Clapp Weekly: BTC's slip from $100k, fading Fed hopes, 130 years for Do Kwon

Price dynamics

BTC price

A post-holiday return to markets and high hopes for Trump's presidency built a bullish sentiment ahead of the inauguration — before macro reports changed everything. On Monday, January 6, US spot Bitcoin ETFs raked in $987 million, the highest net inflow since November 21.

BTC bounced off its January 1 low of $93,051.98, hitting $97.4k the next day and moving further to reclaim six figures on Monday, January 6. The surge culminated in yesterday's high of $102,290. Sinking sharply, the coin then dived back below $96.4k.

At $94,858.84, BTC has shed 5.9% over 24 hours, remaining in the green over seven days (+2.9%).

ETH price

Ether rose from a low of $3,320.90 on Wednesday, January 1, moving in lockstep with Bitcoin, before the general decline canceled out those gains. Over 500,000 ETH withdrawn from staking protocols in the past month may affect its long-term prospects.

After revisiting $3.5k, the price soared on Friday, January 3, to reach $3,658.60 in two days. It then reversed from a 7-day high of $3,714.58 on Monday, January. 6, with a steep decline culminating in $3,380.02 this morning.

Currently at $3,326.51, ETH is down 8.5% in 24 hours and up 0.9% over 7 days.

Seven-day altcoin dynamics

Bitcoin's recovery past $100k sparked an uptick across altcoins; demand manifested after the Fed's 2025 projections cut the Santa Claus rally short. Then, on January 7, the tide turned.

