Clapp Weekly: Modest recovery, first DOGE ETF, Polymarket returns to US

BTC price

Bitcoin climbed back above $88k, buoyed by rising Fed cut odds and a more orderly weekend de-risking. The rebound comes as data from Glassnode points to exhausting seller momentum — a shift underscored by spot Bitcoin ETFs, which attracted $128.7 million yesterday, reversing the previous day's outflows.

The BTC price briefly breached $92.5k on Thursday, November 20, before a steep plunge that culminated in $82,175.40 the following day. Rebounding, the coin rose gradually to $89,111.75 yesterday, November 25, then lost steam and stabilized around $87.5k.

Currently trading at $87,195.17, BTC has lost 0.9% over the past 24 hours and 6.0% over the past 7 days.

ETH price

Ether is also attempting a recovery as bullish pressure builds. BitMine Immersion Technology has purchased an additional 69,822 ETH last week, bringing its holdings to 3% of the supply. Meanwhile, ETF flows have reversed after record weekly outflows, attracting roughly $250 million since last Friday.

The price mirrored BTC after a 7-day high of $3,095.70 last Wednesday, November 19, and another breach of the $3k level the next day. Bottoming out at $2,680.48 on Friday, November 21, ETH climbed steadily to $2,979.19 on November 25, and cooled slightly.

Now at $2,933.40, ETH is up 4.0% over the past 24 hours but down 6.0% over the past 7 days.

Seven-day altcoin dynamics

Altcoins have plunged deeper than Bitcoin over the past month. While equities are holding up, crypto momentum is hampered by leveraged liquidations and a "lack of blockchain-AI convergence." The Crypto Fear & Greed Index remains in the "extreme fear" zone, at 15/100, after ticking up to 20 yesterday.

