Clapp Weekly: Black Friday, anatomy of the crash, Binance's relief effort

BTC price

Following record single-day liquidations sparked by Donald Trump's 100% tariff threat on Chinese goods on Friday, October 10, BTC attempted to recover but tumbled again. Pressure from the US-China trade tension returned yesterday as Trump threatened China with a cooking oil embargo after making conciliatory remarks.

The BTC price breached $123k repeatedly before collapsing on October 10. The decline culminated in a 7-day low of $109,883 on Sunday, October 12. After a rebound to $115,934 the next day, BTC dipped back below $111k.

Currently at $112,474, BTC has lost 0.9% over the past 24 hours and 7.3% over the past 7 days.

ETH price

After ether tumbled on “Black Friday,” US spot ETFs saw the largest single-day exodus in five weeks. Monday's $428.5 million outflows were seen as a macro reflex rather than a structural retreat — institutional positioning is intact and the coming sessions should reveal if this was a “passing tremor or the start of a deeper rotation.”

The ETH price topped out at $4,534.93 last Wednesday, October 8, before a steep collapse on October 10. On October 12, it fell as low as $3,686.83 before reversing. After a high of $4,277.17 yesterday, ETH fell below $4k again.

Currently at $4,118.39, ETH has lost 0.1% in the past 24 hours and 7.3% over the past 7 days, matching Bitcoin's results.

Seven-day altcoin dynamics

The total crypto market is back at $4 trillion after a sharp decline amid the largest liquidation event. Almost $20 billion worth of positions were wiped out on October 10 after President Trump threatened 100% tariffs on China in retaliation for its restrictions on rare earth exports to the US.

After the weekend rout, the market rebounded to the $4 trillion mark quickly, but momentum has since cooled off. BTC retreated below $111k again yesterday — yet analysts do not think we are entering a bear market.

History suggests BTC’s results may turn positive by the end of the month, as it has clocked October gains in 10 of the past 12 years. Furthermore, there is still hope for “altseason 3.0,” as massive market dumps typically precede strong rallies.

Fed’s outlook

While the US government shutdown continues to delay key reports, including the September jobs figures, Fed Chair Jerome Powell has hinted at further easing. Speaking on October 14, he said the economy has not changed much since September and current policies are working well. This suggests the Fed's balance sheet contraction (tightening) may end soon.

Weekly winners

- COAI (+366.5%) achieved a $1.1 billion market cap in less than a month, fueled by an Aster listing and BNB ecosystem momentum. Demand from over 3 million AI users and 300,000 BNB payers continues to drive the surge.

- ZEC (+88.8%) gained 520% over the past month, hitting a $4 billion market cap supported by Grayscale's Zcash Trust reopening for private placement. Transaction volume has soared as users increasingly utilize its privacy features.

- TAO (+33.6%) rallied after Grayscale announced its Bittensor Trust ($TAO) filing with the SEC. This move represents the first step toward making TAO an SEC-reporting company, potentially enhancing its institutional credibility and market transparency.

Weekly losers

- PUMP (-33.9%) saw its largest weekly decline to date, with on-chain data revealing massive outflows. The previous rally now appears heavily speculative, lacking fundamental backing or new ecosystem integrations.

- APT (-31.6%) followed the broader sell-off after surging on news of Bitwise Asset Management's S-1 filing for a Bitwise Aptos ETF with the SEC.

- IP (-29.7%) plunged on October 11 amid the market-wide downturn. The token had previously rebounded on a partnership with Korean megafranchise Solo Leveling and the general altcoin uptick, but couldn't sustain momentum against broader market pressures.

