Clapp Weekly: Dip before Santa Claus rally, US as crypto leader, combo ETFs

Price dynamics

BTC price

BTC plunged from $104k on December 18 following the Fed’s cautious forecast. Cutting the benchmark rate by another 25 bps, the agency scaled back the outlook for next year’s reductions from four to two, rattling markets (more below).

After sinking to $92,805.76, BTC rebounded last Friday, December 20. Once the price pushed above $99k, it dropped again, seesawing until another sub-$93k low. A Santa Claus rally, which pushed all major indices and stocks into the green yesterday, helped it re-approach $100k, with a high of $99,303.79.

At press time, BTC is changing hands at $99,095.35, up 5.7% in 24 hours but down 4.9% in the past week.

ETH price

Activity across long-term and short-term sellers has strengthened the bearish pressure for ETH as whales bought the dip. Although it has lagged behind BTC, declining exchange balances hint at growing confidence in a post-holiday rebound.

Following a nosedive from $3.9k to $3,114.57, ETH shot back past $3.5k and slipped again before Wall Street's Santa Claus rally. Based on increasing holding time, analysts note it may surpass resistance at $3.5k to revisit $4k.

Changing hands at $3,537.86, ETH is up 4.2% over the past 24 hours, with a -8.6% seven-day change.

Seven-day altcoin dynamics

Cryptocurrencies plunged last weekend as investors grappled with a relatively hawkish Fed outlook. Although the FOMC approved a 25-bps reduction on December 18, it slashed its forecast for 2025 cuts from four to two, fueling market uncertainty.

Spirits improved on Monday as Trump appointed Stephen Miran to share his Council of Economic Advisers. A former US Treasury Department official, Miran has a crypto-friendly stance, similar to Bo Hines, appointed Executive Director of the Presidential Council of Advisers for Digital Assets.

Many altcoins have outpaced BTC recently, although a full-blown altcoin season is not here yet. The Fear And Greed Index reflects bullish investor sentiment despite Bitcoin's first weekly drop since Trump's November 5 re-election.

A new partnership with BitGo to bring WBTC onto the Movement mainnet has helped MOVE (+59.8%) outshine the broader market. BGB (+28.0%) issuer Bitget is now the sixth biggest exchange by trading volume, while spikes in activity on the Hyperliquid DEX pushed HYPE (+16.0) to the third position.

Token unlocks and Aptos Labs CEO's departure have triggeres the deepest plunge for APT (-22.8%). As Solana faces selling pressure, WIF (-22.9%) has also sunk in the past week, while SOL (-8.3%) has nearly reversed to the pre-election level. Meanwhile, FTM has tanked on its Binance delisting as part of a strategic network upgrade.

Cryptocurrency news

US reclaims crypto market leadership amid Trump agenda

The United States has once again emerged as the heartbeat of the global crypto market. Donald Trump’s victory and surging demand for US digital asset funds and derivatives are driving a shift away from Asia.

