Dollar-cost averaging (DCA) in crypto: Strategic approach to volatility

Crypto volatility complicates investing. While timing the market is nearly impossible, buyers can navigate uncertainty with automation. Dollar-cost averaging (DCA), also known as the constant dollar plan, is a systematic strategy that mitigates the effects of price swings on portfolios. Here is how DCA works.

What is DCA in crypto?

DCA involves investing fixed amounts at regular intervals, regardless of market conditions or price movements. Over time, this approach "averages out" the cost per token, reducing the impact of fluctuations.

Investors divide their capital into smaller increments to buy consistently in both bear and bull markets — accumulating more tokens when prices are low and fewer when prices rise. This passive system is the most common choice for crypto investors, according to a Kraken survey.

DCA isn’t exclusive to crypto; it is widely used in traditional finance. For example, 401(k) plans employ similar principles, with employees contributing fixed amounts each pay period, irrespective of market moves. The same strategy is applied to mutual funds and index funds.

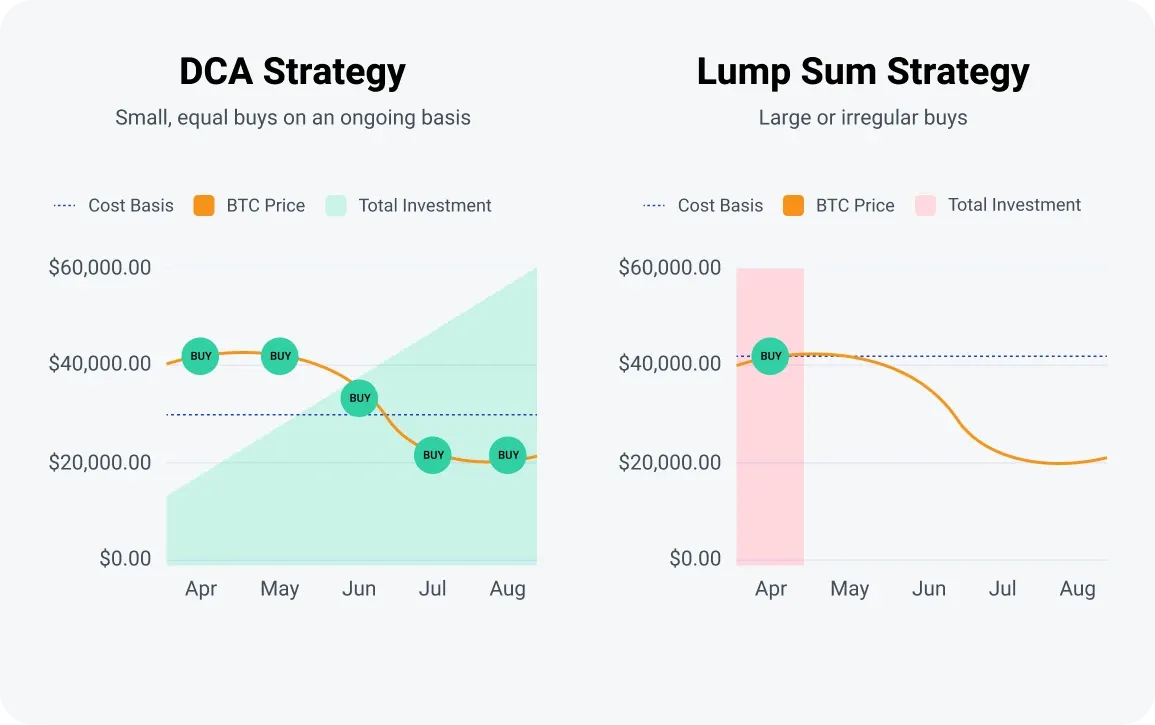

DCA vs. lump-sum investing

DCA shifts the focus from timing the market (waiting for the perfect entry point) to time in the market (steadily building holdings). It smooths out price fluctuations but may not fully capture sharp rallies — a drawback for those chasing quick gains.

