Clapp Weekly: BTC rebound, Strategy's dilemma, CNN's Kalshi bet

BTC price

Bitcoin has returned to $92k, recovering from its Sunday and Monday plunge below $84k. Sentiment improved as Vanguard decided to give clients access to crypto ETFs, while Bank of America allowed its wealth managers to propose up to a 4% BTC allocation.

The price rose from $86.5k to $90k a week ago and pushed higher, reaching a peak of $92,346.35 on Friday, November 28. On Monday, December 1, BTC nosedived from $91k to $84,553.52 before a violent rebound.

Currently at $92,980.71, BTC has gained 7.8% over the past 24 hours and 6.8% over the past week.

ETH price

Ether also regained momentum, bouncing back above $3k after a plunge toward $2.7k. Today, the network implements its next major upgrade, Fusaka, a shift aimed at boosting blockchain capacity and lowering transaction costs. Whales have resumed buying — one wallet purchased $68 million in ETH over two days.

ETH closely followed BTC's path, initially rising from $2.9k to $3k and hovering around that level before the December 1 collapse. The price bottomed out at $2,740.42 on Monday, December 1, and sprang back, erasing the losses by December 3.

Currently trading at $3,046.66, ETH is up 8.6% over the past 24 hours and 3.2% over the past week.

Seven-day altcoin dynamics

Following a volatile Monday, Bitcoin's rebound to $93k lifted the rest of the market. Large-cap tokens posted massive gains after $457 million in short positions were liquidated in 24 hours. Despite the relief, sentiment remains cautious — ongoing structural concerns and regulatory developments restrict momentum.

Strategy-driven fears

The rebound failed to settle nerves after thinning liquidity and spillover from macro jitters amplified weekend plunges. The broader market is still processing the dramatic drawdowns in Strategy-linked ETFs and the expected MSCI methodology review — both denting risk appetite.

Hayes sparks Tether concerns

Arthur Hayes's warning that a sharp drop in BTC or gold prices could affect Tether's solvency fueled caution. Citing the issuer's increased exposure, the BitMEX co-founder claimed the scenario would pressure its surplus and spark panic over USDT's backing.

Previously, S&P Global assigned Tether a "weak" stability rating while highlighting heavier allocations toward risk assets.

Regulatory catalysts

On Tuesday, December 3, sentiment improved as the Securities and Exchange Commission (SEC) took a step toward regulatory clarity. SEC Chairman Paul Atkins said the agency would support its proposed "innovation exemption" for crypto firms with a detailed framework. Meanwhile, Vanguard allowed trading of crypto-focused ETFs and mutual funds on its platform.