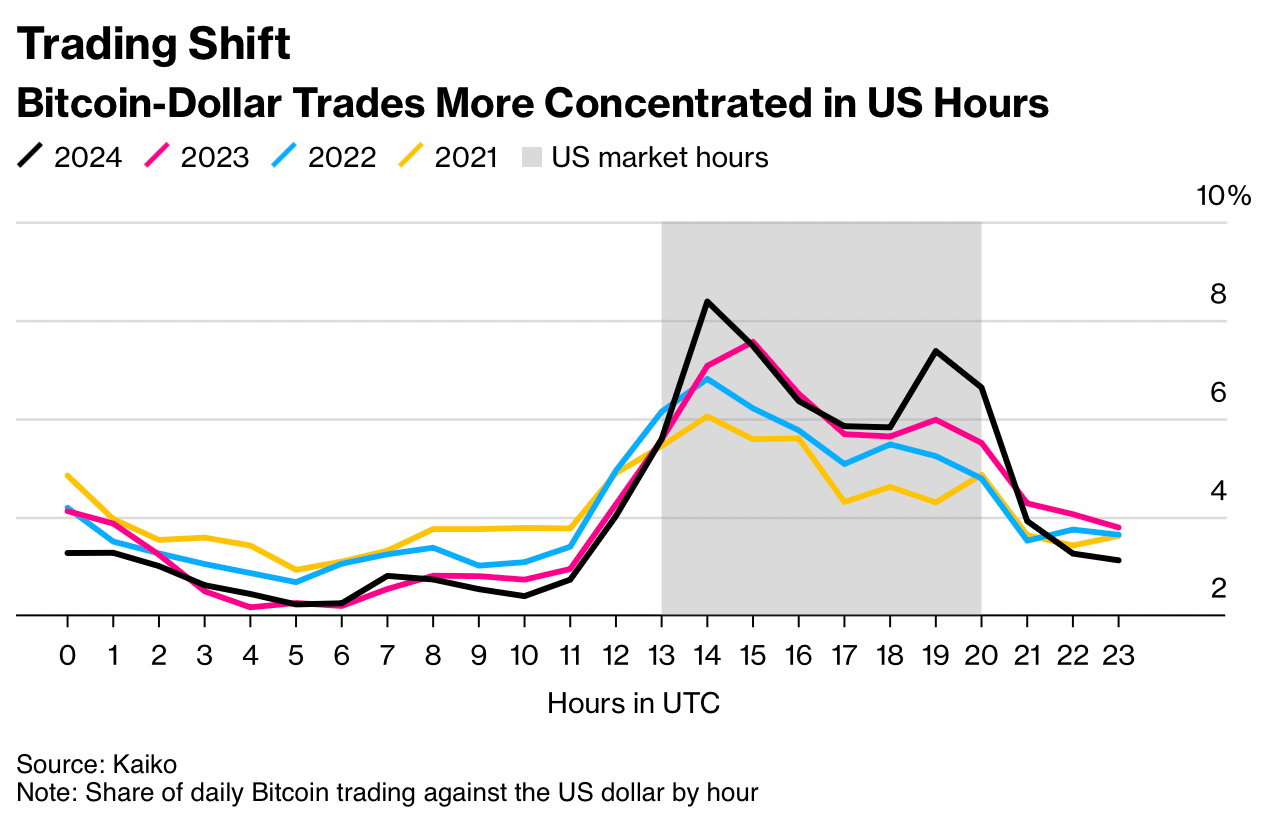

Trump’s vow to make America the world’s “crypto capital” has triggered changes re-establishing it as a key liquidity and pricing player. US hours now account for 53% of daily Bitcoin trading against the USD, up from 40% in 2021, according to Kaiko. CF Benchmarks’ Thomas Erdösi notes that institutional participation has driven “liquidity dominance” toward the US.

Previously, Asia led the way as a key beneficiary of Biden’s crypto crackdown. US ETFs and Trump-fueled optimism have turned things around, resolving the liquidity issues triggered by the 2022 FTX debacle. Crypto market depth — the ability to shoulder relatively large orders without unduly impacting prices — is back at levels seen before the platform’s undoing.

