Ethereum blockchain ecosystem in 2025

Ethereum, the brainchild of programmer Vitalik Buterin, was launched to the public in 2015. Today, its founder is the world’s youngest crypto billionaire, while ETH is the second largest cryptocurrency. In this article, we will take a deep dive into the inner workings of the Ethereum blockchain as the home of smart contracts and Dapps.

What makes Ethereum network special?

The Ethereum platform has been dubbed the global supercomputer. By bringing their operations onto this blockchain, businesses and governments achieve higher efficiency and transparency. Here are its main defining characteristics.

- Open-source ecosystem. Anyone can use this blockchain technology or develop solutions running on it.

- No sensitive information is stored by the protocol. Counterparties to any transaction remain fully anonymous even though the transaction ledger is public.

- Resistance to censorship. Transactions on the Ethereum network may not be authorized or denied by any central entity. It is completely decentralized.

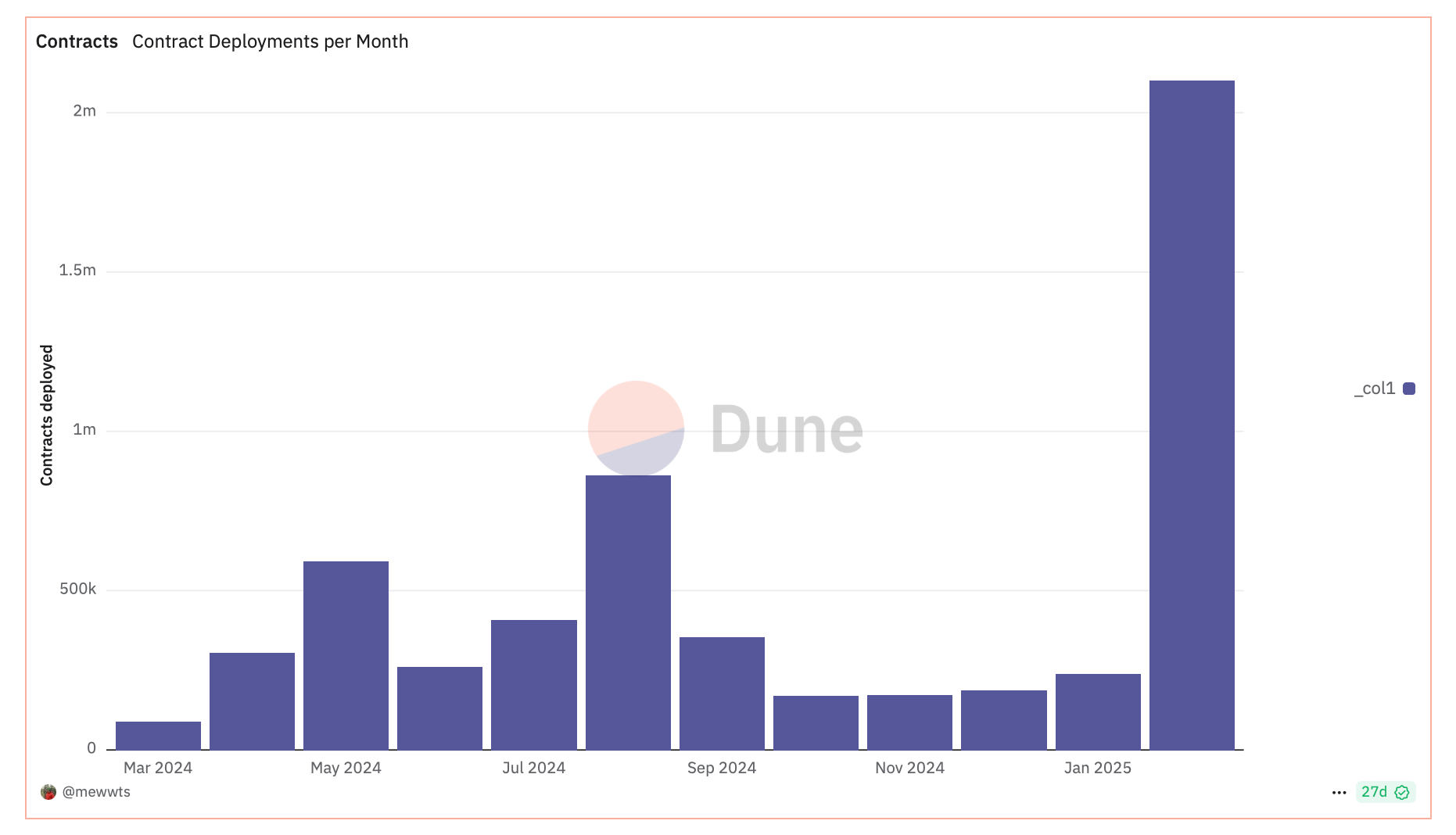

The Ethereum network positions itself as an agile and secure environment for smart contracts and decentralized applications. Nearly 5,000 dApps cover a wide spectrum of industries. Over 2 million self-executing contracts deployed in February 2025 represent explosive growth, with the Total Value Locked exceeding $47 billion.

Ethereum vs. Bitcoin

The Ethereum platform has many infrastructural similarities to Bitcoin. First, it is a blockchain network with its own native currency called ether (ETH). Secondly, both ecosystems launched with the same consensus mechanism – Proof-of-Work (PoW) – to facilitate transactions. Thirdly, all transactions are recorded in a distributed ledger.

Key differences

- Bitcoin is used as digital money in P2P transactions. Smart contract capability adds a new layer of functionality, making Ethereum a more multifunctional protocol.

- Ethereum-based contracts underlie dApps of different complexity. Today, these applications can support an almost infinite range of use cases. Members of the Ethereum community can create, interact with, and modify them.

- In 2023, Ethereum abandoned Proof-of-Work in favor of Proof-of-Stake to become faster and more flexible.

Proof-of-Stake vs. Proof-of-Work

Both consensus mechanisms allow blockchains to validate transactions in a decentralized fashion. However, PoW requires the miners’ computer processing power, while PoS is more lightweight and sustainable.

How PoW works

In the older model, computers solve mathematical puzzles to verify transactions and add them to the ledger. In return for their efforts, they get the native currency of the blockchain. Only the first miner who finds a solution is rewarded. This method of validating transactions is the most energy-intensive.

PoS: more sustainable Ethereum

