GameFi tokens: Deep dive into crypto gaming assets

Gaming cryptocurrencies bridge blockchain entertainment, NFTs, and decentralized finance — fueling GameFi’s vibrant universe. While the segment is still in its infancy, in-game economies are evolving rapidly, offering another diversification avenue for portfolio investors. Here’s the lowdown on these tokens in 2025.

What are gaming tokens?

GameFi tokens are cryptocurrencies designed for specific blockchain games. Their holders can buy, sell, and trade game assets, earn rewards, secure ownership rights, and more. Leading projects merge blockchain technology with immersive gaming experiences and DeFi functionalities. These tokens are the lifeblood of their ecosystems.

GameFi has spawned innovative markets where gaming investments can yield substantial returns. These virtual metaverses reward players with digital treasures, enabling verifiable ownership of in-game assets. Ultimately, it’s finance — not just gaming — driving this revolution.

Key uses of gaming tokens

- Rewarding players for blockchain-based gameplay.

- Facilitating NFT trading, mining, and token exchanges — primary profit streams for blockchain gamers.

- Powering in-game economies, supporting creation, progression, and sustainability of gaming metaverses.

- Enabling investment in crypto-based gaming economies without reliance on centralized publishers.

That said, blockchain game development still lags behind traditional titles.

WCK: First gaming token

One of the earliest gaming tokens emerged in CryptoKitties, a Pokémon-inspired universe. True to its name, the game lets players buy, breed, and battle NFT kitties — earning rewards in WCK tokens. This cryptocurrency holds real-world value, tradable for other cryptos or fiat.

Gaming cryptos vs. traditional in-game currencies

Traditional games feature in-game economies where players earn and spend currencies on virtual items like weapon skins. Blockchain projects reimagine this concept, adding a decentralized twist with NFTs and crypto exchange trading.

Example: AXS (Axie Infinity)

Axie Infinity is also one of the first play-to-earn platforms, with gamers garnering tokens as they play. Similar to CryptoKitties, it is a Pokémon-inspired universe with unique characters, Axies, that are bought, collected, battled, and exchanged.

Owning Axies as NFTs, gamers breed them to produce more Axies or trade through a dedicated P2P marketplace. Smooth Love Potions (SLP) is a reward currency, while Axie Infinity Shards (AXS) is the principal token used for governance.

Both are ERC-20 assets — on the 688th ($47 million) and 189th ($336 million) position by market cap, respectively.

When did gaming tokens boom?

GameFi exploded in 2021, fueled by pandemic lockdowns. In the first half of the year, blockchain gaming firms raked in $476 million. CryptoKitties led the charge with novel features and mass adoption.

Its token pioneered seamless in-game transactions, decentralized ownership, and heightened security. WCK captivated gamers and investors alike, setting the stage for new platforms. Since then, GameFi has evolved into a thriving fusion of gaming and crypto.

GameFi economics: Single-token vs. multi-token models

Today’s GameFi landscape offers two distinct economic models:

Single-token models

Some projects use one token for all activities, including governance and trading. For example, The Sandbox's SAND supports in-game value transfers, staking, and governance. This streamlines interactions but comes with risks:

- Volatility: Sharp price swings deter players — plummeting values kill profit potential, while spikes trigger mass sell-offs. Holding tokens (instead of spending them) is at odds with developers’ intentions.

- Inflation: Uncontrolled token issuance can erode value over time (SAND's supply is capped).

These flaws explain why many developers prefer multi-token systems.

Multi-token models

Projects like Axie Infinity separate in-game tokens from governance tokens. The latter incentivize community participation, boosting platform value. The former fuel trading, quests, and upgrades — with uncapped supply and secondary market sales. Benefits include:

- Economic stability (players aren’t at the mercy of a single token’s price).

- Flexibility (developers can tweak the economy as needed).

Evaluating GameFi tokens: Key criteria

Issuance & burning

Capped-supply tokenomics prevent inflation — when issuance is unlimited, tokens may depreciate, eroding players' trust in their long-term potential. Burning mechanisms (removing tokens from circulation) stabilize prices.