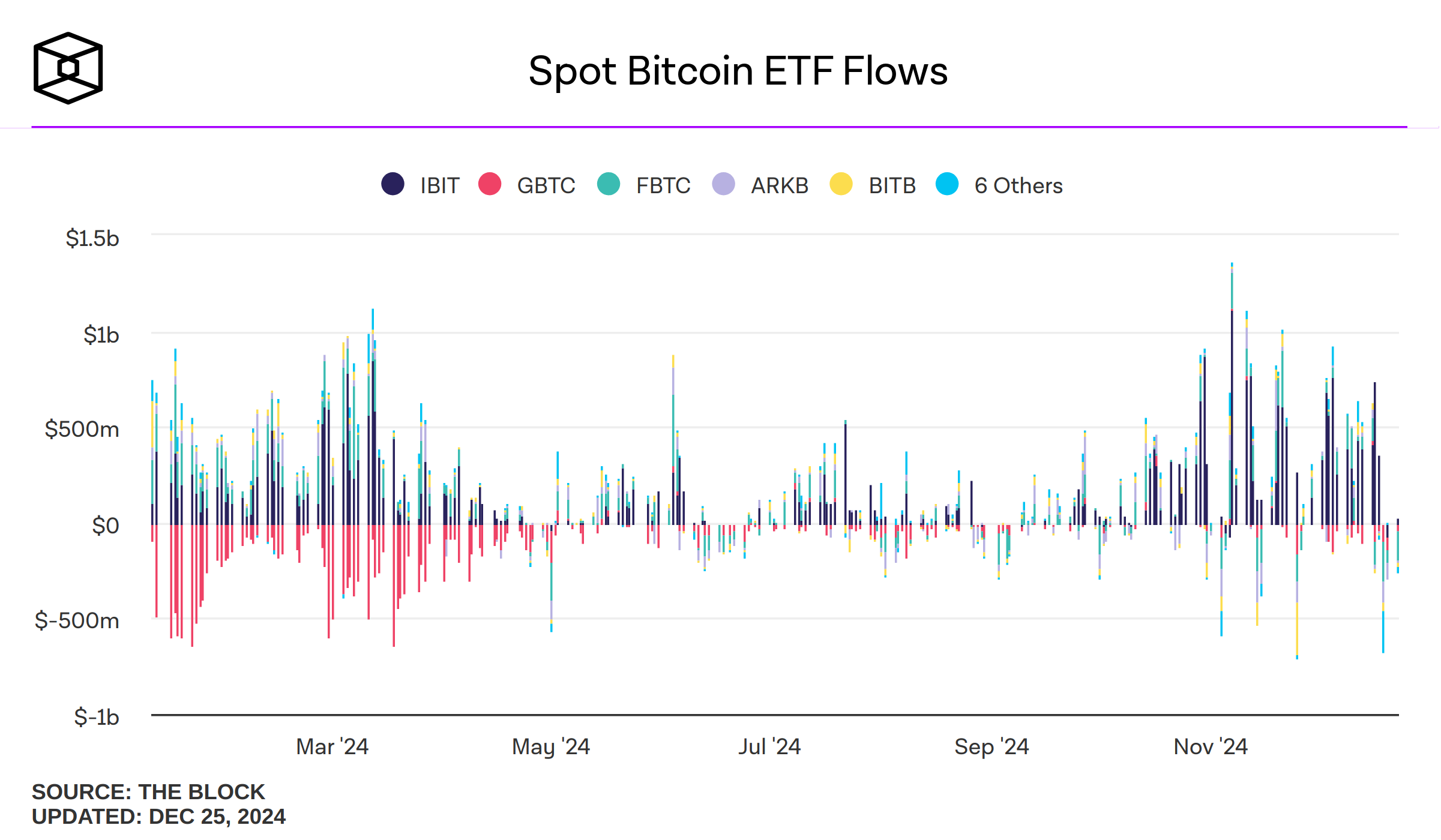

US Bitcoin ETFs, led by BlackRock’s iShares Bitcoin Trust, have seen over $36 billion in inflows and $500 billion in trading volume since January. Open interest in Bitcoin and Ether futures on the CME Group has also hit record highs, solidifying its position as the top platform for Bitcoin futures.

SEC greenlights first spot Bitcoin and Ethereum combo ETFs

The US Securities and Exchange Commission (SEC) has approved the first exchange-traded funds combining spot Bitcoin and ether. Managed by Hashdex and Franklin Templeton, these trailblazing products are set to launch in January 2025.

The Hashdex Nasdaq Crypto Index US ETF (NCIQ) and Franklin Crypto Index ETF (EZPZ) will allocate holdings based on market cap, roughly 80% in BTC and 20% in ETH. Additional cryptocurrencies may be added in the future, pending regulatory approval. The core custodians are BitGo and Coinbase.

The SEC based its approval on the criteria established for spot crypto ETF counterparts. This move signals a milestone in the US crypto ETF market, which has already seen over $36 billion in net inflows from spot Bitcoin products alone. Spot Ethereum ETFs, launched in July, have attracted a more modest $2.4 billion.

The debut of combo ETFs underscores the continued evolution and growing acceptance of crypto in TradFi. The ETF Store President Nate Geraci expects “meaningful demand for these products” as “advisors LOVE diversification. Especially in an emerging asset class such as crypto.” Furthermore, other asset managers like BlackRock may follow suit, launching their own bundle offerings.

Bloomberg ETF analysts Eric Balchunas and James Seyffart also anticipate strong investor interest in diversified products. After crypto backer Paul Atkins replaces Gary Gensler as SEC chair, a wave of new crypto-based ETFs may follow, involving SOL, XRP, LTC, and HBAR.