Clapp Weekly: Surge on tariff pause, Trump gala, crypto Dubai

BTC price

Bitcoin was flat yesterday after April US inflation data showed price growth held steady. Previously, Monday's news of a US-China trade truce — a partial tariff pause — helped it re-approach $105k.

BTC saw explosive growth from just over $96.3k to $103,776 on May 9 before climbing further. The price slipped from $104,581 on May 12, bottomed out at $101.7k the next day, and rebounded. It then retreated from yesterday's high of $104,778.

Currently at $103,568, BTC has gained 1.8% in 24 hours and 7.3% over the past seven days.

ETH price

Supported by the Pectra upgrade, ether breached the $2.7k level for the first time in months, despite steady outflows from spot ETFs. The rally is fueled by spot buying pressure as the estimated leverage ratio (ELR) has declined.

ETH shot up from $1.8k to $2.4k on May 9 and then higher — outperforming BTC and breaching the $2.5k level. Spectacular double-digit growth culminated in yesterday's peak of $2,687.84 after a brief dip to $2.4k.

Now at $2,637.10, ETH is up 8.6% over 24 hours and 44.5% in seven days.

7-day altcoin dynamics

Bitcoin’s surge above the psychological $100k level heralded the comeback of the bulls. Several altcoins followed suit, prompting analysts to declare the onset of an altseason. Yet, skeptics cite massive declines from the respective all-time highs.

Ether’s robust performance, alongside falling Bitcoin dominance, supports the optimistic narrative. BTC dominance has declined from 65% to 62%, while the altcoin market cap grew by $300 billion in recent weeks. Interest in sector leaders like TAO, XLM, and SUI is also rising.

Recent macro developments have restored confidence and reignited bullish momentum. In particular, inflation has eased, and clarity around Trump's tariffs is evolving.

The meme coin sector outperformed top altcoins, recording the highest gains last week. On Tuesday, as BTC tested $105k, a spate of tokens outpaced the pioneer, with ETH, SOL, and DOGE leading the charge.

Winners & losers

As of this writing, no cryptocurrencies from the top 100 are in the red. The leader — PI (+118.0%) — surged following large whale transfers, reflecting skyrocketing retail interest. One user moved 70 million PI off exchanges before another 20 million were withdrawn from OKX. The momentum is supported by rumors of a potential Binance listing, sparked by test transactions.

WIF (+96.9%) benefited from the broader bullish comeback, rebounding as expected after a deep pullback and an equally aggressive recovery. Meanwhile, PEPE (+74.6%) soared as Open Interest hit a historic high on Monday, with traders betting heavily on the frog-themed coin.

Other top memecoins also posted double-digit gains, including FLOKI (+48.0%), BONK (+40.0%), and DOGE (+39.1%).