The PoS concept lets users become validators by staking the native crypto. Like miners, they verify transactions to prevent fraud. A node whose block proposal is accepted gets a reward in a process referred to as forging or minting.

When a certain number of nodes attest to seeing a new block, it is added to the blockchain. Whether a node can propose a block or not depends on two factors:

- how much crypto they have staked

- how long they have staked it for

This new system aims to solve the sustainability problem by enabling consensus without laborious processing. The blockchain now requires less computing power to stay secure. According to Ethereum co-founder Joe Lubin, the upgrade was designed to "lay to rest Ethereum’s carbon or energy footprint problem," as it is "orders of magnitude less expensive, energetically."

What is Ethereum Virtual Machine?

Every Ethereum account and smart contract is hosted on EVM. This software platform also underlies Dapps, so developers do not need powerful hardware. This environment is beginner-friendly – even rookies feel comfortable using it.

EVM defines the state of Ethereum for each block in the blockchain. Here, the word state refers to a massive database of all accounts and balances on the network. It changes according to a set of predetermined rules for code execution.

Functions of ether (ETH)

The second biggest digital currency boasts over $361 billion in market cap. As of this writing, you can buy ETH for around $1,650, while its original price was merely $2.77. On November 10, 2021, the coin set a record of $4,878.26.

Ether is mined through the PoW algorithm. It is more than a store of value and a popular trading asset. This native cryptocurrency fuels the Ethereum blockchain network, as users pay gas fees for any transaction on it.

The gas price is notorious due to network congestion. High transaction fees and execution delays have given rise to so-called Ethereum killers – rival blockchain networks like Solana, Cardano, and Polkadot.

Types of Ethereum account

Network participants include individuals and entities. Each of them has an ETH balance stored on a specific account address. This ecosystem includes externally owned accounts (controlled via a private key) and contract accounts (controlled via smart contract code). Both types enable users to manage ETH and compatible tokens (send, receive, and hold) and interact with self-executing contracts.

Smart contracts on Ethereum platform

So, how do automatic contracts on Ethereum work? Self-executing agreements are based on hard code. They enable, verify, and enforce particular functions on the blockchain when predetermined conditions are met.

Ethereum-based contracts take different forms, from basic exchanges between two users to entire networks of interconnected transactions. Such operational platforms may constitute separate DAOs (decentralized autonomous organizations) or Dapps. Smart contracts bring three major benefits:

- Automation — execution happens only when pre-agreed conditions are met.

