Master your risk: How to build a diversified crypto portfolio

Concentrating capital in a single asset or instrument is inherently risky, particularly in a market as notoriously turbulent as crypto. Diversifying holdings empowers you to mitigate risk and capitalize on opportunities — here is how to strategically allocate your investments.

What is crypto portfolio diversification?

Diversification is the practice of dividing investments between various cryptocurrencies, sectors, and strategies. Instead of over-relying on Bitcoin or ether alone, traders distribute their allocations to achieve a varied and balanced portfolio.

Why diversify?

Some cryptocurrencies see double- or even triple-digit price changes within 24 hours. Volatility can severely erode your portfolio's value if you are overexposed to a single asset. With diversification, losses from one underperformer are offset by exposure to assets that are growing in value — partially or even fully.

Diversification helps minimize losses while increasing your potential to capitalize on high-potential alternatives. It is an essential strategy for anyone looking to master risk and enhance their financial results.

Variety of digital assets

While Bitcoin (BTC) remains primarily a store of value, different cryptocurrencies offer various functionalities based on unique use cases. For example, ether (ETH), the second-biggest coin, is a “productive asset” because holders can earn yield through staking.

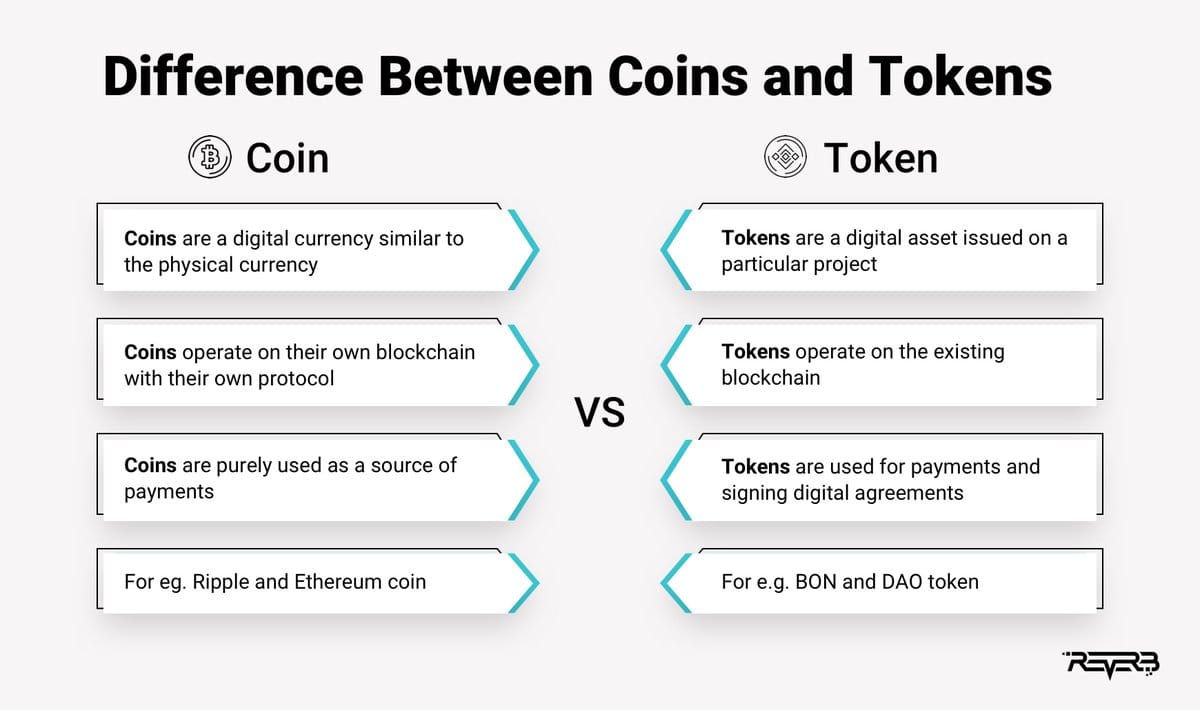

Cryptocurrencies operating on native blockchains are classified as "coins"; digital assets using non-native blockchains as "tokens." To navigate market complexities, investors should consider involving different assets, utilities, and parts of the crypto ecosystem.

Approaches vary, as everyone can develop their own methodology for assessing opportunities and risks. Commonly, investors diversify holdings by:

- Market cap

- Types of cryptocurrencies

- Blockchain industry sectors

Principles of crypto portfolio diversification

Here are three core principles that underlie a well-diversified portfolio.

1. Risk mitigation

Diversification shields your portfolio from being decimated by a single underperformer or a black swan event. For instance, adding a stablecoin like USDT cushions drops in crypto prices with the anchor of a fiat-pegged value — while ensuring readily available liquidity for quick market moves.