For instance, Axie Infinity halted SLP rewards for adventure mode and daily quests in the classic version — triggering a price rebound in 2022. The change was implemented to "balance the SLP economy" and attract users to a new game mode called Axie Infinity Origin. In 2024, the team also introduced an SLP supply cap, a buyback fund, and deflation targeting.

Token distribution

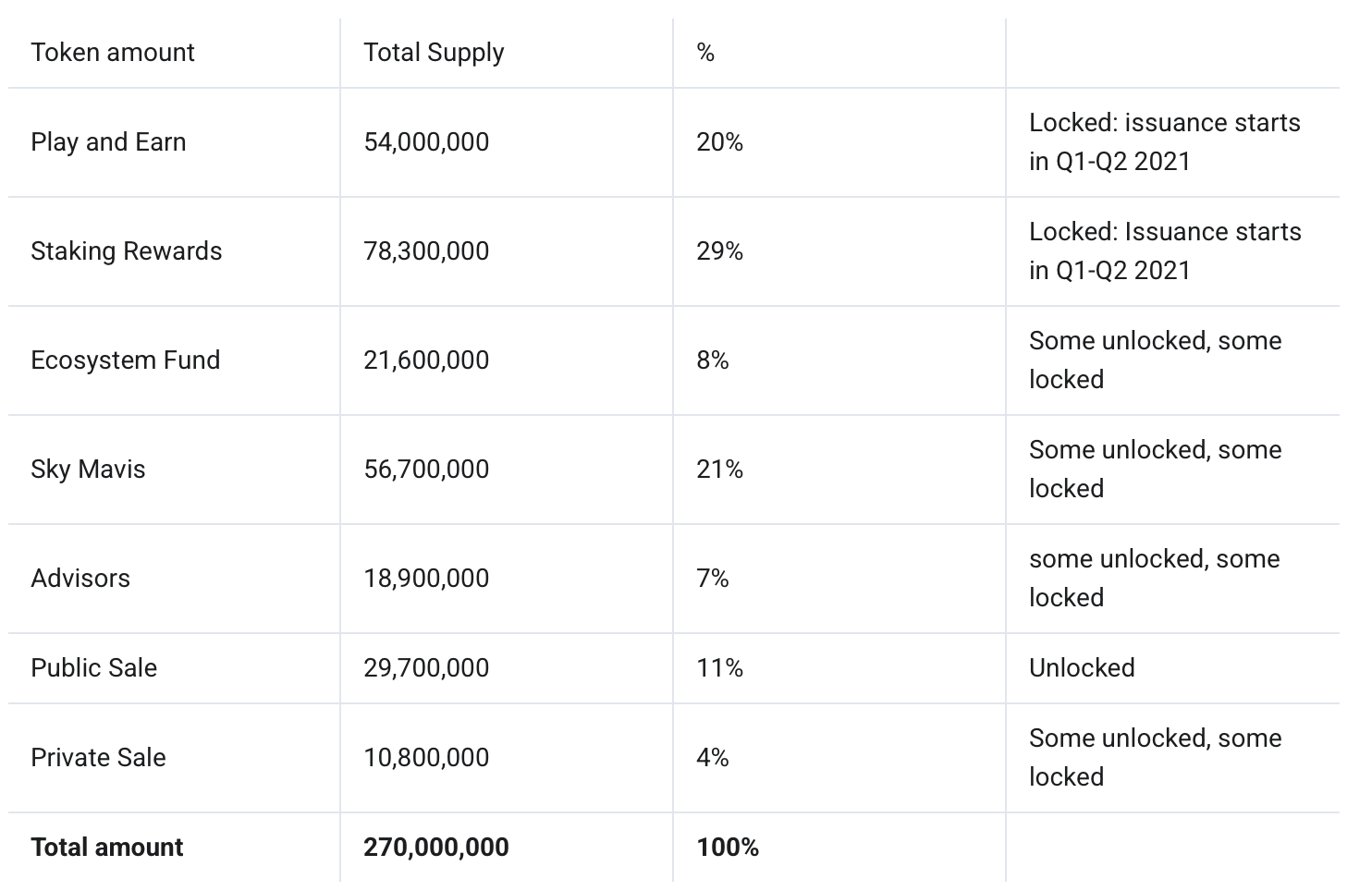

Community-focused allocation builds trust. Consider how Axie Infinity distributes its 270 million AXS tokens distributes: 20% play-to-earn + 29% staking rewards + 21% for the team (Sky Mavis). The rest is spread between the Ecosystem Fund, Public Sale, Private Sale, and Advisors. The staking reward system encourages user participation, supporting the game's overall stability and growth.

Token utility

GameFi tokens are versatile, with applications ranging from daily missions to in-game leveling to purchases. These use cases propel token value on secondary markets, facilitate integrations with other projects, and more.

