Guide to crypto exchange order book

Aspiring crypto traders can feel overwhelmed by market data. Exchanges for conventional assets are used indirectly, as intermediaries — brokers and fund managers — place the orders. Misunderstanding of direct trading causes misinterpretation of your favorite token's price action. The crypto exchange book is the starting point in learning the ropes.

Whether you trade on one or multiple platforms, the order book is the centerpiece of your exchange environment, your guide, and best friend. It is essential for tracking price action and making informed trading decisions.

What is an exchange order book?

An exchange order book takes you behind the scenes of market dynamics. It shows the relationship between buyers and sellers who trade directly — in a broader sense, supply and demand. It comprises two lists of outstanding (open) orders for a particular trading pair like BTC/USD.

A crypto exchange is like a marketplace where visitors buy and sell one item in exchange for another. Anyone can have their order placed in the order book. Open orders are listed until canceled or taken, buyers want the lowest price, and sellers are always looking for the best bid.

An order is open when the investor placing it is ready to purchase or sell a specific cryptocurrency at a specific price. The lists show only limit orders — orders to be executed at a predetermined price.

Price analysis: Understanding buy and sell orders

Order books vary in form, but they include the same fundamentals. Generally, they reflect the market situation through a range of data. The lists for BTC/USD feature all buy and sell orders from those who want to purchase and sell Bitcoin for US dollars. This visual representation includes four key concepts:

Bid (offer from a buyer)

Ask (offer from a seller)

Amount (total units to be traded)

Price (per unit traded)

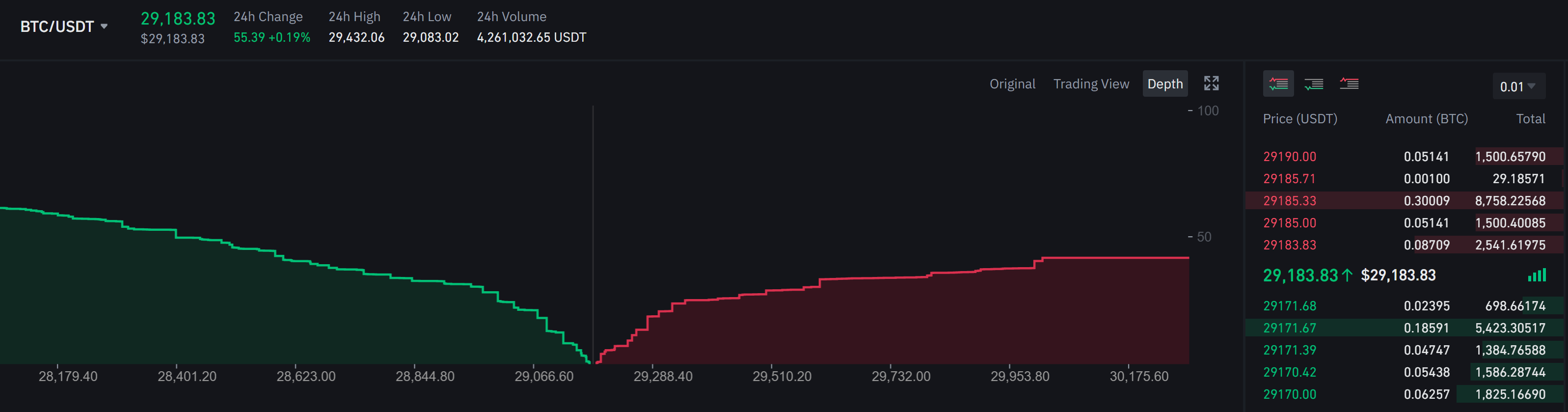

Every order book is split in half — there is a buy side (green) and a sell side (red). The former lists outstanding bids below the last traded price, with the best bid at the top. The latter lists outstanding sell orders above the last traded price. The concepts of amount and price are used on both sides.

Through a bid, you voice your intention to purchase X units of a Y asset at a Z price. Execution requires matching your bid with a corresponding ask. The lowest ask and the highest bid are always the closest to each other — these are the two prices in the middle, as this limit order book shows.

Finding ideal price level

In crypto trading, like currency trading, every trading pair follows the formula base currency/quote currency. The US dollar is the quote currency in hundreds of pairs, such as ETH/USD, LTC/USD, and XRP/USD.

