Clapp Weekly: Crypto rally, Bitcoin resurgence, TON’s tokenized fund

BTC price

Bitcoin has managed an impressive rally, supported by robust spot demand, BTC ETF inflows, and Coinbase unveiling a yield fund for institutions. In addition, Strategy announced a $1.42 billion BTC purchase on April 28.

Rising from $92.8k, BTC touched $94.3k before sinking to $91,979.96 on Thursday, April 24, and rebounding to $95,501.31 the next day. After slipping again, it bottomed out near $93k on Monday, April 28, and has since see-sawed around the $95k mark.

Currently at $94,699.63, BTC shows no 24-hour change but has gained 2.0% over the past seven days.

ETH price

A report by Fidelity Digital Assets suggests ether is bottoming, based on several on-chain metrics. In particular, the MVRV-Z score, which compares market value to realized value, entered the undervalued zone on March 9, while NUPL indicates capitulation — the point where unrealized profits equal losses.

Mirroring BTC, ETH fell from $1.8k to $1,733.69 on April 24 before gradually climbing to $1,843.68 on Sunday, April 27, only to lose momentum. After dipping to $1,660.50 this Monday, the price has struggled to break above $1.825k.

Now at $1,801.91, ETH is up 0.1% over the past 24 hours and 0.5% over the past seven days.

