Corporate Bitcoin treasuries: Why companies are hoarding BTC

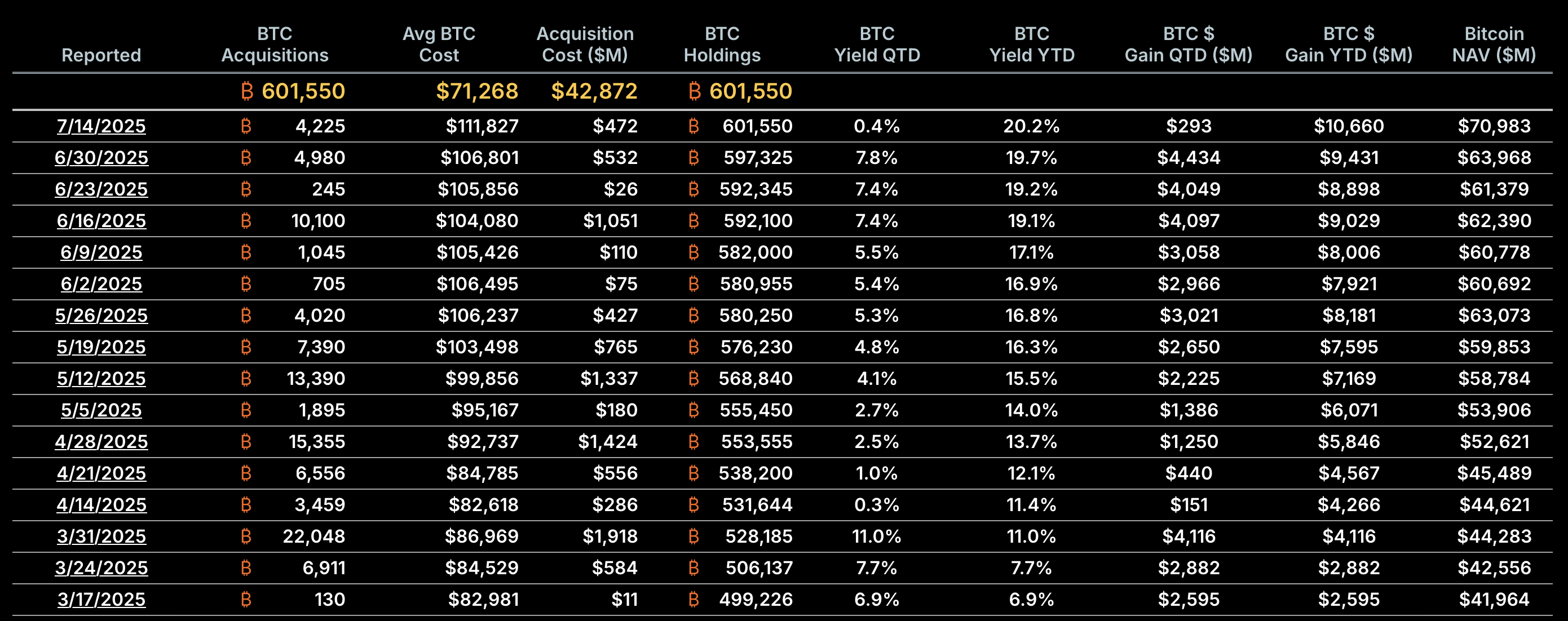

Companies accumulating Bitcoin are making headlines, with Strategy keeping its trailblazer lead with a stash worth over $70 billion. Crypto purchases are a progressive way to diversify corporate holdings, hedge against inflation, and signal a forward-thinking philosophy. Here are the basics of corporate Bitcoin buying.

Corporate pioneer: Strategy

Software provider Strategy (formerly MicroStrategy), which started buying Bitcoin in August 2020, has made more than 80 purchases as of this writing. Over the years, as the BTC price skyrocketed — confirming Michael Saylor’s bullish conviction — so did the average cost. By July 14, 2025, it had grown tenfold, from $11,652 to $111,827.

Crypto treasury purchases became a trend after Saylor shared his Bitcoin evangelism playbook with Tesla in 2020. Subsequently, the EV manufacturer added $1.5 billion worth of BTC to its balance sheet in February 2021.

Companies like Rumble (a streaming platform) and GameStop (a video game retailer) are now following Strategy's lead. More and more companies are borrowing its playbook — and by 2029, Bernstein expects corporate BTC treasuries to swell to $330 billion.