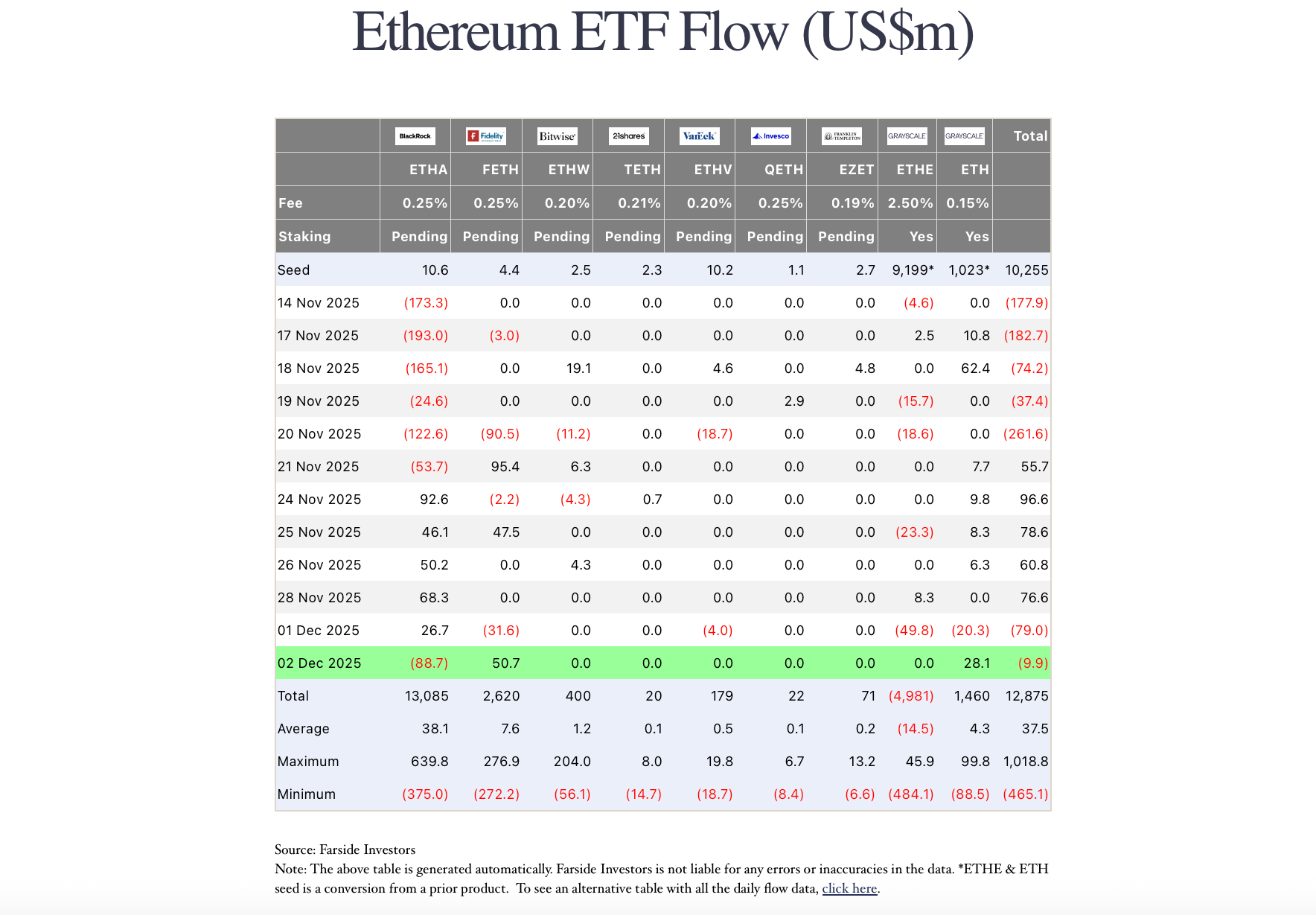

The news lifted spirits after a long stretch of outflows and stalled policymaking. Bitcoin ETFs have seen five straight days of inflows (totaling $288 million); outflows from Ethereum ETFs resumed on Monday, December 1, but decelerated from $79.9 million to $9.9 million yesterday.

Despite macro tailwinds — nearly 90% odds of a Fed rate cut on December 10—experts see the rebound as a relief move rather than a fundamental reversal. Market depth remains uneven.

New ETF launches

SOL and XRP's recovery appears fueled by two new ETFs from REX Shares and Tuttle Capital Management. The T-REX 2X Long SOL Daily Target ETF (CBOE: SOLX) and the T-REX 2X Long XRP Daily Target ETF (CBOE: XRPK) provide 200% leveraged exposure to the underlying tokens.

Meanwhile, Grayscale has launched the first US Chainlink ETF (GLNK) on NYSE Arca, enabled by updated SEC listing standards. The Grayscale Chainlink Trust ETF, converted from a private trust, showed robust day-one performance (over 1.17 million shares traded).

Weekly winners

- SKY (+30.2%) holds firm above the support zone formed last week, showing buyers have not stepped away. On December 1, Sky Protocol announced a buyback of 154 million tokens (7.8 million USDS) in November, bringing the total buyback to over 88 million USDS — helping absorb supply during sell-offs.

- PUMP (+17.1%) has defied market uncertainty, supported by a $23.5 million whale acquisition over multiple days — one of the largest purchases in recent months.

