Clapp Weekly: Triple macro shocks, ETF outflows, SEC's 'Project Crypto'

BTC price

Bitcoin entered August, historically one of its worst-performing months, at just over $114k due to combined macro shocks. On July 30, President Trump imposed higher tariffs on over 67 countries — followed by the repositioning of two nuclear submarines that escalated tensions with Russia. Friday's jobs report intensified the plunge (more below).

The BTC price lost its grip on $119k last Tuesday, July 29, and plummeted two days later (after Trump's executive order announcement). The decline culminated on Saturday, August 2, at $112,296. Rebounding, BTC is struggling to hold above $115k.

Currently at $114,206, BTC has lost 0.3% in the past 24 hours and 3.7% over the past week.

ETH price

Ether followed the broader sell-off as investors flocked to safer options like Treasuries. Shrinking exchange balances, institutional inflows of $154 million, and weekend whale accumulation helped the coin rebound despite tariff fears and the Fed’s hawkishness.

Price-wise, ETH followed BTC's trajectory after slipping from $3.9k a week ago. Thursday's crash continued into Saturday, August 2, when ETH bottomed out at $3,380.72. Gradually recovering, it touched $3.7k last night.

Now trading at $3,652.82, ETH is up 2.9% over the past 24 hours but down 3.6% over the past 7 days.

Seven-day altcoin dynamics

Last Friday's weaker-than-expected jobs report boosted traders' confidence that the Federal Reserve will cut interest rates in September. Yet it also triggered a massive sell-off across risk assets — with both stocks and crypto declining sharply.

The US economy added 73,000 jobs in July (versus 100,000 projected), with unemployment remaining flat at 4.2%. Dramatic revisions for May and June eliminated 258,000 jobs — prompting President Trump to fire the commissioner of the Bureau of Labor Statistics for reporting "rigged" figures.

Repositioning of US nuclear submarines and revived tariff fears contributed to the sell-off. The day before, on July 31, Trump's executive order increased tariff rates for over 67 countries. The new levies are scheduled to take effect on Aug. 7.

Sell-off: Tanking meme coins, defiant RWAs

'Cautiously optimistic' traders bought the dip, causing ETH and other major altcoins to recover Sunday night. Presto Research analyst Min Jung suggests the dismal jobs data, coupled with US stock market declines, likely fueled the profit-taking, especially after several weeks of rallying.

Meme coins succumbed to the broader pressure, amplifying altcoin losses. Meanwhile, real-world asset (RWA)-related tokens emerged as Monday's top-performing category (August 5), with the sector gaining nearly 7% over 24 hours — triple the broader crypto market's 1.5% gain — as investors pursued a "flight to quality" amid ongoing macro uncertainty.

Winners & losers

HASH (+32.2%) led this week’s gains. Institutional demand for RWA projects surged after the signing of the GENIUS Act, which provides regulatory clarity for tokenized assets.

Meanwhile, LTC (+12.8%) staged a comeback as Litecoin Foundation data revealed an unprecedented spike in adoption — 12% of all transactions since 2011 occurred this year alone. The LTC rally is supported by three spot LTC ETF filings (Grayscale, CoinShares, and Canary Capital).

IP (+12.2%) continued its ascent, nearing its all-time high after Grayscale launched its Story Trust Fund — a single-asset vehicle offering daily subscriptions for accredited investors. The fund’s debut validates IP’s unique positioning at the intersection of intellectual property and blockchain.

On the downside, SPX (-19.3%) collapsed under combined macro pressures, including tariff uncertainties and a risk-off shift in traditional markets. Similarly, PI (-19.0%) plunged to a record low amid whale sell-offs and delayed exchange listings, with fears mounting over its upcoming $57 million token unlock.

Even BONK (-18.0%) defied its ecosystem growth — despite Bonk.fun dominating Solana’s launchpad market — as meme coins broadly retreated from recent highs.

Cryptocurrency news

Crypto ETFs see $223M outflow amid macro turmoil

The crypto market’s 15-week inflow streak has come to an abrupt halt — investors pulled $223 million from digital asset funds last week, spooked by hawkish Federal Reserve rhetoric and shifting macro expectations.

ETF exodus on Fed pessimism

The plunge followed the Federal Open Market Committee (FOMC) meeting that left the benchmark rates unchanged. Commenting on the decision, Fed Chair Jerome Powell tempered expectations of a September rate cut.

US crypto ETFs, which had started the week with $883 million worth of inflows, saw a dramatic reversal — losing over $1 billion in a day and $223 million over the week. Bitcoin ETFs bore the brunt, shedding roughly $930 million between July 31 and August 1.

The Ethereum counterparts broke a record 20-day inflow streak — with $152.3 million pulled out last Friday, August 1. That day, both types of products booked the second-largest daily outflows YTD, largely due to the Fed's rhetoric and Trump's renewed tariff threats.

August blues or temporary pullback?