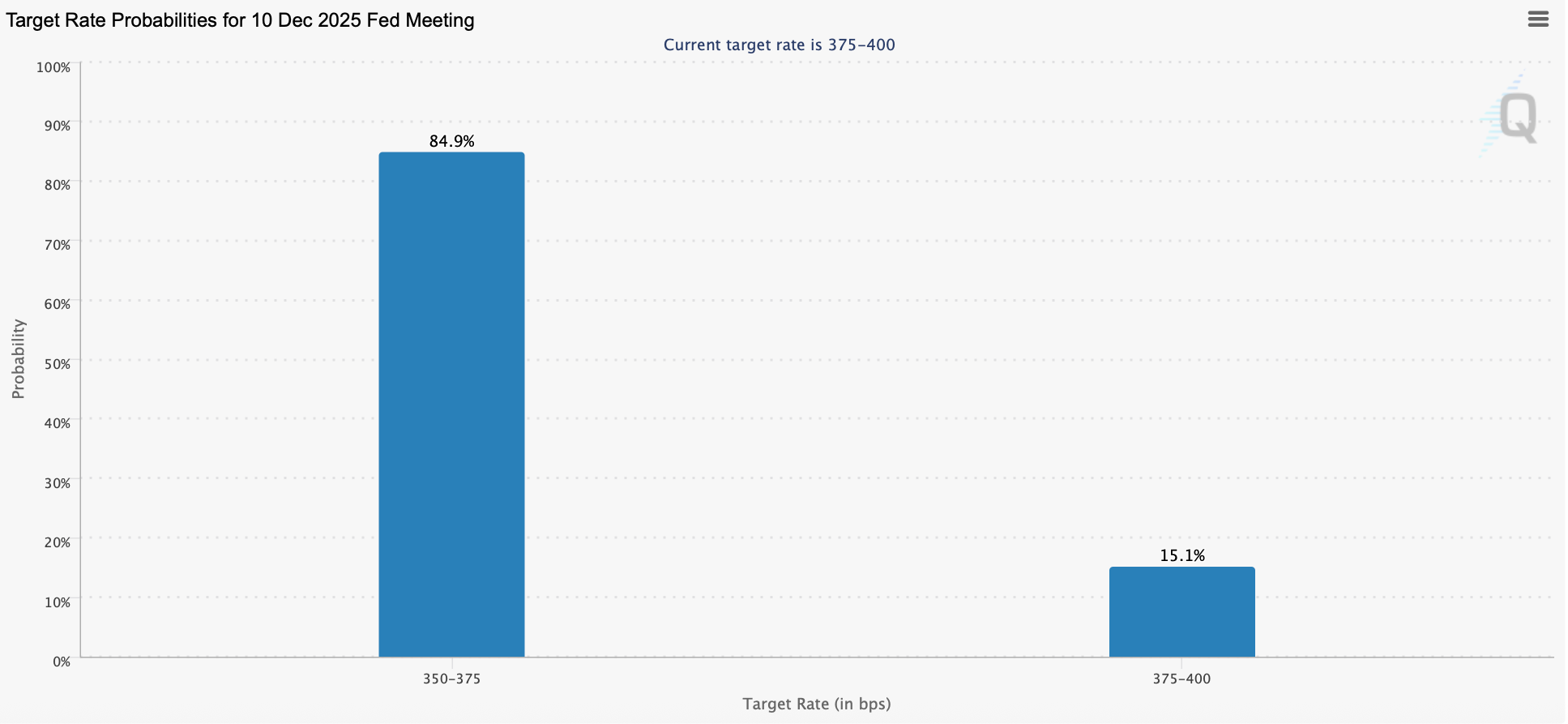

Uptick on Fed cut odds

The much-needed Monday rebound came as the odds of a 25-bps Fed rate cut on December 10 hit 70% (now 85%), doubling since last week. This change in sentiment came after New York Fed President Williams hinted at near-term easing.

Previously, the odds dropped as low as 33% after the Bureau of Labor Statistics (BLS) canceled the October jobs report — due to the record government shutdown, no payroll or employment data were collected.

The decision eliminated one of the crucial data points informing the Fed's policy decisions. The November jobs report is now expected on December 16, six days after the FOMC meeting.

Weekly winners

- RAIN (+121.6%) exploded after Enlivex Therapeutics announced plans to implement the first RAIN prediction markets token treasury. The company has entered into a securities purchase agreement, with future proceeds earmarked for the strategy. Enlivex's Board of Directors was also joined by chairman Matteo Renzi, former Prime Minister of Italy.

- WLFI (+22.0%) is supported by a buyback of 59 million tokens (around $10 million) over just 24 hours. The move follows last week's burn of 166 million tokens (roughly $22 million) linked to phishing breaches. Similar to a corporate share buyback, it reduced supply and reflected commitment to remaining holders.

- KAS (+19.1%) rocketed on a supply squeeze triggered by massive accumulation. Whales have scooped up over 35 million tokens in the last 10 days, capitalizing on the latest price dip.

Weekly losers

- APT (-21.2%) crashed despite Aptos' stablecoin supply hitting an all-time high of 1.43 billion this month. At press time, the disconnect between price action and fundamentals remains confounding.

- DOT (-17.6%) is affected by a sell-off triggered by technical resistance. Buyers failed to hold the $2.40 breakout level following Monday's rally.

- ASTER (-16.8%) gave in to broader market pressure, while the recent Coinbase listing turned into a "buy the rumor, sell the news" scenario.

Cryptocurrency news

Dogecoin ETF era begins with a whimper, not a bark

The arrival of a spot Dogecoin ETF was supposed to mark meme coins’ triumphant entry into mainstream finance, but the debut proved underwhelming. The opening bell for Grayscale’s GDOG on the NYSE Arca was met with more of a polite nod than a roaring crowd.

