Layer 1 blockchains: Foundation of crypto ecosystems

The security, scalability, and efficiency of blockchain networks rely on their building blocks. The foundation — Layer 1 (L1) — forms the base protocols, such as Bitcoin or Ethereum. Unlike additional layers, it operates independently, handling core functions like transaction validation and data storage. Here's how L1 works.

Quick dive into blockchain layers

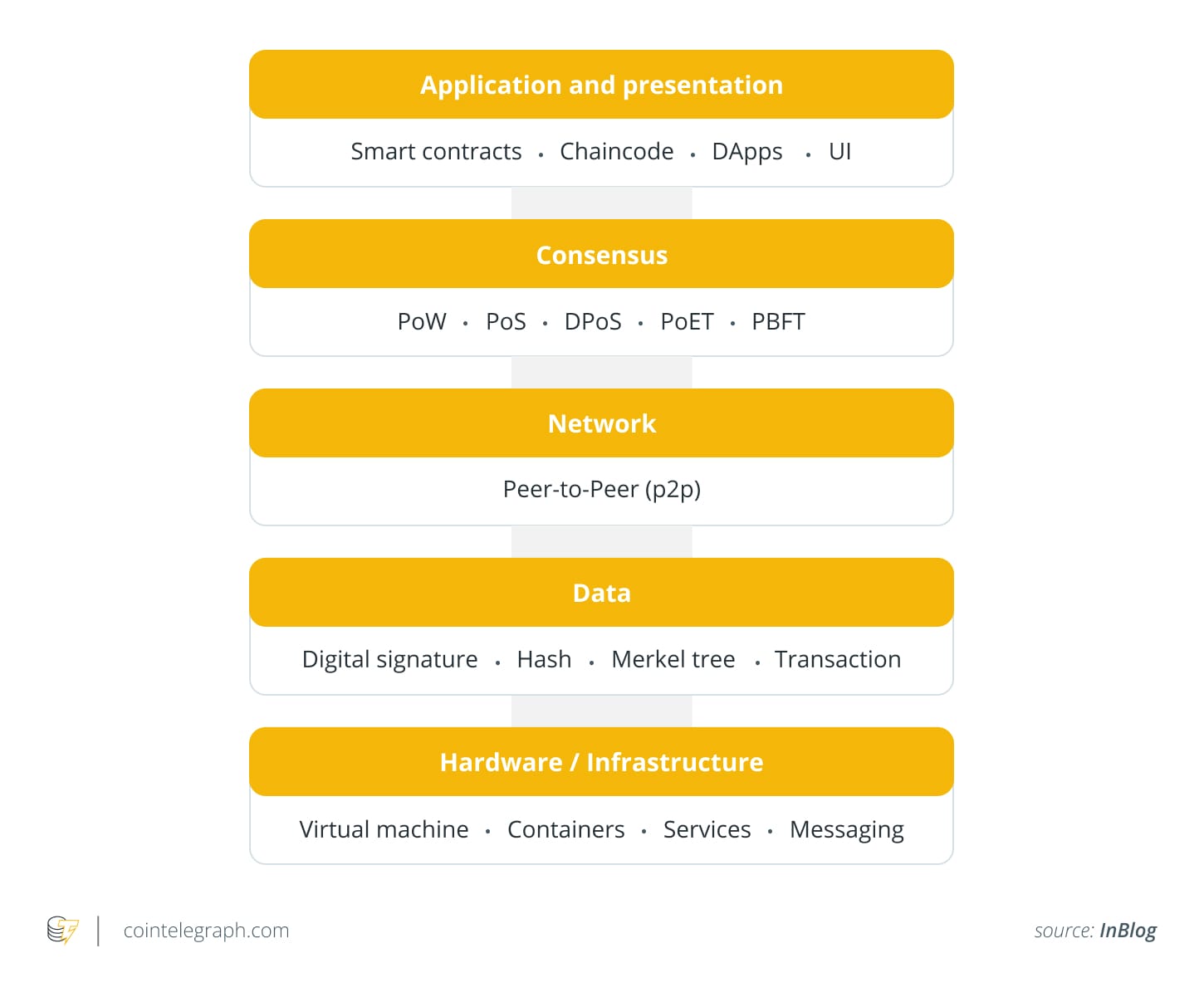

Blockchain architecture may be visualized as a stack of five crucial elements, each adding functionality to the one below it:

- Hardware/virtual machine — physical infrastructure providing computational power (mining equipment and nodes) and data storage (cloud infrastructure).

