Clapp Weekly: Macro-driven recovery, decoupled BTC, Ethereum's focus shift

BTC price

Easter weekend performance marked a notable shift in Bitcoin sentiment, as the price decoupled from US stocks to track the soaring gold. The Coinbase Bitcoin Premium Index — which compares BTC prices between Coinbase Pro and Binance — indicates renewed institutional interest.

BTC climbed from $83.6k and traded in a tight range around the $85k mark until Monday, April 21. After briefly touching $88.1k, it rocketed the next day and peaked at $93,518.26 — its highest level since early March — this morning.

Currently trading at $92,878.40, BTC has posted gains of 5.4% over 24 hours and 10.8% for the week.

ETH price

Ethereum has also benefited from improving macro conditions, with anticipation building for the upcoming Petra upgrade on May 7. A significant decline in CME futures basis — from 20% to just 5% since November 2024 — suggests the easing of arbitrage pressures that previously weighed on the price.

Like BTC, ETH kicked off this week with explosive growth after hovering around $1.6k for days. Following Monday's high of $1,649.24, the price retreated and soared again, hitting $1,793.09 a few hours ago.

At its current price of $1,786.57, ETH has gained 13.2% in 24 hours and 11.8% for the week.

Seven-day altcoin dynamics

Bitcoin's Monday surge past $93k followed reports that US Treasury Secretary Scott Bessent called the tariff standoff with China "unsustainable." At a closed-door JPMorgan event, Bessent predicted de-escalation in the "very near future" but cautioned that a comprehensive deal could take years.

Later, President Donald Trump told White House reporters that US tariffs on China would be reduced "substantially" from the current 145% rate. As fears of an escalating trade war eased, BTC's rally lifted altcoins.

SOL's (+21.9%) price action stood out. Approximately 11 million tokens (worth $1.6 billion) were unlocked from FTX's estate — the largest such release since January 2021. While unlocks typically exert downward pressure, SOL defied expectations, suggesting the market had already priced in the impact.

Meanwhile, Solana meme coins continued gaining traction, with FARTCOIN (+34.3%) overtaking BONK (+34.1%) to become the second-largest meme coin in the ecosystem — trailing only TRUMP (+16.5%).

Winners & losers

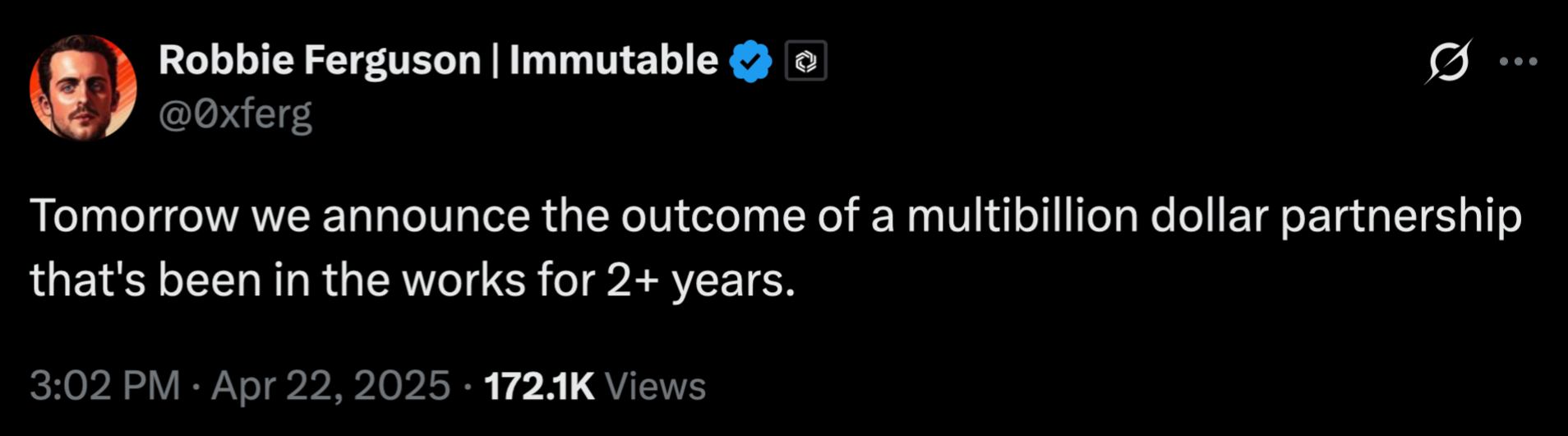

IMX (+53.6%) has surged after Immutable president and co-founder Robbie Ferguson hinted at a major announcement — "the outcome of a multibillion-dollar partnership that's been in the works for 2+ years." The teaser fueled speculation and buying momentum.