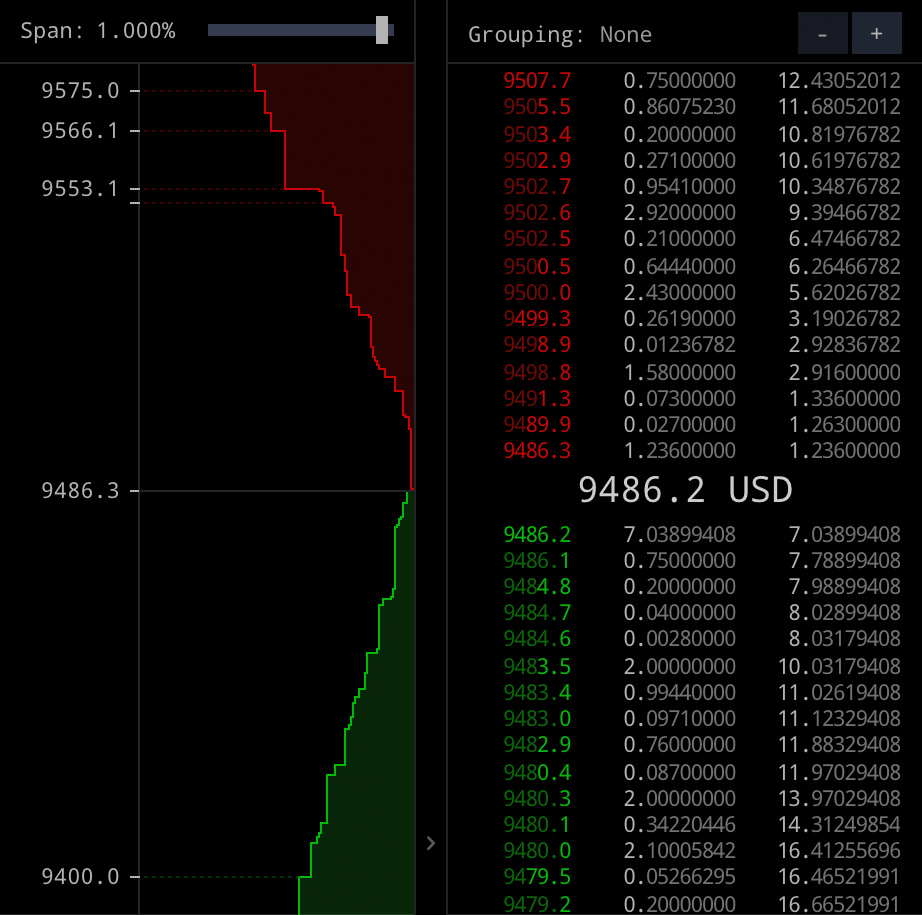

In the screenshot above, 9,486.2 USD is the highest price a buyer can pay. Compare Kraken's layout above to the Binance order book for another quote currency (BTC/USDT).

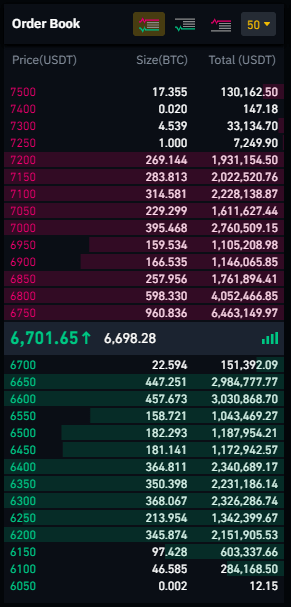

Here, the lowest ask is 6,750 USDT, while the highest bid is 6,700 USDT. The interface also includes the last traded price (6,701.65 USDT) and the market price (6,698.28 USDT).

Popular crypto exchanges feature dozens (sometimes, hundreds) of trading pairs. This lets traders assemble diversified portfolios, mitigating risk by spreading it over a spectrum of digital assets.

If you offer 1 BTC for 90,000 USD, someone else must agree to pay the exact same price. Your order may or may not be taken — some asks could beat yours, and exchanges prioritize the best offers. If you tried to get 1 BTC for 30,000 USD today, when BTC is worth around 70,000 USD, finding a match would be impossible.