- Public ledger — an immutable, transparent record of all transactions grouped into blocks. Each block contains transaction data with hashes and timestamps. Ethereum and Bitcoin also use Merkle trees to encrypt data more effectively and securely.

- Network — the "nervous system" of a blockchain, connecting and synchronizing nodes with the protocol. The former verify and relay data within the network; the latter handles its distribution. Peer-to-peer (P2P) principles ensure users connect directly, without middlemen.

- Consensus mechanism — the system of ensuring trust and preventing double-spending, the use of the same tokens in multiple transactions. Consensus ensures all nodes agree on the validity of transactions and the state of the ledger.

- Applications — the topmost layer users interact with via smart contracts and dApps (decentralized applications). For instance, this layer enables exchanging crypto, buying an NFT, or playing a blockchain game.

Why have multiple blockchain layers?

When discussing blockchain architecture, there are two main types of layers:

- Functional layers contain core components that define a blockchain’s operations, security, and application capabilities.

- Blockchain layers (tech stacks) add solutions designed to tackle scalability challenges while maintaining security and decentralization.

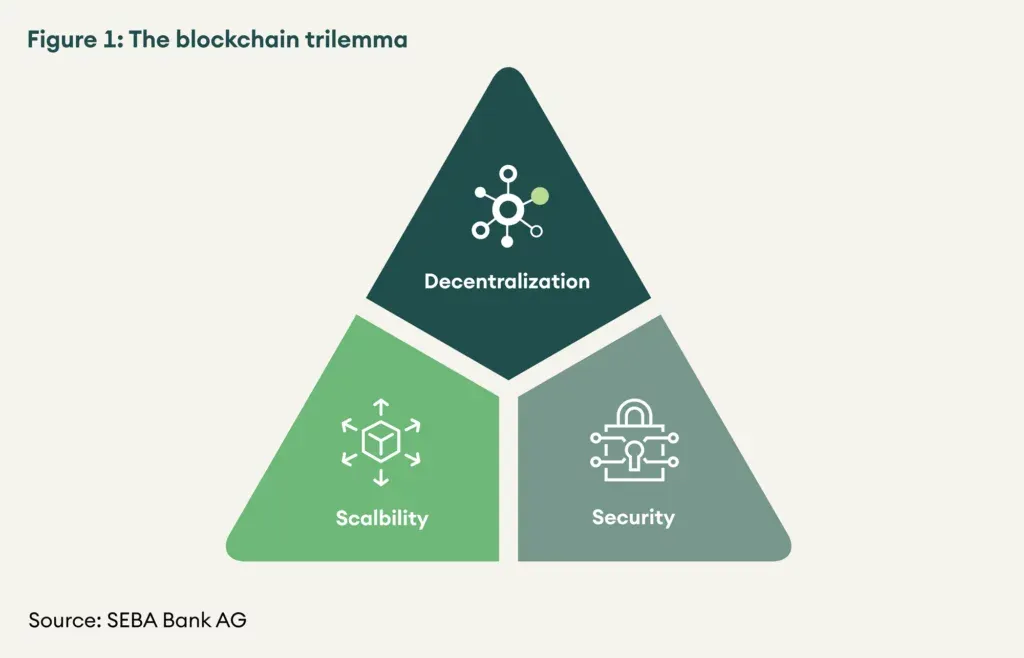

The blockchain trilemma, coined by Ethereum’s Vitalik Buterin, highlights a key challenge: blockchains struggle to optimize decentralization, security, and scalability simultaneously. Most networks prioritize two at the expense of the third.

By separating responsibilities, blockchains can maintain security while improving efficiency. Developers often build tiered systems:

- Layer 1 (e.g., Ethereum, Bitcoin) focuses on security and decentralization.

- Layer 2 (e.g., zkSync, Lightning Network) enhances scalability without altering L1’s core structure.

- Layer 3 (e.g., Degen Chain, Orbs) enables specific real-world cases like DeFi, gaming and smart contracts.

L1 refers to the backbone — a self-sufficient network that doesn’t rely on external layers. Its core functions include consensus mechanisms, data storage, and transaction validation. All secondary layers, plugins, or applications ultimately rely on it for final transaction confirmations — hence the second name, "settlement layer."

