Clapp Weekly: Ceasefire-triggered recovery, Mastercard integrations, Fed's support

BTC price

Bitcoin surged past $106k as geopolitical tensions eased yesterday following a ceasefire between Israel and Iran. Experts note that the crypto market behavior is increasingly defined by macro liquidity and institutional demand.

BTC hovered above $104k until Friday, June 20, when it nearly reached $106K before declining. On Sunday, June 22, BTC bottomed out at $98,974 before surpassing $104k in two days and hitting $106,564 this morning.

Trading at $106,450, BTC is up 1.3% over the past 24 hours, with a 7-day gain of 1.5%.

ETH price

Ether gained 17% following the news of an Iran-Israel ceasefire. Yet, despite the geopolitical easing — and $101M in Monday’s US spot ETF inflows — sustainability concerns are growing. The gap between the market cap ($293B) and monthly network fees ($41M) alarms analysts.

ETH echoed BTC’s volatility — dipping from $2,552.45 last Friday, June 20, and bouncing off $2,177.47 on Sunday, June 22. The price returned to $2,473.84 yesterday before pulling back.

Changing hands at $2,453.53, ETH has gained 2.1% over the past 24 hours but remains down 2.6% over the past 7 days.

Seven-day altcoin dynamics

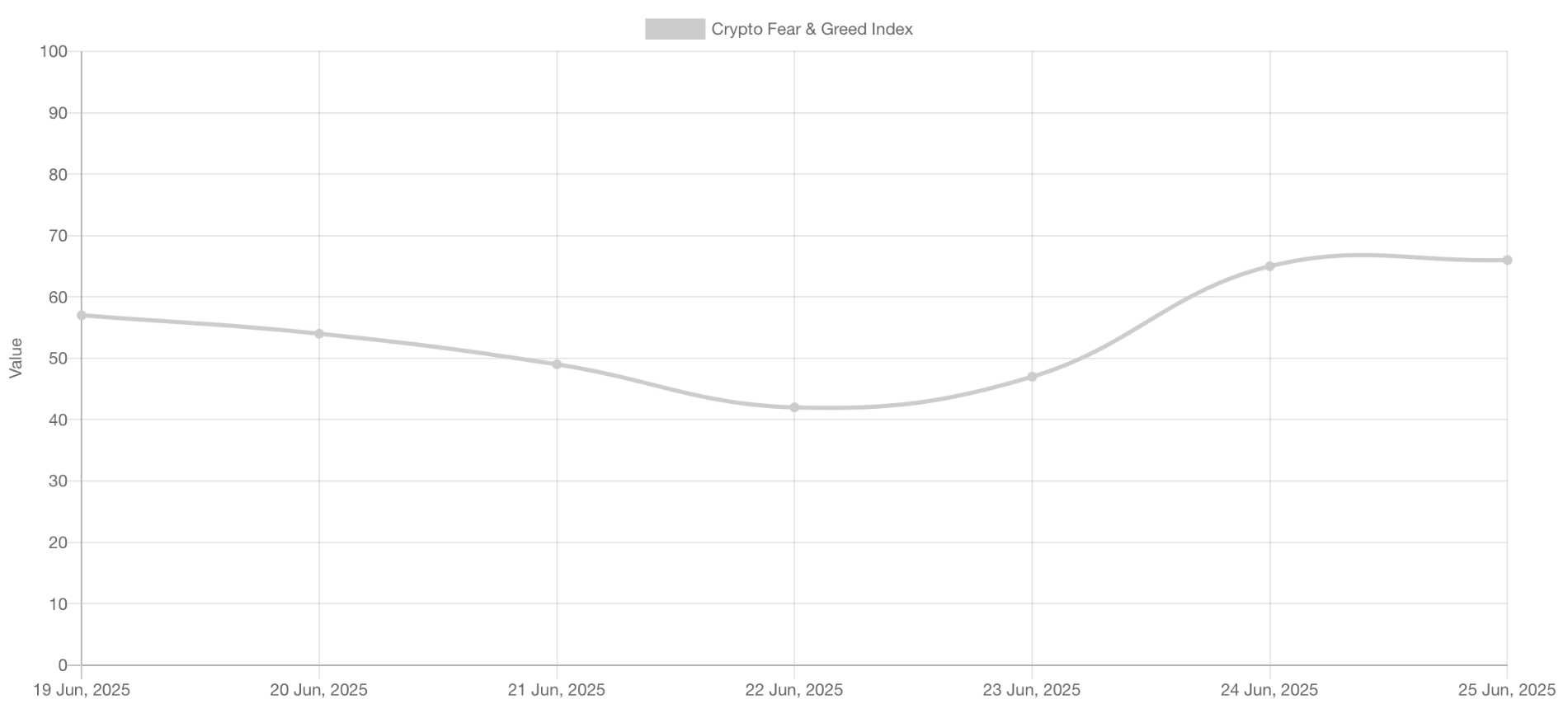

Crypto’s momentum is lifted by hopes of an Israel-Iran resolution following a tense weekend that saw US strikes on Iranian nuclear sites. Easing Middle East tensions post-ceasefire spurred a broad market recovery. On Tuesday, June 24, 98 of the top 100 tokens posted gains, with the sentiment index returning to Greed (65).

