Crypto coins, tokens, and commodities: What sets them apart?

Cryptocurrencies are not created equal. Coins, tokens, and commodities are three distinct, yet overlapping, categories of blockchain-based assets. Here is how the three classes compare.

Defining cryptocurrencies

Cryptocurrencies are crypto tokens issued using a blockchain, designed to be used as an alternate form of payment. The word "cryptocurrency" has also become a blanket term for any token with an exchange or market value, from BTC to PEPE. The price of any such asset depends on multiple drivers:

- Purpose and use

- Market sentiment

- Traction

- Expectations

As the industry continues to evolve, so do the definitions. At present, the terms cryptocurrencies, tokens, and crypto commodities are often used interchangeably, but crucial distinctions are important to grasp.

Blockchain type: Coins and tokens

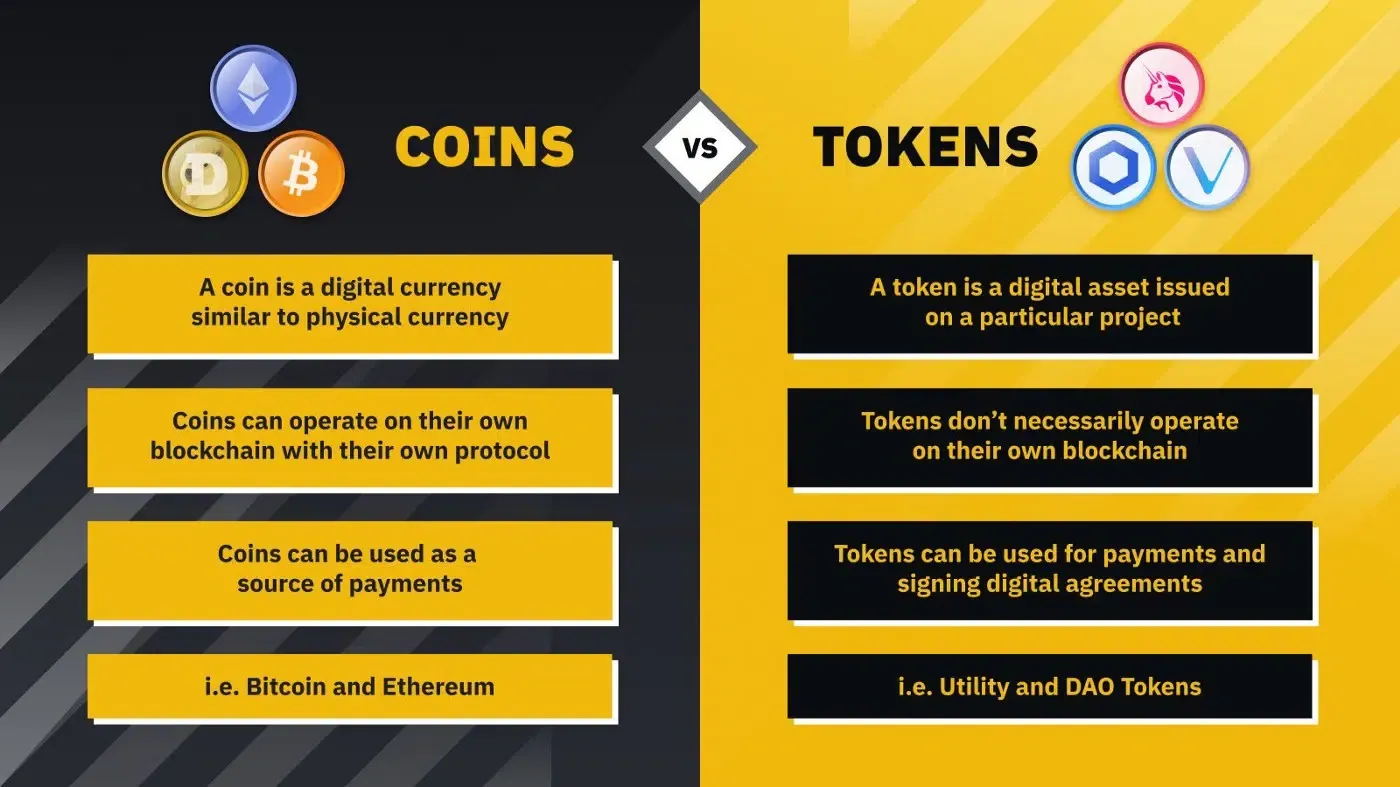

According to one classification, coins are cryptocurrencies on their own blockchains. Tokens use non-native blockchains, such as USDT on Ethereum's ERC-20 standard.

