Clapp Weekly: BTC price records, 'Crypto Week' in Washington DC, Pump.fun ICO

BTC price

Following a spectacular run to all-time highs peaking at $123k, Bitcoin traders have begun taking profits. The price surge was sparked by growing institutional embrace, an endorsement by US President Trump, and the anticipation of lawmakers' "Crypto Week" (more below).

BTC saw explosive growth from $108k a week ago to $118,502 on Friday, July 11. After a calm weekend near $117.5k, another push drove the price to $122,718 ($123,091.61 on CMC) on Monday, July 14, before a retreat started.

Currently trading at $117,439, BTC has gained 0.2% over the past 24 hours and 8.1% over the past week.

ETH price

Ether defied yesterday's market correction after SharpLink Gaming revealed expanding its treasury holdings to more than 280k coins — overtaking the Ethereum Foundation as the largest corporate holder. Meanwhile, Ethereum ETFs have attracted $1.3 billion in net inflows over the past week.

Echoing BTC's momentum, ETH rose from $2.6k to $3,021.48 on Friday, July 11, hovered under $3k, then breached the level again on Monday. After slipping from $3,006.81, the price rebounded, hitting $3,142.32 a few hours ago.

At press time, ETH is at $3,114.77, up 5.5% in 24 hours and +19.6% over the past 7 days.

Seven-day altcoin dynamics

As Bitcoin pulls back from its new all-time high, experts warn of growing risks. Aggressive long positions and widening funding rates reflect the ‘Crypto Week’ enthusiasm supporting sentiment, but the escalation of US trade tensions with major partners may trigger sharp corrections.

Trader fatigue

CMC notes signs of trader fatigue and disbelief on social media — a disconnect typical in sustained bull markets. This suggests the rally “may have more room to run.”

Despite double-digit gains for major altcoins, the Altcoin Season Index remains at a low of 32, showing Bitcoin still dominates. This week's macro news, including the US and UK CPI inflation, US retail sales, and consumer sentiment, may set the tone for global risk markets.

AI crypto rally

AI-related tokens jumped 5% overnight, with the sector's market cap reaching $29.6 billion amid a surge in investment news from US tech giants.

Yesterday, Google announced a $25 billion investment in data centers and AI infrastructure across PJM, America's largest electric grid. Meanwhile, Meta is considering AI data center projects worth hundreds of billions, including a multi-gigawatt Prometheus facility in Ohio.

Winners & losers

PENGU (+119.6%) continues to dominate the winners’ circle, tripling in price over the past month after the SEC accepted Canary Capital’s filing for a spot ETF that blends PENGU tokens with Pudgy Penguins NFTs. Momentum accelerated with its Hyperliquid listing and viral marketing stunts — Coinbase and Binance US swapped their profile pictures to Pudgy Penguins NFTs.

Meanwhile, XLM (+76.4%) has emerged as a dark horse, buoyed by record-breaking TVL ($104M) and growing stablecoin adoption, with Open Interest data signaling sustained demand from both institutions and retail traders. ALGO (+56.4%) staged a comeback after months of stagnation, though on-chain metrics raise doubts — revenue and fees have plummeted year-over-year.

In contrast, PI (-3.6%) is stuck in a two-month downtrend, struggling to capitalize on the broader altcoin rally. Its underperformance is likely tied to delayed Tier-1 exchange listings, which have dampened investor confidence.

The losers’ side saw abrupt declines, with LEO (-2.9%) collapsing from $9 to $8.85 in just 30 minutes, reflecting waning demand for Bitfinex’s ecosystem token. Similarly, SKY (-2.6%) lags despite its high-profile Coinbase listing, as the MakerDAO rebrand fails to reignite momentum amid competition from newer DeFi protocols.

Cryptocurrency news

House's "Crypto Week" can reshape crypto and TradFi

The "Crypto Week" has kicked off in Washington DC, with the House of Representatives set to vote on the GENIUS Act — a bill poised to transform the $238 billion stablecoin market. Meanwhile, the CLARITY Act aims to resolve the "security/commodity" uncertainty, while the Anti-CBDC Surveillance State Act would prevent the Federal Reserve from issuing a digital US dollar.

GENIUS Act: Stablecoins go mainstream

Stablecoins have become essential for traders, cross-border payments, and inflation hedging. However, the market is currently dominated by just two players — Tether’s USDT and Circle’s USDC.

The GENIUS Act seeks to disrupt this near-duopoly by opening the door for banks, fintech firms, and even retailers like Amazon to issue their own compliant stablecoins. This could spur competition, giving consumers more options while embedding stablecoins deeper into everyday commerce.

Consumer protections are also in focus. Under the bill, issuers must maintain 1:1 reserves in cash or short-term US Treasuries, undergo regular audits, and disclose reserve compositions monthly.

Crucially, the Act bans yield-bearing stablecoins, preventing issuers from paying interest to holders — a move designed to protect traditional banks from deposit flight. While this restricts DeFi’s ability to offer passive yield, it may push the sector toward more transparent, sustainable strategies.

CLARITY Act: Ending asset status debates

Today, House lawmakers are due to vote on The CLARITY Act — a bill the establishes the criteria for asset classification as securities (subject to the SEC's oversight) or as CFTC-overseen commodity. Previously, the bill received bipartisan support when it cleared two committees.

