Clapp Weekly: ETF boost, TON's visa debacle, Ripple's banking bid

BTC price

BTC is trading range-bound near its all-time highs as the market awaits new catalysts — while TradFi assets recoil from renewed tariff tensions. Thin holiday liquidity and an $8 billion transfer from a Satoshi-era wallet did not suppress momentum.

Rocketing from under $106k, BTC topped out at $110,307 last Thursday, July 3. The next day's dip to $107,475 preceded weekend fluctuations around $108k, culminating in a rally pushing the price to $109k on Monday, July 7. Yesterday, BTC dipped below $108k and rebounded.

Currently at $108,481, BTC has gained 0.7% over the past 24 hours and 2.5% over the past week.

ETH price

The SEC’s acknowledgment of a Truth Social BTC and ETH ETF has boosted sentiment, while existing ETFs attracted $226 million last week. Ether “mega whales” have ramped up holdings by over 9% — at a rate higher than the pre-95% rally of 2022 — suggesting upside expectations.

Echoing BTC’s trajectory, ETH shot up from under $2.5K to $2,627.75 last Thursday, July 3, before plunging to $2,482.40 the next day. Gaining strength last Sunday, July 6, the price peaked at $2,587.74 and bounced back, breaching $2.6K last night.

Currently at $2,596.78, ETH is up 2.5% over the past 24 hours with a 7.4% 7-day gain.

Seven-day altcoin dynamics

While Bitcoin trades near its all-time high (ATH), capital flows are concentrated into large-cap tokens and meme coins, with mid-tier momentum fading. Crypto has largely defied the TradFi downturn — Trump’s new tariff threats in warning letters to 14 countries pushed stocks into the red on Monday.

CoinDesk suggests investors could be “discounting the market noise” or regarding BTC as increasingly separated from global policy risks. However, a surge in Japan’s 30-year government bond yield is a warning sign, as it could trigger financial tightening.

Earlier, crypto followed BTC upward after Elon Musk announced the launch of his Bitcoin-friendly “America Party.” The tech tycoon also called fiat hopeless, expressing frustration with Trump’s “Big, Beautiful Bill,” set to lift the US debt ceiling by as much as $4 trillion.

Another positive driver is Donald Trump’s plan to launch the Crypto Blue Chip ETF through his media company, Truth Social. Trump Media and Technology Group (TMTG) has filed paperwork with the SEC for approval of the product, which allocates 70% to BTC, 15% to ETH, 8% to SOL, 5% to XRP, and 2% to CRO.

Winners & losers

BONK (+61.1%) surged to become the fourth-largest meme coin by market cap, overtaking TRUMP. The rally was fueled by excitement around bonk.fun’s dominance in Solana token issuance (54.7% share), upcoming meme art campaigns, and speculative ETF chatter.

SPX (+22.6%) also soared, riding the wave of memecoin mania as retail traders piled in alongside Bitcoin’s push toward a new all-time high. Meanwhile, CRO (+18.9%) jumped after Trump Media and Technology Group filed for a Truth Social-branded crypto ETF, which includes CRO in its allocation (see above).

On the losing side, TKX (-40.9%) collapsed without clear catalysts, plummeting from $20 to $15 on Sunday, July 6, before crashing further to $10 the following day. PI (-6.2%) dipped ahead of its largest daily unlock on July 10, which will release $7.5 million worth of tokens. On July 4, Pi Network’s launched a 30-day distribution of 304.7 million tokens — its highest monthly unlock ever.

SEI (-5.8%) defied positive fundamentals, slipping despite hitting a record total value locked (TVL) of over $626 million amid DeFi expansion. The decline came even after securing regulatory approval in Japan, suggesting profit-taking or broader market pressures outweighed bullish developments.

Cryptocurrency news

TON’s UAE Golden Visa news triggers backlash

On July 6, Toncoin (TON) surged 12% after the TON Foundation CEO, Max Crown, announced a “groundbreaking initiative.” Holders who stake $100k worth of TON for three years and pay a $35k fee could secure a 10-year UAE Golden Visa, the tweet read. Within hours, UAE authorities debunked that claim, leaving TON in the dust.

Golden Visa for just $135k

The “exclusive chance” offer suggested it was possible to secure residency for a price far below the regular requirement. It was presented as a capital-efficient alternative to traditional residency routes, requiring roughly $540k in illiquid assets — fixed deposits or real estate.

Furthermore, the stakers would reportedly earn 3%–4% APY on their locked-up assets. TON's official website also mentioned fast-tracked approval (within seven weeks from document submission) and inclusion of family members at no extra cost beyond government fees.

The staking was supposed to be conducted via decentralized smart contracts on the native blockchain. The announcement generated enthusiasm within the crypto community — even Telegram CEO Pavel Durov reposted a post with details of the program.

Shortly afterward, the UAE’s Federal Authority for Identity, Citizenship, Customs and Port Security, Securities and Commodities Authority, and Virtual Assets Regulatory Authority published a joint statement — clarifying there was no dedicated visa program for crypto holders.

