Stablecoins’ big break: How GENIUS Act affects crypto

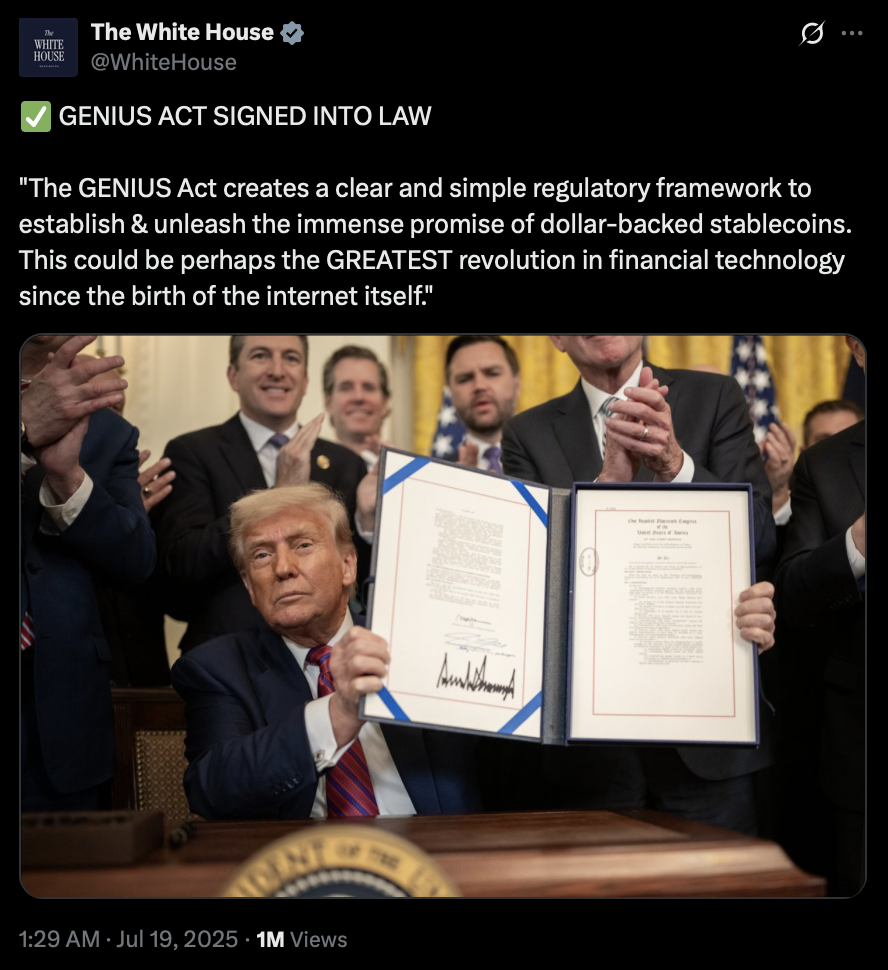

The GENIUS Act, signed by President Donald Trump on July 18, 2025, is meant to “unleash” the power of stablecoins in the world's biggest economy. What does it actually do, and what does it mean for crypto investors? Here is our lowdown on the groundbreaking law.

What is GENIUS Act?

