Clapp Weekly: BTC below $90k, Bybit hack, Saylor meets with SEC

Price dynamics

BTC price

Traders seized the opportunity to buy the dip as BTC's price slipped below $87k yesterday, coinciding with the Fear and Greed Index flashing 'extreme fear.' This marked the most significant sentiment shift since September.

The price initially climbed from $95K to $99,244.09 on Friday, February 21, before dipping back and holding above the initial level for four consecutive days. A sharp decline began on Monday, February 24, reaching a low of $86,776.45 yesterday, followed by a modest rebound.

Currently priced at $88,523.78, BTC is down 1.0% over the past 24 hours and 7.4% over the last seven days.

ETH price

Ether is struggling despite Aya Miyaguchi's transition to President of the Ethereum Foundation (EF) after months of dissent. The latest rout saw the price tank to $2,337, its lowest since early November, with all post-US election gains erased.

The ETH price mirrored BTC's trajectory, climbing from $2.6k to $2,831.81 on Friday, February 21, before a dip. However, the coin saw steady gains over the weekend, reaching $2.8k on Monday, February 24, prior to the downturn. Following yesterday's weekly low of $2.3k, ETH is slowly regaining momentum.

Changing hands at $2,466.75, ETH is up 2.4% over the past 24 hours but down 8.9% over the last seven days.

Seven-day altcoin dynamics

The latest turmoil marks a drastic shift from the rally that followed Donald Trump’s re-election. His plans to impose tariffs on key trading partners, combined with inflation concerns and industry-specific setbacks, have pushed BTC below $90k for the first time this year.

Macro uncertainty has impacted most financial markets. The current crypto decline mirrors a broader retreat from risky assets, which began after last week’s January inflation reports revealed higher-than-expected rises in both CPI and PPI. As a result, money has flowed into safer havens like bonds, driving the 10-year Treasury yield down for five consecutive sessions.

Additionally, cryptocurrencies have underperformed tech stocks in recent weeks due to industry-specific challenges. The recent LIBRA memecoin scandal involving Argentine President Javier Milei was followed by the largest-ever crypto hack targeting the Bybit CEX (more details below).

DOGE (-16.5%) has fallen below $0.20 for the first time since November amid a broader meme coin sell-off. Meme coins launched by Donald and Melania Trump shortly before the inauguration have also declined, further eroding investor confidence. At press time, TRUMP (-24.0%) is down over 80% from its launch-day peak.

Winners & losers

Story Protocol's token (IP) is leading gains (+161.3%). Its price surged following the Mainnet launch on February 13, overcoming initial losses from an airdrop. Story Protocol enables users to tokenize diverse intellectual property, with blockchain integration for terms of use, ownership, and royalty agreements.

MKR (+47.0%) has also defied market trends, experiencing high demand. Derivatives and on-chain data support a bullish outlook despite consistent profit-taking. Meanwhile, SEI (+22.9%) has surged after Donald Trump’s World Liberty Financial took a $125K position in the token. The network has seen explosive growth in activity.

On the losing side, MNT (-24.5%) has taken a significant hit due to signs of rising US inflation, particularly the January CPI, which climbed to 3% for the first time since June. LDO (-20.8%) is also struggling with selling pressure as whales offload their holdings following a short-term recovery.

AAVE (-18.9%) has succumbed to short-term bearish pressure amid broader market fear and uncertainty, despite surging an impressive 177% year-over-year.

Cryptocurrency news

Bybit closes post-hack deficit with $1.23B in purchases and loans

The Bybit exchange has suffered a hack in which $1.4 billion worth of ETH and stETH was drained by the North Korean state-sponsored Lazarus Group. Although the hackers have begun laundering those funds, Bybit has successfully closed the deficit.

The breach on February 21 exploited a vulnerability in Bybit's Ethereum cold wallet, highlighting the increasing sophistication of North Korea’s hacking operations. The Lazarus Group attempted to obscure their trail by dividing and funneling the funds across decentralized exchanges (DEXs) and privacy protocols, converting over $140 million into BTC.

Bybit CEO Ben Zhou announced that the exchange has replenished nearly 88% of the stolen funds. It acquired approximately $1.23 billion worth of ETH through loans, large deposits from "whales," and direct purchases.

On-chain analytics data from Lookonchain reveals that Bybit has executed several high-volume transactions, including a $437 million over-the-counter (OTC) purchase from crypto investment firms Galaxy Digital, FalconX, and Wintermute, among other channels. Additionally, a Bybit-related wallet acquired 304,000 ETH.