Senate Democrats may change their stance over concerns about Trump's crypto empire. The President's family is currently linked to the $TRUMP and $MELANIA meme coins, the USD1 stablecoin, and the World Liberty Financial DeFi platform. Some supporters of the GENIUS Act had hoped the broader bill would address conflicts of interest — but it does not.

Pump.fun’s stellar $2B market cap debut

Pump.fun, the Solana-based meme coin launchpad, has stormed into the crypto top 100 with a $2 billion market cap — days after its $600 million ICO sold out in 12 minutes. The July 12 ICO, priced at $0.004 per token, saw PUMP surge 65% to $0.0061 on launch day before settling at $0.0055.

ICO frenzy meets post-launch reality

Data cited by Decrypt reveals 21.6% of ICO buyers sold immediately, while 43.4% transferred tokens, possibly to preparing for trading or airdrops. Only 31.8% held, suggesting cautious optimism among investors.

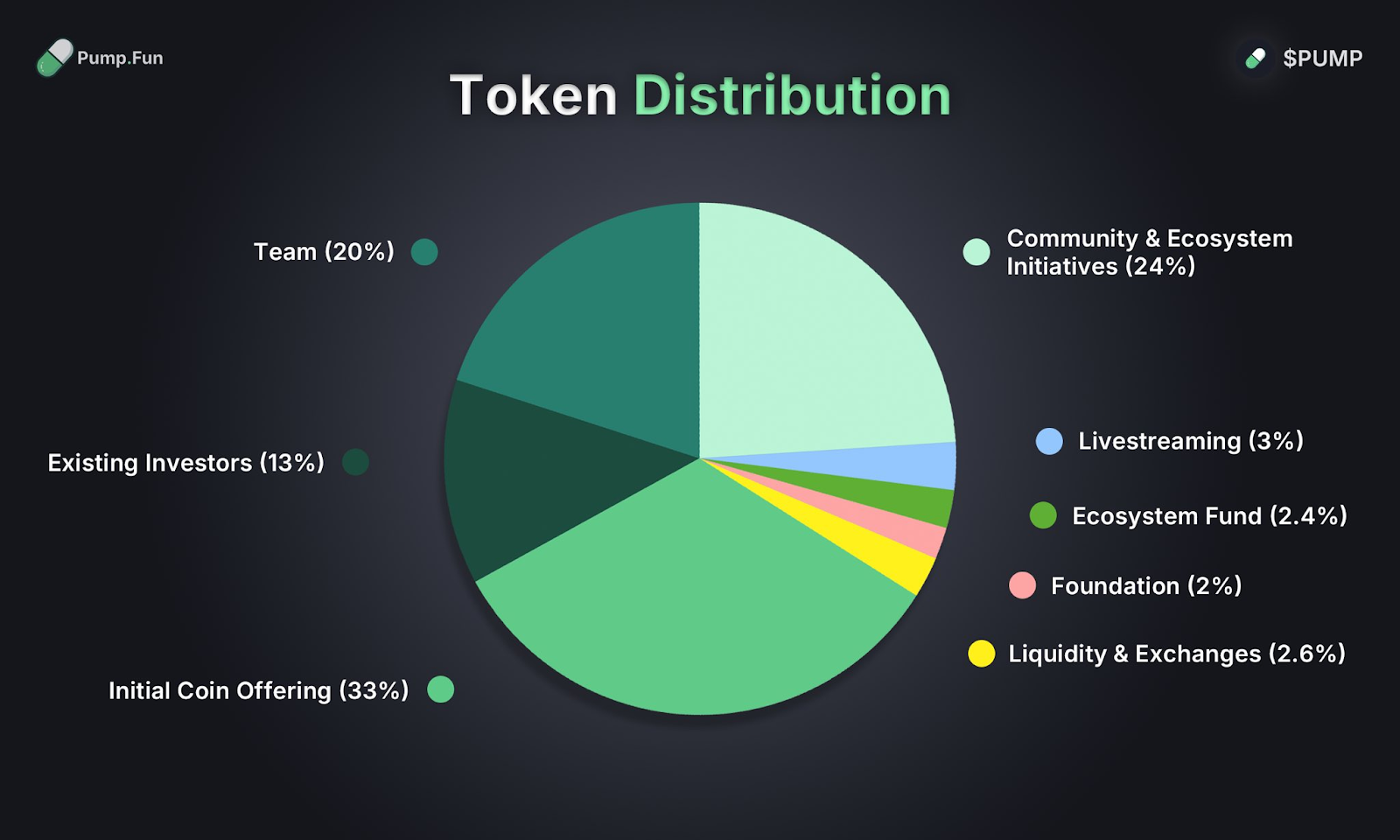

Since 2024, Pump.fun has topped $784 million in revenue, according to Dune. With 24% of PUMP’s supply earmarked for “Community & Ecosystem”, holders anticipate airdrop announcements. Prediction markets give a 47.7% chance of an airdrop by July’s end — a move that could boost adoption.

Challenges ahead

Pump.fun faces pressure from rivals like LetsBonk, which surpassed it in daily token creations last week. Its success hinges on sustaining hype while navigating the risks of token dilution — especially with $2B in vested PUMP tokens waiting to enter circulation.

BONK is sitting on a $2.23 billion market cap — $230 million ahead of PUMP. Thus, PUMP’s ICO proves demand for meme infrastructure is soaring, but the path to dominance may require more than viral tokens — think ecosystem expansion and flawless airdrop execution.