Lock-ups & unlocks

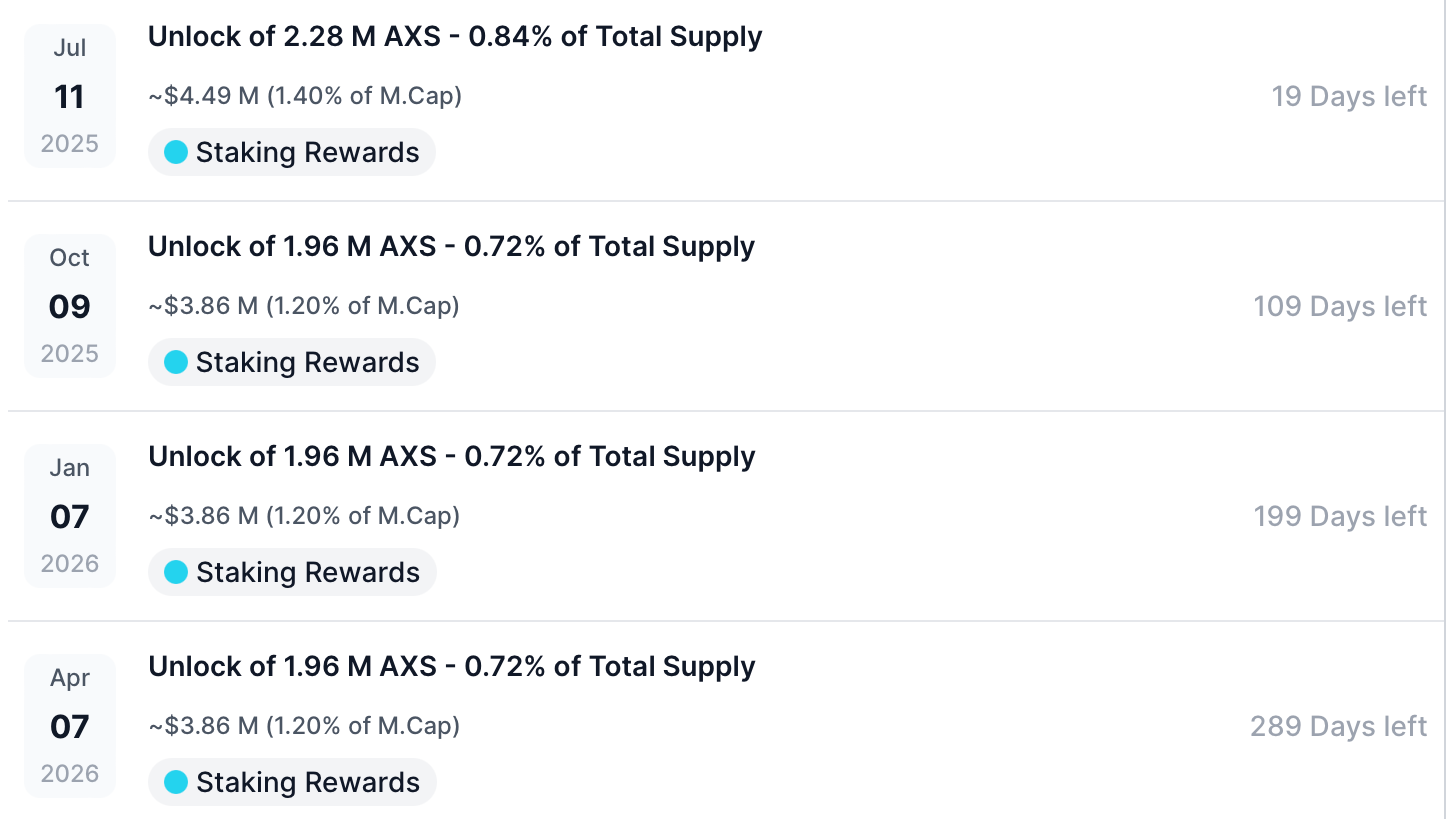

Lock-ups prevent early sell-offs, aligning team and player incentives. For example, Axie Infinity follows a pre-determined 65-month schedule with a 90-day interval. Many token allocations are subject to vesting periods to ensure long-term alignment of interests between the team, users, and investors.