- Rumble and GameStop currently hold 4,710 BTC and 210.8 BTC, respectively.

- Biopharmaceutical provider ATAI Life Sciences is planning to pursue its own Bitcoin treasury strategy, initially investing $5 million.

- Metaplanet (a Japanese investment firm) and Semler Scientific (a medical device manufacturer) continue growing their holdings — holding 13,350 BTC and 4,846 BTC as of July 21, 2025.

- Trump Media & Technology Group is raising $2.5 billion for its Bitcoin treasury strategy. The firm has secured subscription agreements with around 50 institutional investors and will sell $1.5 billion worth of common stock and $1 billion worth of convertible senior secured notes to finance the purchases.

- Strive Asset Management is driving Bitcoin adoption on balance sheets — and has recently secured $750 million to fund its first round of Bitcoin purchases.

How do corporate treasuries work?

A corporate treasury stores a company's financial assets, including cash, stocks, and investments. Preserving capital and maintaining liquidity require investing cash surpluses, which traditionally take the form of government bonds or money market accounts.

While these instruments are low-risk, an increasing number of firms are embracing BTC as an alternative store of value. Holding it involves the use of custodial services from specialized firms like Coinbase Custody, BitGo, and Fidelity Digital Assets. Institutional-grade safeguards — including cold storage, multi-signature wallets, and insurance — secure these corporate BTC stashes.

Why BTC?

Asset appreciation is not the primary criterion for treasuries — strategic reserves are held to counteract economic downturns. They should be “counter-cyclical to the rest of the economy,” as James Davis, co-founder of Crypto Valley Exchange, put it.

Strive Asset Management — co-founded by Vivek Ramaswamy — calls Bitcoin “the most secure, transparent, and resilient reserve asset available to corporations today — and a natural benchmark for long-term capital discipline.”

In this regard, corporate holders typically view Bitcoin's decentralization and fixed supply as a hedge against fiat inflation and the declining yields of traditional cash holdings.