A report by Glassnode and Avenir Group highlights Bitcoin's sensitivity to traditional finance (TradFi) assets and macro drivers. This phenomenon reflects “its growing integration into the broader macro-financial system.” At the same time, Bitcoin's long-term focus may have been key to easing war jitters.

Chainlink’s partnership with Mastercard fueled a 13% surge in LINK (+2.2%) yesterday. The collaboration with the global payments giant will enable its 3 billion cardholders to buy crypto on-chain. FIL (-5.4%) also regained strength following the Iran-Israel truce news.

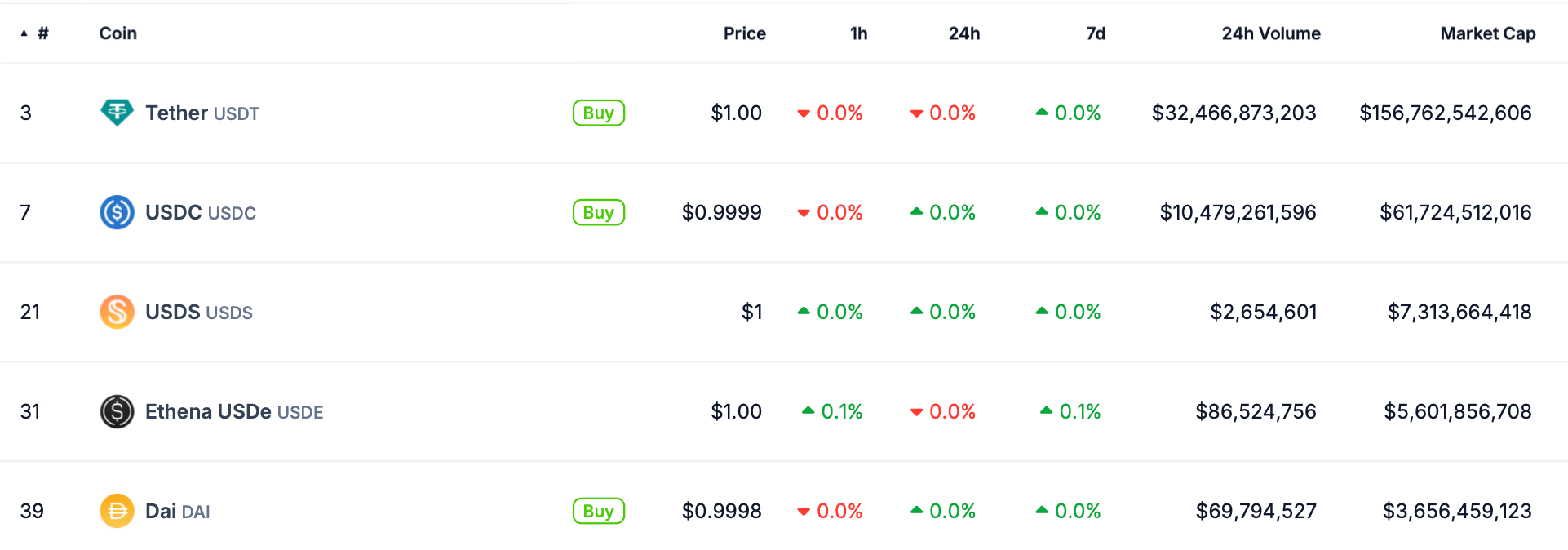

Meanwhile, Circle's stock frenzy is cooling. The Bank for International Settlements’ new report cast doubt on stablecoins’ potential role in global finance — highlighting risks to stability and monetary sovereignty in the absence of regulation. “Stablecoins as a form of sound money fall short,” the report concludes.

Circle's USDC remains the second-largest stablecoin with a roughly $62 billion market cap, behind Tether's USDT with over $156 billion.

Winners & losers

SEI (+88.5%) surged following Wyoming’s decision to name Sei Network as a finalist for a new governmental stablecoin initiative. The token also benefited from its alignment with a $200 billion AI economy target and its leading position in Web3 gaming.

