Clapp Weekly: Fed jitters, ETF breakthrough, Ethereum's 10th anniversary

BTC price

Bitcoin is flat as the markets await the Federal Reserve’s interest rate decision. A packed macro calendar is pressuring crypto and stocks, but BTC shows relative strength, defying Galaxy Digital’s potential $450 million sale. Meanwhile, Strategy has raised $2.5 billion in a record stock offering to buy more BTC.

BTC plunged from $119k to $115k on Friday, July 25, rebounded the next day, and climbed to $119,568 on Monday, July 28. After another decline below the $118k mark, the price touched $118.9k yesterday.

Currently at $117,143, BTC has lost 0.3% over the past 24 hours and 1.4% over the past 7 days.

ETH price

Ether has approached the critical $4k level, reaching a 7-month high with 96% of supply in profit, suggesting a market top. This rally is fueled by strong ETF inflows, robust network activity, and the explosive growth of ETH treasuries.

The ETH price resumed its gradual climb after dipping from $3,735 to $3,530 on Thursday, July 24. Bouncing back, the price moved steadily until Monday's high of $3,933.79. It then retreated and breached $3.8k again.

Now at $3,813.52, ETH is in the green, with a +0.9% 24-hour change and a 7-day gain of +2.2%.

Seven-day altcoin dynamics

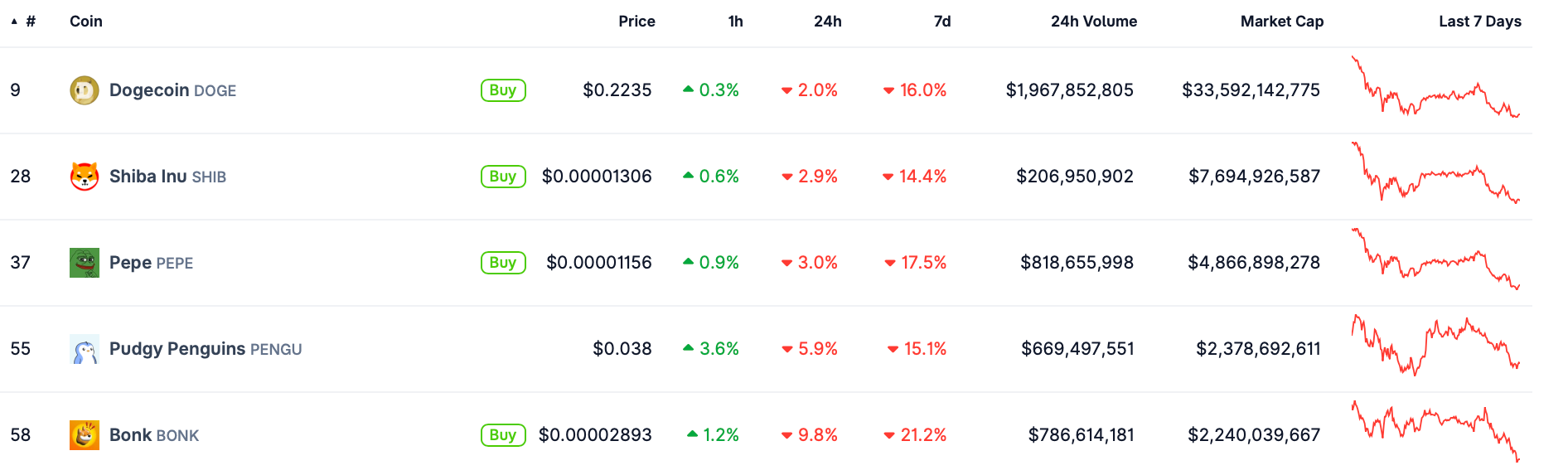

Altcoins tumbled yesterday as traders braced for a barrage of macro signals, from the Fed rate decision to GDP and PCE inflation updates, and the July jobs report.

The central bank is expected to keep rates unchanged despite increased pressure from President Trump. Fed officials have explained their “wait-and-see” stance by citing a strong labor market and fears that trade tariffs could reignite inflation.

Regulatory uncertainty and Fed policy jitters ahead of today's rate decision have triggered a sudden meme coin meltdown. Speculative deleveraging suggests aggressive repositioning among institutional players.