Risks of holding BTC

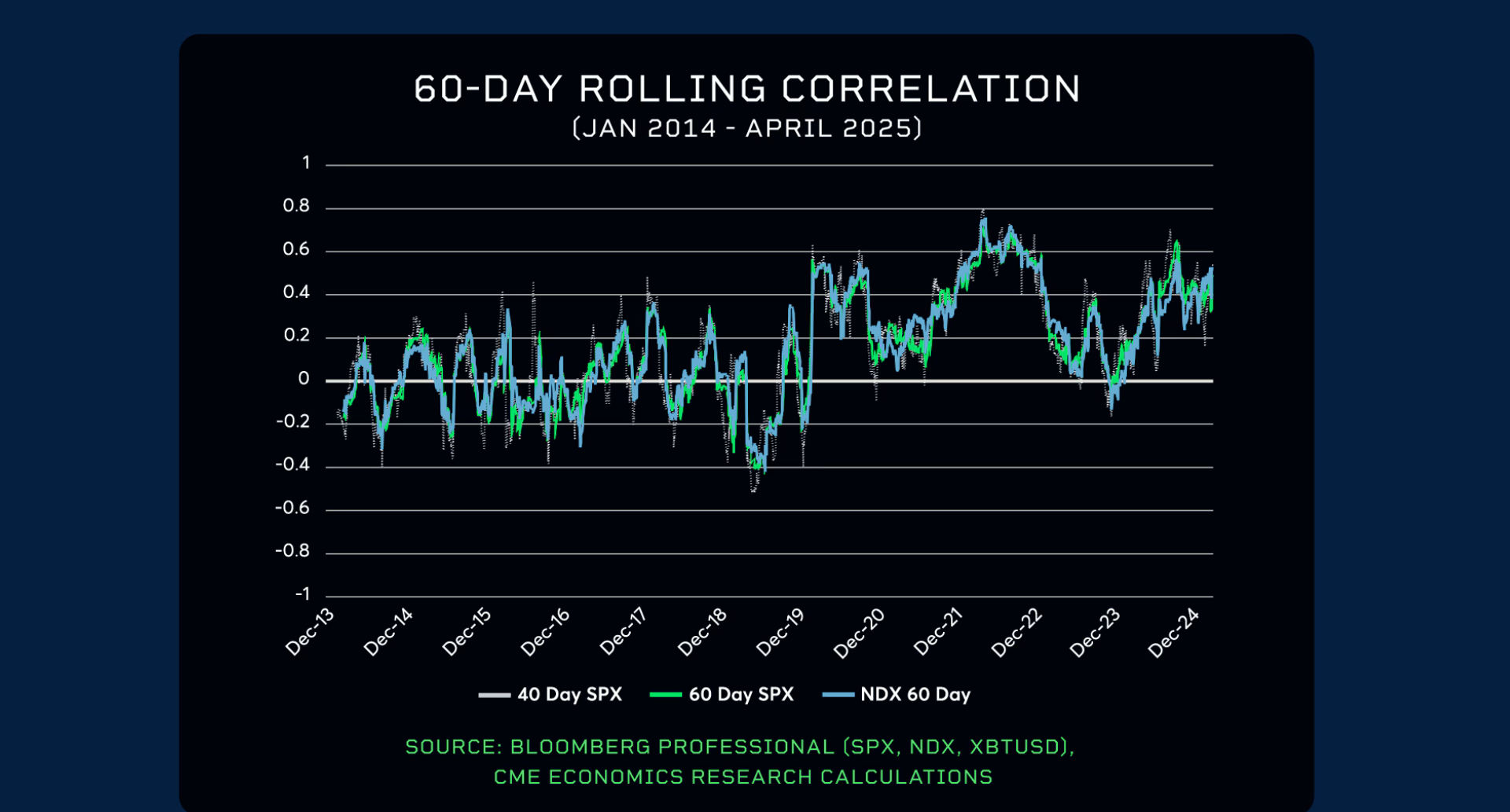

At times, however, Bitcoin appears to be the opposite — pro-cyclical, losing value when the market needs liquidity the most. A positive correlation with S&P 500 and Nasdaq-100 indices since 2020 has affected its potential as a hedge and portfolio diversifier.

As the two stock indices reflect the performance of different sectors, BTC appears tied to broad economic conditions. As noted by the CME Group, this shared risk-off sentiment rises at times of market stress, such as:

- Between February and March 2020: The COVID-19 pandemic started to unfold.

- Between July and October 2023: The Fed raised its benchmark rate by 0.75% to 4.00%–4.25% to combat inflation fueled by supply chain disruptions, labor shortages, and energy price spikes.

- Between January to early April 2025: Geopolitical uncertainty (like India-Pakistan skirmishes), escalating trade tensions, and unpredictable US policy triggered risk aversion. In April, broad US import tariffs triggered a global market sell-off, with the S&P 500 dropping 12.9%.

When conventional assets dipped, so did appetite for cryptocurrency. Investors shifted to gold and safer havens as equities faced pressure from higher borrowing costs.

Both Bitcoin and stocks are susceptible to the Federal Reserve's rate decisions and macroeconomic reports impacting their probability. Hawkish comments by Chair Jerome Powell have sent both asset classes down this year — for instance, a tariff-related stagflation warning in April 2025 short-circuited Bitcoin's rally to $86k.

On the other hand, crypto-specific factors, such as endorsement by President Trump or the passage of laws like the GENIUS Act, have also helped Bitcoin gain value. Since Trump's re-election in 2024, the BTC price has doubled, rising from $68k to $118k.

Skeptics voice doubts

Thus, holding Bitcoin does not guarantee safety from market uncertainty and risk. Many companies remain hesitant — even within the crypto industry.

