Clapp Weekly: Global chaos, 30% market dip, Ripple's $1.25B power move

Price dynamics

BTC price

Bitcoin dipped near $75K today before a slight recovery, as Trump’s sweeping tariffs took effect. Soaring Treasury yields and plunging bond prices — driving up the government's borrowing costs — prompt bears to target $70k. A prolonged trade war could further pressure BTC, which often mirrors US stock sentiment.

BTC briefly climbed to $87k last Wednesday, April 2, before sliding back into the $82.5k–$83.5k range, where it lingered until Sunday’s sell-off. The price hit a low of $74,773.26 on Monday, April 7, rebounded to $80.7k the following day, then stalled once more.

Now trading at $75,702.90, BTC is down 5.4% over the past 24 hours and 10.7% over the last week.

ETH price

Ethereum’s ether is facing loss-driven selling and DeFi liquidations as investors react to being underwater. Analysts point to the start of a capitulation phase, though historical data suggests a potential long-term recovery ahead.

ETH’s losses nearly doubled those of BTC after a high of $1,907.14 a week ago. The price hovered around $1.8k until Sunday, April 6, before plunging to $1,431.71 the following day. A brief rebound to $1,593.74 was followed by yet another retreat.

Currently at $1,420.35, ETH has dropped 10.7% in 24 hours and 24.4% over the past week.

Seven-day altcoin dynamics

Risk and appetite has cooled across the board — after Donald Trump announced sweeping trade tariffs, global markets crashed in an event compared to the 1987 Black Monday. Tariffs on any Chinese goods, hiked to 104%, came alongside import taxes on over 60 trading partners.

Bitcoin has shown surprising resilience and solid fundamentals, dipping to $74,500 but maintaining nearly 60% market dominance. Meanwhile, altcoins, NFTs, and memecoins have suffered far steeper losses, highlighting a flight to relative safety within crypto.

The exodus from crypto majors reversed all gains from Tuesday’s relief rally. Ryan Lee, Chief Analyst at Bitget Research, told CoinDesk, “If macro conditions stabilize or pro-crypto policies emerge, we could see Bitcoin hit $95,000–$100,000 by late 2025, lifting the market cap past $3 trillion again."

Winners & losers

DEXE (+22.0%) leads a handful of gainers, fueled by the recent rollout of staking in its revamped DeXe dApp. By March 31, over 300 million tokens had been committed, reflecting strong user participation.

OKB (+4.9%) extended its upward trajectory, supported by sustained investor interest and heightened buying activity on the platform. Meanwhile, OM (+0.7%) edged higher following MANTRA’s launch of a $108 million Ecosystem Fund, a strategic reserve dedicated to advancing RWA innovation and project development.

On the downside, NEAR (-28.2%) succumbed to broader market uncertainty despite earlier resilience driven by cross-chain interoperability updates. The token’s sharp decline highlighted fading investor confidence amid volatile conditions.

TRUMP (-27.9%) mirrored geopolitical tensions, plummeting as President Trump’s escalated trade war intensified recession fears. The token’s drop coincided with his approval rating sliding to 46%. Rounding out the losers, MOVE (-27.1%) faced relentless selling pressure in the absence of fundamental catalysts.

Crypto market plummets 30% amid Trump tariff chaos

The crypto market has taken a brutal hit, losing 30% of its value since its December 2024 peak, with total capitalization crashing from $3.9 trillion to $2.7 trillion. The sharp decline follows President Trump’s aggressive new tariffs — 34% on China, 24% on Japan, and 20% on the EU — sparking fears of a global trade war.

Investors have rushed to reduce risk, pulling capital from volatile assets. The correlation between crypto and traditional markets has strengthened, with both reacting negatively to uncertainty. US stock futures tumbled, and Bitcoin dropped 6% in 24 hours, while Ethereum plunged over 12%.