KAIA (+22.1%) gained traction as demand for its dApps soared, driving significant inflows. The total value locked (TVL) in Kaia’s ecosystem grew 20% over the past seven days and 45% over the past 30 days, reflecting strong momentum.

STX (+19.6%) rebounded sharply after hitting a low on Sunday, closely tracking Bitcoin’s recovery. The rally suggests renewed confidence among traders as the broader market stabilizes.

On the downside, DOT (-7.7%) struggled after the US SEC delayed its Polkadot ETF decision until November 2025, stifling a potential macro-driven rally. POL (-5.5%) underperformed due to intensifying competition in the Layer-2 space, where Base now holds four times its TVL, compounded by the shutdown of Polygon zkEVM.

Meanwhile, VIRTUAL (-6.0%) faced downward pressure despite upcoming Genesis token launches, as declining revenue and user activity weighed on sentiment.

Cryptocurrency news

Mastercard accelerates stablecoin adoption with new integrations

Mastercard is positioning itself at the forefront of stablecoin payments. In a push toward mainstream adoption of dollar-pegged crypto, it announced integrations with PayPal’s PYUSD, Paxos’ USDG, and Fiserv’s FIUSD.

The payments giant is expanding its network to support regulated stablecoins for everyday transactions and cross-border settlements. Mastercard's 150+ million merchants will now be able to use three new stablecoins. Tuesday's press release lists four key areas it will explore with Fiserv:

- Seamless on and off-ramping

- Enabling merchants to settle in FIUSD

- Connectivity to the Mastercard Multi-Token Network (MTN)

- Powering stablecoin-powered cards

“This work with Fiserv is setting the stage for a new era, where stablecoins are as ubiquitous and trusted as fiat currencies,” Mastercard Americas Co-President Chiro Aikat said in a statement. “We are creating a robust ecosystem.”

Bridging TradFi and digital assets

The latest initiatives aim to seamlessly integrate stablecoins into Mastercard's vast payment ecosystem. Teaming up with Fiserv will enable FIUSD support across card products, merchant settlements, and fund transfers — so consumers can spend both fiat and stablecoin balances interchangeably via Mastercard One Credential.

This move underscores the growing institutional embrace of a $260 billion asset class offering faster, cheaper, and programmable transactions compared to traditional banking. With the US Senate recently passing the GENIUS Act to regulate stablecoins, financial institutions are now more confident in adopting them.

Competitive edge in payments

Mastercard’s strategy goes beyond innovation — it is also about staying ahead of potential disruptions. With major retailers like Walmart and Amazon reportedly exploring their own stablecoins, traditional payment networks risk being sidelined. Partnerships with established players like Fiserv and Paxos help Mastercard secure its relevance in an increasingly digital economy.

Jorn Lambert, Mastercard’s Chief Product Officer, emphasized that while fiat remains dominant, “regulated stablecoins are undoubtedly part of the evolution of digital payments.” The company’s Multi-Token Network will further enhance programmable payments, unlocking new use cases for businesses and consumers alike.

Mastercard’s expansion into stablecoins signals a broader shift toward tokenized finance, where digital and traditional currencies coexist within a unified payments framework. As more merchants and financial institutions adopt stablecoins, Mastercard’s network could become a critical bridge between legacy systems and blockchain-based transactions.

Fed Chair Powell greenlights crypto banking in Congress testimony

Speaking to the US Congress this week, Federal Reserve Chair Jerome Powell has noted that US banks are free to provide services to crypto firms — as long as they manage risks appropriately. This clarification removes a major barrier for TradFi institutions looking to enter the digital asset space.

Clear signal for crypto banking

Fed will not stand in the way of banking relationships with crypto firms — a move that could accelerate institutional adoption. This statement, made during Powell's testimony on June 24, marks a notable departure from past uncertainty.

"Banks get to decide who their customers are," Powell said, signaling a more open stance. Previously, many institutions hesitated to engage with crypto due to fears of regulatory backlash.

“Very significant change in the tone”

While Powell’s testimony primarily focused on inflation and interest rates, his comments on crypto were particularly telling. Acknowledging "a very significant change in the tone," he suggested that regulatory attitudes are evolving alongside the industry’s maturation.

This shift comes as Congress advances crypto legislation, including the stablecoin-focused GENIUS Act. Powell endorsed these efforts, stating, "We need a stablecoin framework."

Market implications

The Fed’s stance could encourage more banks to offer crypto custody, trading, and payment services — further bridging the gap between traditional finance and blockchain. Meanwhile, Powell reiterated a cautious approach to rate cuts, with markets still expecting a potential easing in September.

For crypto, this development is a major win — clearer banking access could drive liquidity, stability, and broader adoption. With regulatory clarity improving, the stage is set for deeper integration between Wall Street and the digital asset economy.