Real-world assets (RWAs) explained

Real-world assets (RWAs) are revolutionizing the crypto space by bringing tangible and intangible assets onto the blockchain. With institutional giants like BlackRock entering the fray, RWAs are poised for explosive growth. For crypto traders and portfolio holders, understanding this asset class unlocks new opportunities.

What are real-world assets (RWAs)?

RWAs are blockchain-based tokens representing real-world assets — everything from real estate and gold to intellectual property and government bonds. These tokens offer enhanced liquidity, fractional ownership, and the security of blockchain transactions while maintaining ties to real-world value.

Unlike purely speculative crypto assets, RWAs provide stability by anchoring digital investments to physical or financial assets. This makes them an attractive option for risk-averse investors and institutions.

Why RWAs matter

The crypto market remains volatile, deterring traditional investors. RWAs bridge this gap by merging decentralized finance (DeFi) with traditional finance (TradFi). Tokenized assets like bonds, real estate, and commodities offer:

- Lower volatility – Backed by real-world value, RWAs reduce exposure to crypto market swings.

- Institutional adoption – BlackRock CEO Larry Fink calls RWAs the "next generation for markets," signaling major capital inflows.

- Massive growth potential – Projections suggest the RWA market could hit $16 trillion by 2030.

Top RWA categories for portfolio diversification

| Asset Type | Examples | Why It Matters |

|---|---|---|

| Real Estate | Tokenized properties, REITs | Fractional ownership, global liquidity |

| Commodities | Gold, silver, oil | Hedge against inflation |

| Government Bonds | Tokenized U.S. Treasuries (e.g., BUIDL) | Low-risk yield |

| Private Credit | Business loans, invoices | Higher yields than traditional bonds |

| Art & Collectibles | Fine art, luxury watches | Democratized access to high-value assets |

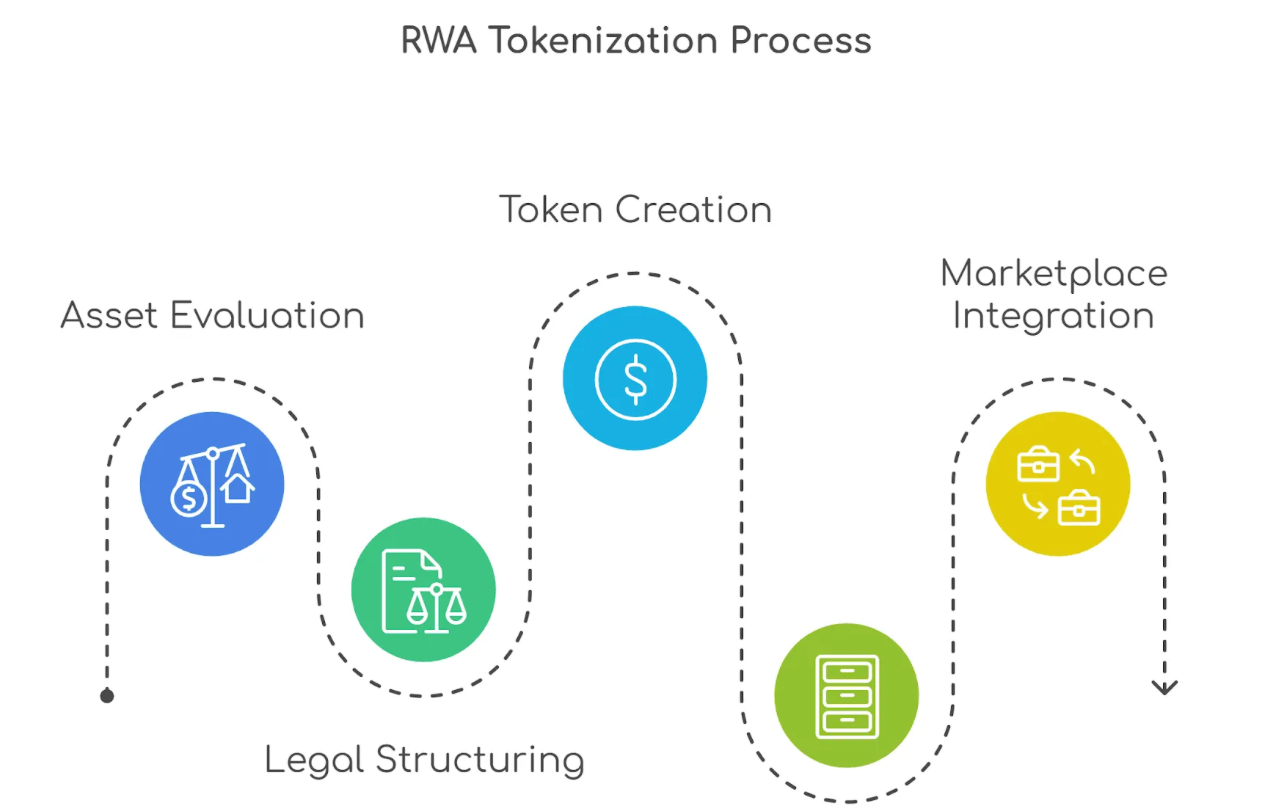

How RWA tokenization works

Digitization of assets is typically performed on dedicated platforms, such as Polymesh. Here is how to issue anything — from collectibles to securities — on the blockchain.