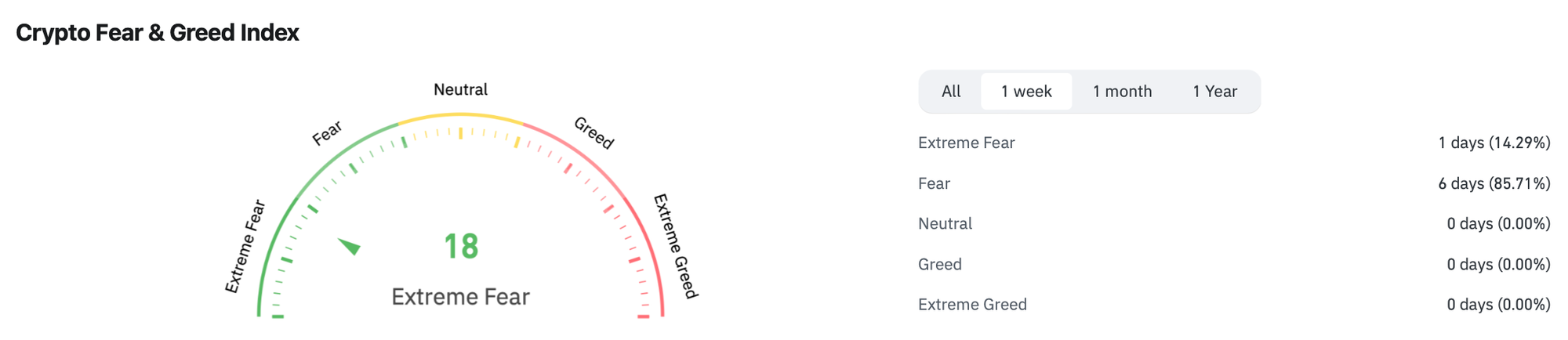

With liquidity thin on weekends, the sell-off intensified, pushing the Crypto Fear & Greed Index to an "extreme fear" level of 18. Yet, some see opportunity — BitMEX’s Arthur Hayes suggests tariffs could eventually fuel a Bitcoin rally as investors seek alternatives to shaky fiat systems.