Purpose: Tokens and cryptocurrencies

Some experts distinguish between all tokens – as any digital assets on the blockchain, including NFTs and security tokens – and cryptocurrencies, designed as payment methods or speculative investments with an exchange or market value.

Commodities as separate group

Crypto commodities are defined as either cryptocurrencies or tokens that represent an underlying asset. In the case of the latter, they may represent a physical commodity or any virtual currency, as interpreted by the CFTC (the Commodity Futures Trading Commission).

Coins vs. tokens

Coins — cryptocurrencies operating on proprietary blockchains — primarily function as a medium of exchange and payment, akin to fiat money and other digital forms of value transfer. They are predominantly used for transactions within their native networks, offering a foundation for secure and decentralized transactions.

On the other hand, tokens, as cryptocurrencies on non-native blockchains, typically offer a broader range of use cases within the supporting ecosystem, powering decentralized applications (dApps) and other blockchain-based platforms.

For instance, a host of ERC-20 tokens have been launched on the Ethereum blockchain, the most common platform for tokenization, mostly due to its smart contract functionality. Use as a means of payment is secondary, while existing utilities include the following.

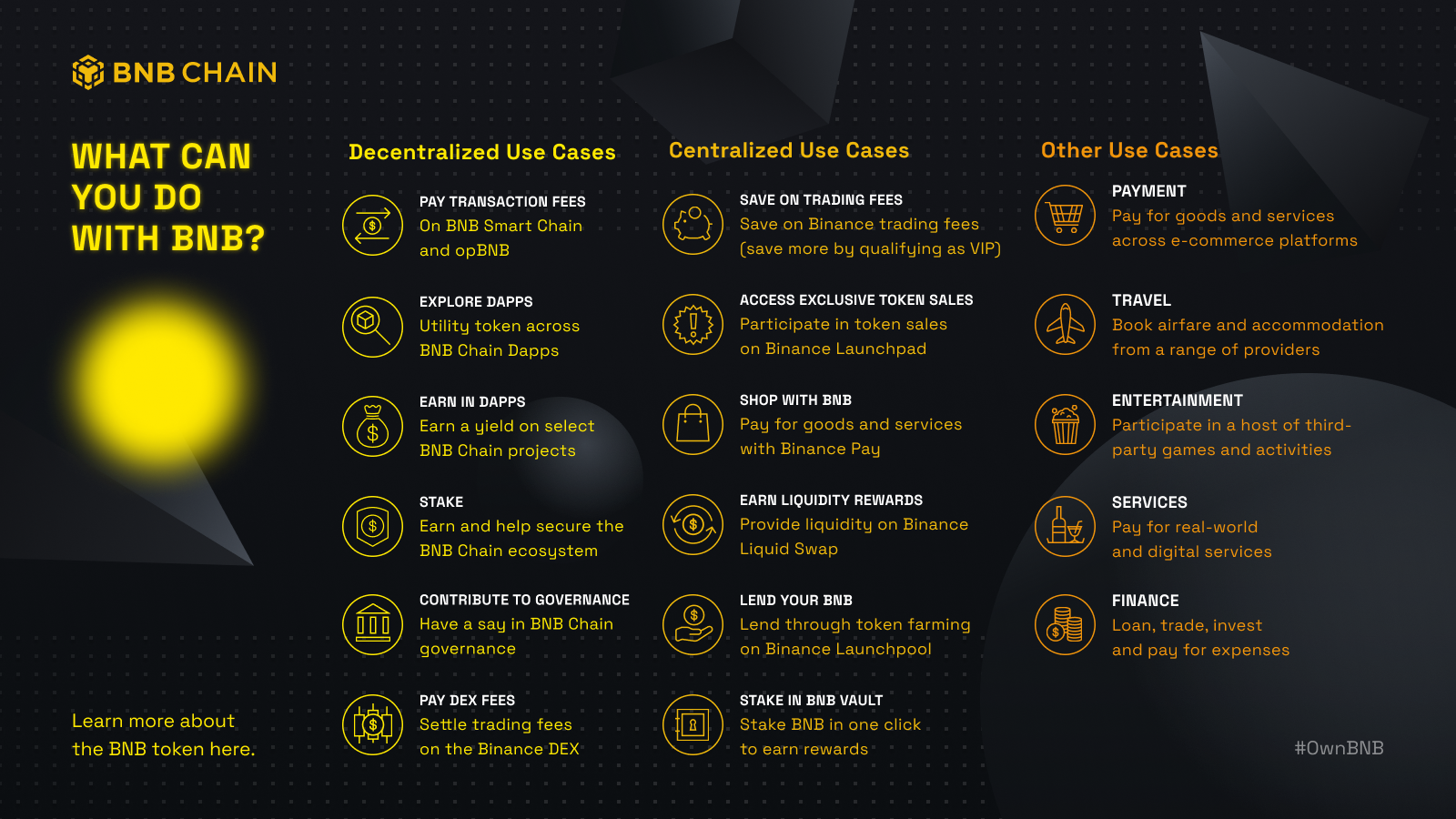

Preferential treatment

BNB holders enjoy discounted transaction fees on Binance when using the platform's native token for payments. This incentivizes users to hold and utilize BNB, enhancing its utility within the ecosystem.

