Clapp Weekly: Bitcoin at $80k, recession worries, strategic reserve disappointment

Price dynamics

BTC price

On Tuesday, March 11, Bitcoin dipped below $80k, triggering a sharp sell-off that liquidated $700 million in long positions. With a Fed rate cut less likely due to a stable February jobs report, investors have adopted a risk-off approach.

After peaking at $92,300.44 on Thursday, March 6, BTC trended downward and remained flat over the weekend at around $86,200. Monday’s steep decline culminated in a drop to $77,186.93 yesterday, followed by a rebound attempt.

Currently priced at $81,983.56, BTC is up 2.7% over the past 24 hours but down 5.3% over the past week.

ETH price

Yesterday, ether fell by as much as 6% to $1,813.21, marking its lowest intra-day level since October 2023. The sharp decline rattled the DeFi space, endangering a crypto loan on Sky (formerly Maker) backed by $130 million in ETH. Such liquidations can further pressure ETH’s price, as they intensify selling activity.

ETH mirrored Bitcoin’s volatility, reaching a high of $2,298.49 on Thursday, March 6. After trading below $2,200 over the weekend, the price slid further on Monday, March 10, hitting a seven-day low of $1,813.21 yesterday.

At press time, ETH is trading at $1,859.34, reflecting a 0.6% drop over the past 24 hours and a 13.7% decline over the past week.

Seven-day altcoin dynamics

On March 7, President Trump launched the creation of a US Bitcoin reserve and a separate stockpile for other cryptocurrencies. The executive order preceded the Digital Assets Summit in Washington, attended by prominent figures such as Michael Saylor of Strategy, along with the CEOs of Coinbase, Crypto.com, and Robinhood.

However, these moves failed to significantly boost market sentiment. By March 11, crypto prices slid as concerns over a sell-off in US equities overshadowed Trump’s initiatives. The decline followed a sharp drop in tech stocks, with the Nasdaq 100 Index falling 3.8% — its worst day since October 2022.

Wall Street remains uneasy after Trump warned of a potential “little disturbance” for US citizens due to ongoing trade wars with Canada, Mexico, and China. Strategists and economists have since increased their projections for a US recession.

As Joshua Lim, FalconX Global Co-Head of Markets, noted, “With the strategic Bitcoin reserve executive order now in place, crypto has one fewer positive catalyst to price in, leaving it vulnerable to macro risk appetites.”

Winners & losers

Only three tokens in the top 100 have posted gains above 1%. Leading the winners is MOVE (+21.4%), which surged following the launch of its Public Mainnet Beta. The token benefited from increased trading volume, a rise in locked value, and growing investor interest fueled by potential ETF applications.

CRO (+8.3%) also rose after a proposal to reverse the burn of 70 billion tokens, aiming to restore the total supply to 100 billion and establish a Cronus Strategic Reserve. Meanwhile, ENA (+3.0%) climbed as bullish momentum returned, with traders opening more long positions in ENA futures and liquidating shorts following recent token unlocks.

On the losing side, S (-24.5%) has reversed its strong performance from February when it led blockchain TVL growth due to ecosystem expansion and new protocol launches. ADA (-23.8%) also struggles amid a broader market correction and concerns following Trump’s announcement of an ADA crypto reserve. However, a rumored listing on the Gemini CEX could provide a turnaround opportunity.

Lastly, TRUMP (-22.0%) continues its downward spiral, extending a sharp decline that began after peaking ahead of the Trump inauguration.

Cryptocurrency news

Bitcoin dips below $80k as Trump refuses to rule out a recession

Bitcoin crashed below $80k on Monday, March 10, as investor sentiment soured amid growing fears of a potential US recession. Meanwhile, US equities saw the biggest one-day drop since September 2022 — the so-called ‘Magnificent 7’ cohort shed $830 billion in market cap.

This downturn followed former President Donald Trump’s warning of a "period of transition" tied to ongoing tariff policies, which exacerbated market pessimism. Crypto investment products faced record outflows, totaling $4.75 billion over four weeks. US investors withdrew $922 million, primarily from Bitcoin.

Despite Bitcoin’s reputation as a potential hedge during market uncertainty, it has shown increasing correlation with traditional equities. The broader financial markets also suffered, with the Dow Jones Industrial Average falling 8% and the S&P 500 hitting its lowest point since September 2024.

