Clapp Weekly: Surge to $107k, BTC overtakes gold, GENIUS Act advances

BTC price

Monday's spot Bitcoin ETF inflows reached $667.4 million, the highest since May 2, signaling renewed demand. The options markets are flashing signs of anticipation, with bets placed on $120k for late June. On Sunday, May 18, BTC recorded the highest daily candle close ever as it approached $107k.

BTC dipped from $104k to $101,776 on Thursday, May 15, before reversing. Weekend price action breached the crucial $105K level before Monday's dip below $103k. A rebound took BTC to a high of $106,518 yesterday and $106,873 earlier today.

Currently at $106,877, BTC has gained 0.8% in the past 24 hours and 3.1% over the past week.

ETH price

Despite ether's weekly decline, yesterday's bullishness, alongside substantial derivatives liquidations, signals robust upward pressure. Open Interest (OI), the total value of outstanding futures contracts, hit a record of 20.1 million ETH on May 20. More traders are going long, as indicated by higher funding rates.

Diverging from BTC, the ETH price declined choppily from $2,672.60 last Wednesday, May 14, to $2,370.84 on Monday, May 19, before a turnaround. It then reached a high of $2,568.52 yesterday, corrected, and rose again, hitting $2,541.29 earlier today.

Currently trading at $2,540.37, ETH is down 1.2% over 24 hours and 4.0% over the past 7 days.

7-day altcoin dynamics

The market benchmark is in the red, with the total market cap dropping by 1.5% overnight after a sweeping rally last Friday. Global trade tensions and geopolitical risks are creating volatility.

On Monday, Moody’s downgrade of the US credit outlook from Aaa (negative) to Aa1 (stable) caused equities to drop and gold to extend its downtrend. Yet digital assets proved resilient, while US crypto funds saw their fifth consecutive week of inflows — attracting $7.5 billion year-to-date (YTD) and fully recovering from the February-March selloff.

