What are сrypto AI agents?

AI agents are among the hottest trends in the crypto space. Some believe they may become the cornerstone of decentralized finance, while skeptics talk of a bubble waiting to burst. Here is the lowdown on how these software programs work.

What are AI agents?

These programs can analyze, solve, and execute tasks on the blockchain without human input. They are autonomous and — as the term suggests — rely on artificial intelligence. Able to adapt and learn, they support efficient decision-making and power viral crypto narratives.

AI agents are much more than bots. They can trade, manage portfolios, and even run social media accounts. Given their flexibility, Mark Zuckerberg’s words hardly seem surprising:

“I think we’re going to live in a world where there are going to be hundreds of millions or billions of different AI agents. Eventually, probably, more AI agents than there are people in the world.”

Understanding crypto AI agents

AI agents have a plethora of applications in crypto due to its decentralized, volatile, and data-heavy nature. A survey conducted by CoinGecko in Q2 2025 revealed that AI-agent key opinion leaders (KOLs) on Crypto Twitter (X) were trusted more than human counterparts.

The most common applications include trading, portfolio management, blockchain governance, and KOLs. The latter can post market updates on social media and spark hype by engaging with communities.

How are crypto AI agents different from bots?

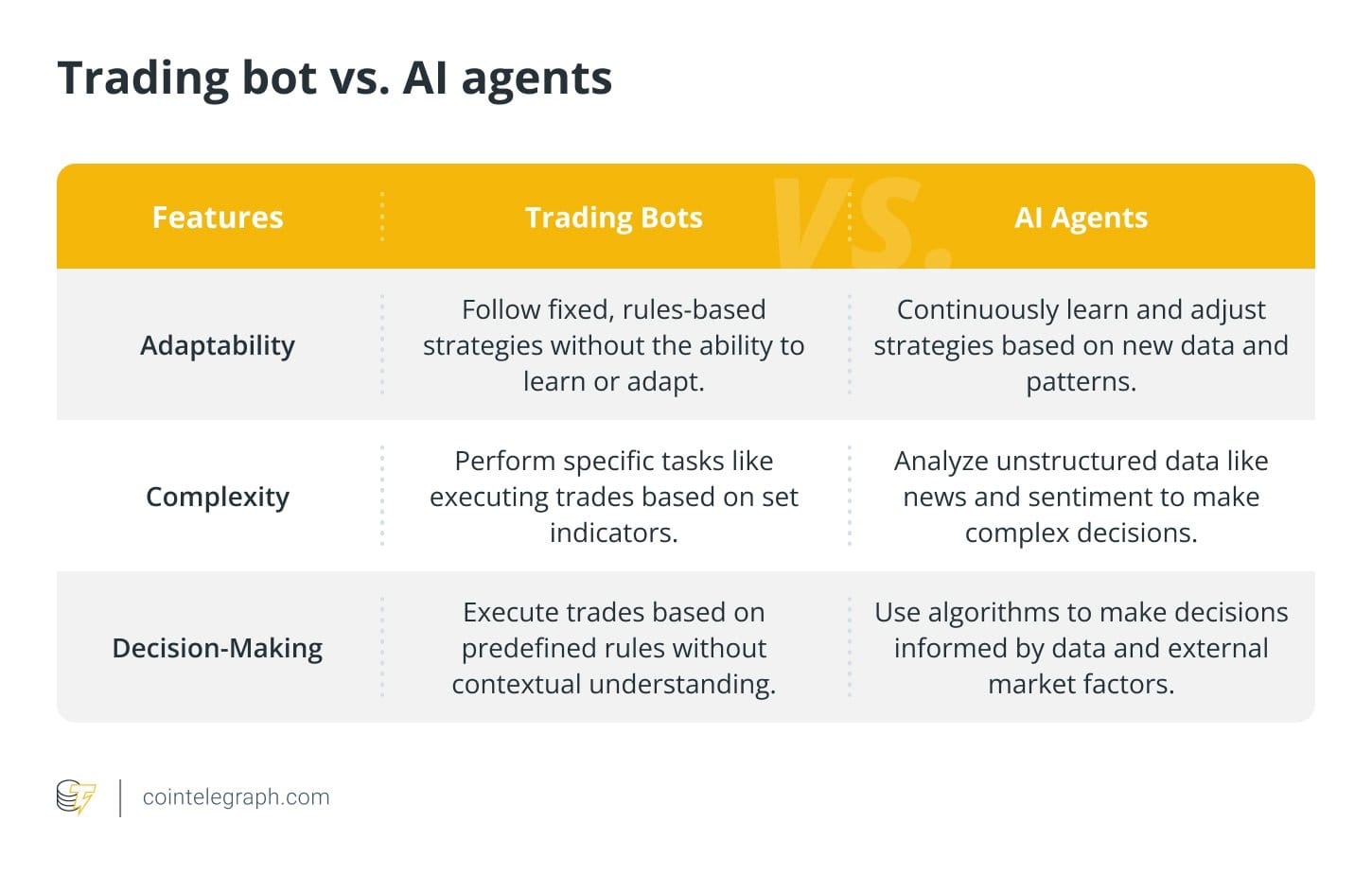

Like bots, AI agents also automate tasks, reply to questions, and help users with repetitive tasks. Yet they are unique — flexible and adaptive — due to their probabilistic, rather than deterministic, nature.

Bots follow rules and scripts created by developers — without analyzing contextual relevance — and execute tasks as instructed, managing risk based on technical indicators. For instance, a trading bot may execute a buy order if the price sinks below a preset threshold.

Crypto AI agents are more complex than market makers or arbitrage bots. In contrast to predetermined rules, they consider real-time data for more intelligent actions. Probabilistic decisions involve machine learning and AI models, while trend and pattern analysis allows for more nuanced work. This enables AI agents to serve as portfolio managers or sentiment analysts.

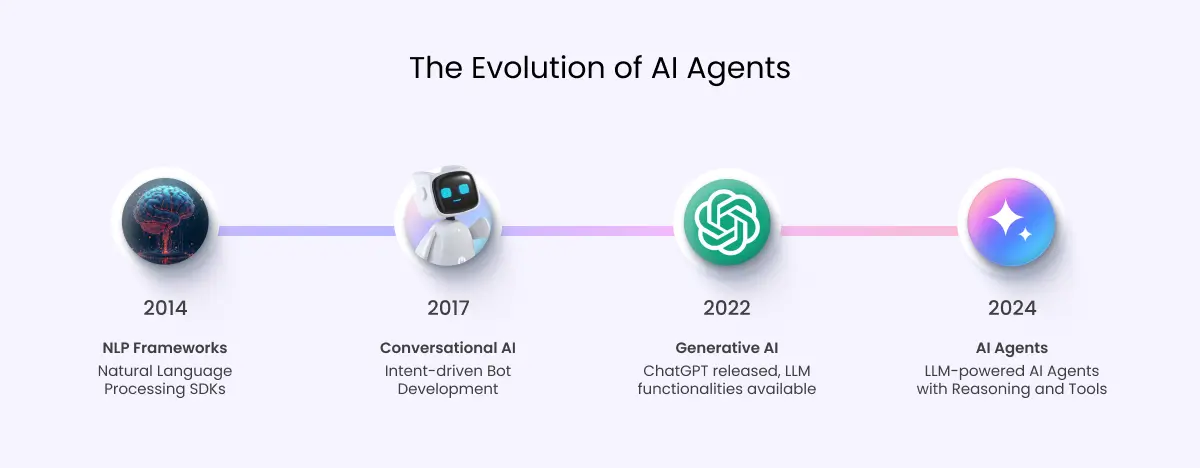

History of AI agents in crypto

Truth Terminal has made history as the pioneer in the space. Aiming to launch a satirical religion based on memes, it operates semi-anonymously on X.com. Over time, the project began posting about its unique “Goatse Gospel.”