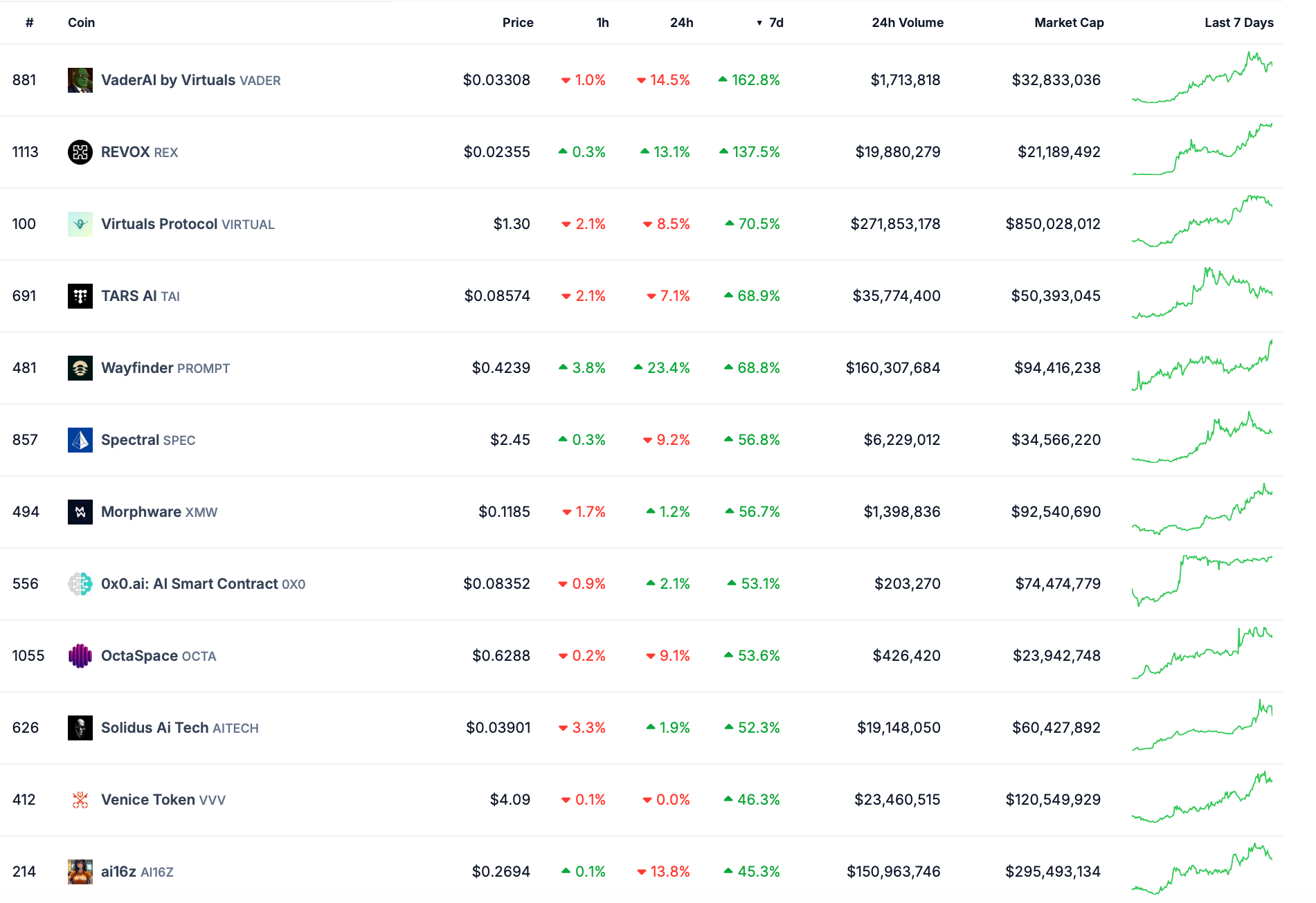

Seven-day altcoin dynamics

April has brought game-changing gains for Bitcoin, which rose over 14% — outpacing gold and tech stocks — reigniting the debate over its safe-haven potential. Investors funneled roughly $2.9 billion into U.S. spot Bitcoin ETFs, marking a sharp reversal from the outflows seen in March and February.

After rebounding from a local low of $75k and briefly surpassing $95k on April 25, BTC fueled a broader crypto market recovery. Notably, the AI narrative has regained momentum, with its total market cap approaching $26 billion. Several related categories surged 40%, led by Virtuals Protocol’s VIRTUAL and AI agent protocol Eliza OS’s AI16Z token.

According to Cookie.fun, the total AI Agent market cap — including infrastructure tokens and meme-driven projects like Fartcoin — has doubled in the past three weeks. Blockchains with strong AI ties, such as Bittensor's TAO (+7.7%), also posted notable gains. FET — the token of the Artificial Superintelligence Alliance — is up 12.7%.

While Bitcoin’s resurgence appears to be the primary catalyst, ongoing developments in the sector have contributed. For instance, Virtuals Protocol has recently introduced its Genesis launch mechanism, designed to provide fairer access to AI agent tokens.

On the downside, XRP (-1.2%) and DOGE (-4.3%) faced pressure after the US Securities and Exchange Commission (SEC) delayed its decision on proposed ETF listings until June.

Winners & losers

VIRTUAL (+78.8%) has surged on the back of a broad ecosystem rebound lifting tokens like GAME, Ribbita, and VaderAI, while futures open interest climbed to its highest level since January.

Meanwhile, TRUMP (+40.1%) rocketed on the news of an exclusive gala dinner for its top 220 holders, although a $20 million insider sell-off has since dampened momentum. SUI (+28.1%) is bolstered by $278 million in stablecoin inflows over the past month, alongside heightened whale accumulation and rising social engagement.

On the downside, UNI (-10.1%) faced selling pressure after the Uniswap Foundation released its unaudited 2024 financial report, revealing a $4.68 million deficit. Despite the short-term dip, the long-term outlook remains optimistic as the foundation continues to push development forward.

KAS (-9.7%) also retreated, giving up some of last week’s 13% gains as traders took profits ahead of the upcoming Crescendo hard fork, which is expected to drive adoption. Similarly, PI (-9.6%) reversed course after the unlock of 6.7 million tokens (worth approximately $4.67 million), cooling off from its earlier rally fueled by user growth and Banxa’s integration.