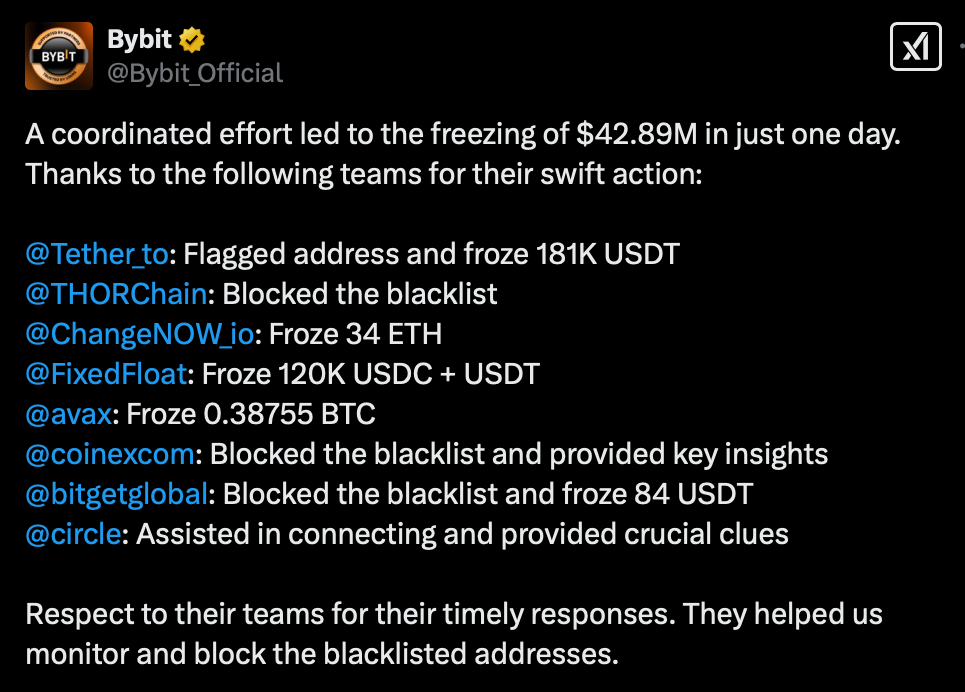

Bybit has assured users that its reserves exceed liabilities and has promised a new proof-of-reserves report to demonstrate full asset restoration. The exchange also praised industry partners like Tether, Circle, and THORChain for freezing $42.89 million of the stolen funds.

"Respect to their teams for their timely responses," the company tweeted on Sunday, acknowledging the firms that helped “monitor and block the blacklisted addresses.”

Bybit’s swift response and transparency have helped stabilize its position, with total assets now standing at $10.81 billion.

However, the hack has heightened concerns about the safety of crypto platforms, contributing to this week’s market plunge. Caroline Mauron, co-founder of derivatives provider Orbit Markets, noted that the incident “was the latest in a string of events, such as questionable memecoin launches, that have brought back unhappy memories for crypto market participants.”

Michael Saylor advocates for clearer crypto rules in SEC meeting

Strategy (ex-MicroStrategy) co-founder Michael Saylor met with the SEC’s Crypto Task Force on February 21 to advocate for clearer, more business-friendly regulations. His proposals focused on reducing financial burdens for crypto firms, including capping asset-issuing costs at 1% of assets under management and limiting listing maintenance fees to 10 basis points per year.

Saylor also emphasized the need for regulators to define different categories of digital assets — such as NFTs, stablecoins, and meme coins — while clarifying the rights and responsibilities of crypto businesses and investors. His proposals come as the SEC, now under acting chair Mark Uyeda, has begun softening its stance on enforcement, recently dropping cases against Coinbase and Robinhood.

The meeting reflects a broader shift in US crypto policy following the election of pro-crypto President Donald Trump. The SEC’s newly formed Crypto Task Force, led by Commissioner Hester Peirce, is collaborating with industry leaders to shape regulatory guidelines that support innovation while ensuring investor protection.

Saylor, a long-time Bitcoin advocate, has been vocal about strengthening the U.S. crypto ecosystem. He recently met with Eric Trump to discuss Bitcoin’s future and has backed a plan to establish a US Bitcoin reserve. With ongoing dialogue between regulators and industry leaders, the landscape for digital assets in the US may be on the brink of dramatic change.

Beyond regulations, Saylor remains a steadfast believer in Bitcoin. As the market experienced a sharp decline, with the BTC price dipping below $89k for the first time in three months, he urged traders to "buy the dip," echoing a similar message from Eric Trump.

Strategy, a long-time aggressive Bitcoin buyer, now holds 499,096 BTC, worth $47 billion at current prices. On Monday, the firm announced a $2 billion purchase, adding 20,365 BTC at an average price of $97,514 per coin. It aims to raise funds through zero-coupon convertible bonds and buy more BTC as part of its "21/21" plan—a strategy to accumulate $42 billion worth of BTC over the next three years.