How to use exchange order book

To execute a trade, you can accept an available offer or create your own open order at an attractive price. For example, if you want to pay for Bitcoins with US dollars, you need a corresponding order on the sell side.

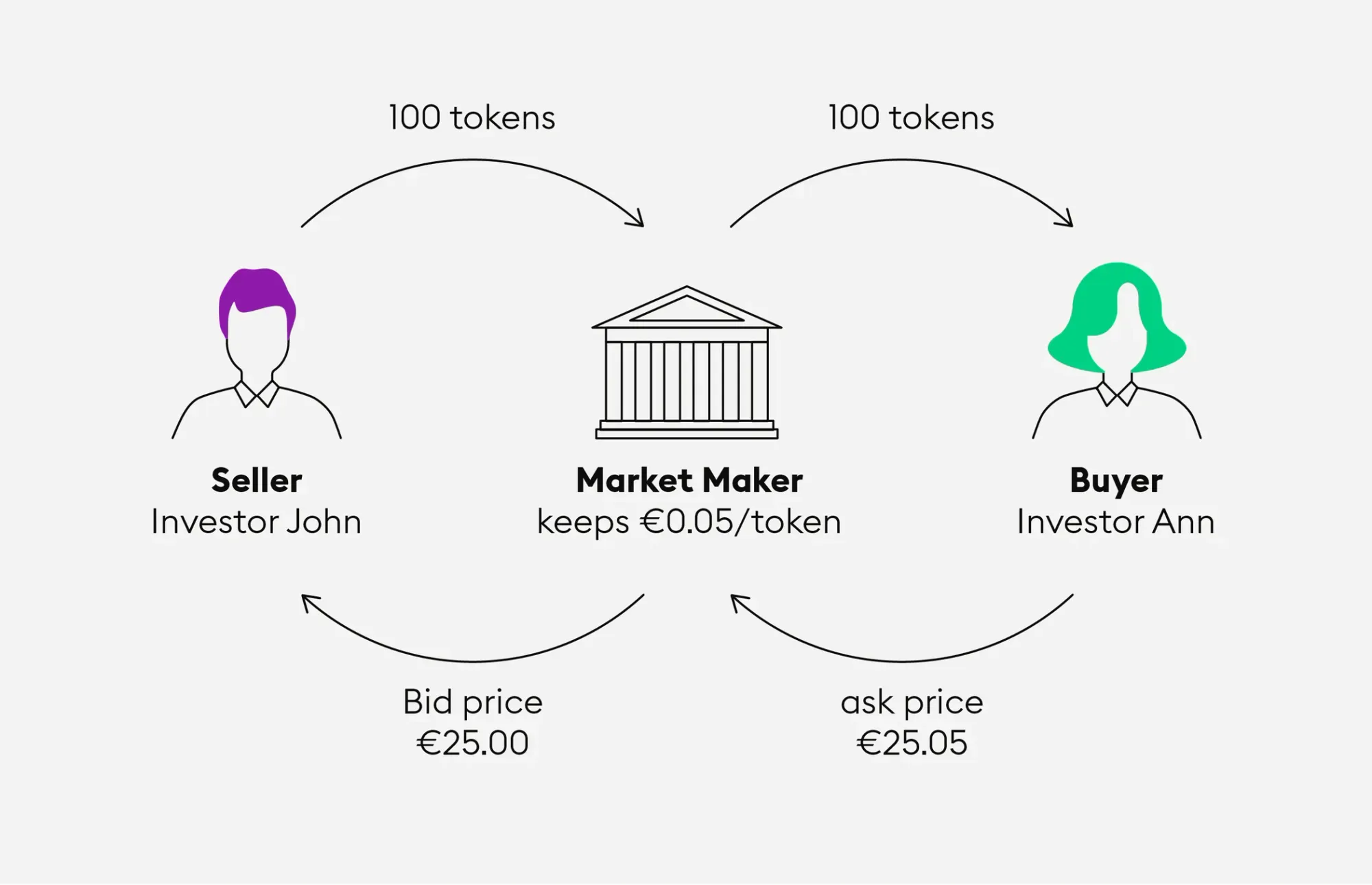

The Kraken order book above gives a spectrum with the lowest ask of 9,486.3 USD (in red) and the highest bid of 9,486.2 USD (in green). The gap between them constitutes the spread — in this example, 1 cent. This difference is a source of profit for market makers.