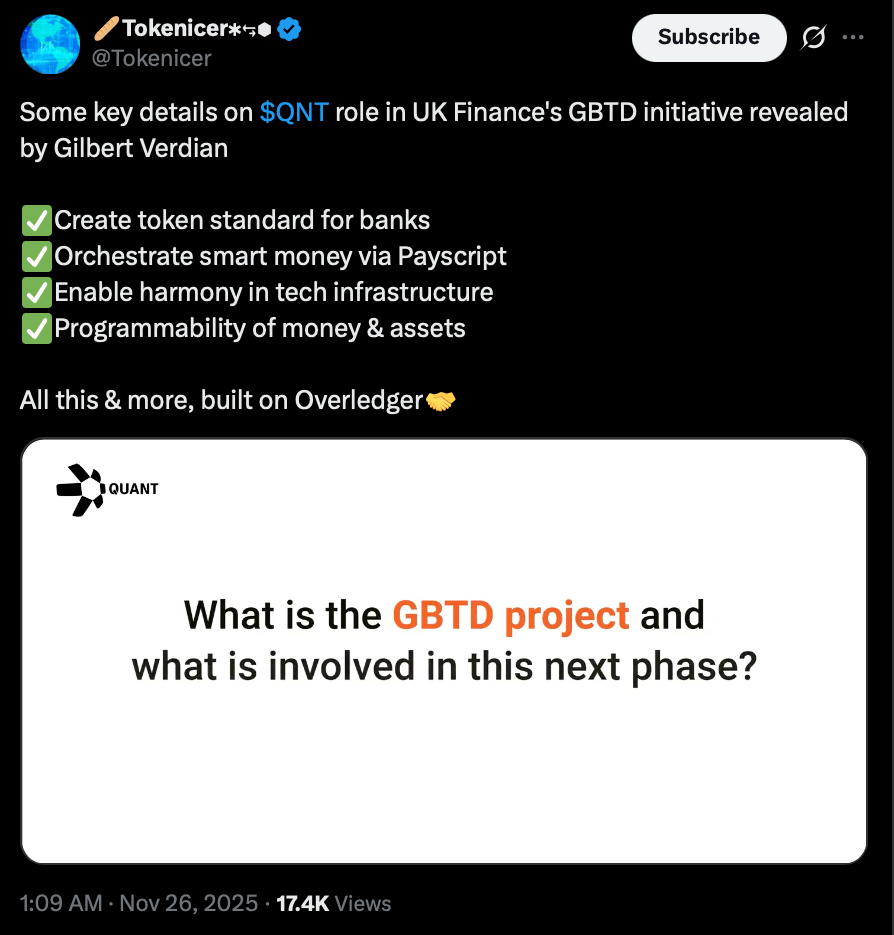

- QNT (+9.2%) rocketed and corrected as exchange and futures demand soared. Sentiment is boosted by QNT's role in the Tokenized Sterling Deposits (GBTD) initiative led by UK Finance, a trade body including financial giants like Barclays and HSBC.

Weekly losers

- ZEC (-39.8%) tumbled as the privacy narrative faded, underscoring the fleeting nature of sentiment-driven rallies. Criticism of its off-chain governance also played a role — decisions made by a small appointed group raise centralization concerns.

- M (-28.9%) sank sharply on November 27 (from $1.95 to $1.25), sparking rug-pull fears. The plunge came after Meson Finance sold 15.7k M — half its holdings — for $233k across Kraken, OKX, and Binance.

- CC (-14.7%) failed to continue its institution-driven rally as momentum faded. The pump was fueled by a partnership with Taurus, a Swiss fintech that became a super validator, and Alchemy Pay enabling international fiat on-ramps for CC.

Cryptocurrency news

Strategy’s $1.44B safety net: Pivot from “never sell” to “strategic sell”?

Strategy has established a massive $1.44 billion US dollar reserve to ensure “very smooth continuous dividends” to shareholders, regardless of Bitcoin’s notorious volatility. The company built on that very principle is openly mapping out scenarios where it would sell BTC.

Fascinating paradox

For years, Executive Chairman Michael Saylor evangelized the “never sell your Bitcoin” mantra. The rationale is tied to its market-adjusted net asset value (mNAV). Should that figure drop below 1 — meaning the company’s market value falls beneath the value of its assets — selling Bitcoin becomes a tool on the table to fund dividends.

“It’s important for us to dispel this notion,” Saylor stated, addressing skeptics head-on. He argues that the company can sell appreciated Bitcoin, pay dividends, and still increase its total BTC holdings over time through its business model.