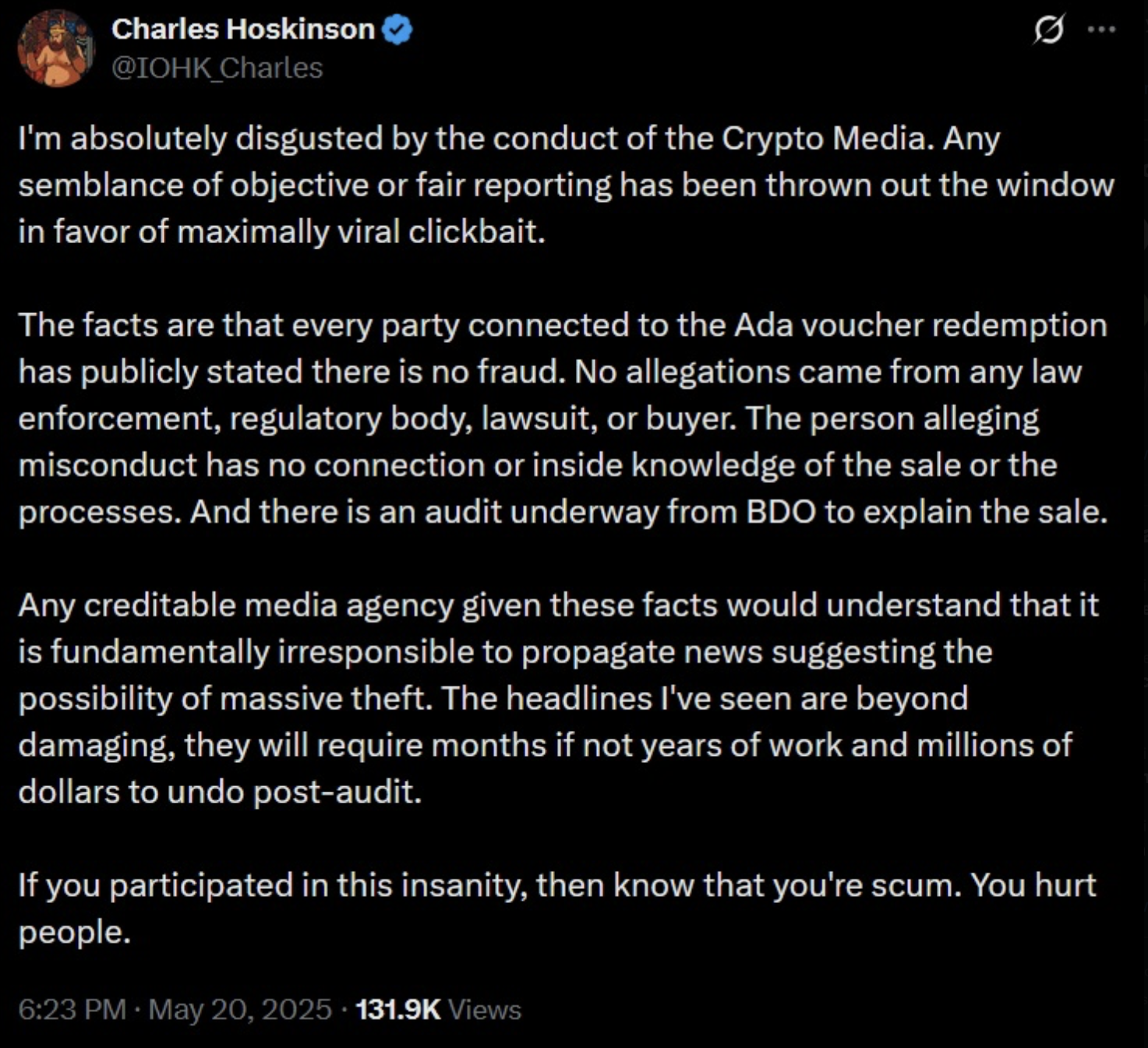

Cardano (ADA, -7.2%) was hurt by claims that Charles Hoskinson misappropriated $619 million, which triggered community backlash. NFT artist Masato Alexander and other members allege Hoskinson used a genesis key to rewrite the ledger during the Allegra hard fork in 2021.

The founder has denied the allegations and promised an audit report on treasury holdings from Input Output Global (IOG).

Winners & losers

AAVE's surge (+11.2%) appears linked to optimism around the GENIUS Act, signalling a more favorable regulatory environment for DeFi and stablecoins in the US. Meanwhile, BGB (+7.9%) has gained ground following Bitget’s first on-chain trading points campaign, offering traders additional incentives to engage with the platform. Another standout, TRUMP (+5.7%), continues to attract whale interest ahead of a high-profile gala dinner for its top holders, scheduled for May 22.

On the flip side, some assets have struggled to maintain momentum. PI (-38.4%) remains flat after a steep drop last week — though 4 million PI withdrawn from exchanges suggest whale positioning for a potential rebound.

Recently, whales have scooped up 20 million PI worth $14 million. Similarly, TIA (-19.3%) has extended losses after last week’s downturn, leaving traders uncertain whether another drop or a recovery is imminent.

OP (-17.4%) has also faced challenges, losing ground after failing to break the key $1 resistance level last week. Despite the decline, whale accumulation hints at long-term confidence in the asset. Overall, the market remains divided, with regulatory developments and whale movements driving sentiment.

GENIUS Act passes key Senate hurdle

The GENIUS Act — the Guiding and Establishing National Innovation for US Stablecoins Act — has just cleared a major hurdle in the Senate, signaling a potential shift toward mainstream adoption of stablecoins. But while supporters see this as a win for innovation and consumer protection, critics warn it could open the door to corruption and financial instability.

What does GENIUS Act do?

