Clapp Weekly: Resilient BTC, OM crash, Google's crypto policy

BTC price

Bitcoin has shown resilience to global macro jitters, in contrast to traditional assets. Yesterday, the price neared $86k before dipping on news of a ban on Nvidia chip sales. Yet BTC dominance — its share of the total crypto market cap — is approaching 64%, a level last seen in January 2021.

BTC has made steady gains, rising from the $75k mark. On Thursday, April 10, it briefly touched $83.3k before a pullback. The next day, the price reclaimed $82k and climbed higher, peaking at $85,917.27 yesterday.

Currently trading at $83,740.70, BTC has gained 10.7% over the past seven days despite a 1.8% drop in the last 24 hours.

ETH price

Ether’s market share has approached a historic low of 7.09% as the price risks further declines. ETF outflows, sluggish derivatives activity, and rising competition from other L1 blockchains have contributed to its underwhelming performance.

Mirroring BTC’s momentum, ETH surged from $1.4k to $1,672.70 last Thursday, April 10, before entering a choppy uptrend. After hitting $1,672.70 the following day, it briefly retreated to $1.5k and climbed again — reaching a weekend high of $1,657.36 and Monday’s peak of $1,677.74, before pulling back.

Currently priced at $1,593.58, ETH has gained 12.1% over the past week but lost 2.8% in the last 24 hours.

Seven-day altcoin dynamics

Bitcoin dominance approaching 64% — a four-year peak — means the altcoin season will likely be delayed. This term refers to a period where 75% of the top 50 altcoins outperform the pioneer in the 90-day timeframe.

Bitcoin’s flash crashes since Trump's reelection have caused massive altcoin holder wipeouts. The coin is struggling to reclaim its status alongside gold as a safe-haven asset — traders seeking refuge from uncertainty have shifted toward the metal after years of BTC dominance as an alternative.

Tariff fears subside

While tariff concerns are gradually easing, betting markets reflect growing fears of a US recession. Some traders anticipate improved sentiment, saying the trade war-related sell-offs are over. The Fed's assurance that it will stabilize markets if a liquidity crisis hits also supports cautious optimism.

Generally, digital assets have proven more resilient than stocks. “Crypto has benefited from the recent shake-out, as equities have been realizing higher volatility than Bitcoin through the risk-off move," according to Augustine Fan, head of insights at SignalPlus.

AI tokens plunge

AI-related tokens have underperformed market leaders. On April 14, Nvidia chipmaker announced plans to build an AI supercomputer in the US — a development promising new opportunities for crypto miners to repurpose their infrastructure.

Yet the next day, the chipmaker's shares sank 8% after the US banned sales of its H20 graphics processing units to China — a move expected to cost the company $5.5 billion. Nvidia stated it had been informed about the new license requirement, in effect “for the indefinite future.” AI-related tokens like FET and TAO tanked.

Winners & losers

FARTCOIN (+68.7%) has posted perplexing gains despite its history of deeper retracements during bearish periods. Meanwhile, CRV (+37.9%) also saw a significant rally as the total value locked (TVL) in its issuer — the leading DEX for stablecoins — surged, benefiting from easing macroeconomic pressures.

FLR (+35.0%) also performed strongly. Buoyed by an expanding ecosystem, it benefits from a rising dApp TVL and its historical ties to XRP, as the project was initially marketed as "smart contracts for XRP."

Meanwhile, OM (-87.4%) is reeling from its 90% overnight collapse sparking rug pull speculations — while the Mantra team blames CEX liquidations. The token has tumbled to the 100th position by market cap.

DEXE (-10.1%) continued its decline, though its underlying DeFi infrastructure and utility provide long-term value. EOS (-9.3%) faced a sharp drop after a brief weekend rally, succumbing to the broader market’s fearful sentiment.

Cryptocurrency news

Mantra’s OM token rebounds 50% after $5B crash — Terra LUNA comparisons emerge

Mantra’s OM token staged a near-50% rally just one day after a catastrophic crash wiped out $5 billion in market value, sparking fears of another Terra LUNA-style collapse.