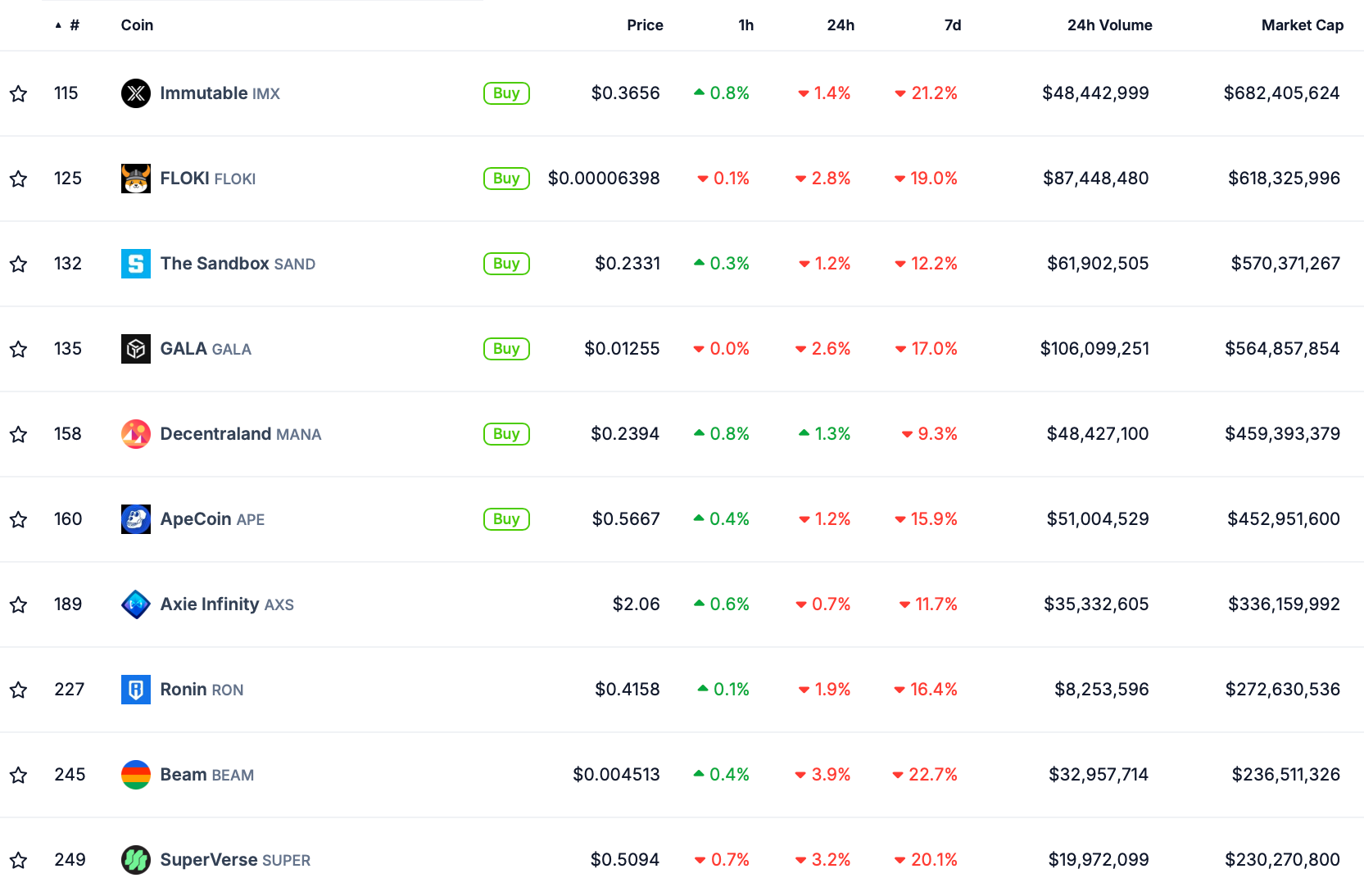

Top 5 gaming tokens by market cap

IMX (Immutable X)

The largest gaming token by market cap (115th position at $682 million) is an ERC-20 asset powering Immutable X, a layer-2 scaling solution for Ethereum. This gaming hub facilitates fast, secure, and gas-free NFT trading, which is crucial for Web3.

Immutable X enables instant transactions, with users paying zero gas for minting and trading NFTs. It is a scalable, sustainable environment that offsets carbon emissions. IMX is used for fees, staking, governance, and rewards — users earn native tokens through trading activity.

FLOKI (Floki)