- Transparency — Ethereum transactions are public.

- Immutability — conditions may not be altered or reversed.

Using smart contract code, users can also create new digital assets and program them to execute specific functions. All these advantages make the Ethereum blockchain attractive for businesses of any size, from innovative startups to legacy enterprises.

Uses of smart contracts

Ethereum transactions can enhance transparency in virtually any industry. They speed up and simplify the transfer of funds and data, ensuring that all counterparts fulfill their obligations. Here are some of the most notable use cases — check out our guide to smart contracts for more:

- Finance and banking

- Insurance

- Voting

- Prediction markets

- Alternative to escrow

- Safe digital identity management

DApps on Ethereum platform

At first glance, some of these applications look like conventional web apps. What truly sets them apart is decentralization. Transactions through dApps occur as P2P operations without a central authority.

Ethereum introduced DeFi applications running on smart contracts, and rival blockchain projects borrowed this concept. In March 2025, Ethereum reclaimed leadship as the leading DEX chain, overtaking Solana for the first time in half a year.

Most popular dApps in 2025

Decentralized applications are used in a wide range of sectors, from e-commerce to healthcare to transportation. According to DappRadar, the following products have the most unique active wallets as of April 14, 2025.

- Uniswap (V2, V3, and V4) – a decentralized crypto exchange supporting automated trading between Ethereum-based tokens through smart contracts. While the second version introduced liquidity pools, V3 unlocked concentrated liquidity, and V4 brought rich DeFi customization.

- 1inch Network – a distributed network for DeFi protocols on Ethereum and BSC (Binance Smart Chain). It empowers users for efficient, user-friendly, and secure transactions in the Web3 space, offering access to hundreds of liquidity sources. In the Fusion mode, users can swap tokens without network fees and at attractive rates.

- MetaMask Swap – a crypto swap from the popular MetaMask wallet to blockchain apps, boasting over 5 million users. Working via a browser extension and mobile app, MetaMask enables users to store and manage account keys, send and receive crypto assets, and connect to other dApps securely.

- Jumper Exchange — “crypto’s everything exchange” supporting 42 chains, 15 bridges, and 15 DEXs as of April 14, 2025. As an audited multi-chain liquidity aggregator, it aspires to be the place for a “community of the most successful Degens.”

Tokens on Ethereum blockchain

Ethereum has its own system of token standards – Ethereum Request for Comments (ERC). Most smart contracts rely on fungible (mutually interchangeable) assets compliant with ERC-20, the first popular specification.

Every standard determines the nature of specific tokens and the range of compatible networks. It is an interface that shows that a token contract reacts to commands within a particular smart contract.

Functions of tokens

All tokens in this ecosystem function as smart contracts executed on the EVM in a decentralized way. They have a wide range of functions:

- representing digital and physical assets

- network governance

- staking

- reputation building

- transaction settlement between multiple parties

Popular token standards

Virtual currencies, staking tokens, and voting tokens all fall into the fungible category supported by ERC-20. At one point, 94 of the top 100 cryptocurrencies by market cap were based on it. Here are some other popular Ethereum token standards.

- ERC-721 is a standard interface for non-fungible tokens (NFTs) like a song, collectible, or piece of digital art. NFTs are unique and may not be replaced by other tokens. They are used in contexts where provable asset ownership is crucial.

- ERC-777 enables expansion of functionality – for example, creation of mixer contracts for higher privacy or an emergency recovery function.

- ERC-1155 supports both utility tokens and non-fungible tokens. It raises trade efficiency and enables bundling of transactions to lower costs.

- ERC-621, an extension of ETC-20, allows modification of token supply via minting and burning of tokens.

- ERC-1155 enables smart contracts based on several token types, including fungible, non-fungible, and mixed combinations.