2. Non-correlation

Strategically select assets that behave differently to market shifts. If they do not move in sync, you can offset losses in one area with gains elsewhere.

For example, to buffer potential losses from highly volatile meme coins, one might combine them with more stable cryptocurrencies (BTC, ETH) alongside stablecoins.

3. Maximizing upside potential

A BTC and ETH-only portfolio forfeits exposure to other high-growth areas. Diversification is paramount to harnessing growth from multiple sources, for instance:

- Adding DeFi tokens unlocks untapped potential.

- Including NFTs adds exposure to digital collectibles, allowing you to benefit from various market trends.

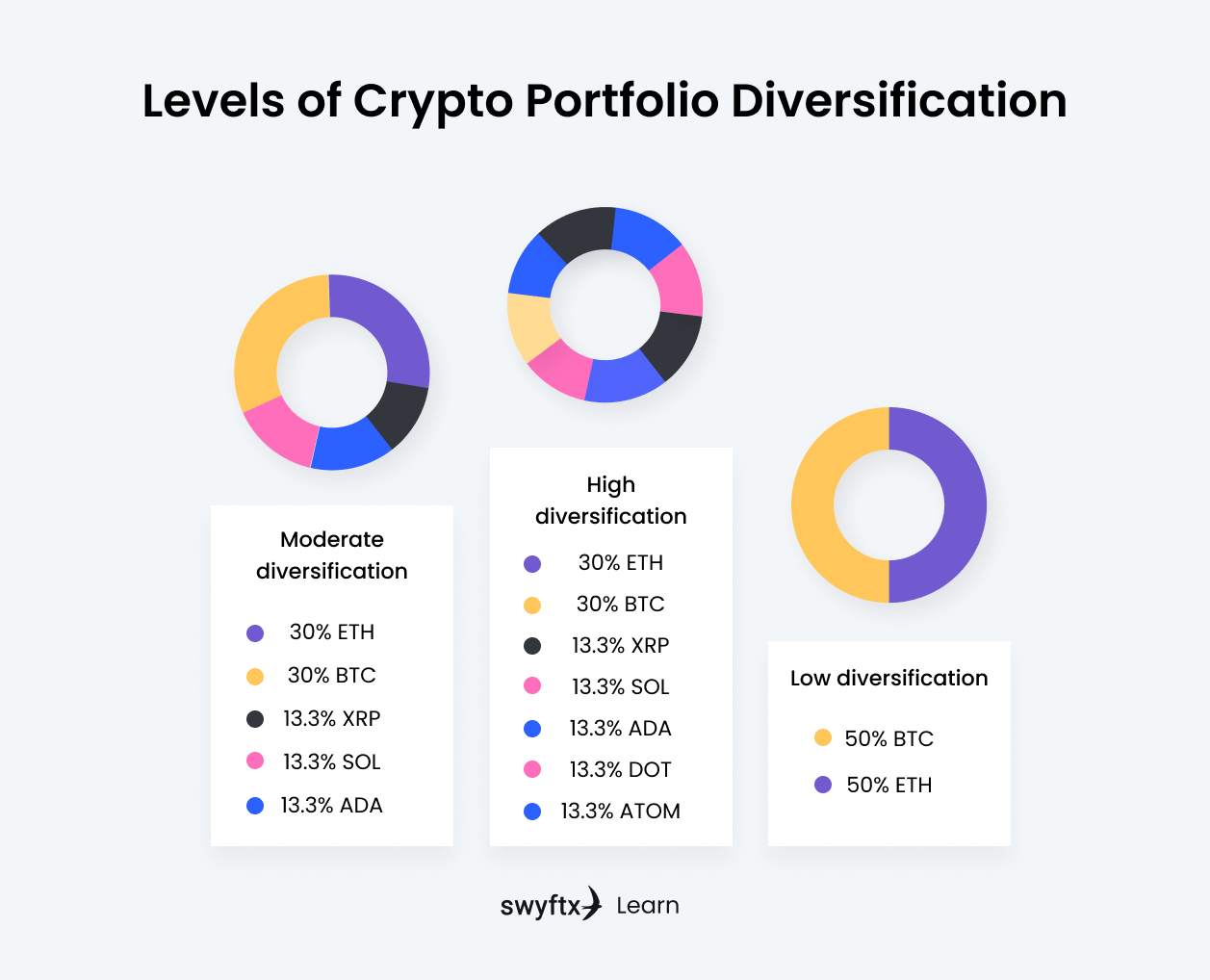

Adjusting portfolios based on market cap

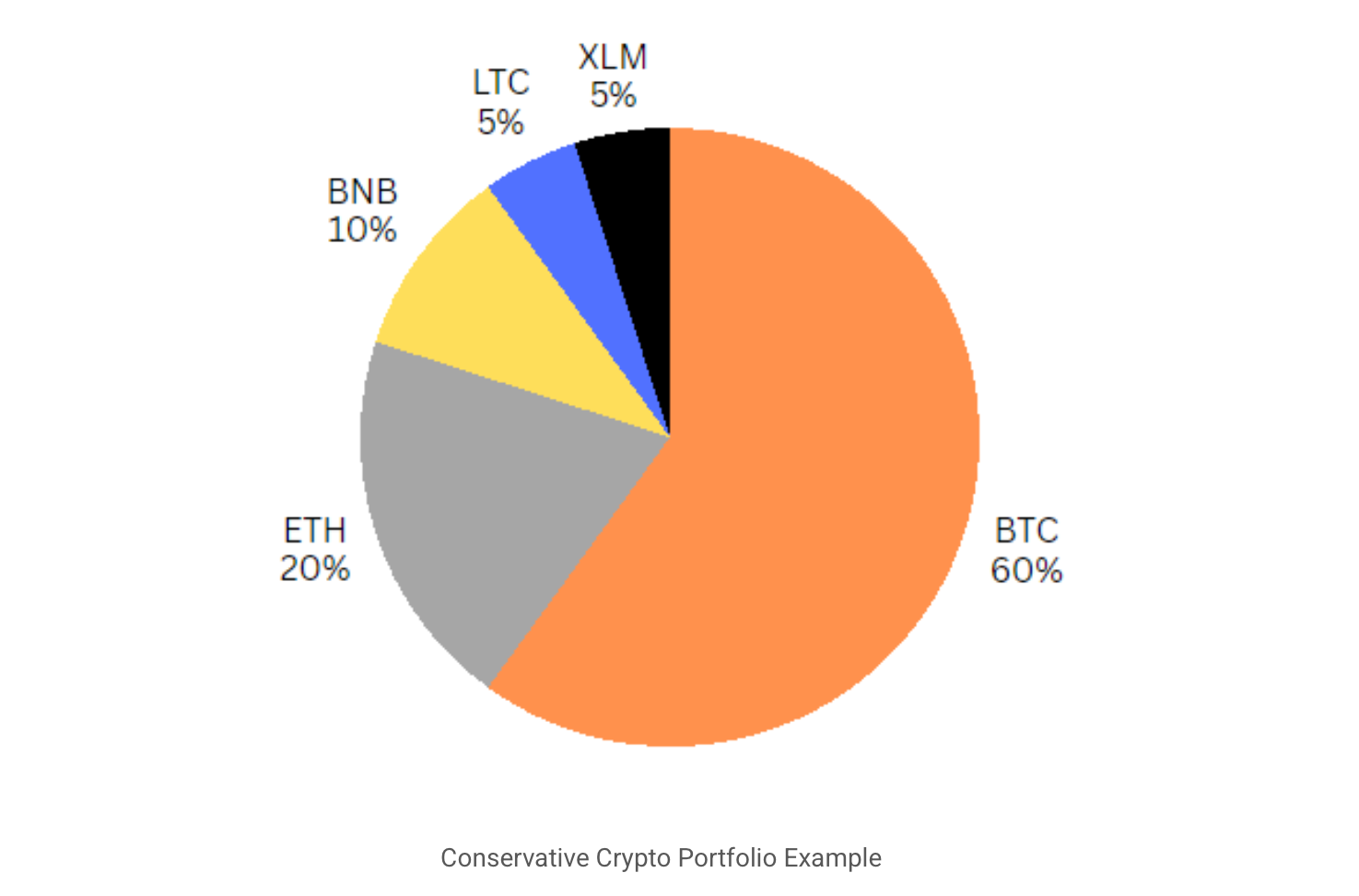

Weighting investments toward market leaders (BTC, ETH) decreases exposure to altcoins' amplified volatility. Capital is spread between large-cap (large allocation), mid-cap (smaller allocation), and small-cap cryptos (even smaller) to create a balance of stability with growth potential.

Mid-cap tokens capture additional growth, while small-cap assets offer high-risk, high-reward potential. Commonly, investors apply an 80/20 split by market cap: 80% to BTC and ETH , and 20% to mid- and small-cap cryptos.