Cryptocurrency news

$20B crypto wipeout: How a single post triggered a domino effect

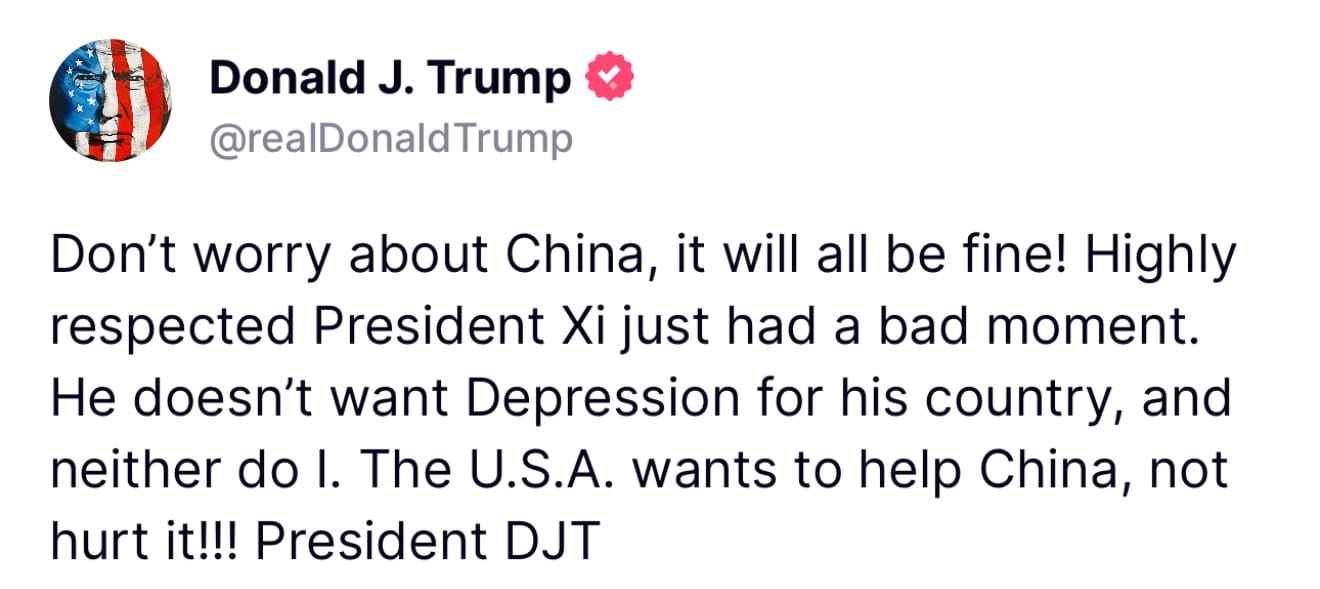

Last Friday was a historic market rupture. In a matter of hours, over half a trillion dollars vanished from the digital asset space. The trigger was a single social media post from President Donald Trump, but the true anatomy of the crash reveals a fragile ecosystem.

The spark was a trade war threat. Trump’s announcement of 100% tariffs on Chinese imports sent shockwaves through global risk assets, and crypto, still highly sensitive to macro fears, was hit hardest. Bitcoin, the market bellwether, plunged from $118,000 to $109,000. But this initial drop was only the first domino.

Real culprit: Extreme leverage

The crypto market had been buoyed by billions in borrowed money, with traders taking massive long positions. As prices began to fall, these leveraged bets started to get automatically liquidated by exchanges. This created a vicious, self-feeding cycle: forced selling drove prices down further, which triggered more liquidations.

This was an algorithmic avalanche. Over $20 billion in positions were wiped out — the worst liquidation event in crypto history. The crash acted as a "Great Reset," vaporizing roughly $65 billion in open interest and resetting positioning to levels last seen in July.

The pain was amplified in the altcoin market. Tokens like SUI fell as much as 80% and ATOM approached zero on some venues before rebounding.

According to Bitwise's Jonathan Man, the headline numbers mattered less than the breakdown in market plumbing. When uncertainty spiked, liquidity providers widened quotes or stepped back, causing organic liquidations to stop clearing at bankruptcy prices.

This forced exchanges to lean on emergency tools like auto-deleveraging (ADL), which forcibly closed profitable positions to cover losses, and liquidity vaults, like Hyperliquid’s HLP, which "had an extremely profitable day" buying at deep discounts.

Another example of TACO trade

As Trump later softened his tone, markets rebounded sharply. This "V-shaped" recovery highlights that the core bullish narratives haven't necessarily been broken. With open interest down sharply, markets entered the weekend on firmer footing.

Instead, the event served as a brutal reminder of the market's immaturity. The extreme leverage that amplifies gains on the way up can create a catastrophic vacuum on the way down.

The crash was a perfect storm: a geopolitical spark, a market drowning in leverage, and a cascade of algorithmic selling. It was a sobering wake-up call that in crypto, sentiment is king, and leverage is its volatile, double-edged sword.

While not a black swan (the crash was predictable to a degree), it was a painful lesson in the modern political pattern of the "TACO trade": Trump creates a dramatic, market-rattling crisis, only to quickly back down and de-escalate. The market panics on the threat, then rallies on the climb-down, leaving a trail of liquidated leverage in its wake.

Binance's $400M attempt to heal crypto's wounds

Last week’s crash exposed critical vulnerabilities in the very infrastructure of the crypto ecosystem. In the wake of the chaos, Binance, the world’s largest exchange, launched an unprecedented recovery effort, acknowledging its role in both the liquidations and a separate, severe technical breakdown.

The centerpiece is a massive $400 million relief fund.

- The exchange has pledged $300 million in token vouchers for retail traders who suffered forced liquidations on Futures and Margin between October 10th and 11th. To qualify, users must have lost a significant portion of their net assets, a criterion targeting those hit hardest.

- An additional $100 million low-interest loan program aims to stabilize institutional partners and market makers, recognizing that their liquidity is the lifeblood of a functioning market.

Responding to systems failure

During the peak of the volatility, wrapped tokens like wBETH and BNSOL — designed to track the price of ETH and SOL — crashed by over 80%, trading for pennies on the dollar. Binance co-founder Yi He publicly apologized and promised case-by-case compensation for users affected by this failure.

Binance’s infrastructure buckled under immense load, preventing market makers and arbitrageurs from accessing the platform to correct the prices. As one analyst noted, it created a "liquidity vacuum," where these crucial players were flying blind and unable to stabilize the assets, causing a procyclical death spiral for prices that should have been stable.

Fundamental change

In response, Binance has announced shifting to a "conversion-ratio" model for pricing wrapped assets. This will tether their value to the underlying staking ratio rather than volatile spot trades, preventing a repeat of such a disastrous depeg during future stress events.

Together, these actions represent a critical, if belated, attempt to restore user confidence and fortify the market’s fragile plumbing against the next inevitable storm.