To buy more BTC, you can accept 9,486.3 USD or open your own bid, which should be equal to or better than 9,486.2 USD. In the latter case, you need to wait until another trader takes your offer.

Exchanges are more interested in new orders due to the liquidity dynamics. When an existing offer is accepted, a portion of the liquidity is removed. That's why the fees for takers of different assets exceed the fees for makers. Opportunistic traders accept higher costs to have their trades executed ASAP.

What is buy wall?

Sometimes, the number of buy orders for a particular asset exceeds the supply (the number of sell orders). This forms a phenomenon that impacts the price, reflecting a positive sentiment toward that cryptocurrency.

When there is a buy wall, neither large nor smaller orders may be filled. The buy wall order must be executed first, followed by the rest of the orders from the highest to the lowest, until the market levels out. Such blocks are created by large players: crypto whales, institutions or groups of traders.

Essentially, traders race to seize all cheap orders. Once those are bought, the buy orders fill in fast behind the growing price point. This image shows a salient buy wall, so the price level is likely to increase. You can see that the wall was growing slowly but steadily. In case of an abrupt spike, the pattern may be false.

Opposite order imbalances — with orders skewed toward the sell side — form a sell wall. This is a sign of adverse market conditions. If you expect a sell wall, getting out is a good idea.

Suppose you hold millions of tokens you bought at 4 USD each. The price has fallen below 10 USD, but you want to make 200% profit. To that end, you place a large sell order at 8 USD. Such orders act as resistance levels — once the target price is reached, the supply of the cryptocurrency grows, hindering further decline.

Understanding market depth

Investopedia defines market depth as a stock market's ability to absorb relatively large market orders without significantly impacting the price of the security. In crypto, it works in the exact same way. Market depth is inversely proportional to the impact of a large order, trading costs, and the likelihood of price manipulation.

Suppose you need to purchase 5 BTC for US dollars, and two exchanges offer the same best ask — 70,000 USD per coin. Exchange A can fill this order at once, as it has 10,000 sell orders at this price. Execution won't affect the price level.

In comparison, exchange B can provide 5 BTC through a combination of orders (for example, 1 BTC at 70,000 USD, 1 BTC at 70,100 USD, and so on). Not only would you spend more — the best ask would also jump once your order is filled.

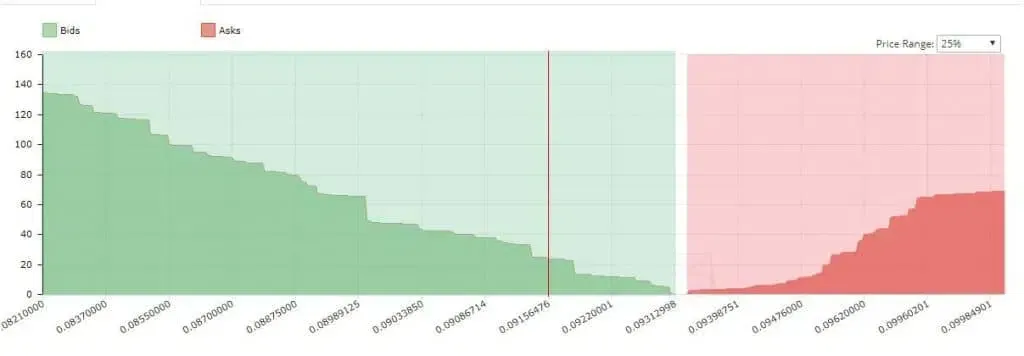

The following chart is an isolated depiction of market depth. If you refer back to the Kraken order book, you will see market depth on the left-hand side of the screen.

To sum up

Exchange order books are trading tools reflecting real-time interaction between the counterparts in crypto markets (exchanges). The outstanding limit orders on the buy side and sell side provide key insights for market analysis. Each entry in an order book includes four parameters: direction, asset, amount, and price. Sellers and buyers can snatch the best available offers or place their own limit orders and wait for a match.