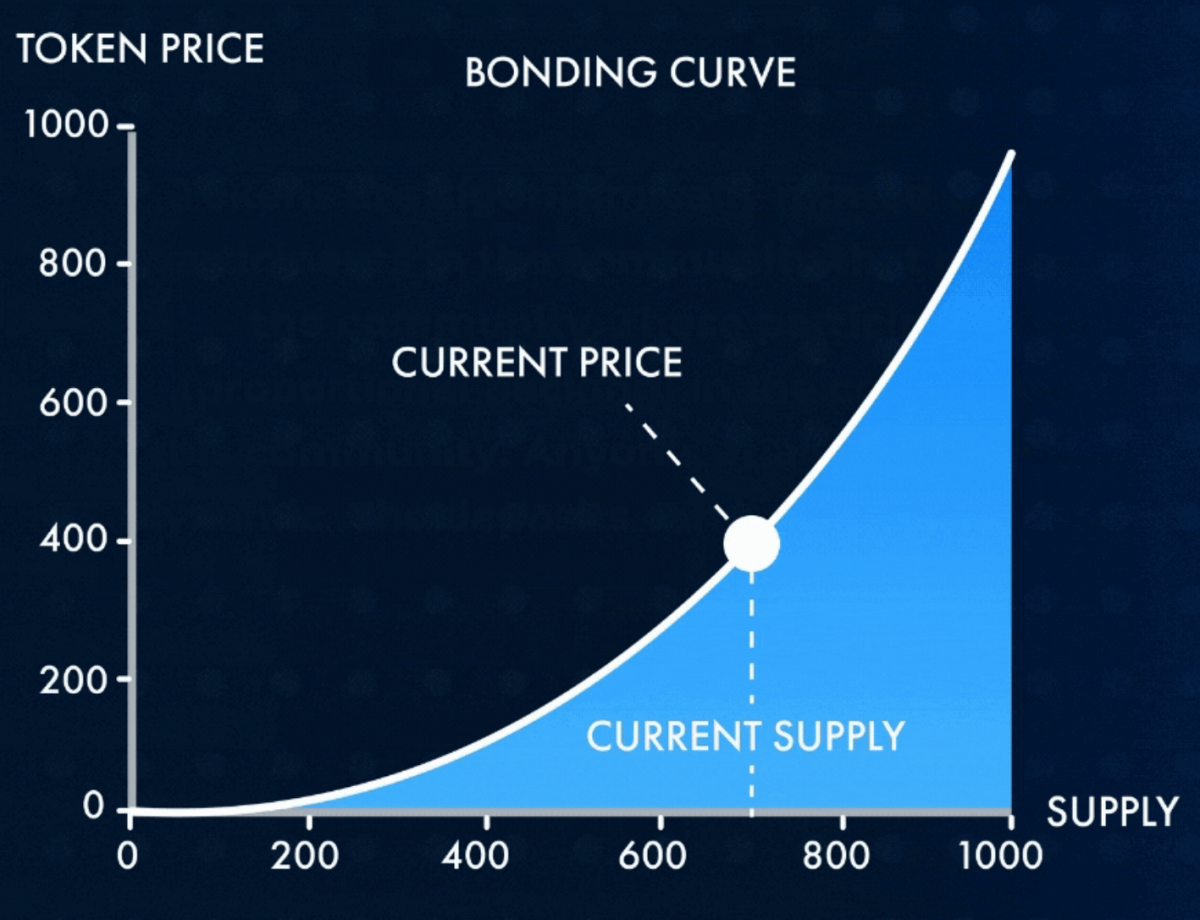

A bonding curve adjusts the initial price depending on supply — creating a direct correlation to ensure demand-based stability. Initially, the token supply is capped, and fees are high to encourage value growth and deter pump-and-dump schemes. Reaching market cap milestones unlocks visibility boosts and issuer rewards.

This lets projects raise funds quickly, while users can trade tokens on-chain—mirroring stocks or bonds in traditional finance (TradFi).

Benefits of ICMs

ICMs are open marketplaces on public blockchains, offering:

- Broader investor access, no gatekeeping.

- Fast, automatic token generation.

- 24/7 trading for instant demand response.

- Quick concept validation to test market fit.

- Low-tech launches (just a social media post).

- Internet-native design for viral potential.

ICM risks: Legal concerns

Currently, meme coins operate in an unregulated space — leaving investors without legal protections provided for securities. However, some could be seen as securities offerings, so businesses must seek legal advice.

A meme coin that functions like a capital raise might qualify as an investment contract under the Howey Test (used by the SEC). Skeptics view ICMs as a rebranded version of ICOs — the 2017 boom where 86% of projects crashed below listing price, and 30% collapsed entirely.

Post-ICO, the SEC cracked down on alleged securities violations, like suing Dragonchain ($16.5M in unregistered DRGN tokens) and Coinbase (unregistered staking program). Both cases were later dismissed.

However, the second Trump administration has shifted US crypto policy. The President’s family has even issued meme coins (TRUMP and MELANIA), suggesting a more favorable regulatory climate.

A February 2025 SEC memo softened its stance, stating meme coins “may not be securities.” The document reads:

“It is the division’s view that transactions in these meme coins do not involve the offer and sale of securities under federal law.”

SEC crypto task force head Hester Peirce (“Crypto Mom”) has told Bloomberg meme coins likely fall outside the SEC’s scope, signaling a more blockchain-friendly approach under Trump.

Why meme coins crash and burn

Meme coins represent subcultures, public figures, and more. They thrive on fun, internet jokes, and community interaction. This light-hearted appeal can onboard substantial numbers of new users — and some have kept their audience engaged for years (like Shiba Inu (SHIB), Bonk (BONK), or Dogecoin (DOGE).

However, most memecoin successes are short-lived. They flare up and burn out quickly, soaring to millions before crashing.

Meme coins beyond funding

Sometimes, meme coins are merely used as a marketing ploy that complements other funding strategies.

- JellyJelly’s token is for tipping creators — not sales. The app gained 10,000 signups on the JELLYJELLY launch day, with the meme coin reaching a $248.5 million market cap.

- Neiry Lab secured VC funding first, then used a meme coin (PYTHIA) to promote its rat experiment on social media — and traders pumped it.

Should you add meme coins to your crypto portfolio?

Meme coins occupy a unique — and polarizing — space in crypto, with explosive growth potential combined with a lack of intrinsic value. Extreme volatility makes them a high-risk gamble. Investopedia likens meme coins to "gambling and entertainment" — their prices are driven by hype, social trends, and celebrity endorsements rather than fundamentals like utility or revenue streams.

That said, investors who can stomach wild swings allocate a modest portion (5–10%) of their portfolio to meme coins, treating them like lottery tickets rather than long-term holdings. They should never replace core assets like Bitcoin or ether, given their susceptibility to scams (e.g., rug pulls accounted for over $500M in losses in 2024) and dependency on fleeting internet trends.

Wrapping up

ICMs offer a global, fast, and flexible alternative to traditional markets, cutting out gatekeepers and red tape. But this nascent space lacks the safeguards of established systems. You don’t need to be a VC to invest — but scams and abandoned projects are common risks. Without regulation, due diligence is essential.