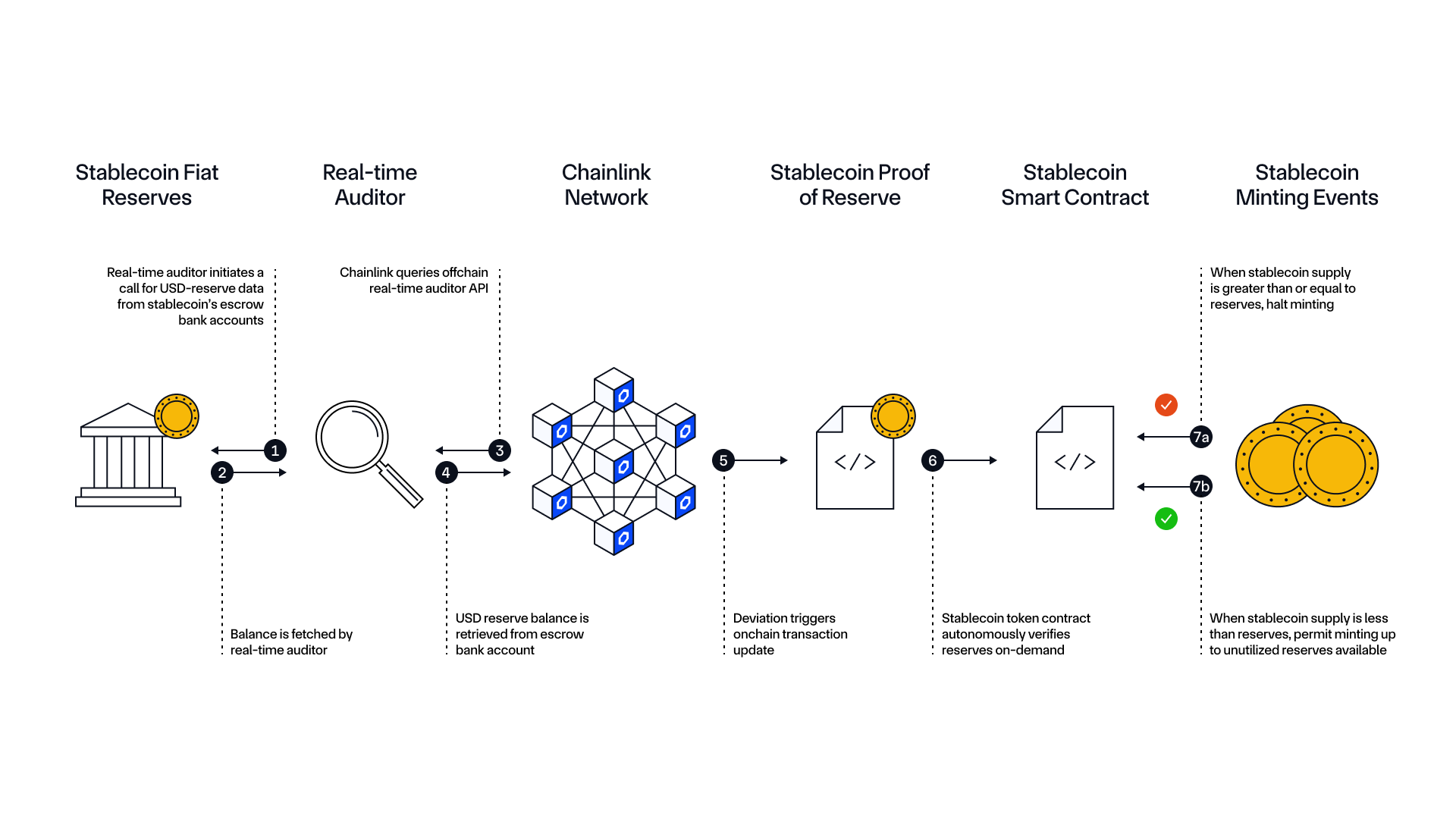

The bill aims to regulate stablecoins, cryptocurrencies pegged to stable assets like the US dollar. Key provisions include:

- Reserve requirements — Issuers must hold enough assets to back their stablecoins, ensuring users can always cash out.

- Bankruptcy protections — Stablecoin holders would be prioritized if an issuer goes under.

- Anti-money laundering (AML) rules — Preventing illicit use of stablecoins for terrorism financing or fraud.

- Conflict-of-interest ban — Prohibiting government officials, including Congress members, from launching their own stablecoins while in office.

Supporters argue this framework will boost trust in crypto, making stablecoins viable for everyday payments and financial services. "This could lead to frictionless payments and greater financial access," said Austen Jensen of the Retail Industry Leaders Association.

Controversy & criticism

Despite bipartisan support, the bill faces fierce opposition. Critics, including Sen. Elizabeth Warren, warn it doesn’t go far enough to prevent abuse — especially with President Trump’s crypto venture, USD1, already the fifth-largest stablecoin globally.

Warren claims the bill could "supercharge Trump’s corruption" by allowing foreign governments and big corporations to use his stablecoin as a "shadowy bank account"— potentially enriching him while evading oversight. She also fears a financial crash if weak regulations lead to risky market behavior.

What’s next?

The Senate’s procedural vote (66-22) suggests strong momentum, but a final vote won’t happen until after Memorial Day (May 26). If passed, this could be a turning point — either legitimizing crypto or setting the stage for future crises.

Bitcoin overtakes gold: America’s new favorite store of value

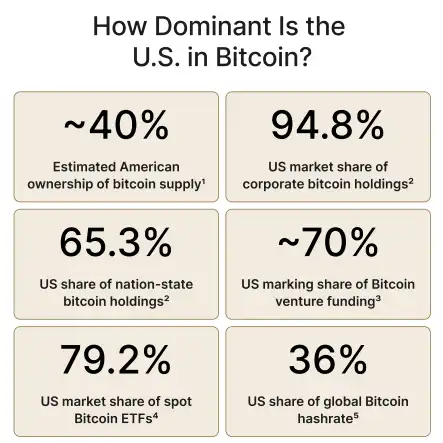

Bitcoin has officially surpassed gold in ownership, with 50 million US adults now holding BTC compared to just 36.7 million owning gold, according to a new report by financial firm River.

- 14.3% of Americans own Bitcoin — the highest rate in the world.

- The US government holds 198,000 BTC (65% of global state-owned Bitcoin) but just 30% of central bank gold reserves.

- 32 US public companies, including Wall Street giants like BlackRock, keep Bitcoin on their balance sheets — accounting for 95% of corporate BTC holdings worldwide.

- US Bitcoin ETFs dominate, making up 80% of global BTC ETF assets since their January 2024 approval.

Why the shift?

Bitcoin’s rise reflects a broader trend toward digital assets over traditional stores of value. Key drivers include:

- Institutional adoption (ETFs, corporate treasuries)

- Regulatory progress (pro-crypto policies under Trump)

- Technological edge (US mines 38% of new BTC since China’s 2021 ban)

What’s next for Bitcoin?

Analysts predict a bullish summer, fueled by ETF demand, macro triggers, and options markets bets. Spot crypto ETFs saw $3.3B inflows in May alone, fully erasing the February-March losses. Meanwhile, concentration of bets at $110K–$120K strike prices suggests anticipation of new price records.

Gold’s luster dims

While gold remains a safe-haven asset, Bitcoin’s scarcity, portability, and growth potential are winning over investors. Even 59% of US senators and 66% of House members now support the crypto pioneer, with Trump recently mandating a federal BTC reserve.

America is betting big on Bitcoin — not just as a speculative asset, but as the 21st-century digital gold. With regulatory tailwinds and institutional momentum, crypto’s breakout summer may just be beginning.