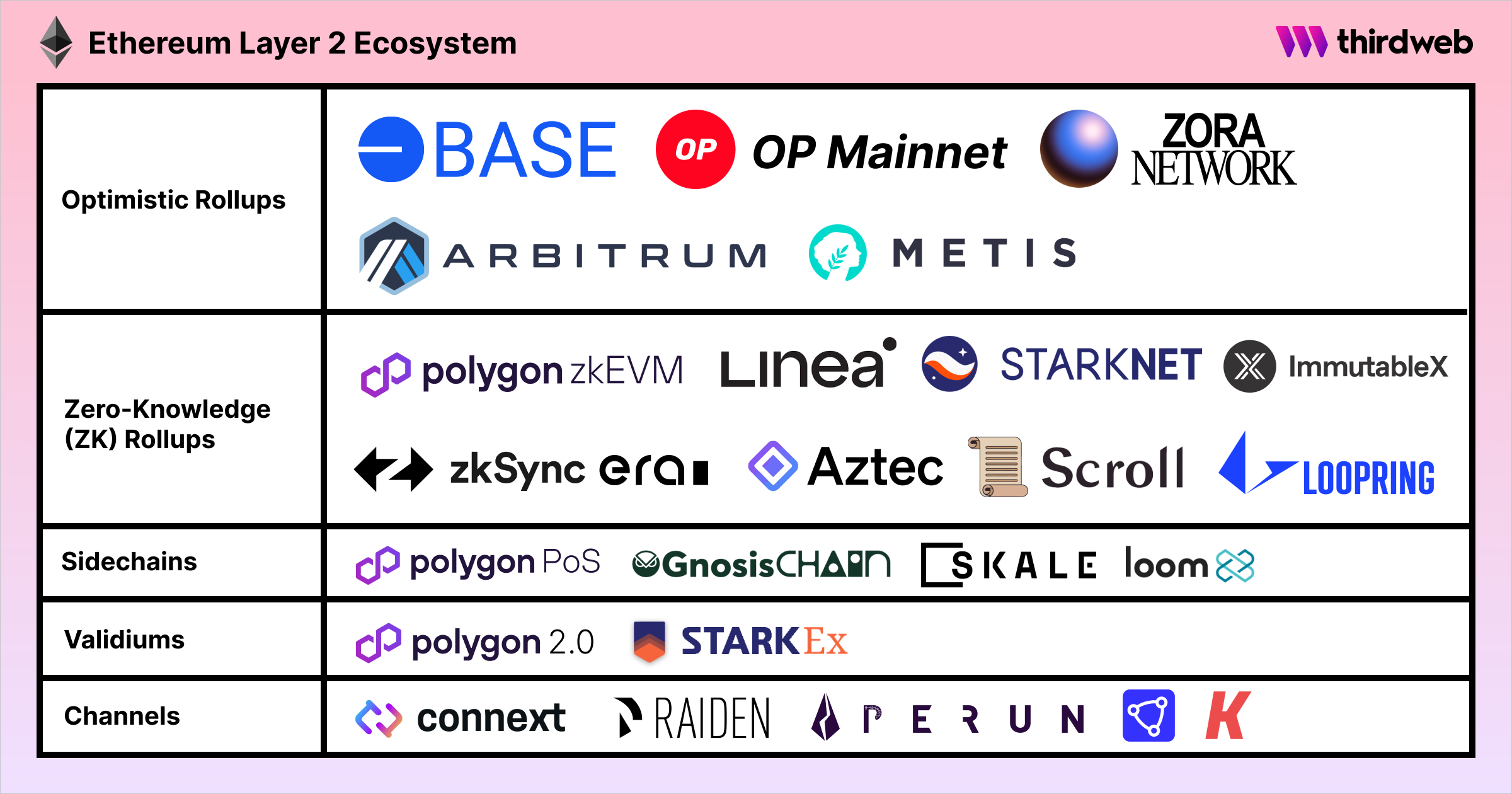

Ethereum Layer-2 Solutions

Layer-2 (L2) comprises secondary frameworks or protocols built on top of Ethereum as the primary layer to enhance its scalability. By processing transactions off-chain and settling final proofs on the mainnet, L2s significantly reduce congestion, lower gas fees, and increase transaction throughput.

These solutions leverage Ethereum’s existing security while optimizing performance, which is essential for dApps, DeFi, and other high-demand use cases. Popular examples represent two approaches, both enabling faster and cheaper transactions without sacrificing security:

- Optimistic Rollups (e.g., Arbitrum and Optimism)

- Zero-Knowledge Rollups (e.g., zkSync and StarkNet).

Optimistic Rollups assume transactions are valid by default and only run fraud proofs in case of disputes, offering full EVM compatibility for smart contract migration. Meanwhile, ZK Rollups use cryptographic validity proofs to bundle transactions off-chain before submitting them to Ethereum.