TAO (+43.0%) benefits from Bitcoin's rally and a rising interest in its subnets, where small communities build next-generation AI systems. The subnet market cap skyrocketed 10x in just nine weeks — from $50 million to $500 million.

STX (+38.8%) is also riding the broader bullish wave, with its stablecoin ecosystem acting as a key catalyst. Stablecoin supply on Stacks quadrupled in Q1, becoming the third-biggest among all chains.

On the downside, IP (-5.2%) faces pressure amid intense volatility reminiscent of OM’s pre-crash behavior, with growing concerns about OTC sales and coordinated moves. TKX (-2.9%) dipped after a weekend flash crash from $33 to $29.57, shaking trader confidence. Meanwhile, LEO (-2.8%) continued consolidating within its long-term range, with its performance closely tied to trading activity on Bitfinex.

Cryptocurrency news

Bitcoin surges past $90k, decoupling from tech stocks

Amid macroeconomic uncertainty and shifting policies, Bitcoin’s rally could mark the beginning of a larger breakout. The climb above $90k for the first time since early March suggests its recent correlation with US tech stocks is fading — potentially signaling a shift toward its long-hyped store-of-value role, akin to gold.

Market dynamics shift; BTC outperforms

After an initial dip triggered by President Trump’s tariffs, Bitcoin has staged a strong recovery. Meanwhile, the Nasdaq 100 lingers below its March highs, reinforcing the idea that crypto is carving its own path. A weakening US dollar — now at its lowest level since late 2023 — has further fueled Bitcoin’s resurgence.

Historically, Bitcoin has behaved like a leveraged Nasdaq proxy, magnifying gains in bull markets and losses in downturns. But now, BTC is trading above its 50-day moving average (MA), while the Nasdaq and major US stock indexes remain below their 200-day MAs. The S&P 500 and Nasdaq 100 ETFs have both suffered double-digit losses, highlighting the divergence.

This breakout challenges one of the long-standing bearish arguments against Bitcoin — that it’s merely a "risk-on" asset tied to equities. The case for BTC as an independent store of value grows stronger.

BTC's correlation with money supply

Bitcoin closely follows Global M2 — a gauge of the world’s liquid assets that can be easily turned to cash (with a 60-90-day lag). With the money supply poised to soar due to central banks' money-printing, Bitcoin should follow suit.

Trump policies and Fed uncertainty

Trump’s recent criticism of Federal Reserve Chair Jerome Powell — including accusations of delaying rate cuts — has rattled traditional markets. Speculation that the era of US "exceptionalism" driving equities may be ending has benefited Bitcoin as an alternative asset.

Anticipation around Trump’s Strategic Bitcoin Reserve (SBR) plan has also provided a tailwind. Signed in early March, the executive order directs the Treasury to evaluate the legal and investment implications of a national BTC reserve within 60 days — a deadline now just weeks away. Analysts believe any progress on this front could further validate Bitcoin’s role in global finance.

What’s next?

While Bitcoin remains 14% below this year's all-time high of $108,786, the stock decoupling and renewed institutional interest suggest a bullish outlook. Crypto analyst Vetle Lunde notes that "any signs of Fed independence being questioned or SBR updates are now key catalysts for Bitcoin."