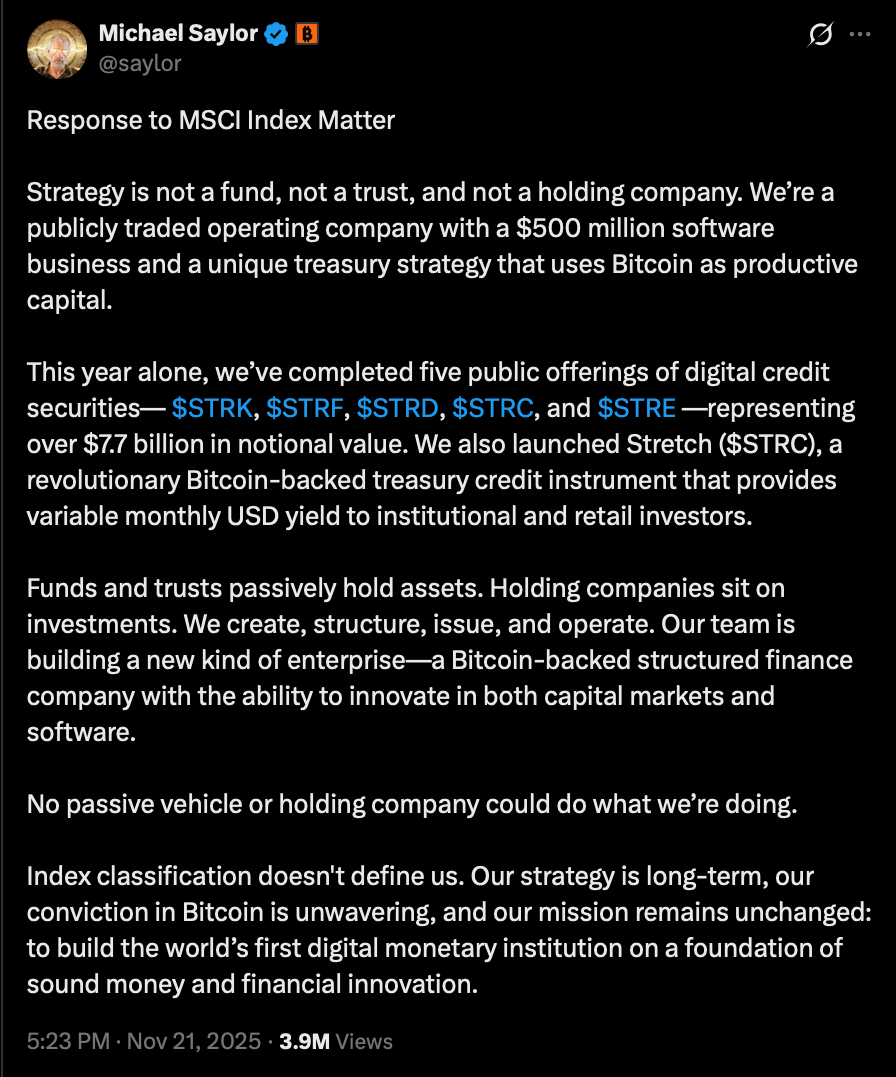

Last week, MSCI announced it was considering removing Strategy Inc. from its major equity indices, citing the firm's substantial Bitcoin exposure. JPMorgan and other market observers have also raised concerns about index eligibility concerns.

The market reacted nervously

The news triggered a plunge in the MSTR stock price. Yet, investment firm Benchmark remains bullish, dismissing critics as “manifestly unfamiliar” with Strategy’s mechanics. They maintain a $705 price target, contingent on Bitcoin reaching $225,000 by 2026, and note that BTC would need to crash below $12,700 for the company’s debt structure to face real pressure.

The takeaway

Strategy is maturing from a pure-play Bitcoin accumulator into a complex, dividend-focused financial entity. The $1.44B reserve is a buffer, but it also underscores a strategic shift: for Strategy, Bitcoin is now both a treasury asset and a potential source of liquidity to satisfy shareholder expectations.

It’s a delicate balance, proving that even the most devoted HODLers must adapt when answering to Wall Street.

From niche to newsroom: CNN bets on prediction markets with Kalshi deal

Kalshi has been named the official prediction markets partner of CNN. This isn't just a sponsorship logo; it's a deep integration that will see the platform's real-time probability data woven directly into CNN's programming and used by its newsroom, data, and production teams.