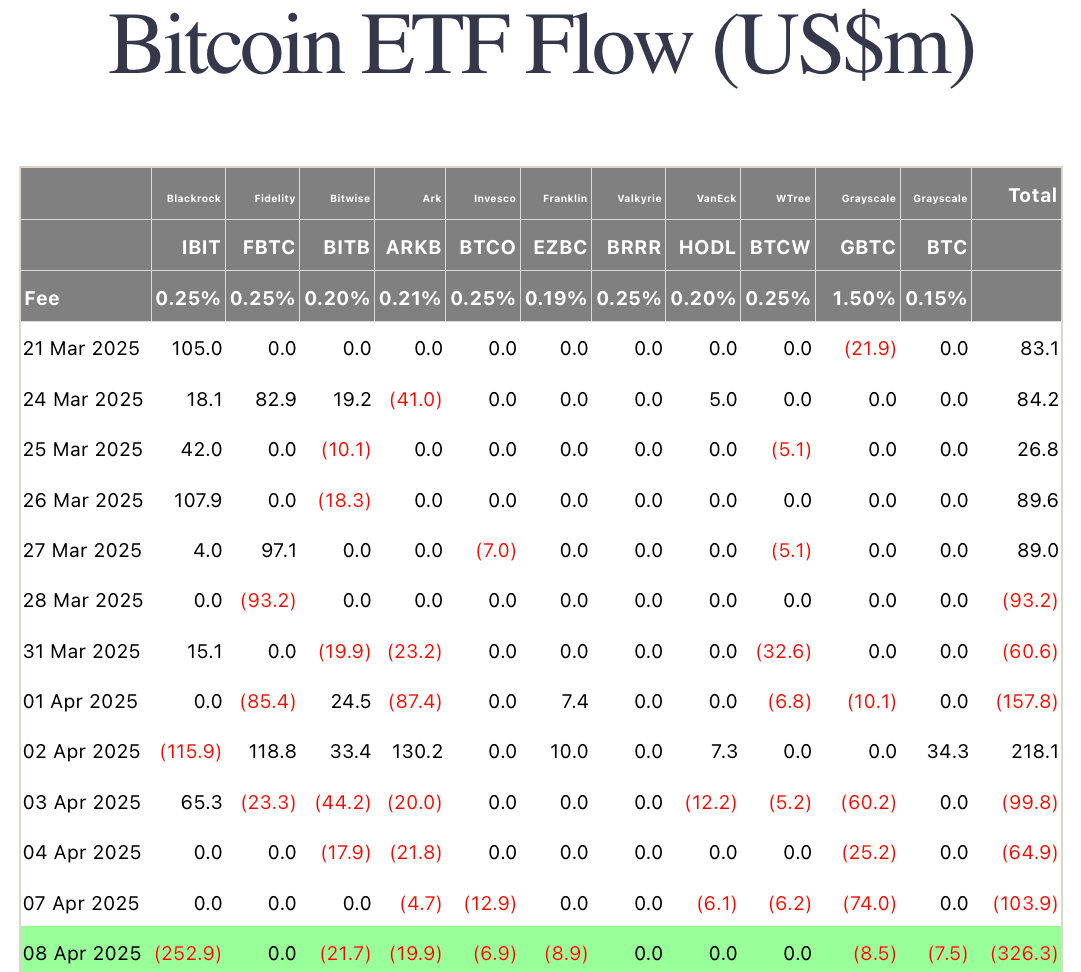

Massive ETF outflows

The crypto ETP market also saw a sharp reversal last week, with $240 million in outflows. Bitcoin funds bore the brunt, losing $207 million, while Ethereum, Solana, and Sui also faced heavy withdrawals. The sell-off marks a stark contrast to the previous two weeks that brought $870 million in inflows.

Grayscale’s Bitcoin Trust continued its 2025 slump, bleeding another $95 million — bringing its year-to-date outflows to a staggering $1.4 billion. Meanwhile, BlackRock’s iShares Bitcoin ETF held strong with $3.2 billion in net inflows this year, despite a $56 million pullback last week.

Stocks defy the trend

Amidst the chaos, blockchain stocks have attracted $8 million in inflows for the second straight week. Institutional investors may see long-term value in crypto infrastructure, even as short-term traders retreat.

Volatility is not going away anytime soon

Analysts argue the outflows reflect broader risk-off sentiment rather than a loss of faith in crypto. With Bitcoin ETPs still up $1.3 billion YTD and altcoins like Toncoin posting inflows, the dip could be a buying opportunity.

The Trump administration defends the tariffs as a measure to reduce trade deficits, but global backlash is mounting, with 50+ countries seeking negotiations. As tensions escalate, the big question is whether Bitcoin’s resilience will hold or if crypto will remain tethered to traditional markets.

Ripple acquires prime broker Hidden Road for $1.25B

In a landmark deal signaling institutional ambitions, Ripple is poised to acquire prime brokerage Hidden Road for $1.25 billion — one of the largest acquisitions in crypto history. The move positions XRP's issuer to compete for heavyweight clients like hedge funds and banks by offering integrated trading, lending, and custody services.

Hidden Road — founded by ex-SAC Capital/Point72 exec Marc Asch — was a rising star among crypto prime brokers, competing with FalconX and Coinbase Prime. Ripple paid mostly cash (plus XRP and stock), betting big that institutional demand will surge post-ETF approvals and regulatory clarity.

This isn’t just a brokerage buy — it’s a strategic chess move that makes Ripple the first crypto company to own a fully operational prime broker active in both TradFi and digital markets. It can dictate how institutions interact with XRP and its stablecoin, while monetizing the booming crypto prime services sector.

- Institutional on-ramp: Hidden Road processed $3T in volume in 2024, giving Ripple instant scale to serve major players. The firm will inject billions in capital to expand operations.

- Stablecoin & XRP push: Hidden Road will adopt Ripple’s RLUSD stablecoin as cross-margin collateral and explore using the XRP Ledger for settlements — accelerating utility for both. Ripple aims to shrink the window for trade settlements to minutes, compared to up to 24 hours via fiat rails.

- Regulatory tailwinds: With Trump’s pro-crypto shift, institutions like Fidelity and BNY Mellon are diving in. Ripple’s CEO Brad Garlinghouse called the deal “critical infrastructure” for this wave.