In contrast, lump-sum investing requires:

- Manually placing each trade order

- Conducting technical analysis with multiple indicators

- Monitoring candlestick charts around the clock

Example of crypto DCA

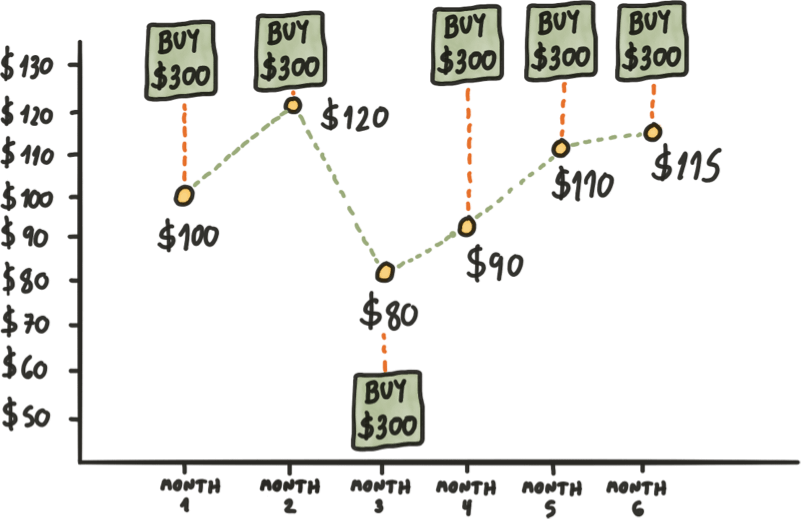

Sarah has $1,800 to invest in Solana but is uncertain about its short-term trajectory. Rather than risking a single lump-sum buy, she implements DCA to spread her investment over time.

Sarah purchases $300 worth of SOL on the 1st of each month for six consecutive months. This way, she accumulates SOL regardless of market ups and downs, which eliminates emotional decisions and the stress of trying to perfectly time the market.

Between May 2023 and May 2025 (24 months), Sarah would have invested $7,200, with the total value of holdings growing to $20,557.17.

Cost basis: Foundation of DCA

The cost basis is the original purchase price of a cryptocurrency, plus any associated fees. When investments are spread over an extended period of time, the overall cost basis may be lower than if the the same amount had been invested at once. Cost basis is critical for calculating profits/losses and optimizing tax strategies.

Advantages of DCA

DCA comes with a potential compounding effect — when tokens appreciate over time, they also amplify portfolio growth, allowing you to reinvest gains for higher long-term returns. Other benefits include:

- Universal applicability – Suitable for beginners and experts alike. Newcomers can start without expertise, while veterans save time by avoiding constant chart-checking.

- Lower average cost basis – Over time, DCA may reduce the average purchase price of digital assets.

- Disciplined investing – Removes emotional decision-making, fostering consistent wealth-building habits.

- Effortless execution – Automation eliminates the need to track market movements.

- Stress reduction – Prevents panic selling or FOMO-driven buys during market extremes.

- Market presence – Ensures participation when opportunities arise.

Disadvantages of DCA

The benefits of DCA shine when prices fluctuate, but it cannot guarantee profits or shield against extended downturns. Furthermore, trading fees on centralized exchanges add up over time, and committing to fixed assets limits adaptability.

- In a bull market, rising prices mean buying fewer tokens at higher average prices. Opportunity cost is also salient — one might miss out on gains that could have been realized through lump-sum investment.

- In a bear market, automated buys may compound losses when the investor should be on the sidelines.