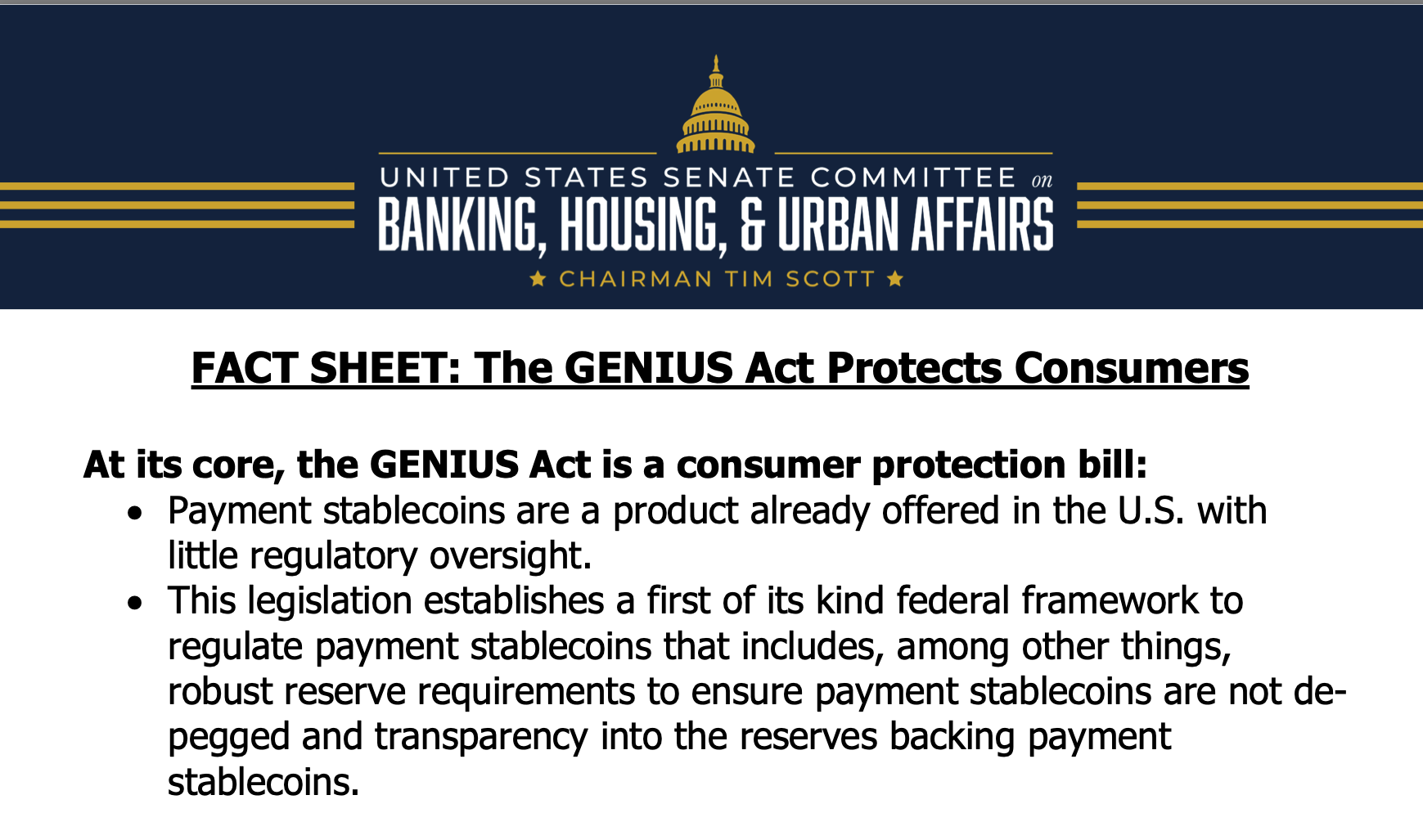

The GENIUS (Guiding and Establishing National Innovation for US Stablecoin) Act is the first regulatory framework for stablecoins — cryptocurrencies pegged to fiat — in the United States. The bill establishes rules for tokens, their issuers, and the underlying reserves while protecting consumers.

Stablecoins are a safe haven during crypto volatility, as their value is tied to the underlying assets — often a traditional fiat currency like the US dollar or the euro. Due to the 1:1 peg, holders do not have to worry about price fluctuations.

Until now, the US had no clear federal regulations for this asset class, which limited its real-world use cases. The GENIUS Act is expected to spur stablecoin adoption.

Purpose of GENIUS Act

The GENIUS Act provides long-awaited clarity. Proponents claim the new rules will open new doors for the stablecoin industry, promoting innovation. Previously, projects operated in a regulatory gray zone, left guessing how their operations fit into state and federal laws.

The framework lays a much-needed foundation that should attract new participants — from banks to fintech firms to retailers — to the crypto space. Since stablecoin transactions cost a fraction of traditional banking fees, industries may level up their operations with faster and cheaper payments.

How does GENIUS Act work?

The bill treats stablecoins as payment instruments, not securities or commodities. This excludes them from the SEC’s jurisdiction, while the Bank Secrecy Act for AML compliance applies.