In contrast, Layer 2 (L2) blockchains require an L1 to function. They process transactions off-chainor via sidechains, lightening the load on L1 to address scalability challenges. L2 makes blockchains faster and cheaper to use while keeping L1 security intact.

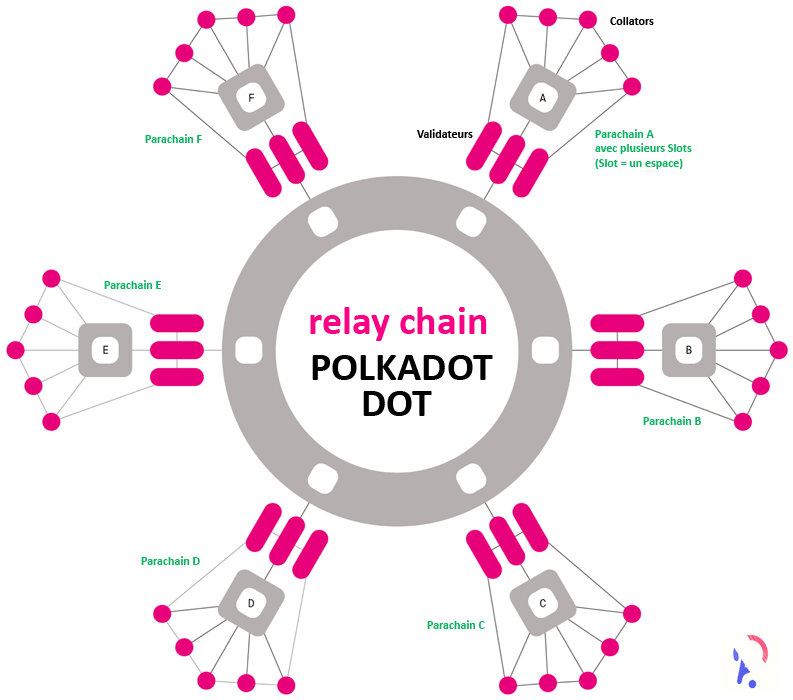

Communication between the two layers would be impossible without an intermediary — Layer 0 (L0). It provides the infrastructure for the underlying protocol. Polkadot's L0 — the relay chain — allows multiple blockchains to share data within the network. Meanwhile, the Tendermint protocol is the L0 in the Cosmos ecosystem, connecting chains within it.

Consensus in popular L1 blockchains

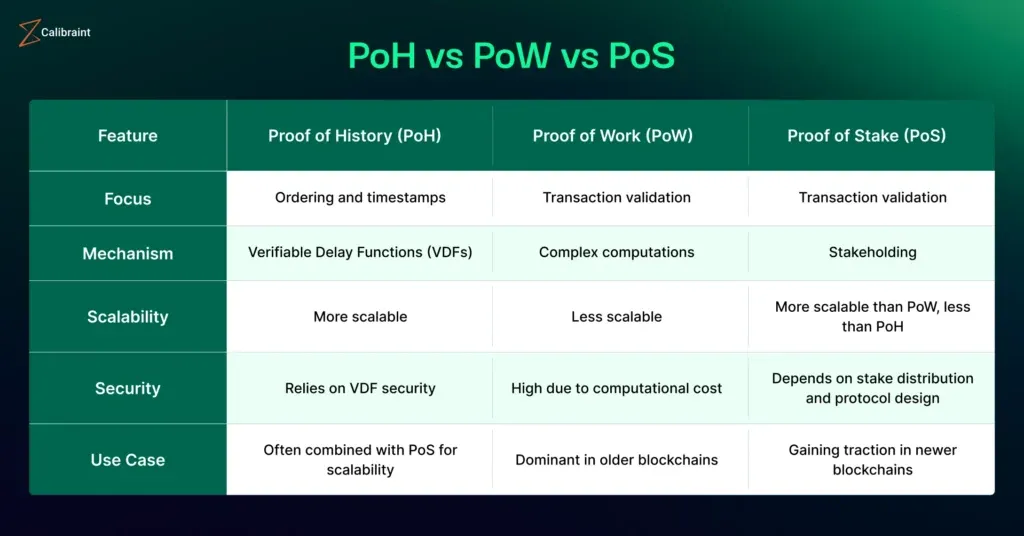

Several L1 networks have emerged with unique scaling approaches. The most well-known ones are Bitcoin, Ethereum, and Solana, each with a specific consensus mechanism for security:

- Bitcoin uses proof or work (PoW), which requires miners. These network participants solve complex mathematical puzzles to validate transactions and add new blocks to the chain. The first miner to solve a puzzle updates the blockchain, receiving a reward — currently, 3.125 BTC.