Diversification tip

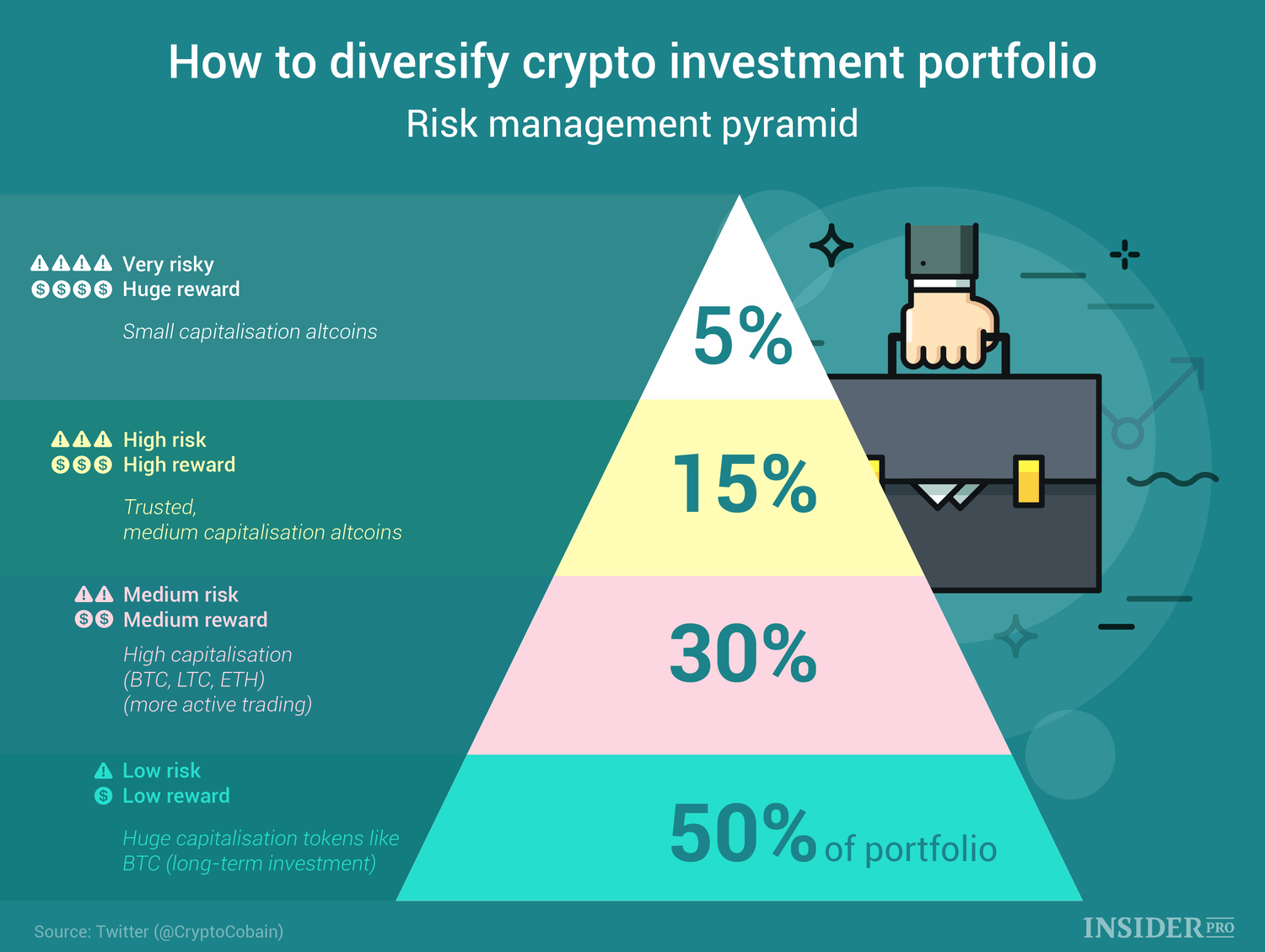

Like all strategies for volatile assets, DCA should be paired with a diversified portfolio.

- Market caps: Blend large-cap (e.g., BTC), mid-cap, and small-cap assets.

- Sectors: Consider DeFi, smart contracts, Layer 2, AI, and others.

- Stablecoins: Hold some for liquidity during volatile times.

How to DCA

1. Choose a cryptocurrency

As a passive strategy spanning months or years, DCA suits those with conviction in blockchain’s future. Evaluate long-term potential by assessing:

- Longevity: Is the project’s popularity hype-driven or backed by enduring utility?

- Fundamentals: Does the project demonstrate strong tokenomics, a committed team, a credible whitepaper, and genuine community engagement?

- Market trends: How positive is the current sentiment around the token?

- Historical performance: How did the token behave in past bull/bear cycles?

