Clapp Weekly: Altcoin rally, GENIUS Act win, Ethereum treasury race

BTC price

Bitcoin holds steady around $118k as markets pull back from the euphoric highs triggered by the landmark GENIUS Act becoming law. The pullback from last Monday's ATH ($123,091.61) appears to be a natural cooling-off phase, rather than a structural shift, as explained by MEXC Chief Analyst Shawn Young.

The BTC price seesawed after jumping from $117.6k to nearly $120k on Thursday, July 17, and $120,654 the next day. A plunge below $117.5k preceded weekend swings around $118k and Monday's push above $119.3k—before yesterday's weekly low of $117,848 and a retreat.

Currently at $118,852, BTC is up 1.2% over the past 24 hours and 1.2% over the past week.

ETH price

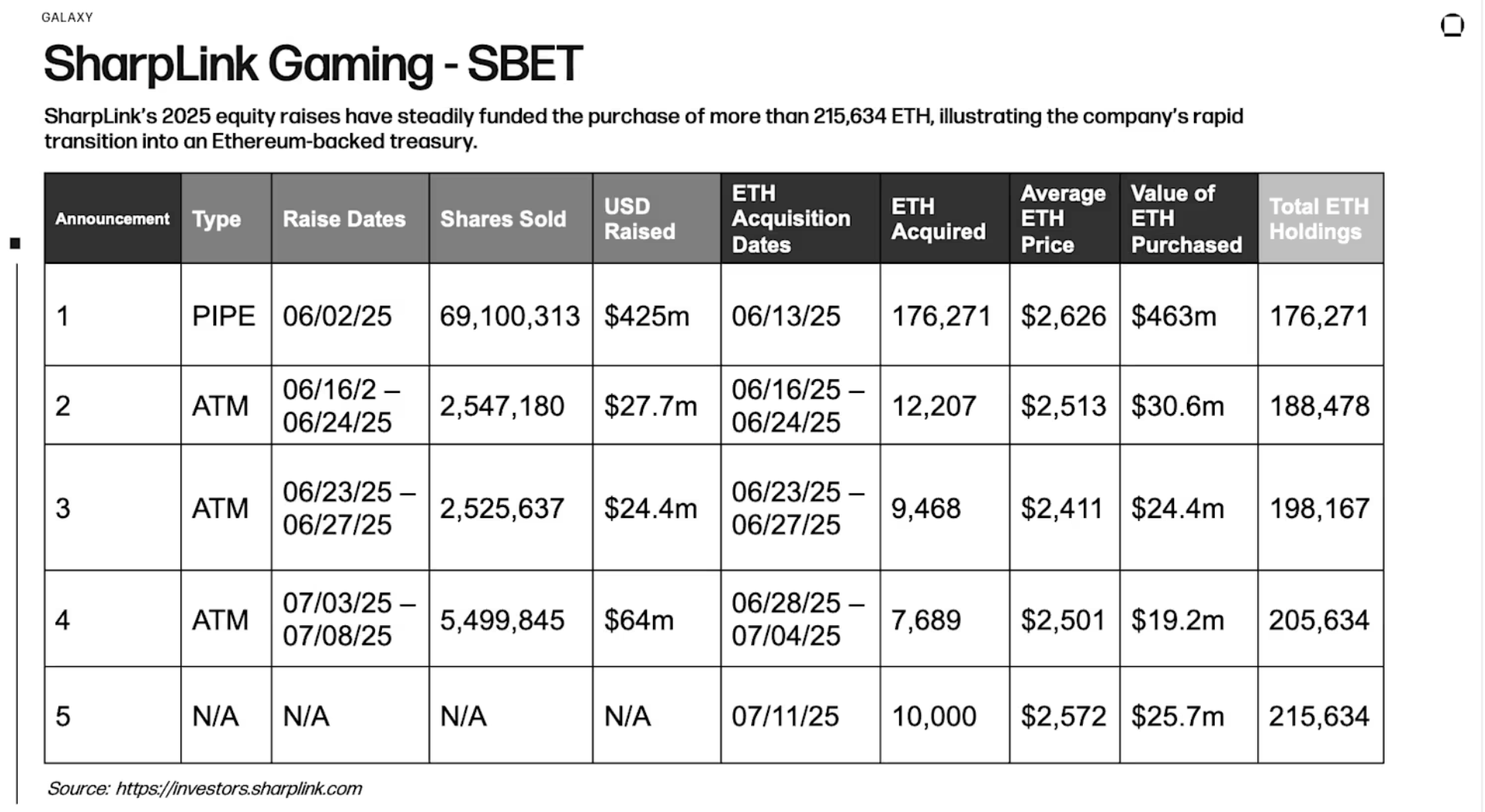

The GENIUS Act optimism supported ether's weekend rise after a $15 million whale buy and record $2 billion+ weekly inflows into US spot ETFs. The price breached $3.8k on Monday amid an intensifying treasury arms race: SharpLink and Bitmine now hold more ETH than the Ethereum Foundation.

ETH finally diverged from BTC’s trajectory — the price has climbed steadily through the week, from $3,100 to a high of $3,844.65 on Monday, July 21, before a slight correction.

Now trading at $3,735.18, ETH has gained 1.2% in the past 24 hours and a spectacular 19.9% over the past 7 days.