Crash and recovery

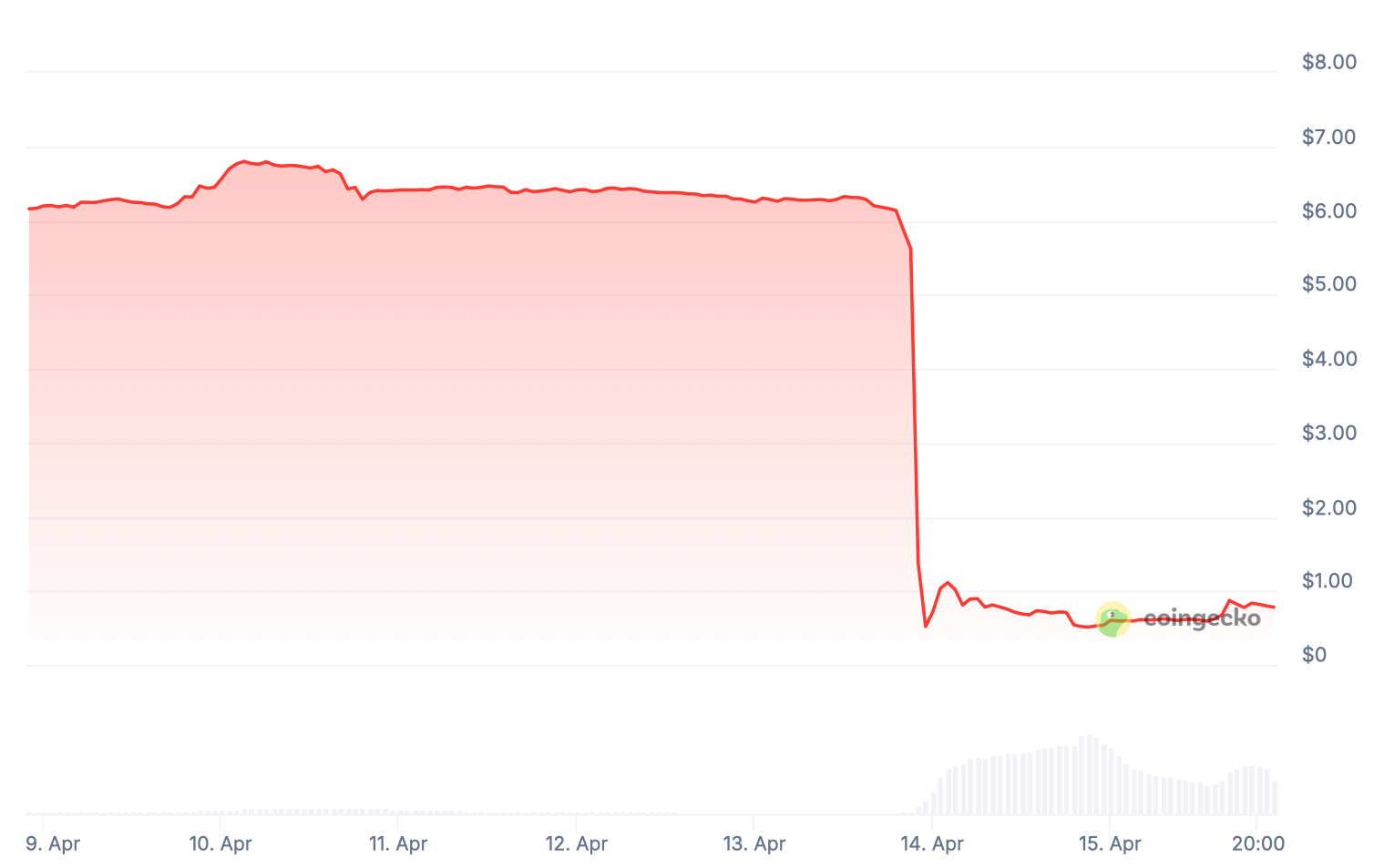

Over the past weekend, OM plummeted almost 90%, briefly hitting $0.50 before surging back to $1.03 on Monday. The crash liquidated $76 million in futures contracts and erased billions in market cap, leaving investors in shock.