Yield farming

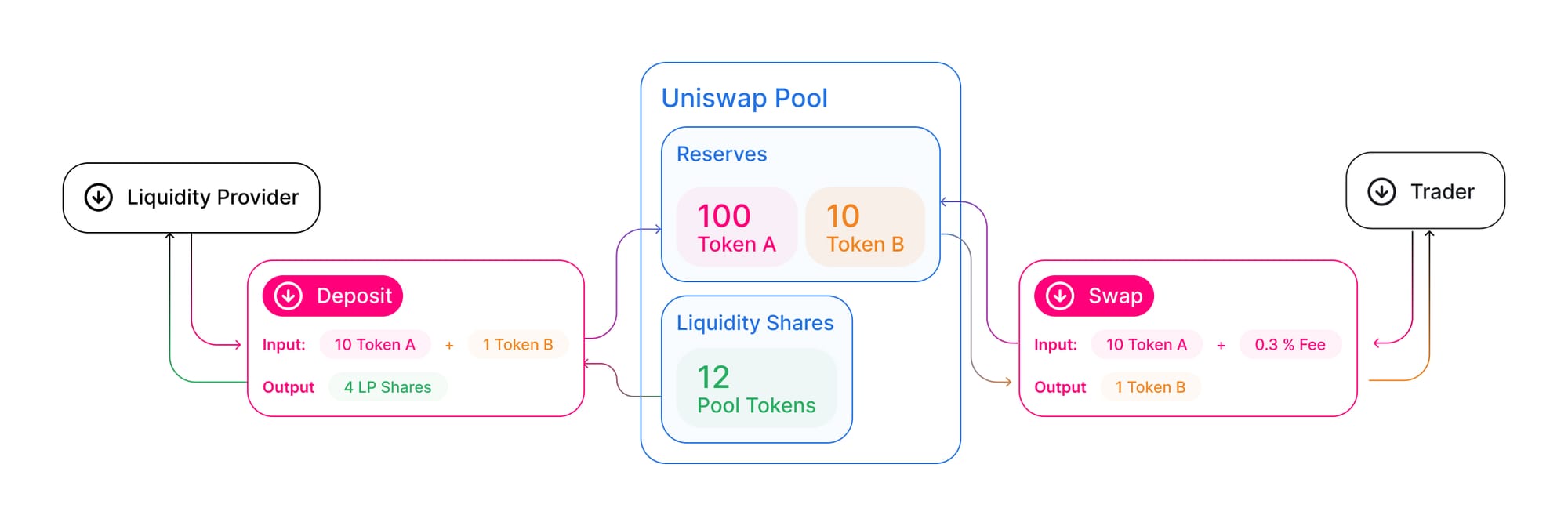

On decentralized exchanges (DEXs), users can earn tokens by providing liquidity to trading pools. For example, on Uniswap, users can deposit ETH and USDC into the ETH/USDC liquidity pool. In return, they receive Liquidity Provider (LP) tokens, which represent their share of the pool and entitle them to a portion of the trading fees generated.

Staking

Token holders can earn rewards by locking up tokens to support network operations. Unlike yield farming, staking typically requires a single token, reducing complexity and risk.

For instance, PancakeSwap users can stake CAKE to earn rewards from other projects, while Uniswap and SushiSwap require staking their native tokens, UNI and SUSHI, respectively. Staking not only provides passive income but also contributes to network security and stability.