In July 2024, the posts caught the attention of Marc Andreessen, co-founder of a16z, who eventually sent $50,000 in BTC to Terminal’s wallet address. That was one of the first instances of substantial human funding for a crypto AI agent.

The project subsequently released a meme coin, GOAT, through Pump.fun on Solana. The cryptocurrency gained ground, hitting an all-time high (ATH) of over $1.2 billion in market cap, making Truth Terminal the first AI agent millionaire.

How do crypto AI agents work?

Users typically interact with crypto AI agents via a conversational interface, like a chatbot. Once a question is submitted, the agent analyzes its context and gets to work, gathering data to make and execute decisions.

- Data accumulation: The AI agent collects blockchain transaction details and additional information, drawing from sources ranging from social media to news websites to price feeds.

- Analyzing and learning: Machine learning models power the agent’s search for patterns and trends — e.g., a sudden surge in a token’s popularity on social media.

- Decision-making: The agent determines what should be done based on its design — such as placing a trade, staking, or sharing its analysis online.

- Blockchain execution: The agent executes the planned transaction, ensuring accuracy. For example, it may pick a DEX with the highest liquidity to buy a token or select the optimal validator for staking.

Common use cases

- Market intelligence and research: Agents like aixbt track and interpret market patterns and trends to supply real-time insights. They also share market updates on X.

- Customer support: Agents can replace support teams, delivering personalized customer interactions — for example, businesses can provide 24/7 support via Sensay.

- Automated trading and portfolio management: This use is still in its early stages — PAAL AI’s SwingX Agent is live, and Wayfinder is available for a select few.

- DeFi strategy execution: AI agents can mine information, execute swaps, bridge assets, and manage automated strategies. For instance, HeyAnon users can pick assets, amounts, conditions, and triggers for a transaction.

- Fraud monitoring: TradFi is already using AI for cybersecurity and fraud detection. Such agents scan real-time transactions, flag anomalies, and prevent suspicious activities.

Benefits of AI agents in crypto

AI agents can cut through noise, act instantly, and stay objective. Working around the clock, they support autonomous and efficient decision-making.