The GENIUS Act is lengthy, complex, and all-encompassing. The provisions that could impact the crypto industry include:

Stablecoin issuers

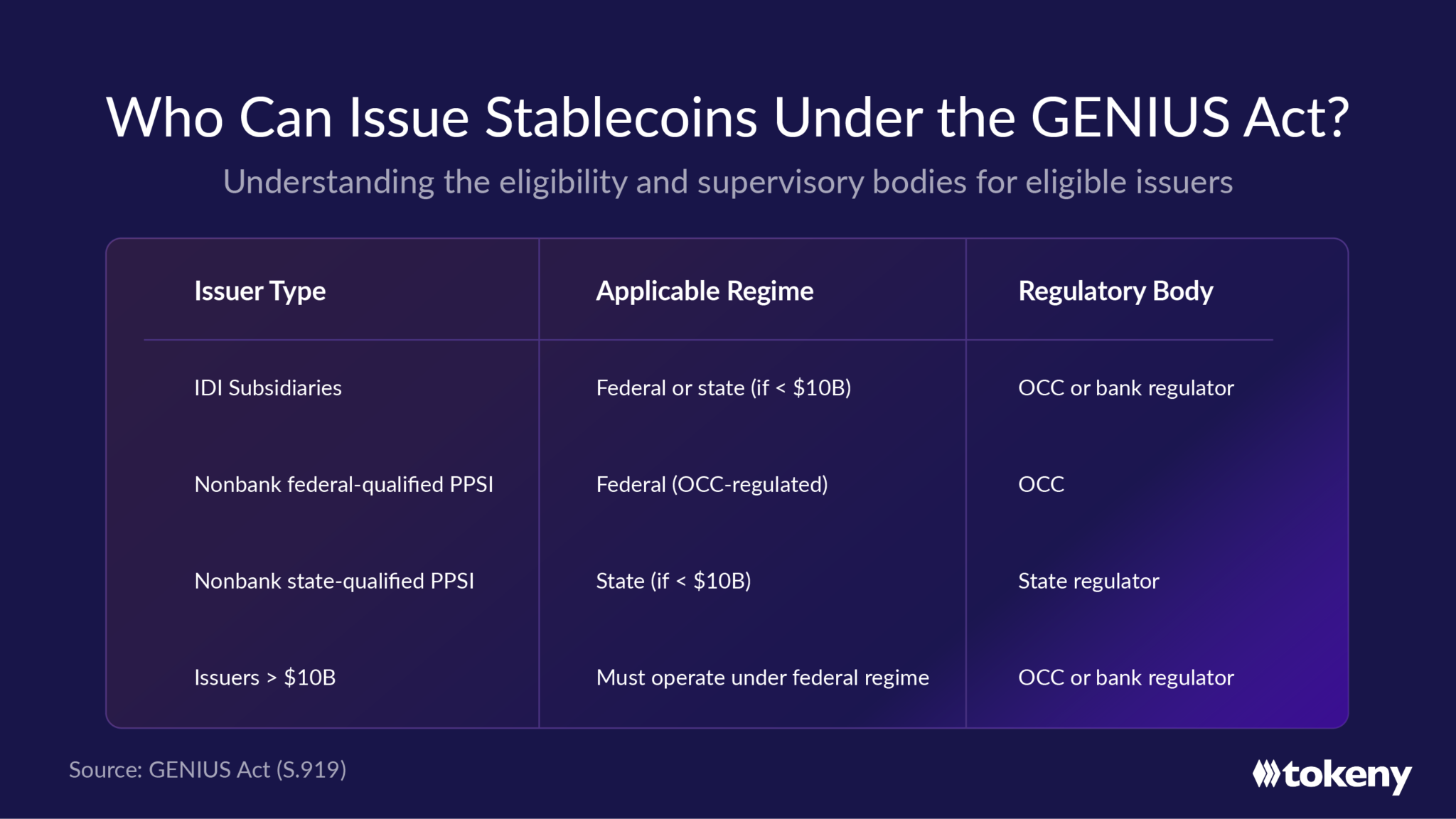

No entity can issue USD-pegged tokens unless they are a Permitted Payment Stablecoin Issuer (PPSI), federally or state-approved. This category includes:

- Subsidiaries of insured depository institutions

- Nonbank institutions supervised by the Office of the Comptroller of the Currency (“OCC”)

- State-chartered entities

Non-financial firms must secure unanimous approval from the Stablecoin Certification Review Committee (“SCRC”). This new federal entity consists of the Secretary of the Treasury, the Chair of the Federal Reserve Board, and the Chair of the Federal Deposit Insurance Corporation.

Foreign issuers must have OCC registration, maintain reserves in US financial institutions, and satisfy other licensing and compliance requirements of the GENIUS Act. Furthermore, their home regulator's regime must be comparable to the new framework, as determined by the Secretary of the Treasury.

Licensing & oversight

- Banks, credit unions, and OCC-chartered non-banks fall under federal oversight.