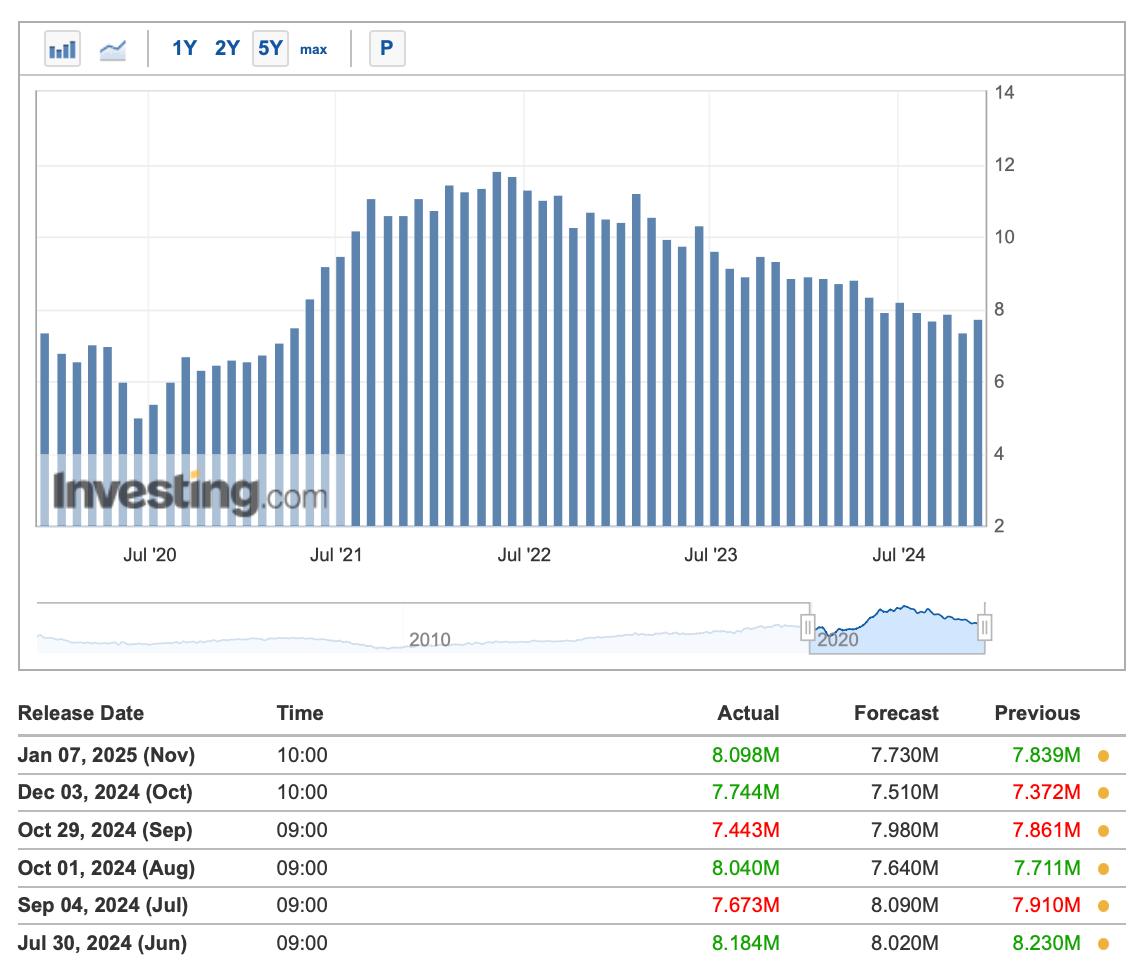

The Institute for Supply Management (ISM) revealed its non-manufacturing purchasing managers index (PMI) had jumped from 52.1 to 54.1 in December. Meanwhile, the JOLTS report revealed higher-than-expected job openings in November.