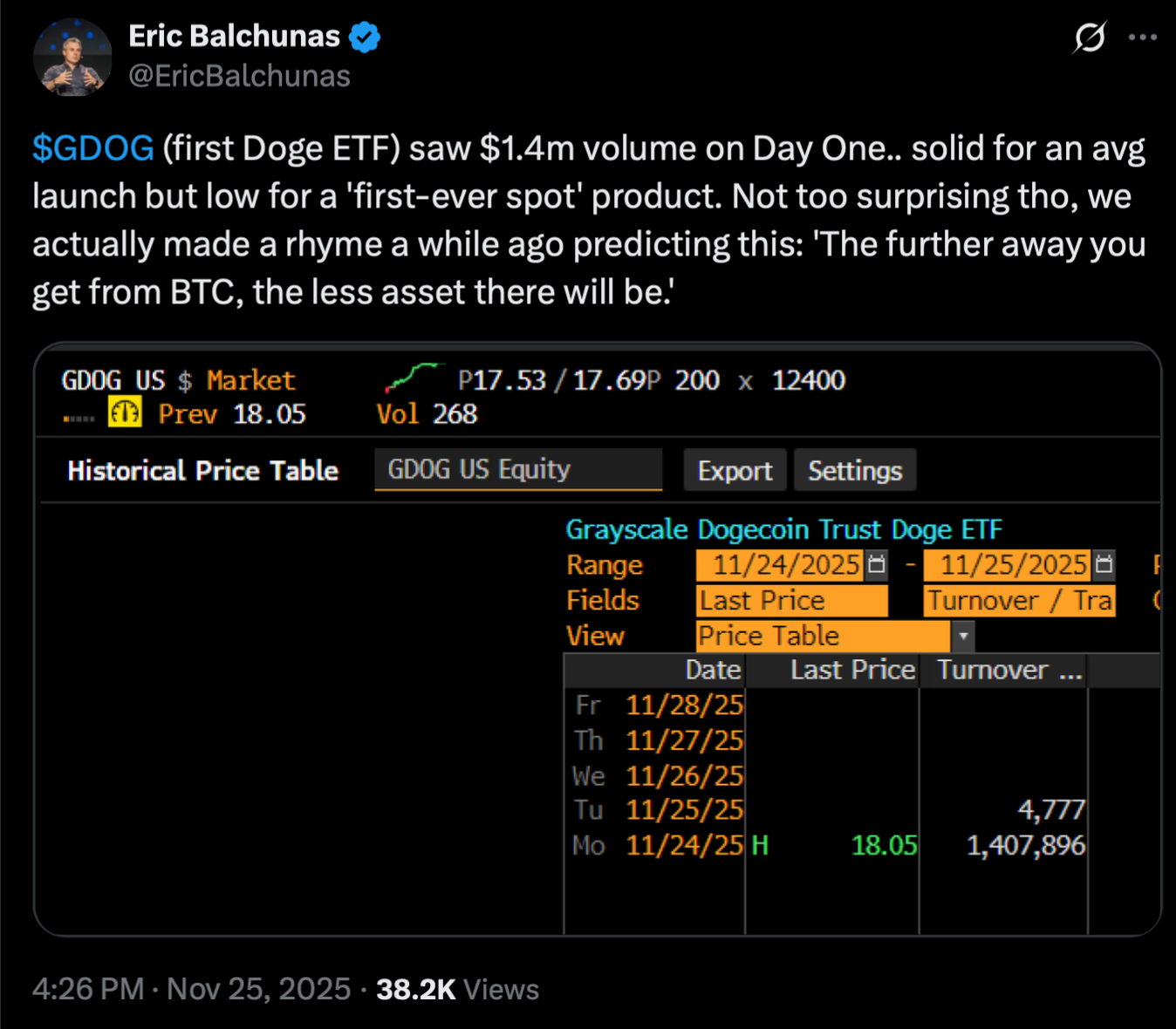

Surprisingly quiet first day

The initial numbers were undeniably soft. GDOG recorded a first-day trading volume of just $1.41 million, a figure that Bloomberg’s ETF expert Eric Balchunas noted was “solid for an avg launch but low for a 'first-ever spot' product.”

This tepid activity, which resulted in zero net inflows, indicates a market in perfect balance — with just as many sellers as buyers. It seems the “first-mover advantage” wasn’t enough to trigger a buying frenzy, especially with Bitwise’s competing DOGE ETF, BWOW, hot on its heels for a Wednesday launch.

What the muted response tells us

The launch of GDOG proves that the path to a regulated Dogecoin product exists. Still, its cautious start underscores that "the further away you get from BTC, the less asset there will be," as Balchunas put it. The market seems to be in a holding pattern, waiting for a stronger catalyst before committing significant capital to this more speculative corner of the crypto world.

While investors have eagerly embraced Bitcoin and even ether ETFs, the leap to a purely meme-based asset like DOGE appears to be a steeper climb for institutional portfolios. For meme coins to win over Wall Street, they need to demonstrate lasting utility and demand beyond the social media hype.