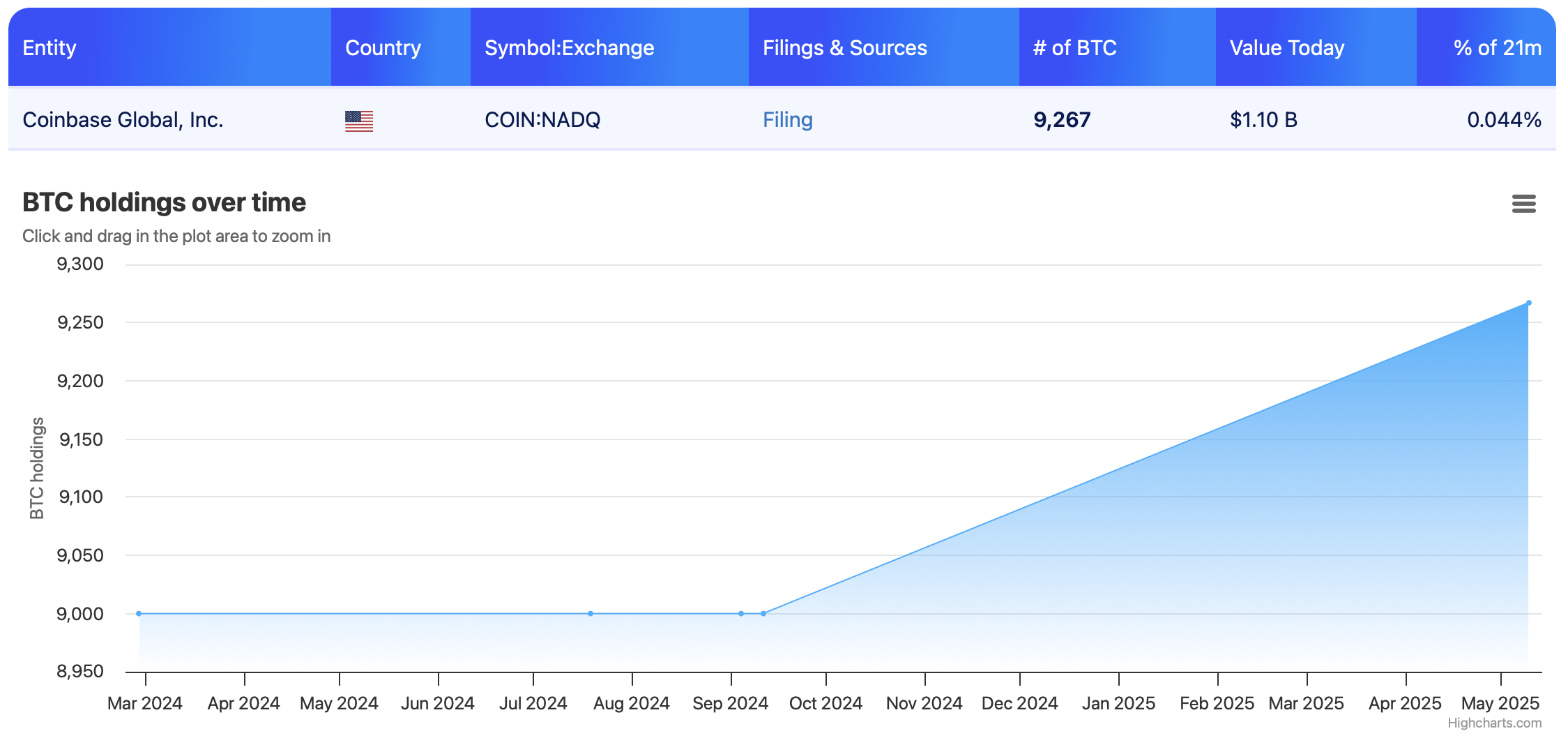

In May 2025, Coinbase CEO Brian Armstrong admitted the exchange dropped the idea of allocating 80% of its balance sheet to BTC, fearing such a Saylor-esque bet could “kill the company.” The company adopted a relatively conservative approach, adding around $153 million in crypto — mostly BTC — to its investment portfolio in Q1 2025.

Currently, Coinbase holds 9,267 BTC (about $1.3 billion) — a far cry from Strategy’s $70+ billion holdings at today’s prices.

How BTC’s perception evolved

From a purely speculative bet, Bitcoin has evolved into a corporate financial strategy tool, with game theory and investor pressure boosting adoption.

- As more companies adopt Bitcoin, others mimic them to stay competitive in the eyes of the public.

- Bitcoin treasuries project a forward-thinking image, impressing investors through responsiveness to financial and tech trends.

- Companies cite the need to preserve and optimize capital amid inflation and market volatility.