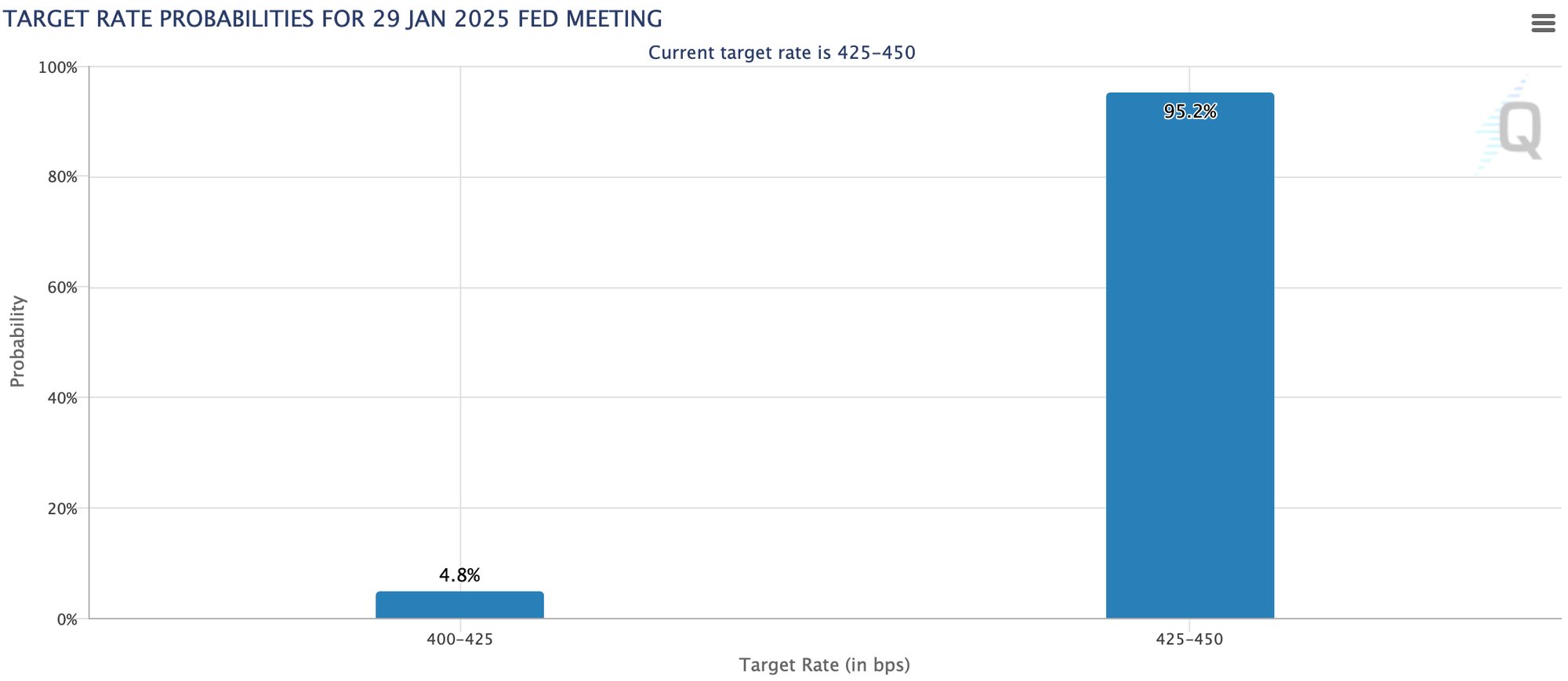

That fresh data pushed the chance of a Fed rate cut before June below 50%, triggering a risk-off reversal across markets. The Altcoin Season Index slipped 3 points to 44, down 38 points from December. As of January 8, around 44 projects in the top 100 by market cap have outperformed Bitcoin in the past 90 days.

Seven-day gains are led by SPX (+65.7%), which hit a new ATH on January 6. The SPX6900 token, a meme coin designed to "beat" the S&P 500, has surged 75% YTD, likely due to the January effect and fear of missing out.

TKX (+28.9%), the token of Singapore's Tokenize CEX, has soared following its Taiwan expansion plans. Meanwhile, XLM (+23.6%) boasts strong fundamentals and recent partnerships like the Stellar-MoneyGram collaboration and adoption by Franklin Templeton for its OnChain US Government Money Fund.

VIRTUAL's dip (-11.6%) is attributed to its distribution phase, while Virtuals Protocol remains a key player in the AI agent sector. HYPE (-9.0%) continues plunging after validators exposed crucial decentralization issues in Hyperliquid. PEPE (-5.5%) is affected by recent whale selloffs.

Cryptocurrency news

Bitcoin plunges as robust job data dims Fed hopes

Bitcoin fell sharply on Tuesday, January 7, retreating from an overnight high near $103k. The decline followed stronger-than-expected US labor market data — high November job openings highlighted economic resilience and diminished hopes for further Fed interest rate cuts.

Furthermore, the ISM Services PMI – gauging an index of US services, orders, backlog, business activity, and other items – jumped in December. The monthly rise from 52.1 to 54.1 was a bullish signal for the economy, as anything over 50 is a sign of economic expansion.

A day prior, Bitcoin had briefly surpassed $100k for the first time in nearly three weeks. Bitcoin ETFs witnessed nearly $1 billion in inflows on Monday, indicating ongoing investor interest.

The drop reflects the broader trend of risk-on assets faltering when rate cuts appear less likely. Lower rates often encourage investment in speculative assets like crypto by increasing liquidity and reducing the appeal of fixed-income investments.

Altcoins saw steeper losses, and crypto-focused stocks were similarly impacted. On Tuesday, January 7, MicroStrategy dropped 10%, Coinbase fell 8%, and Marathon Holdings slid 7%.

The Fed's outlook for 2025 is cautious, and concerns about a resurgence of inflation reminiscent of the 1970s cast uncertainty across markets. Despite its rate cuts implemented in recent months, the agency projects only two more reductions in 2025 due to persistent inflationary pressures.

Fallen 'crypto king' Do Kwon faces 130 years in prison

Former Terraform Labs CEO Do Kwon, once a crypto superstar, now faces a potential 130-year prison sentence following his extradition to the US. The 33-year-old pleaded not guilty in his Manhattan court appearance last week, contesting charges linked to the $40 billion collapse of Terra’s ecosystem — the largest in crypto history.

The US Department of Justice has unsealed a superseding indictment, charging Kwon with securities fraud, wire fraud, money laundering, and conspiracy. Central to the case are allegations that Kwon manipulated Terra’s algorithmic stablecoin, UST, during its 2021 crisis. Prosecutors claim he collaborated with Jump Crypto to falsely restore UST’s $1 peg, misleading investors about the platform’s stability.

Further allegations involve misusing the Luna Foundation Guard (LFG), which Kwon reportedly used to misappropriate millions from reserves. The DOJ accuses him of laundering these funds through exchanges, blockchain networks, and Swiss accounts.

Kwon’s trial is a critical moment for crypto, raising calls for tighter regulations and greater transparency in the industry. His downfall, from celebrated innovator to accused fraudster, underscores the risks of unchecked ambition in crypto’s volatile landscape.