Cryptocurrency news

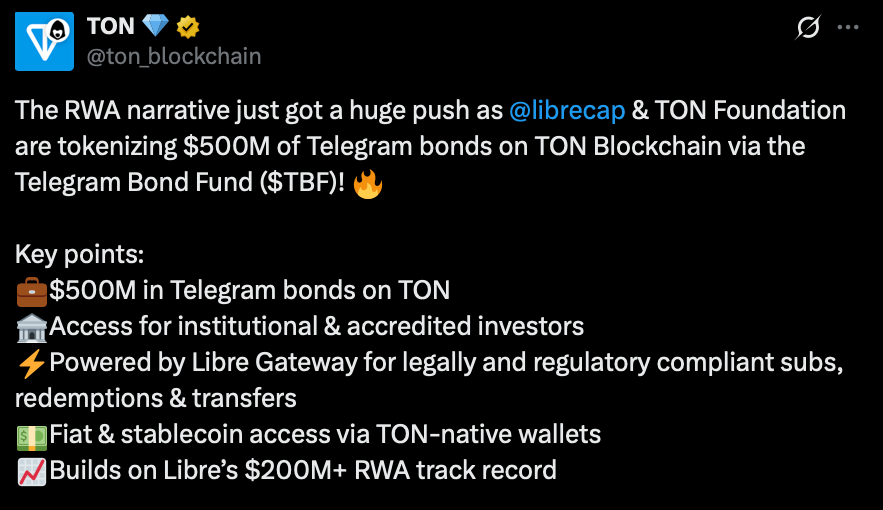

Telegram’s $500M tokenized bond fund bridges DeFi and TradFi

The Open Network (TON) and Libre, a regulated platform for real-world assets (RWAs), have launched a $500 million fund bringing Telegram’s corporate bonds on-chain. This move marks one of the largest institutional forays into decentralized finance — and growing convergence between TradFi and blockchain infrastructure.

The Telegram Bond Fund provides exposure to Telegram’s $2.4 billion in outstanding debt. Institutions and accredited investors will gain it directly through the native blockchain, managing positions via TON wallets.

The fund will also serve as collateral across TON’s ecosystem, benefiting from its integration with Telegram’s 950 million-user messaging platform. Meanwhile, Libre’s institutional-grade platform ensures regulatory compliance while maintaining the efficiency of blockchain settlements.

Institutional RWA boom

This collaboration follows Libre’s previous success tokenizing over $200 million in assets for major institutions including BlackRock and Nomura’s Laser Digital. The launch reflects booming institutional demand for RWA tokenization:

- The sector’s total value locked has more than doubled to $11 billion this year.

- BlackRock’s BUIDL treasury fund now exceeds $2.5 billion, while stablecoin issuer Circle recently acquired Hashnote to expand its RWA offerings.

- In the Middle East, DAMAC’s $1 billion real estate tokenization deal with Mantra Blockchain demonstrates the global scope of this transformation.

As TON deepens its Telegram integration and Libre expands its institutional partnerships, this fund represents a milestone in making traditional debt markets interoperable with DeFi’s liquidity and composability. The coming months will likely see more regulated financial products migrate on-chain as blockchain infrastructure matures.