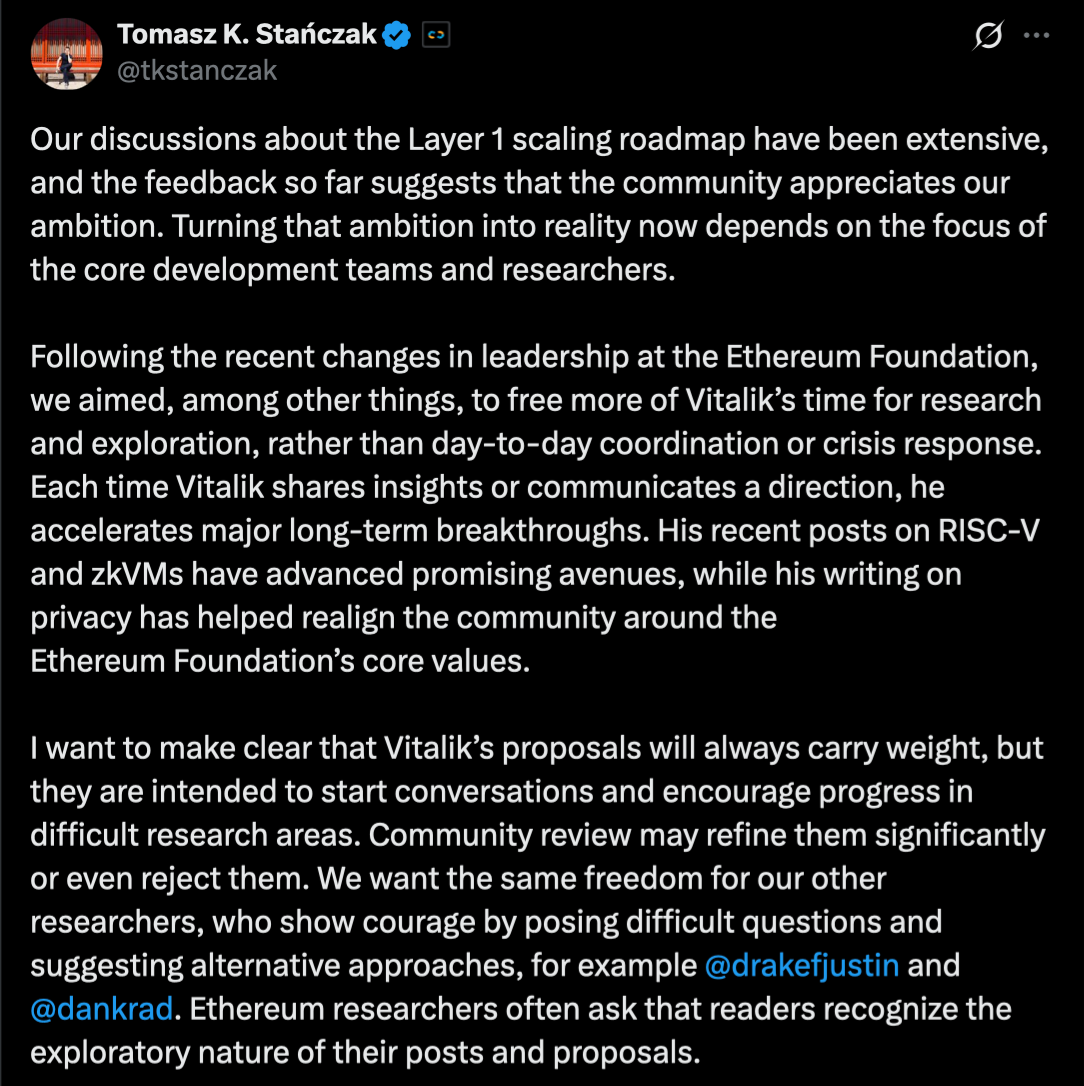

Ethereum Foundation prioritizes UX and scaling as Buterin focuses on research

The Ethereum Foundation is undergoing a strategic shift, refocusing its efforts on user experience (UX) and layer-1 scaling solutions after a leadership reshuffle in March. Co-executive director Tomasz Stańczak explained that Vitalik Buterin, Ethereum’s co-founder, will be able to dedicate more time to long-term research and innovation rather than routine operations.

Freeing Buterin for breakthrough ideas

Buterin’s insights have historically driven major advancements for Ethereum. “Each time Vitalik shares insights or communicates a direction, he accelerates major long-term breakthroughs,” Stańczak noted. Since stepping back from daily management, Buterin has already proposed key upgrades, including:

- A privacy roadmap (April 11) suggesting default anonymity features for transactions.

- An EVM contract language change (April 20) to boost execution layer speed and efficiency.

While Buterin’s proposals carry significant weight, Stańczak clarified that they’re meant to spark discussion — not dictate final decisions. The community can refine, reject, or build upon these ideas.

Near-term upgrades take center stage

The Foundation is now prioritizing near-term protocol improvements, including:

- Layer-1 scaling solutions to enhance Ethereum’s base performance.

- Support for layer-2 networks to improve scalability.

- UX enhancements, such as better interoperability in upcoming upgrades like Pectra, Fusaka, and Glamsterdam.

Despite this shift, Stańczak assured that long-term R&D remains critical, with researchers exploring next-gen execution and consensus layers for future upgrades.

More focused roadmap

By streamlining leadership — with Stańczak and Hsiao-Wei Wang now co-directing — the Foundation aims to balance immediate needs with visionary research. This structure ensures that while Buterin explores bold new ideas (like privacy and speed optimizations), the core team can deliver tangible improvements for users and developers.

As Ethereum continues evolving, this dual focus on scalability and usability could strengthen its position as the leading smart contract platform — both for today’s applications and tomorrow’s innovations.