Winners & losers

ENA (+19.1%) is leading gains after BitMEX co-founder Arthur Hayes purchased $1 million worth of tokens. The momentum is further fueled by growing demand for Ethena's USDe stablecoin, an anticipated product launch, and surging open interest indicating robust speculative interest.

Meanwhile, CRO (+15.3%) rallied following Crypto.com's strategic partnership with Theta Network, which will utilize Crypto.com's institutional custody solutions for THETA tokens. Increasing derivatives activity and long positions also support optimism.

IP (+12.4%) has surged with the launch of IP.World, a new meme token launchpad that kicks off Story Protocol's "Remix Era." The platform's initial meme coin focus will expand to full SocialFi infrastructure in Version 2, while establishing a system to track content virality and reward original creators.

Meme coins have booked the biggest losses, with BONK (-21.3%) plummeting as institutional investors offloaded 2.3 trillion tokens. PEPE (-17.7%) joined the downturn, crashing in a liquidation cascade that reduced prominent trader James Wynn's account below $31k.

WLD (-19.8%) has also pulled back, erasing some of the gains from its 25% weekly rally. That spike had been triggred by partnerships with Razer and Match Group, which validate Worldcoin's real-world utility.

Cryptocurrency news

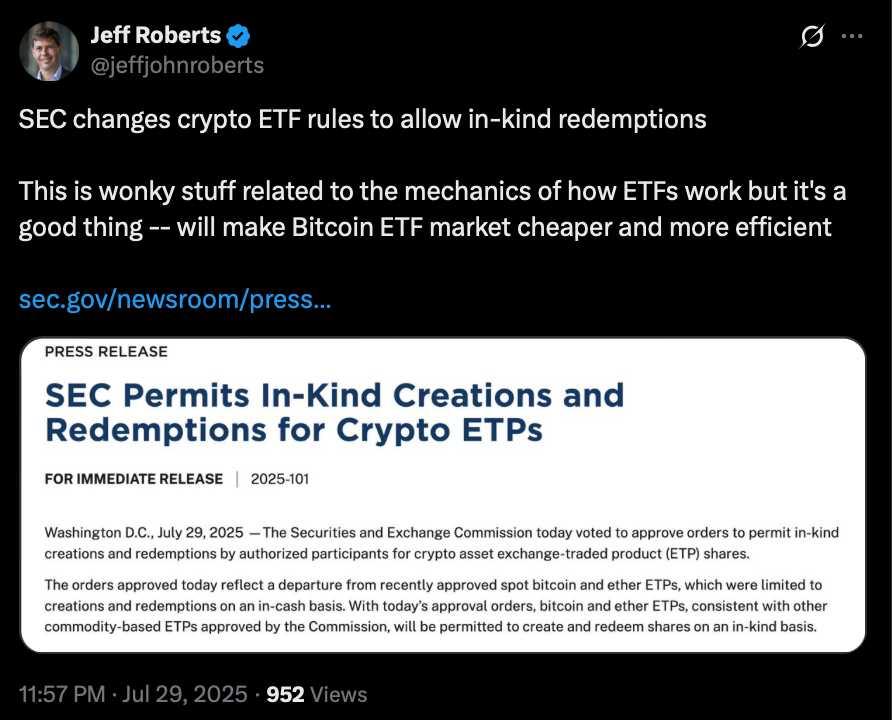

SEC approves in-kind ETF redemptions: ETH staking could be next

Crypto ETF investors are gaining more flexibility as the US Securities and Exchange Commission has greenlit in-kind creation and redemptions for crypto ETFs. Meanwhile, Ethereum funds could soon include staking features.

In-kind redemptions now reality

Previously, ETF investors could only sell their shares for cash. Asset managers like BlackRock, Fidelity, and Ark Invest will now let authorized participants swap ETF shares for the undelying coins — actual BTC and ETH.

This shift improves liquidity and reduces tracking errors between ETF prices and the market value of the tracked cryptocurrencies. In his statement, SEC Chair Paul Atkins has emphasized benefits for markets and investors:

“It’s a new day at the SEC, and a key priority of my chairmanship is developing a fit-for-purpose regulatory framework for crypto asset markets,” he said. “Today’s approvals continue to build a rational regulatory framework for crypto, leading to a deeper and more dynamic market.”

Anticipation had been building for months — Nasdaq filed the rule change on behalf of BlackRock in January. The shift could also help investors manage tax liabilities, though the SEC previously raised security concerns about this process.