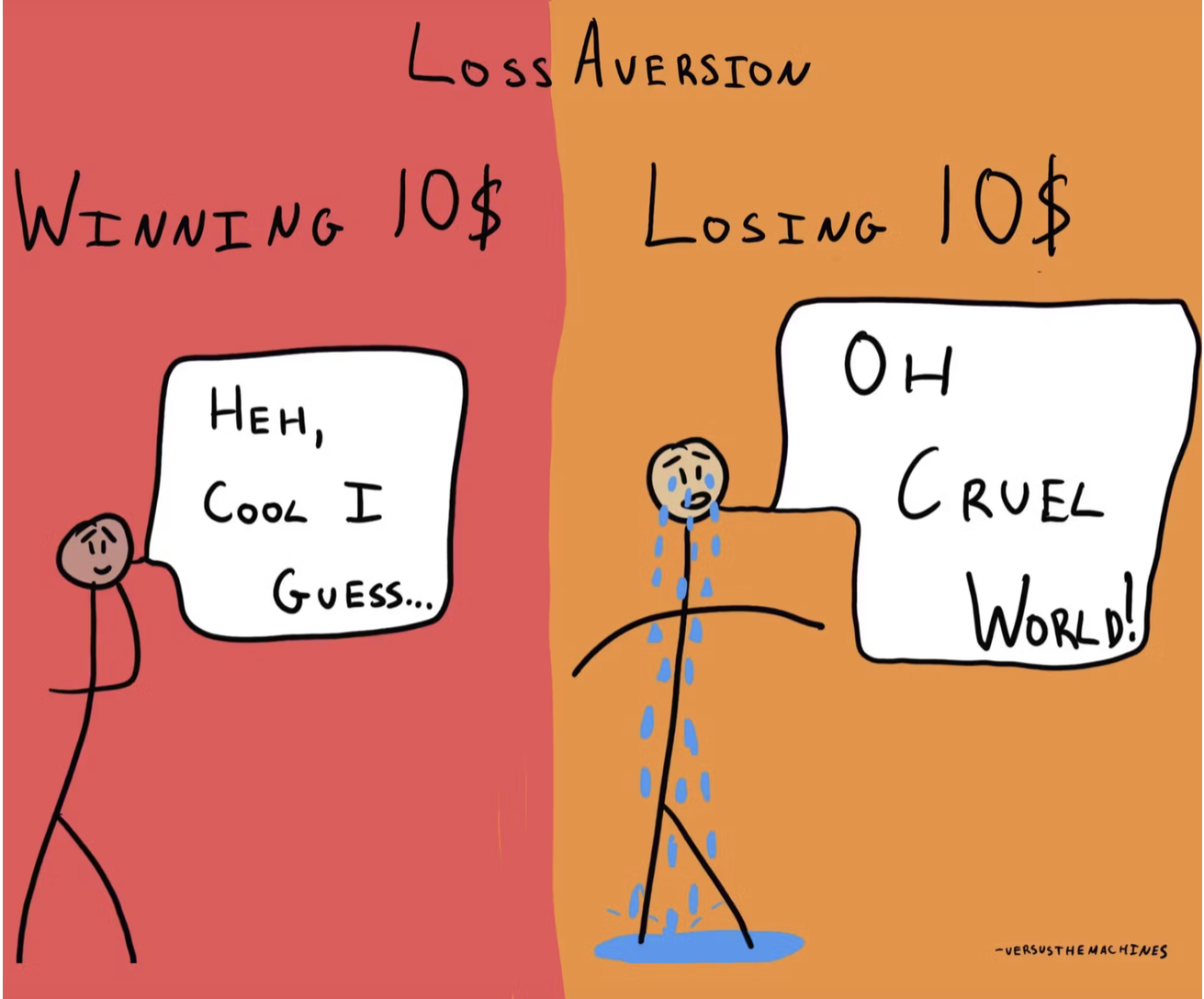

Eliminating emotional biases

Unlike humans, AI agents do not fall into psychological traps, panic, or hesitate. For example, they are immune to loss aversion — the tendency of human traders to hold on to bad investments for too long or panic-sell strong assets just to avoid losses. The logic is purely data-driven, ensuring rational decisions even in the most volatile markets.

Autonomous decision-making

AI agents make decisions faster than any human by leveraging a plethora of data sources across the blockchain and social media. They can analyze market trends in real time and tailor strategies to users’ preferences, risk tolerance, and on-chain behavior.

Efficiency

Crypto AI agents sift through noise and review vast amounts of data in a flash, from price changes to social media mentions, distilling information to help users make informed decisions. They can automate manual operational tasks, such as borrowing, staking, bridging crypto across chains, or swaps.

24/7 operation

Like the crypto market, AI agents never sleep. They stay vigilant to market changes, monitoring opportunities, spotting risks, and executing trades instantly — way faster than any human. They learn from market trends, manage holdings, and fine-tune risk strategies, all without hesitation.

Automated yield farming

In yield farming, AI agents scan the market in real-time, find the best opportunities, and allocate funds for maximum returns. That means users can earn passively without needing to be DeFi experts.

Risks of using crypto AI agents

AI agents can boost efficiency, minimizing risks in trading and yield farming. However, they are not infallible. Timely updates are required, and a lack of context awareness means they cannot adjust for geopolitics or predict black swans. Here are the top concerns:

- Inaccurate predictions: The quality of predictions largely depends on the completeness, correctness, and relevance of reference data. Furthermore, complex questions could elicit problematic responses — for instance, asking about the impact of regulatory updates on a specific token. Users should therefore do their own research and verify AI-powered statements or ask for the sources and reasoning.