- Ethereum employs proof of stake (PoS) relies on network participants who "stake" their tokens to have a chance at verifying transactions. Validators are chosen randomly, and those who successfully validate transactions receive ETH rewards.

- Solana's proof of history (PoH) uses a cryptographic clock to create a verifiable record of all transactions — a unique timeline of hashes. Each hash references the preceding one and relies on Verifiable Delay Functions (VDFs) to ensure the passage of time. Nodes agree on transaction order without direct communication, which ensures faster block times.

Layer-1 scaling solutions

Since L1s face the scalability trilemma, they implement various upgrades to improve performance without relying on L2s. To learn about other solutions, check out Clapp's guide How Layer 2 & Layer 3 scaling improves Ethereum network.

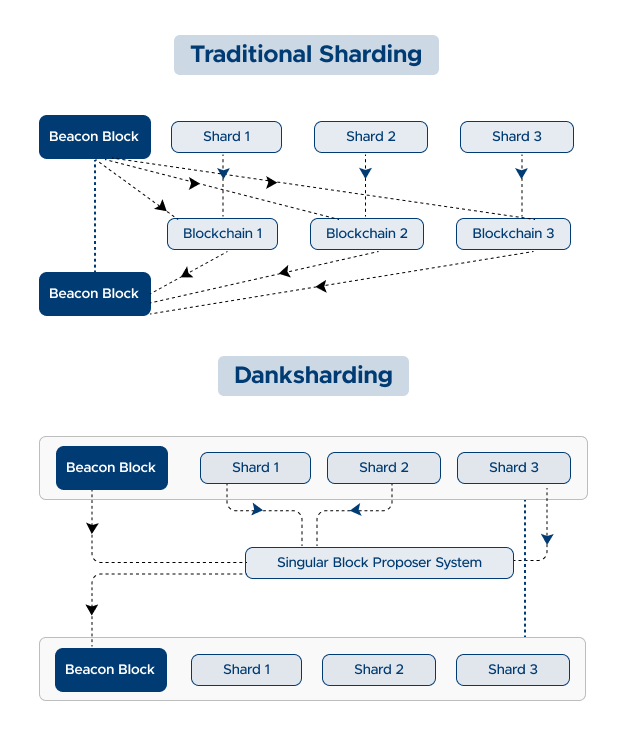

1. Sharding

Sharding splits the blockchain into smaller segments (shards), each processing transactions independently. This reduces node workload and increases throughput.

Example: Ethereum’s Danksharding (partially implemented via EIP-4844) aims to enhance scalability by dividing network data.

2. Consensus mechanism changes

Despite their security PoW networks are plagued by transaction delays as miners compete to solve complex mathematical problems. Switching consensus models (e.g., to proof of stake (PoS)) can potentially improve speed and efficiency.

Example: The transition to PoS dramatically reduced Ethereum's energy consumption (by 99.95%), although it did not directly address the speed limitations. As of May 2025, the network can send around 15 transactions per second.

3. Chain forks

A fork occurs when a blockchain splits into two paths, either to introduce upgrades or resolve disagreements.

- Soft fork – Backward-compatible update (old nodes still function). For example, Bitcoin's SegWit update improved transaction throughput while maintaining backward compatibility.

- Hard fork – Non-compatible update, creating a separate chain. For instance, Bitcoin Cash introduced an increased block size, ensuring faster transactions and lower fees. Meanwhile, Ethereum Classic preserved the original blockchain state after the community decided to roll back a hack that had exploited a smart contract.

Wrapping up

A Layer 1 blockchain is the base infrastructure of a decentralized network. While L1s like Bitcoin and Ethereum prioritize security and decentralization, L2 solutions help scale transaction speeds.

Some chains, like Solana, minimize reliance on L2s by optimizing their base layer. Meanwhile, others, like Ethereum, use sharding, consensus upgrades, and forks to enhance performance. Understanding L1s is crucial for grasping how blockchain ecosystems evolve to balance security, decentralization, and scalability.