Step 1. Asset selection – Choosing an asset (real estate, bonds, equities, commodities, etc.).

Step 2. Defining specifications — Deciding how the tokens will work, including issuance, earning mechanism, and holder rights.

Step 3. Legal structuring – Ensuring compliance with local regulations.

Step 4. Blockchain integration – Tokenizing using standards like ERC-20 or ERC-6960 on a public or private blockchain network.

Step 5. Off-chain data linking – Using oracles (e.g., Chainlink) to verify real-world data, since the asset still exists in the physical world.

Step 6. Liquidity provision – Listing on DEXs/CEXs or specialized RWA platforms to make the tokens available to the public.

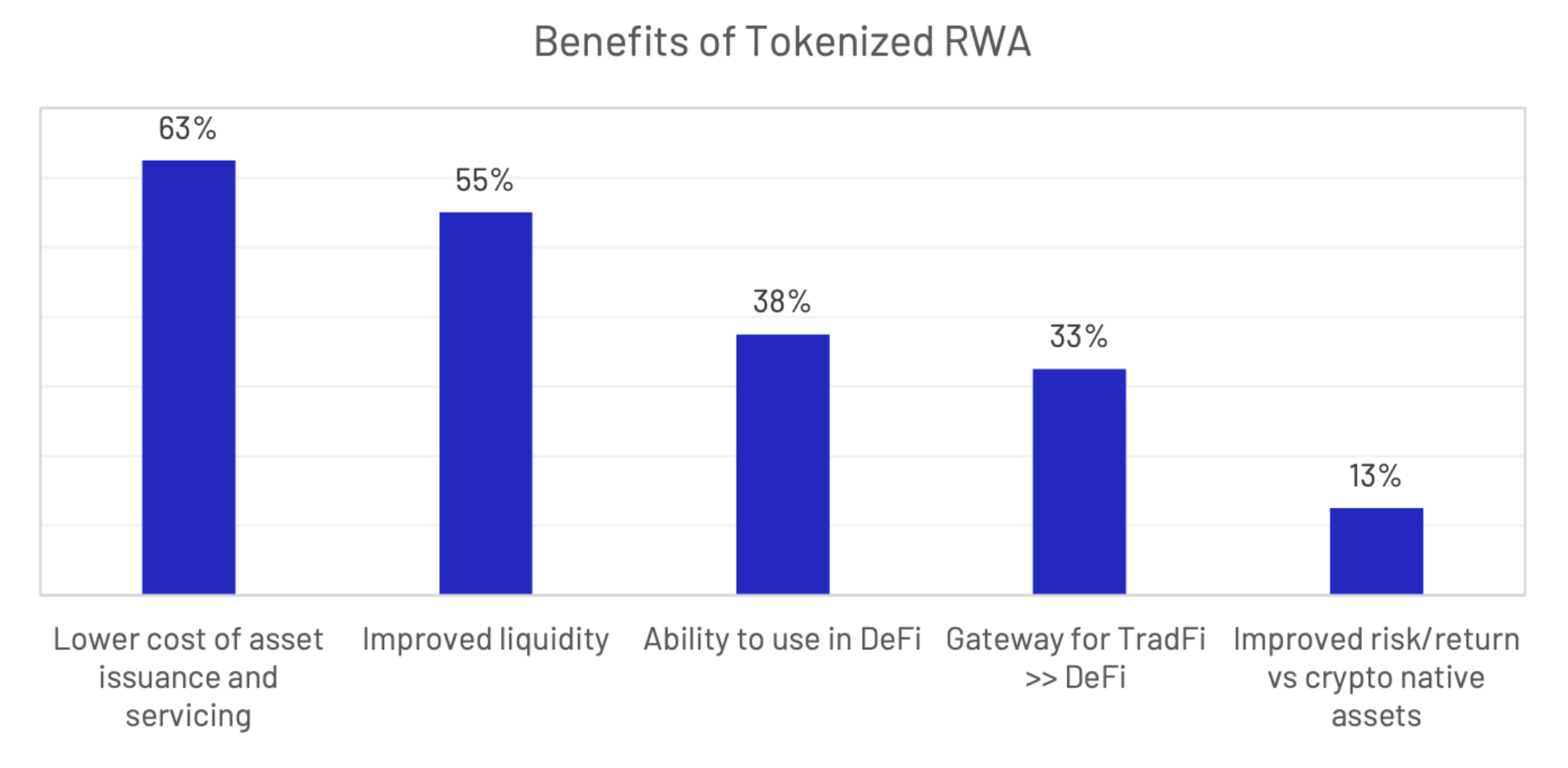

Key benefits for crypto investors

Enhanced liquidity

RWAs enable worldwide trading of traditionally illiquid assets 24/7. Digital marketplaces eliminate weeks of physical paperwork — all transactions are instant.

Fractional ownership

Retail investors can access high-value assets with smaller capital. Fractionalization — the opportunity to hold asset portions — democratizes ownership, broadening opportunities for investing and portfolio diversification.

Passive income

Holders of RWA tokens can earn yields from tokenized bonds, real estate rentals, or private credit.

Portfolio diversification

Adding RWAs to a portfolio helps reduce crypto volatility and overall risk while boosting potential returns. These tokens are inherently more stable, unlocking access to a diverse range of underlying assets, from art to debt.

Example: Real estate vs. stocks

The real estate market is historically uncorrelated to stocks. Platforms Landshare and RealT give global access to real estate and equities, respectively. Holding both RWAs exposes investors to two uncorrelated asset classes.

Risks & challenges

As the RWA market is still nascent, it carries unique risks, primarily around custody and the connection to the physical world. Regulations are evolving, and smart contract vulnerabilities persist.