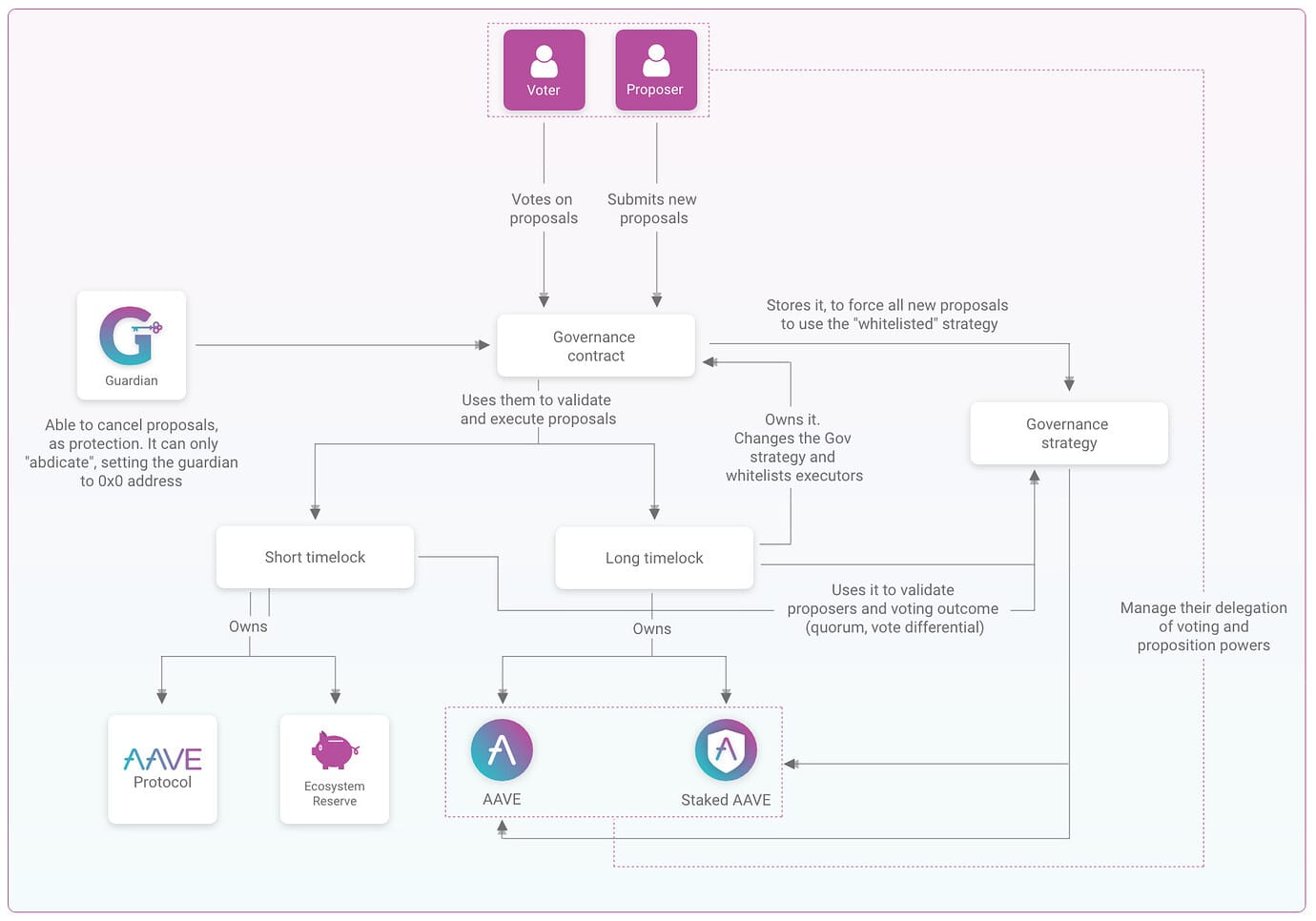

Governance

Governance tokens empower holders to participate in decision-making processes that shape the future of the protocol or decentralized application (DApp). For example, AAVE token holders can vote on proposals, such as funding grants for projects within the Aave ecosystem.

Similarly, Maker (MKR) token holders play a crucial role in governing the DAI lending system, making decisions on risk parameters and other critical factors that influence the platform's direction. These tokens democratize control, allowing users to have a say in platform evolution.

Tokens as blanket term

When used as a blanket term, a token is a representation within a distributed ledger environment, any digital asset associated with a blockchain. For instance, it may represent any data, permissions, or security credentials.

Even Bitcoin and ether are tokens despite operating on proprietary blockchains. Non-fungible tokens (NFTs), representing anything from artwork to sports collectibles, also fit into the category.

Crypto commodities

In traditional finance, a commodity is a raw physical good used for other goods and services. Crypto, however, emerged as a payment method. The line between the two is gradually blurring.

The framework remains gray as regulators, investors, developers, and legal experts are battling over jurisdictions and definitions. The term crypto commodities is fairly controversial, with two definitions vying for prominence. As a result, some or all cryptos are considered commodities depending on the regulatory authority asked.

CFTC: All cryptos are commodities

The Commodities and Futures Trading Commission (CFTC) treats BTC and all other cryptocurrencies as commodities, including their derivatives. Thus, in the US, they all fall under the CFTC's jurisdiction, whether or not they are used in derivative contracts.