Spurring Adoption

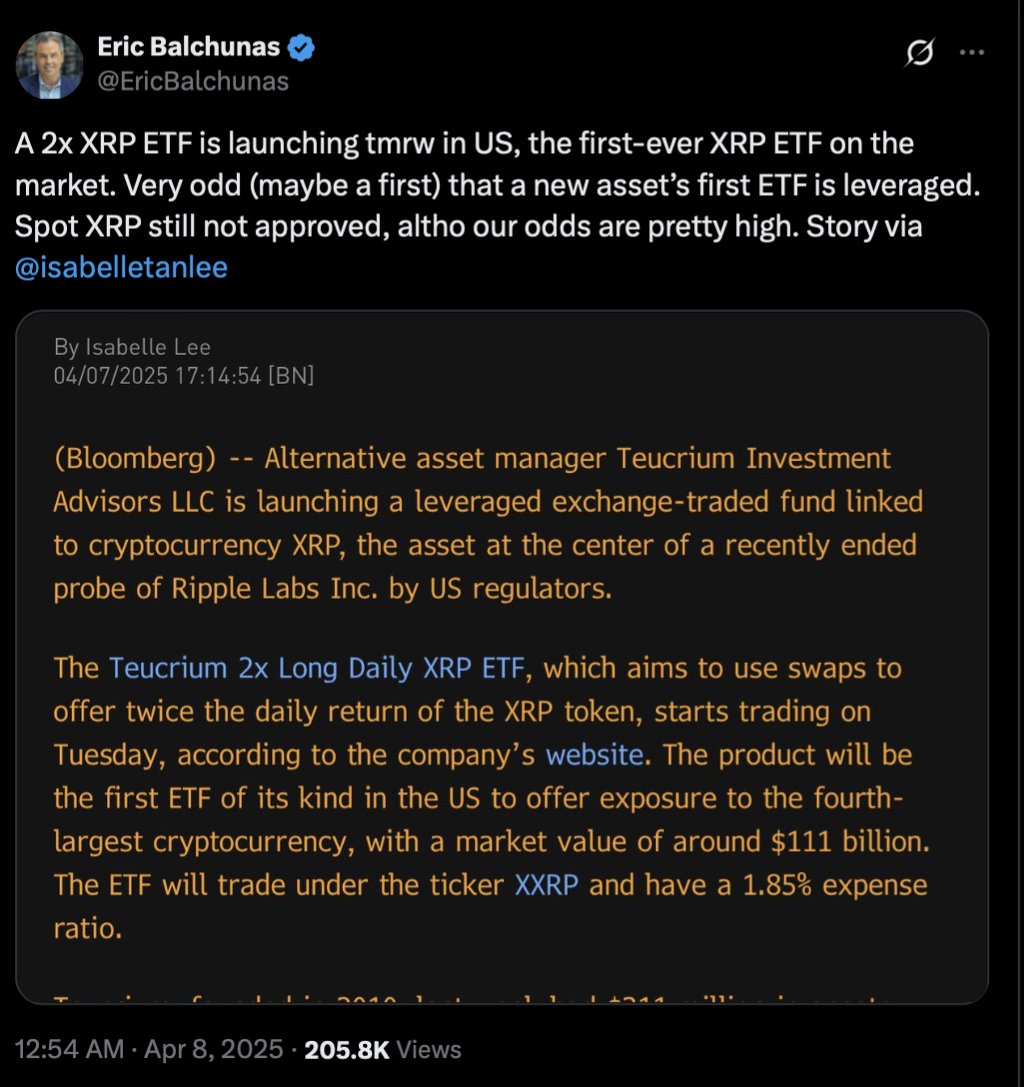

The deal coincided with the arrival of the Teucrium 2x Long Daily XRP ETF (XXRP) on April 8, the first-ever ETF linked to the fourth-largest cryptocurrency. The product offers a leveraged opportunity to bet on the XRP price dynamics, an intriguing choice for bulls.

The short-term impact of the acquisition is yet to be reflected in the price of XRP, given the bear market caused by Trump’s tariffs.