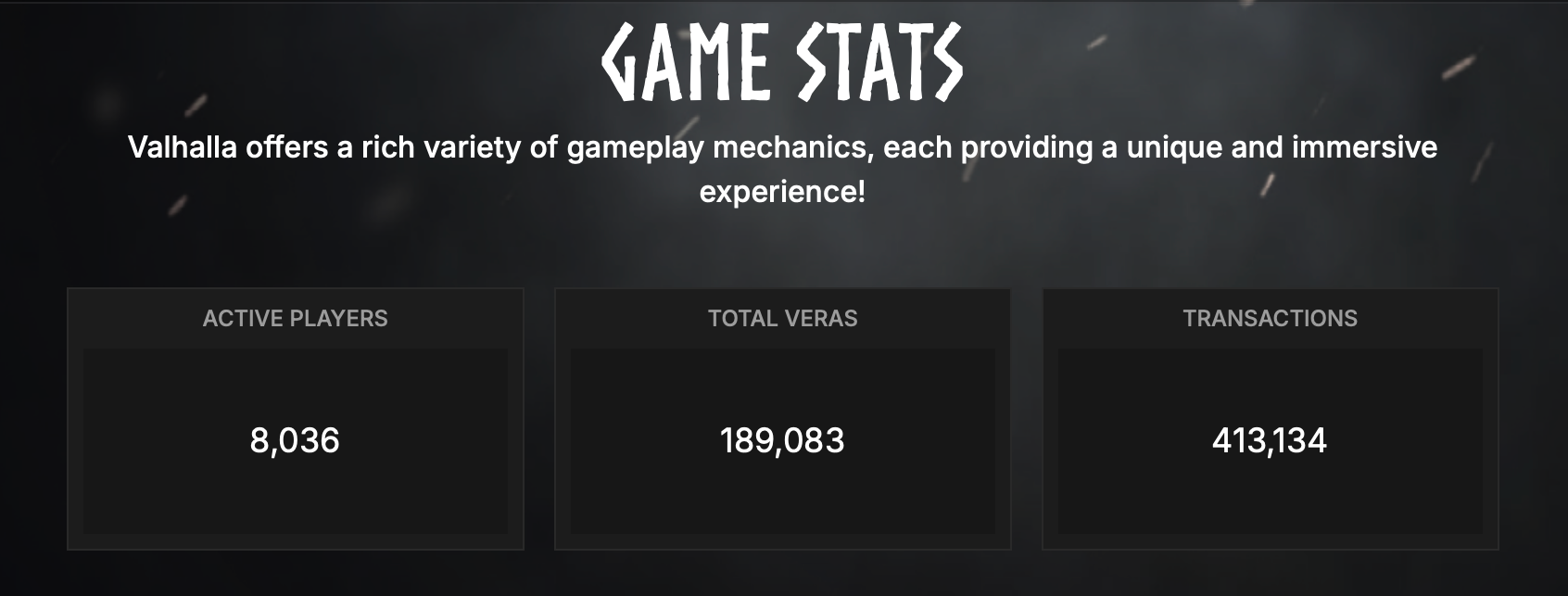

The utility token of the Floki ecosystem powers its Valhalla universe, where gamers can earn from a "$50M treasury by exploring a vast open world and collecting unique Veras." This play-to-earn, open-world experience launches on the mainnet on June 30, 2025, with FLOKI as the reward currency.

However, FLOKI is also a meme coin inspired by Elon Musk's tweet — Tesla CEO once mentioned naming his Shiba Inu dog “Floki.” The token emerged as part of the broader wave that gained traction with the rise of DOGE and SHIB.

Unlike purely speculative meme coins, FLOKI is working toward offering real-world use cases like service payments. It is the 125th cryptocurrency by market cap ($619 million as of this writing).

SAND (The Sandbox)

In this Minecraft-inspired world, players spend native SAND tokens to buy LAND and craft 3D gaming environments and NTFs. While the number of real estate plots is limited (166,464), hundreds of virtual worlds built on The Sandbox have sent plot prices soaring to $15,000. Initially, land parcels cost as low as $48!

SAND is the 152nd token by market cap ($572 million at press time). Based on Ethereum's ERC-20 standard, it powers value transfers, staking, and governance, with the supply capped at 3 million tokens.

GALA (Gala Games)

GALA is an ERC-20 utility token fueling fuel transactions and interactions within the Gala Games ecosystem. Its founders revolutionized gaming by creating an economy controlled by the players themselves.

GALA tokens unlock a myriad of opportunities, from acquiring digital assets to participating in platform governance. The primary medium of exchange, it facilitates in-game purchases, rewards, and community engagement.