Cryptocurrency news

$2M dinner with Trump: High-stakes world of political meme coins

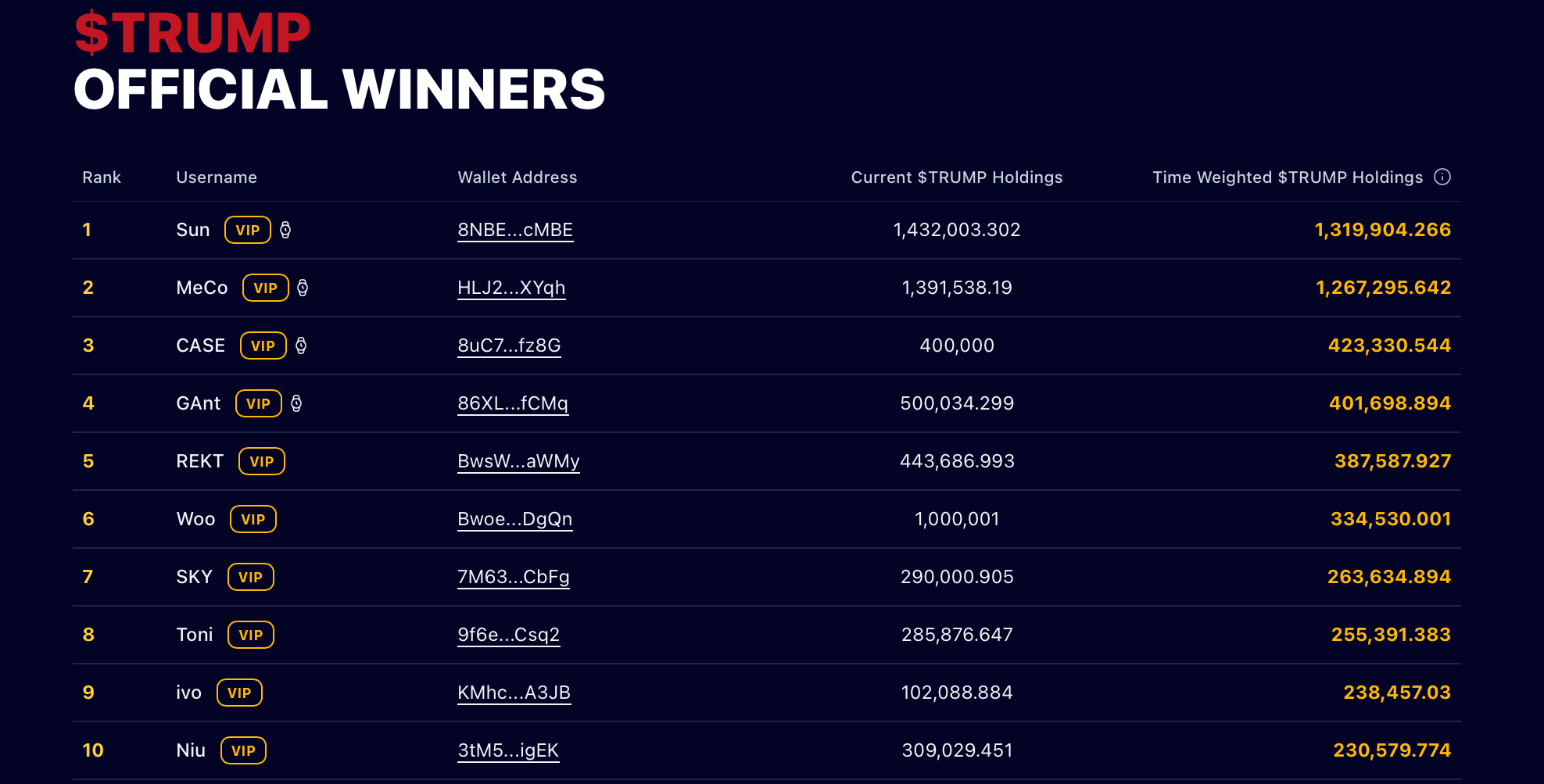

In a move that blurs the lines between politics, finance, and celebrity, Donald Trump is hosting an exclusive crypto gala where the price of admission is loyalty — measured in millions of dollars’ worth of his TRUMP meme coin. The upcoming event, set at his luxurious Washington, D.C. golf club, has sparked controversy and a trading spree among investors, with the winners announced on May 12.

The dinner is scheduled for May 22. To secure a seat, attendees had to hold at least 4,196 TRUMP (worth around $55,000). Yet the real VIP treatment — an intimate pre-dinner reception — required an average holding of 325,000 coins (over $4 million).

The top investor, a pseudonymous trader named "Sun," amassed a staggering $19 million worth of TRUMP, fueling speculation that the wallet belongs to Chinese billionaire Justin Sun.

Some whales gamed the system. One investor, "Woo," bought 1,000,001 coins ($13 million worth) just days before the deadline, instantly securing a top-tier spot. Meanwhile, others dumped their holdings immediately after qualifying, cashing out before potential price drops.