Ethereum staking next?

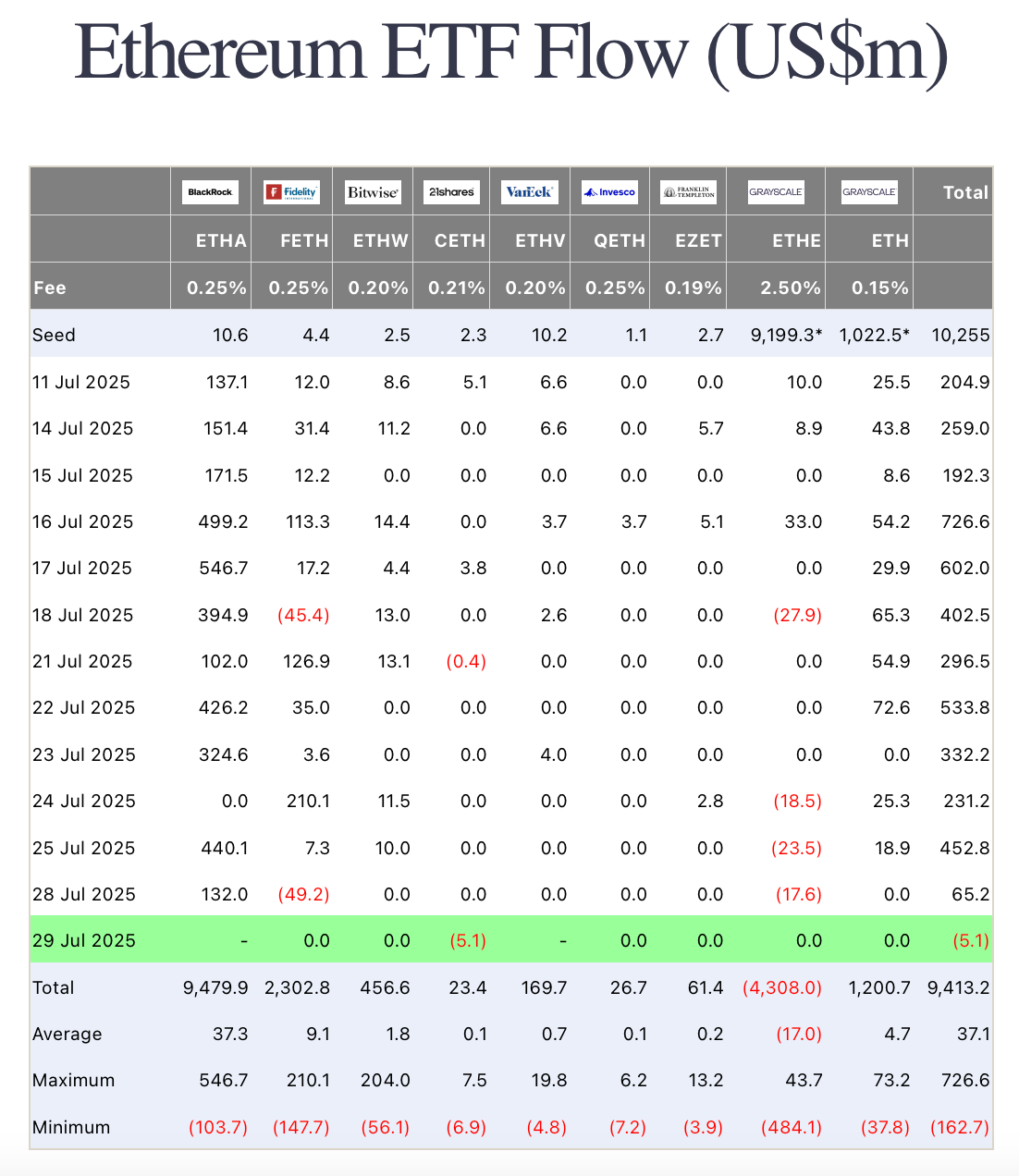

The SEC has acknowledged Nasdaq’s application to include staking in BlackRock’s spot Ethereum ETF (ETHA). If approved, the trust would not only hold ETH but also stake a portion of its assets, allowing investors to earn yield — a more attractive feature than spot holdings alone.