Lack of regulatory clarity

Inconsistent legal interpretations hinder adoption. Laws vary by jurisdiction (SEC, MAS, FCA). For example, the EU’s MiCA regulation excludes tokenized securities like equity, bonds, or structured debt.

Comparison: PAXG vs. USDY

- PAXG — gold-backed tokens issued by Paxos Trust Company, LLC provide direct ownership of the physical metal, including fractional. Its issuer is a regulated entity under the New York Department of Financial Services (NYDFS).

- ONDO's USDY is backed by US government bonds and bank deposits — but the issuer is structured like a Money Services Business (MSB) under the Financial Crimes Enforcement Network (FinCEN).

Regulators do not actively oversee if all USDY investor funds are fully backed — while conventional investment funds undergo mandatory asset verification. Essentially, this RWA operates is a regulatory gray zone. Meanwhile, PAXG must maintain 100% reserves, subject to third-party audits, to comply with NYDFS's rigorous requirements.

Custody risks

Physical assets require secure off-chain storage, and issuers must select custodians carefully. Key considerations are measures against hacking, cybersecurity breaches and unauthorized use. Custodians must provide robust encryption policies, cold storage, and multi-signature authentication in addition to valid licenses.

Smart contract vulnerabilities

Smart contracts, whether for RWAs or other cryptocurrencies, remain susceptible to typical flaws and exploits — from reentrancy attacks to denial of service (DoS). Platforms offer dedicated toolkits addressing the risks, such as MakerDAO's RWA Toolkit Security Audit. Audits are critical for security assurance, trust, and regulatory compliance.

Liquidity risks

Issuing an asset is not enough — there must also be sufficient market liquidity or demand in order for it to thrive. While RWAs are designed to boost liquidity, some may trade on niche platforms with lower volume. Investors should therefore pay attention to volume metrics.