$TRUMP controversy

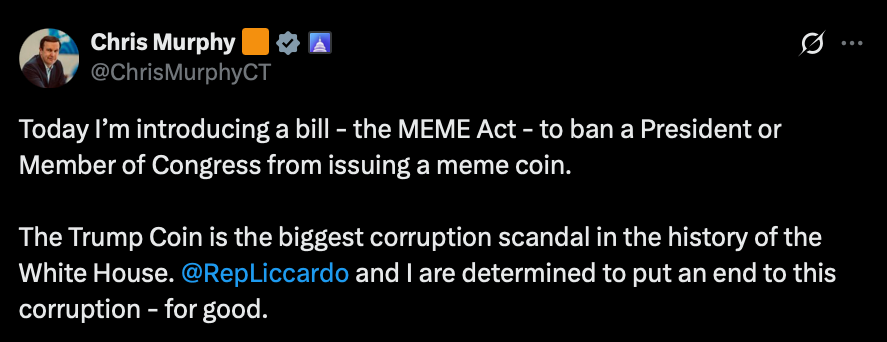

Trump’s TRUMP coin, launched just days before his 2025 inauguration, initially surged to a $14 billion market cap before crashing over 80%. The dinner announcement reignited trading, raising ethical concerns. Critics argue the coin is a "money grab" that could enable foreign influence or undisclosed payments to the Trump family.

Democratic lawmakers have even proposed the MEME Act, aiming to ban politicians from creating their own coins to prevent potential bribery. The bill underscores growing unease over crypto’s role in politics. As Senator Jon Ossoff warned, "He is granting audiences to people who buy the meme coin that directly enriches him.”

While some attendees see it as a networking goldmine (like MemeCore’s Rudy Rong, who crowdsourced TRUMP coins for a seat), others view it as a pay-to-play scheme disguised as a crypto movement.

With no public attendee list and millions in trading fees flowing to Trump-linked entities, the dinner isn’t just a gathering — it is a high-stakes experiment in political finance, influencer culture, and speculative gambling.

Dubai goes crypto: Government to accept digital payments for fees

Dubai is doubling down on its ambition to become the global crypto hub of the Middle East, announcing a landmark deal with Crypto.com that will allow residents and businesses to pay government service fees in cryptocurrency. The move signals a major step toward the emirate’s cashless future — and could add $2.2 billion annually to its economy.

Under the agreement, individuals and businesses will soon be able to use Crypto.com wallets to pay for government services, from visa fees to business licenses. The exchange will instantly convert crypto payments into dirhams (AED), ensuring the government receives traditional currency while users spend digital assets.

This seamless integration avoids volatility risks for Dubai’s treasury while giving crypto holders a real-world utility — bridging the gap between decentralized finance and everyday transactions.

Dubai’s crypto vision

Dubai has been aggressively positioning itself as a blockchain leader:

- 2022: Launched the Virtual Assets Regulatory Authority (VARA), the world’s first dedicated crypto regulator.

- 2023: Granted licenses to major exchanges like Binance and OKX.

- 2030 goal: Attract 1,000+ metaverse and blockchain companies under its Metaverse Strategy.

This latest move reinforces Dubai’s pro-innovation stance, contrasting with the regulatory crackdowns seen in the US and Europe. The shift to crypto payments is projected to inject 8 billion dirhams ($2.2B) per year into Dubai’s economy.

It will reduce transaction costs by cutting out intermediaries and speed up digital transformation in government services. This new environment should attract crypto businesses and talent seeking friendly regulations.

Questions remain

It remains to be seen when other governments will follow — although Singapore and Switzerland are watching closely. Tailoring this model for taxes is likely the next frontier, while stablecoins could play a major role in mitigating volatility.

Dubai isn’t just dipping its toes into crypto — it is diving in headfirst. By integrating digital assets into core government functions, the emirate is setting a global benchmark for blockchain adoption.