The regulator will decide within 45 days of the document’s publication in the Federal Register, with possible extensions. Approval would signal growing regulatory comfort with Ethereum’s proof-of-stake model — despite the SEC’s past actions against staking services like Kraken’s.

The absence of staking has been a key obstacle for Ethereum ETFs since their 2024 debut. Integration could significantly boost demand for these products.

Spot Ethereum ETFs have recently outperformed their Bitcoin counterparts, attracting $1.8 billion last week during a 16-day inflow streak, while spot Bitcoin ETFs added just $70 million.

Exciting road ahead

Staking rewards and in-kind redemptions bridge the gap between passive investing and active blockchain participation, offering institutions and retail investors more comprehensive exposure to digital assets.

Ethereum celebrates 10th mainnet anniversary

Ethereum's 10th anniversary on July 30 marks a milestone few could have predicted in 2015: a decade of uninterrupted uptime, zero scheduled maintenance windows, and a transformation from a "world computer" experiment into the backbone of Web3.

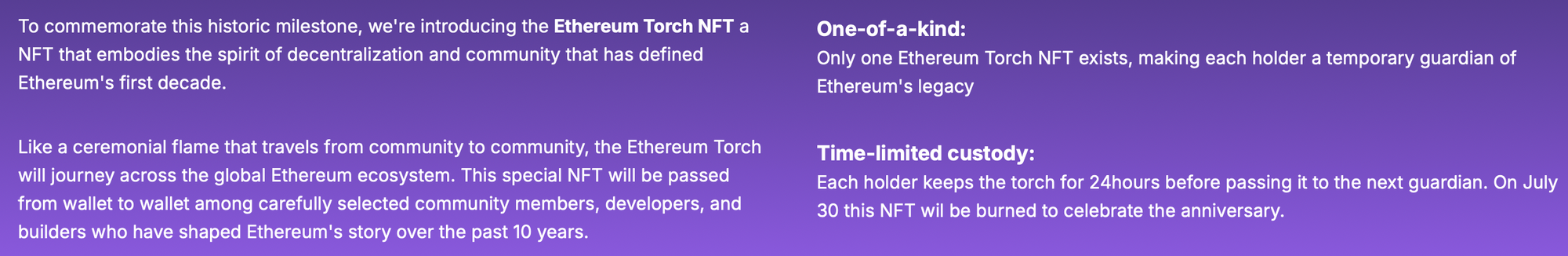

From pioneering smart contracts to fueling the DeFi and NFT revolutions, Ethereum’s resilience has defied crashes, forks, and regulatory storms. To commemorate the event, the Ethereum Foundation is giving away free, limited-time NFTs — while the Ethereum Torch NFT will be burnt today.

Unbreakable machine

Ethereum’s uninterrupted 10-year streak contrasts with centralized giants like Facebook (14-hour outage in 2021) or AWS (17-hour Kinesis freeze). Contributors like Binji Pande highlight its endurance through "bubbles, lawsuits, hacks, and wars," crediting a decentralized community of developers, stakers, and users.

The Merge’s seamless transition to proof-of-stake in 2022, slashing energy use by 99%, further cemented its adaptability. The network has birthed a $100B+ DeFi ecosystem and digital art revolutions, but its next decade hinges on solving scalability without sacrificing decentralization.

Scaling skepticism and L2 debate

Critics argue Ethereum’s "unstoppable" reputation glosses over its limitations. Analyst Marty Party notes the base layer’s 13 TPS cap, calling L2 solutions like Arbitrum and Optimism "centralized sequencers" with 7-day escrow risks.

While L2s now handle millions of transactions weekly, their dependence on Ethereum for final settlement raises questions about true decentralization. Regulatory ambiguity compounds these concerns.

Party warns that many Ethereum-based assets — especially on EVM-compatible platforms like Hyperliquid — may face securities scrutiny under pending US laws like the Clarity Act.

Road ahead

Ethereum’s anniversary is a crossroads as scaling debates and legal uncertainties loom. For now, the world’s most-used blockchain keeps moving — one unstoppable block at a time. Upgrades like proto-danksharding aim to cut fees, while account abstraction could onboard millions by eliminating private keys.

Yet as the NFT torch passes through community hands this week, questions remain. As institutional giants like BlackRock launch tokenized funds, and banks roll out stablecoins, it must scale to meet increasingly heavier workloads — where millisecond-level response times matter.