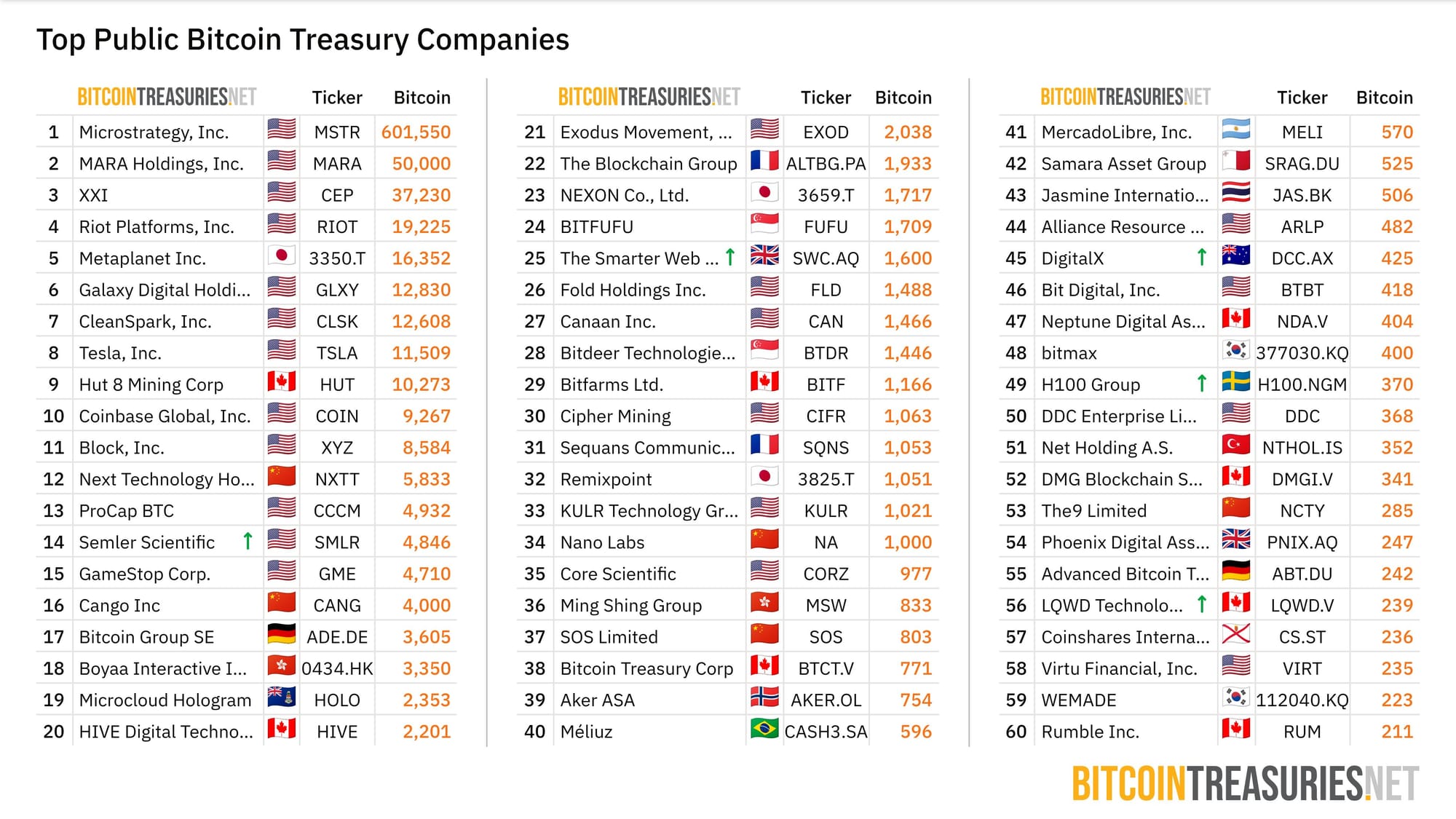

Top corporate Bitcoin holders in July 2025

Over 250 entities, including public companies, private firms, ETFs and pension funds, now hold Bitcoin. The second-largest holder, top Bitcoin miner MARA Holdings, has started lending out bitcoins to institutions instead of selling them. In Q1 2025, this strategic treasury deployment generated a 5-9% yield.

Beyond Bitcoin

Ether — the runner-up by market cap — is lagging behind but gaining steam. In July 2025, SharpLink became the largest ETH holder, ahead of the Ethereum Foundation itself.

Wrapping up: Balancing opportunity and risk

Bitcoin’s emergence as a treasury asset marks a seismic shift in approaches to capital preservation and strategic growth. From Strategy’s billion-dollar bets to mainstream adopters like Trump Media, BTC has cemented its role as a hedge against inflation and a symbol of innovation.

Yet its volatility remains a double-edged sword — while Trump’s pro-crypto policies and institutional adoption have fueled rallies, Fed rate decisions and geopolitical shocks remind investors that BTC is not immune to macroeconomic turbulence. It offers transformative potential, but only for those prepared to navigate its risks.