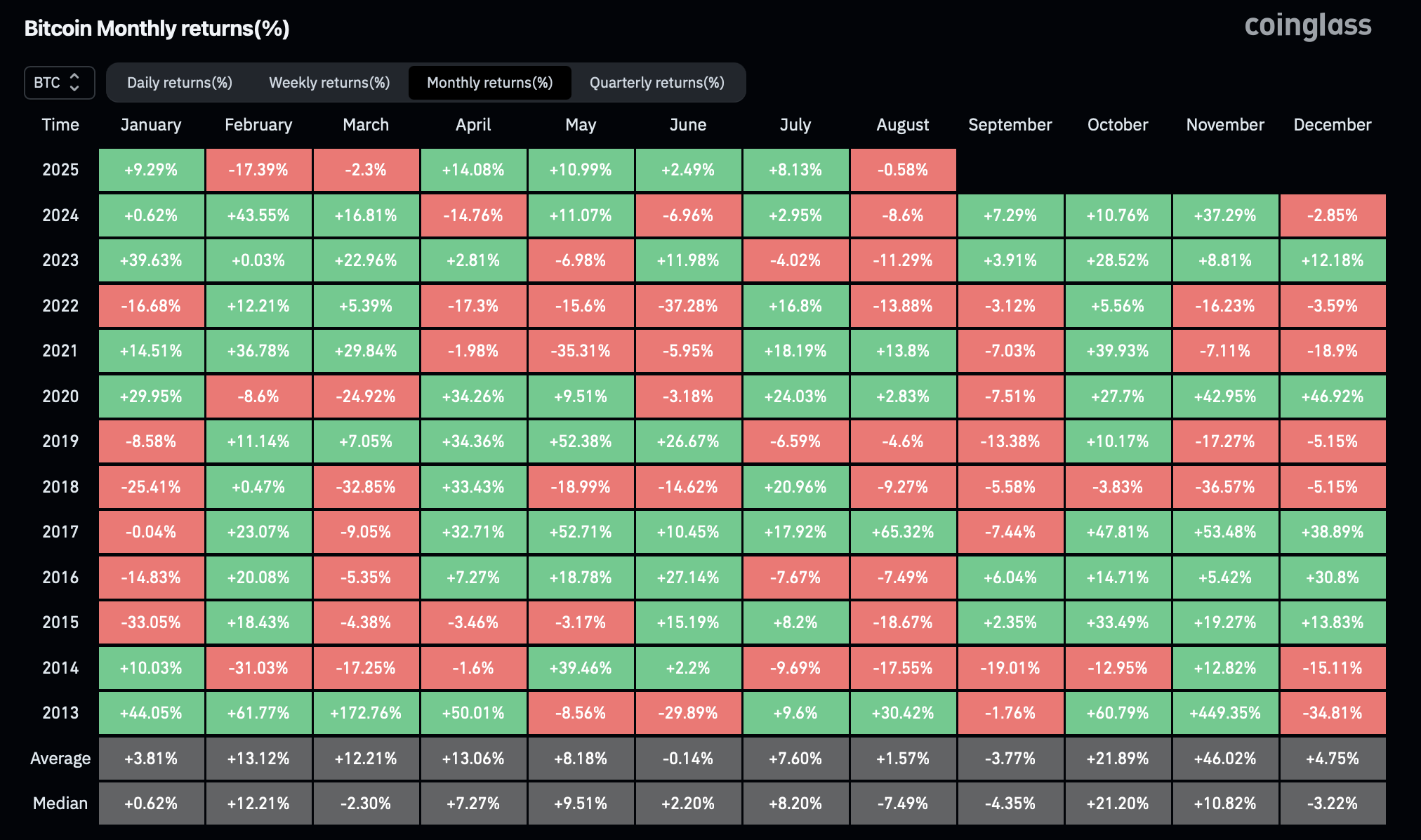

Historically, August has been Bitcoin’s worst month, with median returns of -7.49%. The latest sell-off was exacerbated by post-rally profit-taking — although a CoinShares report expresses optimism:

“Given we have seen US$12.2bn net inflows over the last 30 days, representing 50% of inflows for the year so far, it is perhaps understandable to see what we believe to be minor profit taking.”

Analysts suggest the pullback is temporary, as institutional demand, regulatory clarity, and structural inflows keep the market anchored for long-term growth. Matrixport predicts a post-Labor Day rebound as Congress returns, potentially reigniting Bitcoin’s "hard asset" narrative. Meanwhile, Ethereum’s resilience hints at growing institutional interest.