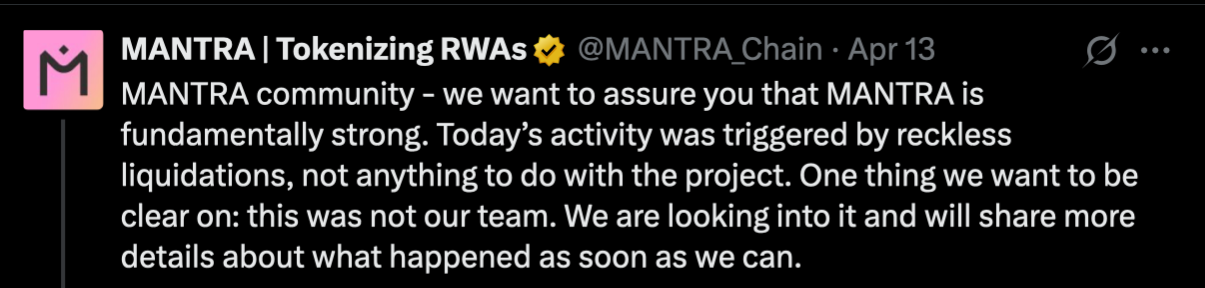

The rebound followed denials from Mantra’s team, who blamed the crash on "reckless" forced liquidations by centralized exchanges rather than internal misconduct.

Binance's response

The incident has reignited debates about exchange accountability and crypto market fragility. In a post shared on X, Binance acknowledged that cross-exchange liquidations had been the primary trigger. Heavy selling pressure across multiple platforms at once had sparked a cascade of price drops.

The CEX's user protection measures already included reduced OM trading leverage levels, introduced in October 2024. Furthermore, Binance has been alerting users of major shifts in OM's supply and tokenomics via pop-ups since January 2025.

Terra LUNA parallels

The team claimed CEXs (like Binance) triggered cascading liquidations. Yet critics highlighted several red flags:

- Large OM transfers to exchanges just before the crash, fueling rug pull suspicions.

- No compensation plan for investors who suffered massive losses.

- Eerie similarities to Terra’s 2022 collapse, where allegations of market manipulation preceded LUNA’s death spiral.

The token's rapid rebound does little to address structural risks or restore long-term confidence. Mantra holders did not receive any prior warnings, while the suspicious timing of large dumps suggests possible insider involvement. If exchanges acted recklessly, why weren’t safeguards in place?

What’s next for OM?

Mantra's token remains far below its $6 peak, and community trust is fractured — and without a clear recovery plan or regulatory intervention, its future looks uncertain. If Mantra fails to provide transparency and restitution, OM could face another devastating drop.