- Smaller providers like fintechs — all those issuing $10 billion or less worth of stablecoins — may opt for state-level laws that meet or exceed federal rules.

- Foreign stablecoin issuers are subject to their own licensing and enforcement regimes (see above).

Backing & redemption

Issuers must maintain 100% of reserves in high-quality liquid assets—cash, US treasuries, or similar securities. All stablecoins must be backed with eligible assets 1:1. For instance, for each $100 worth of stablecoins, the issuer must hold $100 worth of US dollars, treasuries, or other supported assets.

The GENIUS Act also mandates redemption at par value, with publicly available policies. Issuers must segregate all underlying reserves from their operational funds. They are also prohibited from rehypothecation—using clients’ assets for their own purposes.

Audit requirements

The bill mandates periodic public disclosures of reserves and routine reserve audits. Along with the backing requirement, these rules address one of the primary risks in stablecoin markets, demonstrated by the 2022 collapse of the algorithmic stablecoin Terra Luna.

Terra saw its $40 billion market value vanish in a single day — triggering a domino effect of bankruptcies, from Three Arrows Capital to FTX, and a two-year-long bear market. Insiders blamed the issuer’s reckless practices, as it failed to back Terra with assets on a 1:1 basis.

The GENIUS Act provisions minimize the chances of a similar scenario repeating, although they refer only to fiat-backed stablecoins.

Consumer safeguards

Consumer protections are crucial for mainstream stablecoin adoption and further innovation. The new law lays out multi-layer safeguards, including rigorous reserve requirements and audits.

Furthermore, holders get priority over other creditors if stablecoin issuers go bankrupt — they are more likely to get their funds back before banks or bondholders. These protections supersede existing bankruptcy laws, differing from protocols used in TradFi insolvency proceedings.

Implications for crypto investors

The signing of the GENIUS Act is a landmark event for the blockchain industry. It is the first piece of crypto legislation to pass at the US federal level, potentially making lawmakers more likely to pass future crypto-friendly regulation.

An adoption boost could lead to more active usage of blockchain networks stablecoins are built on. This could support the long-term value of their native cryptocurrencies, although this is not guaranteed. Stablecoins themselves, however, should not see any changes in value.

On the flip side, negative events connected to stablecoins, such as bankruptcies or depegging, would cause those native tokens to depreciate. Despite the new anti-fraud measures, regulations do not shield portfolios from negative market sentiment.

The industry still lacks comprehensive guidelines for cryptocurrencies in general, including crypto exchange operations, reporting, and compliance for digital assets. On July 17, 2025, the House passed the Digital Asset Market Clarity Act, which has now moved to the Senate. It should complement the GENIUS Act.

Can Amazon or Walmart issue stablecoins?

In June, The Wall Street Journal reported that retail giants like Walmart and Amazon were looking into stablecoin issuance. This would potentially unlock tens of millions in savings.

Credit card processing fees currently amount to 2% to 3% of every transaction. If clients use proprietary tokens as payment — instead of Visa or MasterCard — the companies would:

- Cut out an expensive intermediary

- Accelerate settlement times

- Gain more control over their payment rails

- Be able to lower prices for consumers

For consumers, paying might not feel very different — they would still tap their phone, check out, and earn applicable rewards. Meanwhile, credit card issuers would lose billions in interchange fees overnight.

Some experts suggest stores can even bake loyalty points directly into their tokens, so they would be issued on-chain. That way, consumers would not have to keep paper receipts to get additional benefits.

Limitations for Big Tech

One little-noticed clause prevents technology giants and banks from dominating the stablecoin market. Circle Chief Strategy Officer Dante Disparte calls it a “Libra clause,” citing this year's pump-and-dump scandal involving a token backed by Argentina’s president Javier Milei.

- A non-bank has to set up a “standalone entity that looks more like Circle and less like a bank,” meet antitrust requirements, and face the Stablecoin Certification Review Committee, which can veto a token launch.

- Banks are barred from any risk-taking, leverage, or lending involving clients’ assets. Lenders must house their stablecoins in a legally separate subsidiary, keeping them on the balance sheet at all times.

Wrapping up

The GENIUS Act is the first comprehensive framework for stablecoins in the United States, poised to spur innovation and adoption. It should ultimately benefit consumers, market participants, and the US dollar. However, investors should bear in mind that regulations do not prevent market downturns, and the industry still lacks broader guidelines.