L2 networks are widely used for DeFi protocols, NFT marketplaces, and gaming applications, where high throughput and low fees are critical. As adoption grows, innovations like zkEVMs — which combine zero-knowledge proofs with EVM compatibility — further bridge the gap between scalability and developer accessibility.

ETH2: faster transaction execution, lower fees

ETH 2.0, or Serenity, is a fundamental update to the Ethereum blockchain, also known as its consensus layer, or Eth2. The existing infrastructure became the execution layer of the revamped network (Eth1).

This makeover was designed to solve security and scalability problems via infrastructural changes. The biggest improvement was the switch from PoW to PoS to make the network more efficient, flexible, and sustainable.

All network rules and smart contracts still reside on Eth1. The second layer ensures that all devices connected to blockchain comply with its rules. The Ethereum Foundation has split its major upgrade into four stages:

- Beacon Chain, a separate blockchain that went live in late 2020, introduced staking as the first step towards PoS.

- The Merge upgrade connected the Beacon Chain with the Ethereum mainnet in 2022. It represents the official switch to PoS.

- Shard Chains added cheaper data storage layers for dApps and roll-ups in 2023. The network load was split horizontally into 64 shards to help nodes validate transactions. Each validator could only store data for one shard at a time, not the entire network.

Yet the shift did not eliminate delays — Ethereum still handles around 15-30 TPS on Layer 1, with the rollup maximum of 173 TPS using blobs and 607 TPS via calldata, according to Buterin’s estimates. Meanwhile, Solana, its biggest competitor, processes over 2,600 TPS. This speed advantage enables its lower fees and better scalability.

The Surge (2024-2026)

In October 2024, Vitalik Buterin suggested that the next big update — The Surge — could achieve the goal of 100,000 TPS across the mainnet and L2 blockchains while increasing interoperability. This phase signifies a shift to scalability, primarily through L2 and roll-ups.

The goal is to make Ethereum feel like a single ecosystem rather than a collection of fragmented chains. That requires improving cross chain interoperability and user experience. Here are a few highlights.

- In March 2024, the Dencun upgrade — the first stage of The Surge — improved data availability, laying the foundation for further scaling. Proto-danksharding divided the chain into “blobs” for parallel processing of transactions and smart contracts. The decline in L2 network fees was dramatic — on Base, they sank from $0.31 to $0.0005.

- The core of The Surge are L2 rollups, crucial tools for making the network faster and more affordable. Multiple transactions are bundled together off-chain, and a summary is posted to the mainnet, reducing the load and accelerating processing.

- Data availability sampling (DAS) will help Ethereum process massive amounts of data more efficiently. It will allow nodes to verify data without downloading and storing everything, so rollups will no longer overload the network.

- Plasma and data compression will further enhance scaling. The former will process transactions off-chain, reducing the amount of data stored on the mainnet. Compression will shrink transactions to save space and boost efficiency, particularly for L2.

Next big upgrade: Pectra

The Pectra upgrade, slated for Q1 2025, includes the EIP-7251 proposal, which is expected to "increase max effective balance." Currently, network validators are limited to staking 32 ETH, but after the upgrade, they will be able to lock up to 2,048 ETH to maximize rewards.

With roughly 1 million active validators, latency concerns are already significant. Post-upgrade, providers like Lido will no longer need to create a new validator for every additional 32 ETH staked — reducing resource demands and lowering complexity.

Additionally, "Verkle trees" will enable nodes to validate blocks without storing large amounts of state data — a key step toward stateless Ethereum clients, allowing nodes to run on cheaper, low-power hardware.

Both the execution layer (EL) and the consensus layer (CL) will be upgraded:

- EIP-6110 will move validator deposit processing from the CL to the EL, simplifying operations, improving deposit security, and cutting validator activation time by ~48 hours.

- EIP-7002 will allow validator exits to be triggered from the EL, giving stakers — especially those delegating operations to third parties — more control over exit timing.

- Validators opting into EIP-7251 will gain the ability to manually trigger partial withdrawals.

Looking ahead

Ethereum remains adaptable, even as challenges — like declining L1 revenue and market volatility — test investor confidence. Maturity and developer ecosystem position it as a dominant force in blockchain innovation. As the network continues to evolve, its future appears deeply intertwined with L2 solutions, which enhance scalability while leveraging established security and infrastructure.