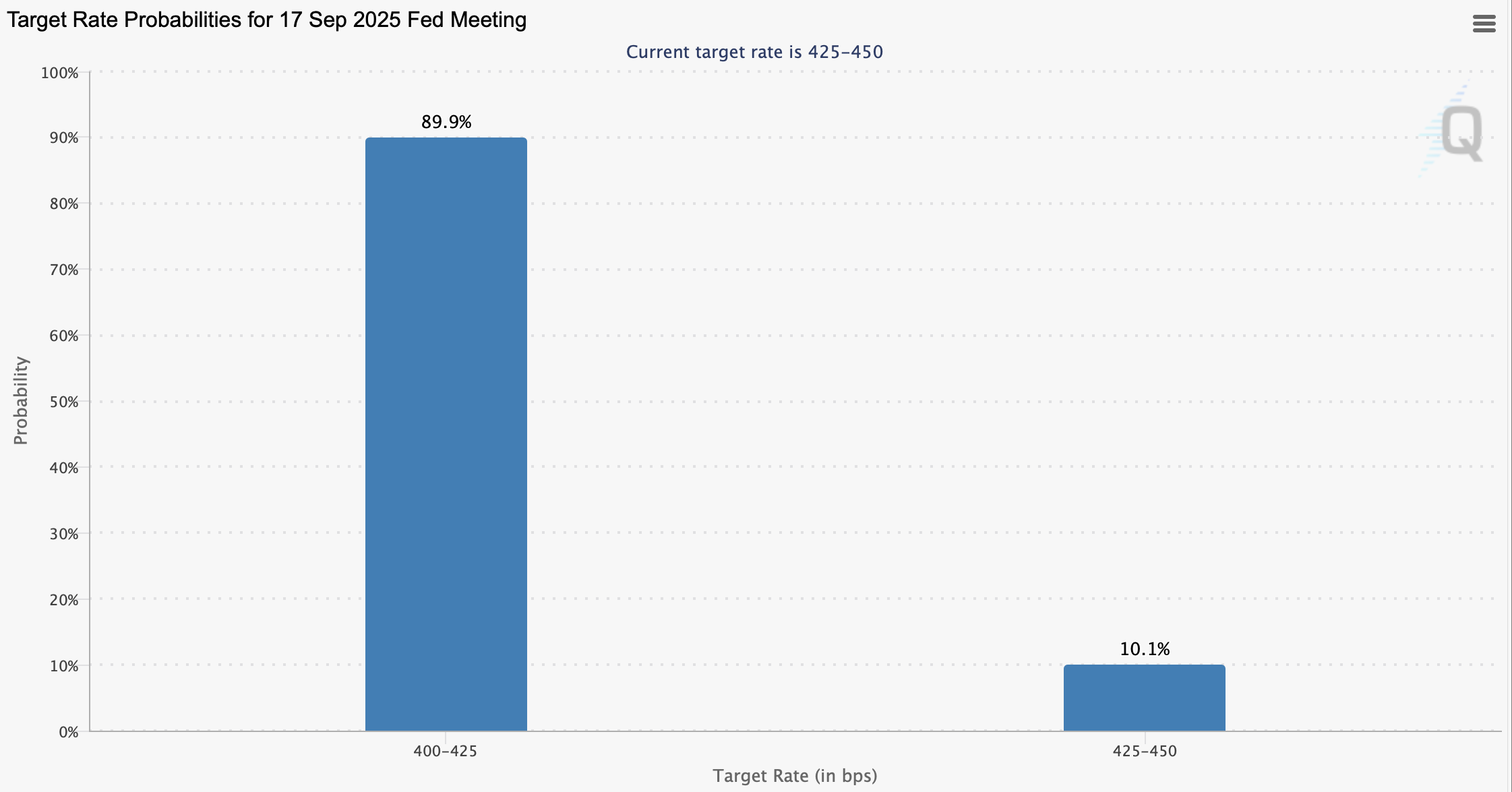

The contentious July jobs report has lifted easing hopes with dovish connotations for the Fed. Markets now price in an 89.9% chance of easing, up from 63% before the meeting and 40% after the Fed’s remarks.

SEC unveils "Project Crypto:" Historic regulatory shift?

As crypto markets reeled from last week’s selloff, a seismic regulatory shift quietly took center stage. In what analysts are calling a historic pivot, US Securities and Exchange Commission (SEC) Chair Paul Atkins presented "Project Crypto"—a sweeping initiative designed to modernize America’s securities framework for the digital age.

This announcement marks a stark departure from the SEC’s previous cautiousness. Bernstein Research hailed the plan as “the boldest and most transformative crypto vision ever laid out by a sitting SEC chair.” It appears to have the potential to reshore crypto innovation — after years of regulatory ambiguity drove businesses offshore.

New regulatory vision

If execution matches ambition, Project Crypto could mark a watershed moment for US crypto leadership. Its key pillars include:

- Clarifying asset classification: Atkins declared that most crypto assets are not securities, pledging clearer standards for tokens, stablecoins, and tokenized traditional assets.

- On-chain finance: The SEC aims to foster the world’s largest tokenized securities market, enabling stocks and bonds to trade on blockchain rails.

- "Super app" integration: Regulatory green lights for platforms to blend crypto, staking, and traditional investments under one roof.

Winners: Coinbase, Robinhood, and Circle

The policy shift is a boon for major US crypto firms that play by the rules. Coinbase and Robinhood gain clarity to expand into tokenized securities and DeFi services, leveraging their compliance-first models.

Circle’s USDC stands to benefit from a new stablecoin framework, reinforcing its role in bridging TradFi and DeFi. Meanwhile, as banks regain custody rights, institutional adoption could surge , unlocking deeper liquidity.

Challenges remain

While Project Crypto signals a pro-innovation stance, full implementation may take until 2027 — leaving room for global rivals (like the EU’s MiCA) to advance. Enforcement and potential overreach are other concerns, given the SEC’s principles-based approach.