TON supported the statement, releasing a clarification mentioning a “licensed partner specializing in blockchain infrastructure and tokenized assets.” The post acknowledged the absence of any official collaboration with the UAE government entities or governmental endorsement for TON.

Community reaction

TON's walk-back was disappointing to the online community — many preceived the program as a way to convert crypto into real-world benefits, without the need for TradFi banking or property-based investment. The controversy triggered widespread backlash, with former Binance CEO CZ criticizing Crown for “hurting the industry.”

Impact on TON price

The announcement sparked a rally, pushing the TON price from $2.73 to $3 within two hours, with trading volumes surging 900%. As the UAE authorities issued their joint statement, the price collapsed. Currently, the token is changing hands at $2.81, with a 7-day change of +0.4%.

UAE Golden Visa details

The UAE’s Golden Visa program, launched in 2019, aims to attract a skilled workforce to the country. It allows foreigners to reside, work, and study without a national sponsor — for a period between 5 and 10 years.

Initially tailored to real estate investors, the Golden Visa now covers "scientists, executives, frontline workers, schoolteachers, principals, university faculty, nurses with 15+ years of experience, YouTubers, podcasters and digital creators, accredited e-sports professionals above the age of 25, and luxury yacht owners and maritime executives."

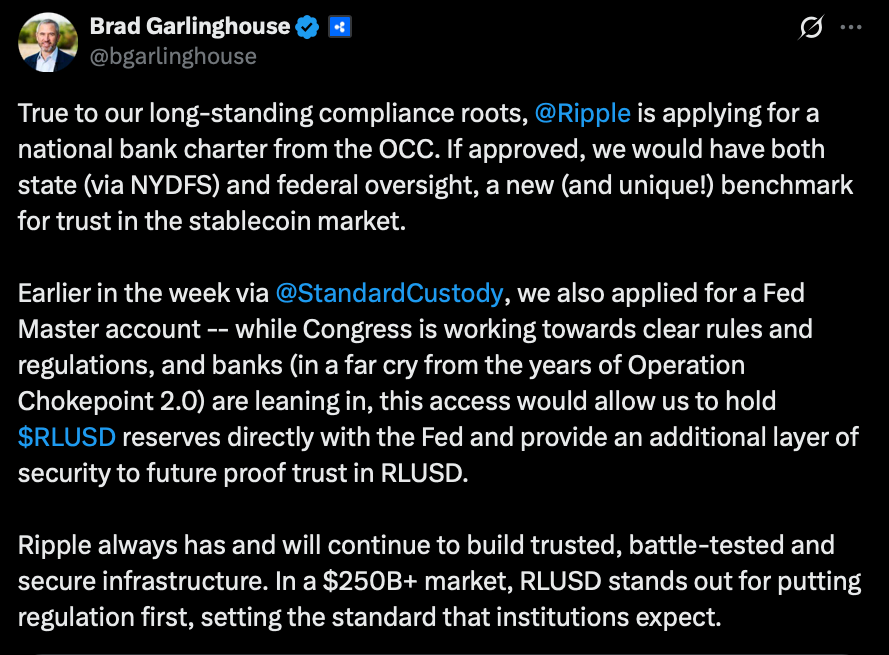

Ripple’s US banking bid sparks optimism

On July 2, Ripple Labs took a leap toward bridging crypto and TradFi by applying for a US national banking license with the Office of the Comptroller of the Currency (OCC). Coupled with a separate bid for a Federal Reserve master account, the move could unlock direct access to the Fed’s payment systems — a first for a crypto-native firm.

The dual applications should reinforce oversight of Ripple’s dollar-backed stablecoin, RLUSD, under both federal and New York state regulators. This sets “a new bar for transparency and compliance in the stablecoin market,” said Ripple’s stablecoin lead Jack McDonald.

If approved, the license would position Ripple alongside Anchorage Digital as one of the few crypto firms with a federal charter, signaling growing institutional legitimacy.

XRP’s $10 potential

The news buoyed XRP’s long-term sentiment despite a 1.07% dip amid broader economic uncertainty. With Ripple’s regulatory progress and speculation around an XRP ETF, some predict a surge to $10 — contingent on sustained institutional adoption and its role as a CBDC bridge for 50+ countries 211.

Stablecoin race heats up

Ripple’s bid follows Circle’s application for a national trust bank to manage USDC reserves, reflecting a broader crypto rush for compliance after the Senate’s GENIUS Act advanced stablecoin regulations 512.

Notably, Ripple’s Fed master account — applied for via its subsidiary Standard Custody — would enable 24/7 stablecoin redemptions and bolster RLUSD’s credibility. CEO Brad Garlinghouse framed the moves as a rejection of “Operation Chokepoint” narratives, emphasizing Congress’s shifting stance on crypto.

Bottom line

Ripple’s banking ambitions mark a pivotal moment for crypto’s integration into traditional finance. As Garlinghouse noted, “Clear rules are coming, and banks are leaning in.” For XRP, the path to $10 hinges on regulatory wins and real-world utility — but the foundation is being laid.