Analyze on-chain metrics

Assess trading volume, liquidity, and the health of the underlying network by combining key metrics:

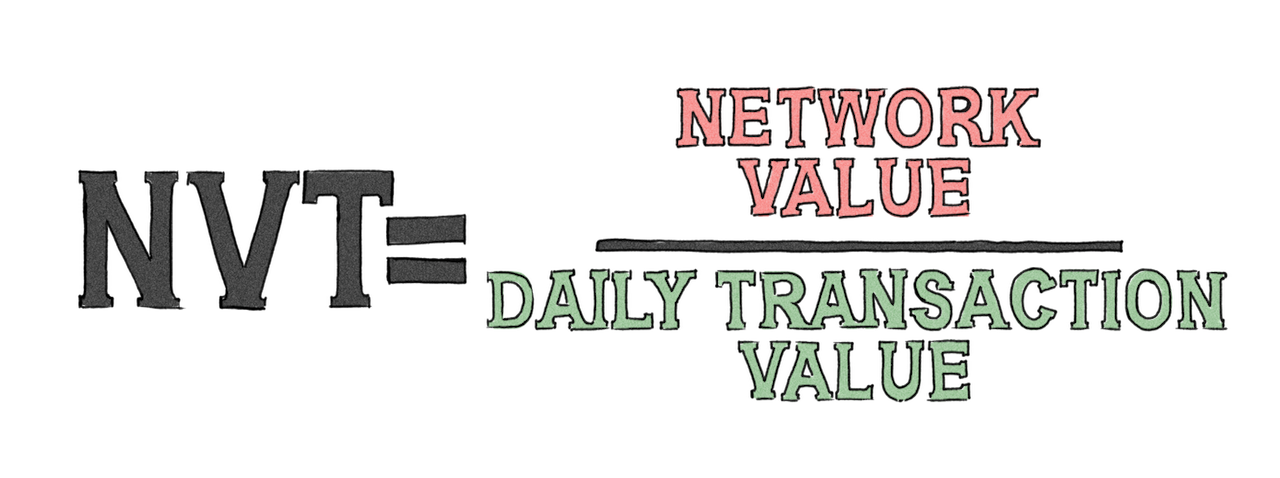

- Network Value-to-Transaction (NVT) Ratio

- Daily Active Addresses

- Miner Revenue

- Top Holder Balances

- Total Value Locked (TVL)

- Fully Diluted Valuation (FDV)

NVT — a crypto version of the Price-to-Earnings (P/E) ratio — evaluates the extent of a token's bubble or undervaluation. A high TVL signals strong capital commitment, suggesting higher user adoption and potential returns, while FDV reflects the project’s market cap if all tokens were in circulation.

Value investing vs. growth investing

Long-term holders may identify undervalued tokens through fundamental analysis — by comparing a project's actual fees or revenue to its token price. This approach, known as value investing, determines whether the current valuation is justified. For example, investors might examine Uniswap's fees relative to UNI's price and then calculate the price-to-earnings ratio.

On the other hand, growth investing focuses on a project's future earnings potential — its long-term upside. Even if a protocol isn't currently generating significant revenue, it may possess strong future potential. This strategy is typically employed by investors with deep understanding of specific ecosystems and the underlying technologies shaping crypto trends.

2. Set order amount

Prioritize bills, rent, groceries, and emergency funds before investing. Never commit more than you can afford to lose — experts typically suggest ≤10% of savings.

3. Pick timeframe

DCA intervals (daily/weekly/monthly) depend on your goals. While historical data may guide timing, consistency matters most.

4. Automate purchases

Many crypto exchanges offer DCA tools to schedule buys at set intervals, executed as long as funds are available.

Determine your time horizon

The length of time you expect to hold an investment guides decisions on what tokens to buy, when to sell, or when to rebalance a portfolio. While traders operate on time horizons as short as minutes, investors typically think in years, focusing on long-term growth.

There is no one-size-fits-all duration— some experts recommend 6-12 months, others stick to multi-year DCA planning.

Final words

DCA is a marathon, not a sprint. Combine it with research, diversification, and periodic portfolio reviews to navigate crypto’s volatility effectively.