Seven-day altcoin dynamics

Last week, the House passed three crypto-related bills - including the CLARITY and GENIUS Acts — which aim to set clearer regulatory frameworks for cryptocurrencies. The news spurred a broad market rally, with the total market cap hitting $4 trillion. Since then, altcoins have cooled off.

XRP broke its seven-year-old price record, hitting a new ATH of $3.61 on July 18. The rally was also supported by institutional filings. ProShares filed for the first XRP futures ETF, and 11 other asset managers submitted products tracking the token's price. The probability of a spot XRP ETF approval by December 2025 rose to 88%.

Experts view the pullback as a healthy correction after double-digit gains in recent weeks. Driven by short-term profit taking, this correction should strengthen the foundation for a sustained rally.

Winners & losers

The meme coin sector is on fire, led by FLOKI (+54.4%), which surged as retail traders returned amid new utility rollouts and exchange listings. PENGU (+43.5%) continued its spectacular run, rallying as Pudgy Penguins NFT owners reached a record 4,879, solidifying its position as the second-largest NFT collection by market cap.

Meanwhile, FLR (+40.5%) benefited from broader market optimism, supported by its 2.2 billion FLR incentive program, token burns and strategic ecosystem initiatives.

While most altcoins showed resilience, some faced corrections. PUMP (-42.9%) plunged below its ICO price as whales moved $160 million worth of tokens to exchanges. The massive sell-off eroded community confidence and halted previous momentum.

SEI (-5.8%) pulled back from six-month highs despite its recent USDC integration that unlocked $60 billion in potential liquidity and attracted institutional interest. Similarly, AAVE (-4.6%) encountered selling pressure even after reaching a $50 billion TVL milestone and announcing its V4 upgrade, which promises reduced gas fees and expanded collateral options.

Cryptocurrency news

GENIUS Act cemented crypto’s political victory in Washington

President Donald Trump signed the GENIUS Act into law on July 18, the first major federal legislation to regulate stablecoins in the country. The bill, passed with bipartisan support, establishes a framework for issuers, mandating 100% reserve backing with liquid assets and imposing strict anti-money laundering (AML) rules.

Crypto's turning point cementing dollar's lead

Trump hailed the success of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) as a step to cement “American dominance in global finance and crypto technology.” A broad crypto rally ensued.

The new law creates a two-tier licensing system for issuers (state/federal) and bars unbacked stablecoins. It also prioritizes consumer protections, requiring monthly reserve disclosures and granting holders priority in bankruptcies.

Stablecoin issuers must fully back their tokens with US dollars, Treasuries, or other liquid assets. This Treasuries demand boost is a win for dollar hegemony.

Industry euphoria vs. skepticism

Proponents, like Circle’s Dante Disparte, argue the Act sets a “pro-growth, pro-consumer” precedent, enabling instant cross-border payments without TradFi banking fees.

Critics warn of loopholes. Advocacy groups like Better Markets fear the law legitimizes risky assets while enabling “uncontrolled experiments” on the financial system. Democrats also criticized its leniency toward tech giants issuing private stablecoins and foreign issuers.

CLARITY Act battles ahead

The crypto industry’s next target is the CLARITY Act, which would shift oversight from the SEC to the CFTC — a move critics say weakens enforcement. After the House's approval, its fate in the Senate is uncertain. With Trump’s backing, the sector is poised to lobby harder, even as Democrats vow resistance.

Ethereum is becoming new corporate treasury asset

While Bitcoin has long been the go-to coin for corporate balance sheets, a growing number of companies are now turning to Ethereum's ether (ETH) as a strategic investment. This shift highlights confidence in its foundational role in decentralized finance (DeFi) and blockchain-based innovation.

Corporate adoption boom

Firms like BitMine Immersion Technologies, Coinbase, and SharpLink Gaming are allocating significant capital to ETH. BitMine, for instance, now holds over $1 billion in ETH, betting that its blockchain will underpin the future of tokenized assets and financial services.

This week, Cathie Wood's ARK Invest has purchased $182 million of BitMine stock, fueling an 800% monthly rise — the latest evidence of interest in ETH-focused investments. Meanwhile, Coinbase holds $440 million in ETH, signaling faith in its long-term utility.

The trend isn’t limited to crypto-native firms. Computing company Bit Digital recently shifted its entire treasury from Bitcoin to ether, with CEO Sam Tabar stating, “We believe Ethereum has the ability to rewrite the entire financial system.”

Tokenization revolution

Unlike Bitcoin, which is primarily a store of value, ether's programmable blockchain enables smart contracts, DeFi, and real-world asset tokenization. Ray Youssef, CEO of NoOnes, calls tokenization Ethereum’s “killer app,” allowing businesses to create their own digital economies.

This utility is driving adoption. Bernstein analyst Gautam Chhugani notes that companies using stablecoins — many of which run on Ethereum — pay transaction fees to the network, making ETH a revenue-generating asset. The GENIUS Act, signed into law by President Trump last week, has further boosted confidence in stablecoins and Ethereum’s infrastructure.

Risks and rewards

Despite its potential, ether remains volatile. The ETH price is up 60% in the past month, but its YTD return of 14% lags behind BTC's 26%. Price swings, like April’s dip following Trump’s tariff announcements, remind investors of the risks.

Yet, businesses are undeterred. Strategy’s Michael Saylor may remain “150% Bitcoin,” but others see Ethereum as a complementary bet on blockchain’s future. As Fundstrat’s Sean Farrell puts it, “These companies are capitalizing on real-world asset tokenization trends.”