- Market manipulation: AI agents can theoretically spread FOMO when tasked with hyping up the same cryptocurrency. Such actions may cause price hikes preceding crashes — another caveat highlighting the value of doing one's own research.

- Centralization risk: Most data services and sources are centralized, so AI systems normally run on servers like AWS or Azure. This means developers may control API keys and private wallets — but DeFi is already working on ways to keep them aligned with decentralization principles.

- New architectures are already addressing this issue. Guardian nodes require verification from multiple nodes before any action is taken — making it much harder for developers to intervene.

- Escrow contracts help prevent unauthorized withdrawals.

- DAOs can ensure AI agents are not controlled by a single entity, with the community voting on how they are regulated and deployed.

- Projects should disclose how their AI makes decisions, what data it is trained on, and how it evaluates performance.

- Overdependence: Relying on AI agents as the sole advisors is risky — instead, consider them as additional sources of insights. When trusted with managing portfolios, AI agents do not eliminate recommended safeguards, such as requiring manual approval for large trades.

- Security concerns: Like any digital technology, AI agents are not immune to cyber threats, which makes audits of smart contracts and DeFi security crucial. Agents that manage portfolios have direct access to users’ funds, which means their accounts and assets may theoretically be compromised.

Examples of crypto AI agent tokens

Most popular tokens support infrastructure projects beyond the realm of consumer products. They focus on crafting AI models and autonomous agents.

- Artificial Superintelligence Alliance (FET): This consortium aims to be the biggest open-source and decentralized entity in AI research and development. Founded by Fetch.ai, SingularityNET, and Ocean Protocol, it allows FET holders to interact with ecosystem AI agents and access AI tools, datasets, and compute resources.

- Virtuals Protocol (VIRTUAL): Operating on Base, Virtuals turns AI agents into tokenized assets supporting fractional ownership. Users can create, own, and deploy AI agents, profiting from their success. VIRTUAL tokens are used for creating agents, establishing their liquidity pools, routing transactions, and paying for AI agent inferences.

- Ai16z (AI16Z): Ai16z, now known as elizaOS, is a framework for building, deploying, and managing autonomous AI agents. It began as an experiment to see if autonomous AI agents could outperform VCs when managing crypto for a DAO on-chain. AI16Z is primarily a governance token and gateway to exposure to elizaOS and the DAO.

- Freysa AI (FAI): The world’s first evolving Sovereign Agent functions without human oversight — humans do not retain control of its private keys or memory, either. The FAI token is live, but its utility is still in development.

- OriginTrail (TRAC): OriginTrail combats misinformation by enhancing discoverability and ensuring authenticity. Using the decentralized knowledge graph, it presents a global open data structure of interconnected Knowledge Assets — on an open, decentralized network of nodes. TRAC tokens can be used for delegated staking.

Looking ahead: Redefining DeFi interactions

AI agents are unlocking a new era of high-frequency algorithmic trading — where institutional DeFi isn’t just catching up to TradFi, but surpassing it. We’re seeing a market that’s not only decentralized but also faster, more efficient, and truly autonomous.