For example, ether, the native coin of Ethereum, functioning as a worldwide virtual computer for decentralized applications, is also a commodity. To the CFTC, it meets the definition as it is a virtual currency.

Meanwhile, crypto-derived products are trading on the Chicago Mercantile Exchange and the Cboe Options Exchange. They are accessible on par with traditional commodities like corn or gold.

Tokens representing assets other than securities

All tokens that do not represent a security or meet the corresponding definition are classified as tradable crypto commodities. Essentially, any token that transfers value to a blockchain constitutes a crypto commodity.

In this context, a crypto commodity is a token that represents an underlying asset. For example, a hypothetical token equivalent to one barrel of oil would be considered a crypto commodity.

A crypto commodity can represent a wide range of entities, including physical or virtual commodities, utilities, assets, or contracts. In contrast, security tokens are digital representations of ownership or rights to an asset or company.

To sum up

Whatever the cryptocurrency, its value is determined by future potential, market sentiment, use cases, economics, network difficulty levels, and other factors. Many apply the terms cryptocurrencies, tokens, and crypto commodities loosely, confusing investors.

In a nutshell, tokens encompass all blockchain assets, fungible and non-fungible. This term also distinguishes cryptocurrencies that do not have native blockchains, unlike coins, and tokens representing other assets that follow their market valuations. Crypto commodities, as understood by the CFTC, encompass virtual currencies and derivatives.