Google tightens crypto ad rules in Europe

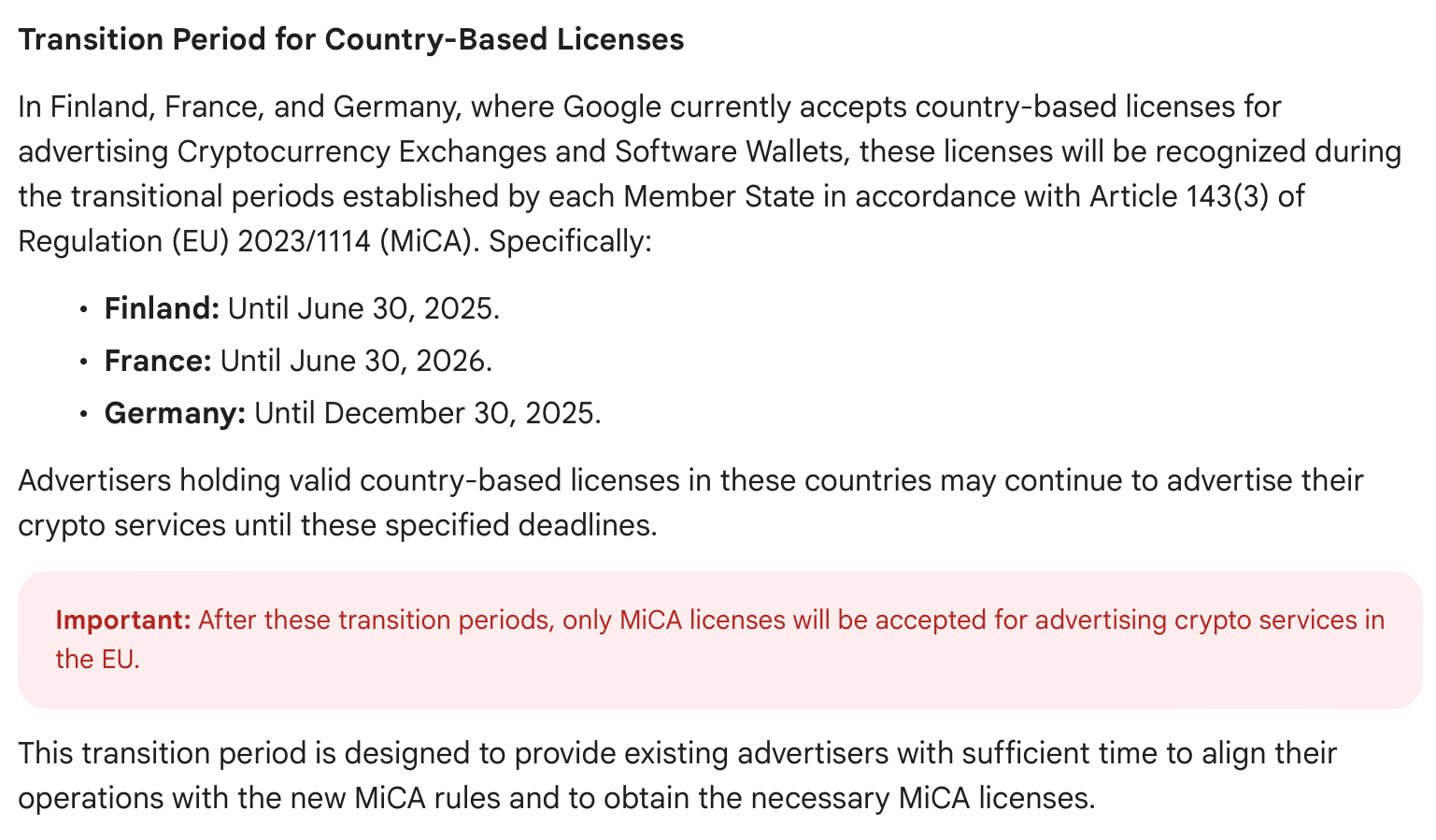

Starting April 23, 2025, Google will enforce stricter advertising policies for crypto services in the EU in accordance with the Markets in Crypto-Assets (MiCA) regulation. Exchanges and wallet providers will have to either comply with MiCA or obtain a Crypto Asset Service Provider (CASP) license.

Key changes to Google rules

The policy applies across most of the EU, including major markets like Germany, France, Italy, and Spain. It aligns with MiCA’s December 2024 rollout, marking a major step in the bloc's crypto regulation. While it promises safer advertising, the industry must navigate multiple challenges.

- Licensing requirement: Crypto advertisers must be MiCA or CASP-licensed.

- Local compliance: Advertisers must meet additional national-level regulations.

- Google certification: Services must also be certified by Google.

- Grace period: Violations won’t lead to immediate suspensions — warnings will be issued at least seven days prior.

Double-edged sword for regulation?

The rules aim to enhance investor protection — by curbing scams like fraudulent ICOs. Yet the debate over their potential impact on the industry remains heated, with experts warning of unintended consequences.

As transition periods for licensing vary by country, enforcement inconsistencies appear inevitable. Smaller exchanges may also struggle with MiCA’s capital requirements (€15k–€150k) and dual certification hurdles. Strict rules favoring larger players could stifle innovation from lesser-known firms.

Bitget’s CLO Hon Ng has called the policy a "net positive for trust," admitting that inflexibility could harm competition. Meanwhile, Mattan Erder (Orbs’ legal counsel) suggests Google’s changes are more about limiting its liability than protecting investors.