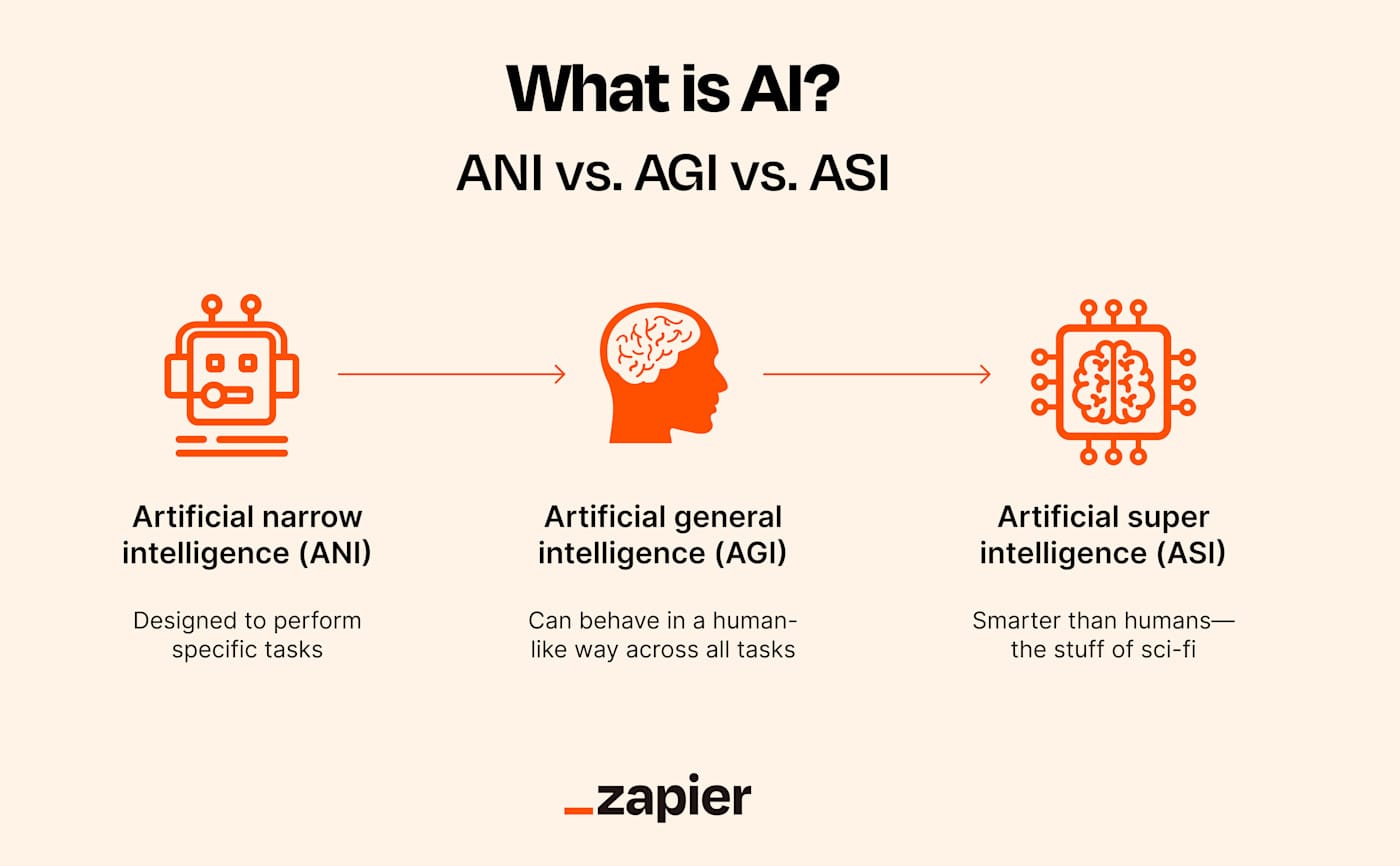

The next logical step is artificial general intelligence (AGI) agents — AI systems that can understand, learn, and adapt in ways that go beyond pre-programmed rules. Imagine fully autonomous financial ecosystems, where AI manages portfolios, optimizes liquidity, and executes complex strategies better than any human.

Wrapping up

Crypto AI agents blend autonomy, adaptability, and intelligence to redefine how we interact with blockchains. Yet, their decisions hinge on data quality, and their influence can amplify market risks. As the space matures, the key lies in balancing innovation with vigilance — leveraging AI’s efficiency while maintaining critical oversight through research and verification.