Unfavorable macroeconomic background

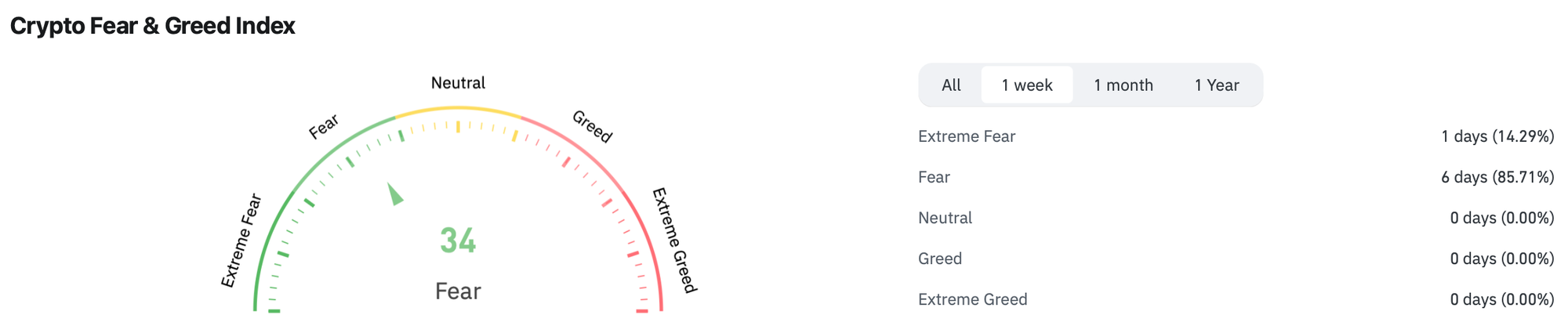

A stronger US dollar, a hawkish Fed signaling fewer rate cuts in 2025, and a shift to safe-haven assets like gold and the yen have dampened hopes for a near-term recovery. However, capitulation often precedes a rebound — and the Crypto Fear & Greed Index, climbing to 34 in " fear" territory, hints at potential short-term relief.

Singapore’s QCP Capital notes that Treasury yields and dollar strength offer key positioning cues. Despite market turmoil, 10-year Treasury yields have dropped about 60 bps, and the dollar has weakened — historically positive for USD-denominated assets like equities and crypto.

Lower yields also ease US government borrowing costs, a critical factor as Trump’s proposed tax cuts and expansionary fiscal policies take shape.

Disappointment with Digital Assets Summit

The recent White House crypto summit, hosted by Trump, failed to inspire market optimism. While expectations were high, the event was described as anticlimactic and underwhelming, with no significant boost to crypto prices.

Trump's Bitcoin reserve plan fails to bolster crypto prices

Last Thursday, March 6, President Trump signed an executive order establishing a Strategic Bitcoin Reserve and a stockpile of other digital assets. The order also calls for federal agencies to develop strategies to acquire more BTC, without generating additional costs for taxpayers.

The US currently holds about 200k BTC, worth roughly $17 billion, and about $400 million worth of several other tokens seized in civil and criminal cases. The reserve will include BTC already held by the US government, rather than new purchases.

"The Secretary of the Treasury and the Secretary of Commerce shall develop strategies for acquiring additional Government BTC [bitcoin] provided that such strategies are budget neutral and do not impose incremental costs on United States taxpayers," the order stated.

Buying BTC to add to the fund appears unlikely in the short term, but the door has been left open. The Digital Asset Stockpile, on the other hand, will not be increased through new purchases — “beyond those obtained through forfeiture proceedings." David Sacks, Trump's "crypto czar," has ordered an audit of the government's existing reserves.

Jeff Mei, chief operating officer at crypto exchange BTSE, has noted that “top cryptocurrencies dropped after it was revealed that the widely anticipated crypto reserve would only hold existing government holdings.”

The notion of an SBR gained traction in 2024 as Trump embraced the industry on the campaign trail. Supporters say BTC investment can help the government reduce the $36 trillion national debt, and ensure that the country retains dominance in a “hypothetical future where the global economy runs on cryptocurrencies,” as The New York Times put it.