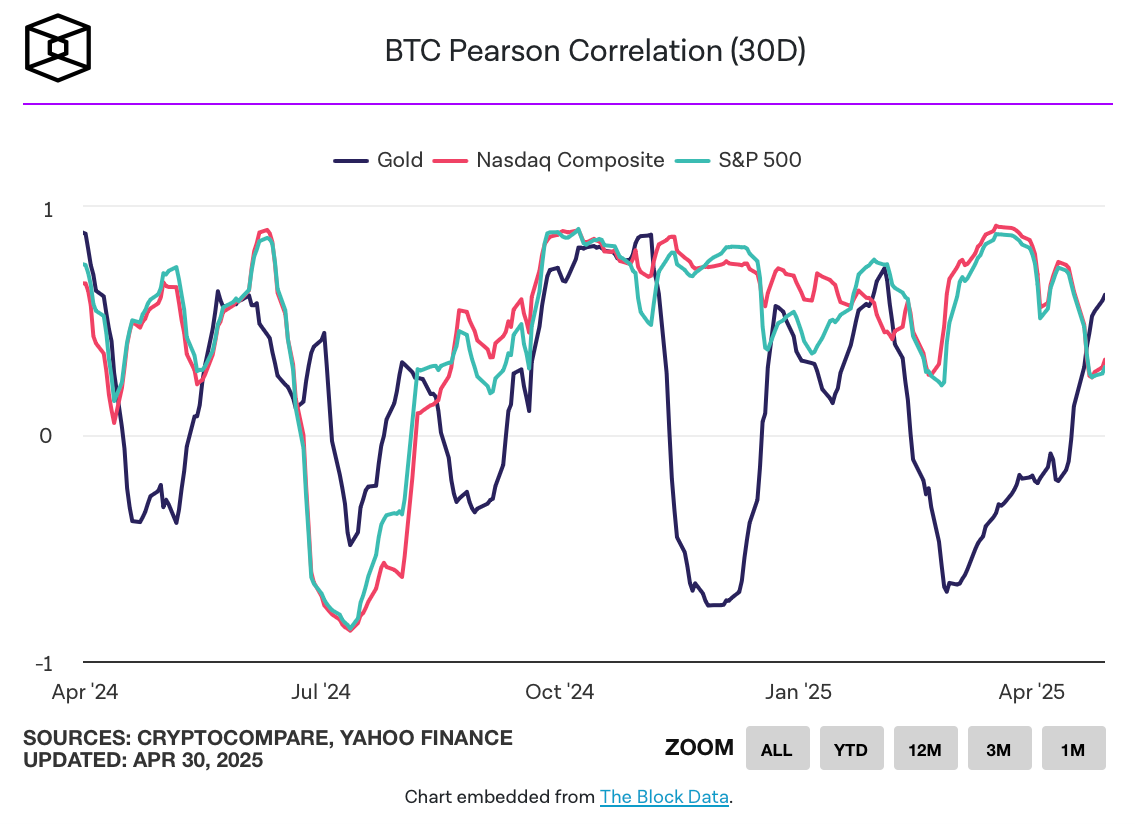

Bitcoin returns to positive: Shift toward digital gold?

Bitcoin (BTC) has officially turned positive year-to-date (+1.60%), reclaiming its momentum — the price has recently approached $95k, erasing an earlier 18% drop YTD. This rebound has reignited debates about the pioneer's evolving role — whether it behaves more like a leveraged tech stock or a form of "digital gold."

Recent data suggests the latter narrative is gaining traction. Advocates say the coin has served as an alternative hedge amid rising concerns about US fiscal policy and institutional stability, fueled by Donald Trump's “Liberation Day” tariffs.

Bitcoin’s 30-day correlation with gold now stands at 0.70, significantly higher than its 0.53 correlation with the Nasdaq 100. BTC appears to be aligning more closely with gold’s safe-haven characteristics rather than mirroring tech equities.

Last week’s 10% surge — the strongest performance since November — further underscores resilience amid economic uncertainty. Geopolitical tensions and trade disruptions are playing a key role in this shift.

With US tariffs on Chinese goods soaring to 145%, supply chain concerns are resurfacing, and retailers like Walmart warn of potential shortages. Meanwhile, escalating conflicts like the India-Pakistan tensions have amplified demand for non-sovereign assets.

As Greg Cipolaro of NYDIG noted, Bitcoin is increasingly being treated as a “non-sovereign store of value,” outperforming traditional safe havens like gold and US Treasuries since early April.

That said, Bitcoin remains sensitive to macro forces. Volatility across equities, bonds, and currencies remains elevated, and traders are cautiously optimistic — options markets show bullish interest in June $110k calls, but funding rates and positioning suggest measured optimism rather than euphoria.

As investors brace for key economic data — including April’s nonfarm payrolls — Bitcoin’s trajectory may hinge on broader financial stability.