Led by CNN’s Chief Data Analyst Harry Enten, the partnership aims to use the "wisdom of the crowd" as a dynamic complement to traditional reporting. Viewers can expect to see a new Kalshi-powered news ticker and data points highlighting the market's implied odds on future events, from political races to cultural milestones.

Pivotal moment for prediction markets

The industry has long battled the perception of being little more than sophisticated gambling. Rival platform Polymarket’s CEO recently argued on 60 Minutes that these markets are “the most accurate thing we have as mankind” for forecasting.

With combined volumes surpassing $45 billion and partnerships now extending to titans like Google Finance and Robinhood, the sector is undeniably knocking on the door of the financial and media establishment.

Yet the path isn't without hurdles

Kalshi is currently facing a nationwide class-action lawsuit alleging it operates an unlicensed sports betting service. This tension — between being seen as a valuable forecasting tool or a glorified betting shop — is the central drama of the industry's maturation.

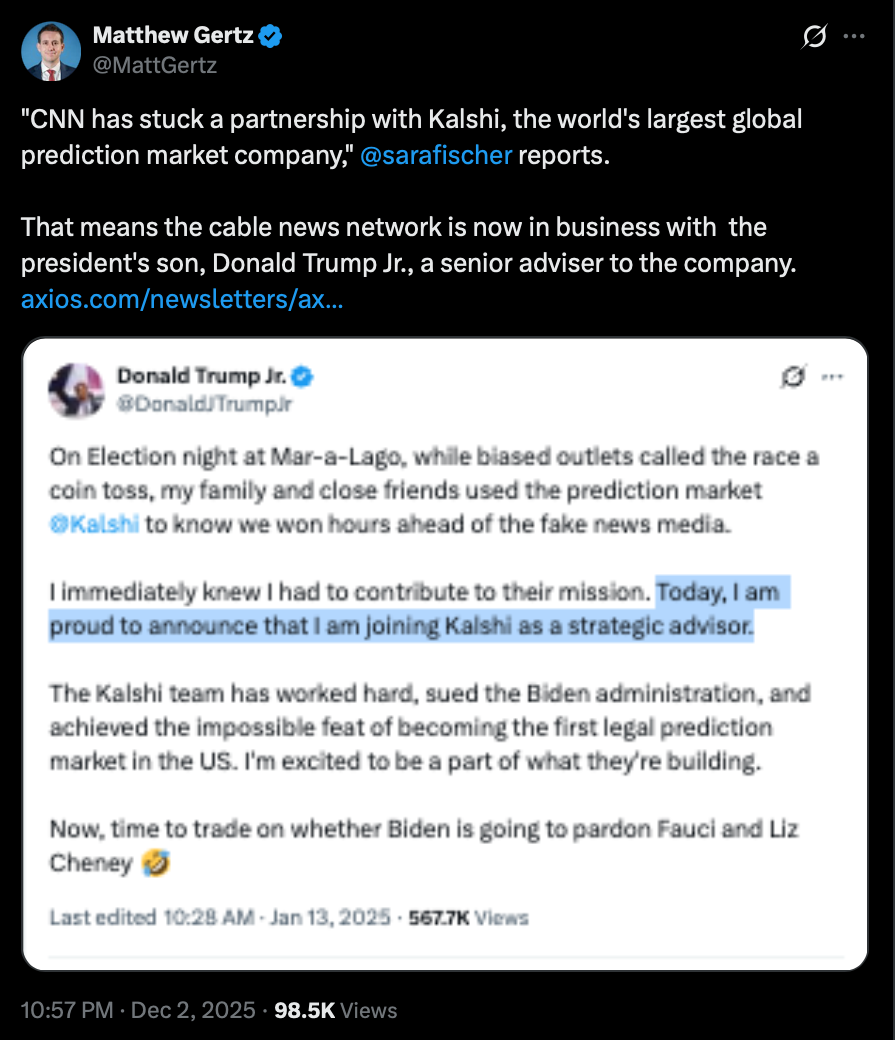

Furthermore, skeptics highlight Kalshi's connection to President Trump's son, Donald Trump Jr., who became its strategic advisor in early 2025.

CNN's endorsement is a powerful vote of confidence. By bringing prediction market data into millions of living rooms, the network is actively testing a new form of data-driven journalism. It remains to be seen whether crowdsourced probabilities can coexist with, or even enhance, traditional analysis.