MANA (Decentraland)

Decentraland, a metaverse platform on Ethereum, lets users purchase land for farming, construction, implementing digital tourism, generating art, and more. Dedicated areas — Districts — explore particular themes like Cyberpunk.

This "open, community-built" and community-owner landscape sparks creativity, with opportunities ranging from dancefloors to binary sunsets on the beach. Plots are sold for native MANA tokens, which power all platform transactions. It is the 158th cryptocurrency by market cap (under $458 million as of June 23, 2025).

GameFi tokens in crypto portfolios

GameFi assets add another layer of diversification to crypto holdings — combining the potential for financial gains in DeFi with entertainment value. The "play-to-earn" model, combined with the appeal of true ownership and NFT trading, attract both gamers and investors. NFTs are not only tradable — they may also serve as collateral.

That said, like all digital assets, gaming tokens are susceptible to changes in market sentiment, game popularity, and overall crypto trends. GameFi crypto may lose value over time, particularly if the game's economy is poorly designed.

Future of GameFi tokens

GameFi represents a thrilling convergence of gaming, finance, and blockchain innovation — where playtime translates into real-world value. As the sector matures, well-designed tokenomics, community-driven ecosystems, and immersive experiences will separate the winners from the fads.

For investors, these assets offer a unique blend of entertainment and financial potential, but caution is key. Volatility, regulatory shifts, and game sustainability all play pivotal roles in long-term success.