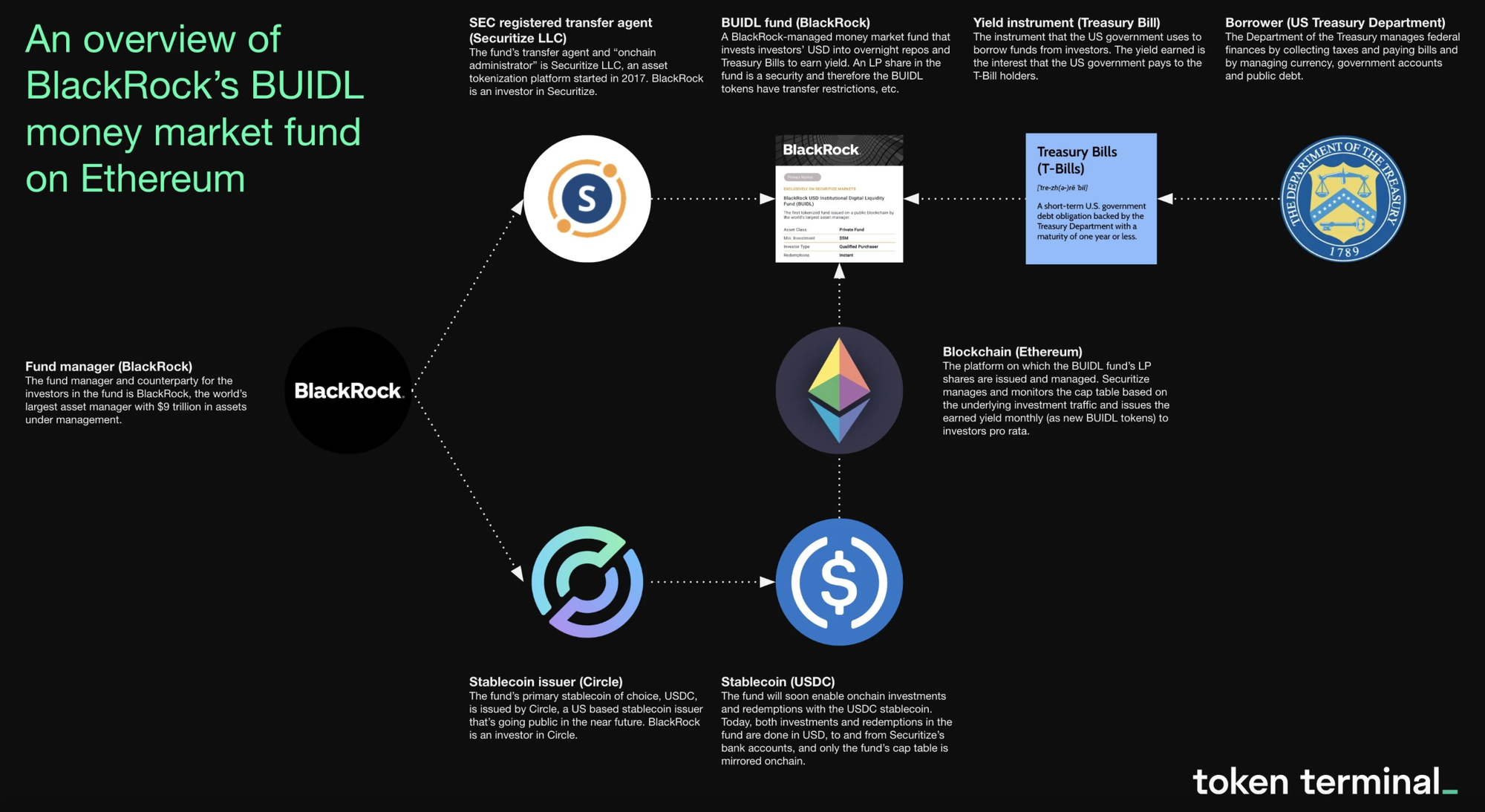

Institutional adoption: BlackRock’s BUIDL & beyond

BlackRock’s BUIDL token (a tokenized money market fund) invests in US Treasuries, offering crypto-native investors a stable yield. While the platform supports multiple blockchains, Ethereum remains its primary network for security token operations.

Breaking down BUIDL: Key components

- Asset backing & yield generation. BUIDL invests in ultra-safe, short-term instruments: overnight repurchase agreements (repos) and U.S. Treasury bills (T-bills). These assets provide stability while generating yield, backed by the full faith and credit of the US government.

- On-chain administration. Securitize LLC, an SEC-registered transfer agent, handles BUIDL’s digital operations — issuing and managing LP shares on Ethereum while ensuring regulatory compliance.

- Stablecoin integration. Circle’s USDC serves as the primary stablecoin for BUIDL, enabling seamless on-chain transactions, redemptions, and settlements.

Since the fund’s underlying assets are US Treasuries, the borrower is effectively the US Treasury Department, making default risk virtually nonexistent. Founded in 2017, Securitize is a top-tier digital securities platform, boasting 3,000+ institutional clients and 1.2 million investor accounts.

Other major players include:

- Ondo Finance – Tokenized Treasuries (OUSG) & private credit.

- Maple Finance – RWA-backed loans for institutions.

- Polytrade – Marketplace for tokenized invoices, real estate, and more.

Final thoughts

RWAs are not just a trend; they’re the future of asset tokenization. As TradFi and DeFi converge, savvy investors who position themselves early stand to benefit the most. RWAs present a compelling opportunity:

✔️ Stable yields in a high-interest-rate environment.

✔️ Diversification beyond volatile crypto assets.

✔️ Early-mover advantage as institutional adoption grows.

However, due diligence is crucial — research custody solutions, regulatory compliance, and liquidity before diving in.