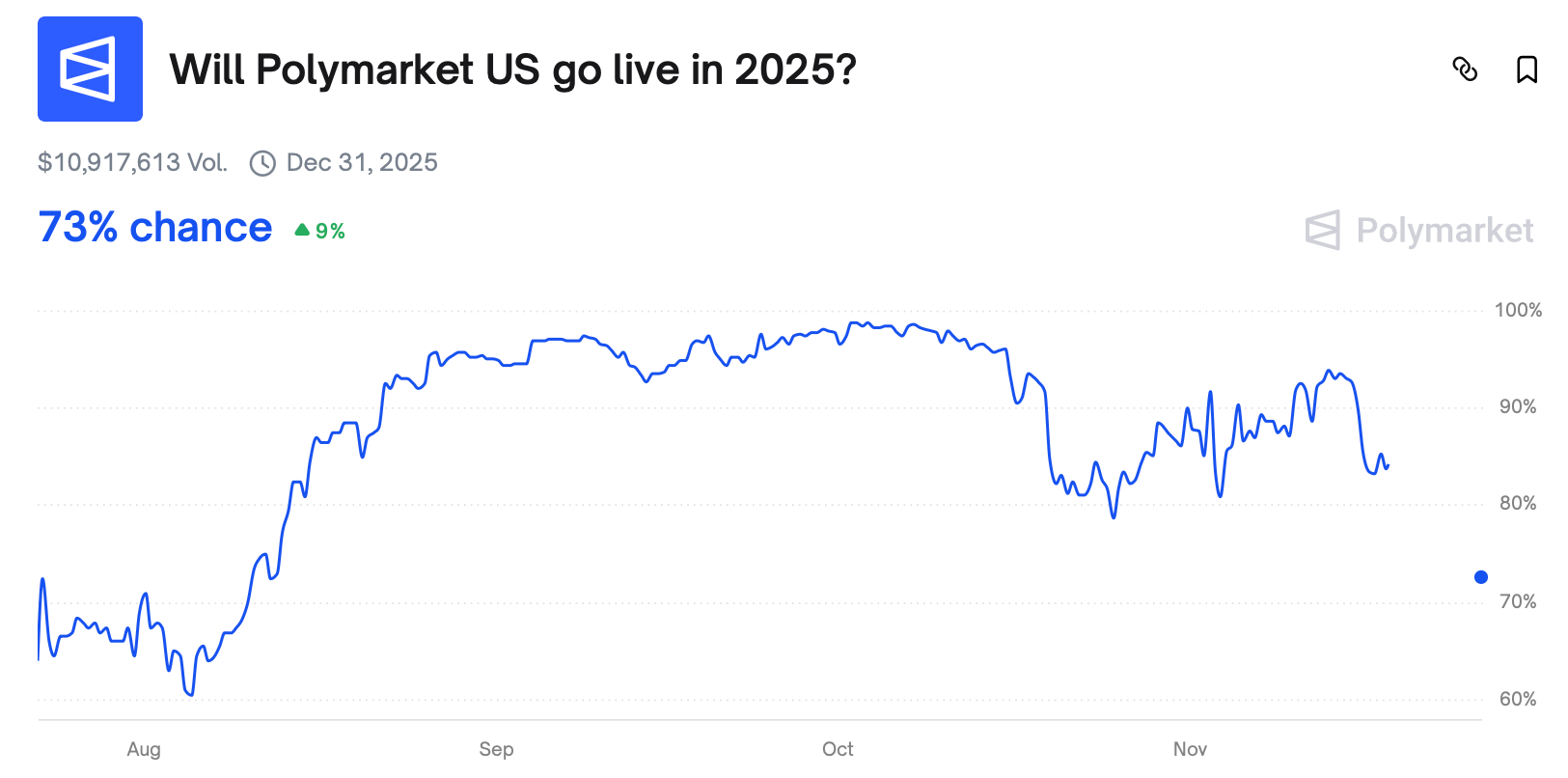

Polymarket is back: New chapter for US prediction markets

Polymarket has officially secured an amended order of designation from the US Commodity Futures Trading Commission (CFTC). It may now formally reopen its doors to American users — but this time, under the full umbrella of federal regulation.

New era of access?

For the average user, the key change is the introduction of intermediated access. Instead of interacting with the platform directly as before, US-based bettors will now participate through futures commission merchants (FCMs) and traditional brokerage channels.

Polymarket's operational structure is now aligned with that of other federally regulated exchanges — making it part of the established financial system. The CFTC's decision enables it to target a potentially wider audience that may have been hesitant to use an unregulated service.

Polymarket matures under regulatory framework

This return comes with significant responsibilities. As a designated contract market, Polymarket is now subject to the full suite of rules under the Commodity Exchange Act.

The company has had to develop and implement enhanced surveillance systems, robust market-supervision policies, new clearing procedures, and comprehensive regulatory reporting capabilities. Founder and CEO Shayne Coplan stated,

"This approval allows us to operate in a way that reflects the maturity and transparency that the U.S. regulatory framework demands. We're grateful for the constructive engagement with the CFTC and look forward to continuing to demonstrate leadership as a regulated US exchange."

After its 2022 retreat from the US, Polymarket’s successful, compliant return charts a course for other ambitious projects. Intermediated market access should enhance consumer protections and market oversight, establishing it as a regulated venue for real-money event prediction in the country.