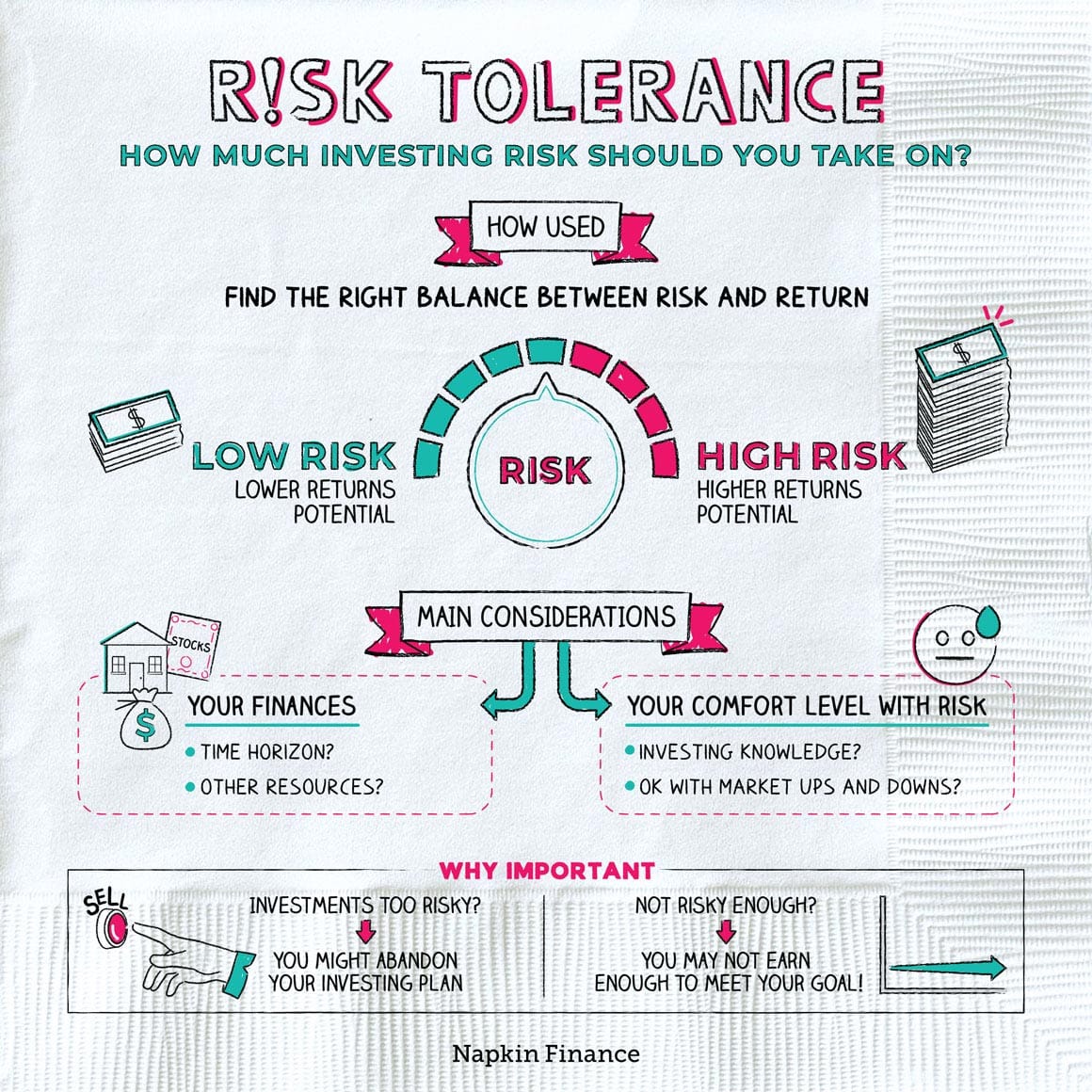

Over-reliance on market cap may cause you to miss out on high-potential opportunities. Sector-specific allocations and equal-weight distribution can help manage risk while capturing the upside potential of emerging projects — but the ideal mix depends on your risk tolerance and long-term goals.

Adjusting portfolios based on risk tolerance

Asset allocation should be strategic and aligned with your goals and risk tolerance — i.e., the maximum level of risk you are willing to accept.

High risk tolerance

Some investors are comfortable with increased exposure to volatile categories like meme coins and emerging tokens. They are ready to embrace market swings and may allocate more funds to purely speculative assets with high growth potential.

- Pros: Potential for high returns.

- Cons: Risk of substantial losses if the market declines.

Moderate risk tolerance

This approach balances stability and growth. Portfolios typically combine established coins (BTC, ETH) with some emerging tokens.

- Pros: Offers lower risk (compared to high-risk portfolios) while maintaining growth potential.

- Cons: Unlikely to see extreme returns.

Low risk tolerance

Focusing on stablecoins or large-cap cryptos shields investors from significant volatility. This approach prioritizes protection from wild fluctuations, and is often combined with predictable returns from crypto lending.

- Pros: Provides stability and the lowest risk.

- Cons: Offers limited growth potential due to the focus on safer assets.

How to diversify your crypto portfolio

Allocating investments across a spectrum of digital assets can help fortify your holdings and reduce overall risk. Here's how to start.

Include stablecoins (stability + liquidity)

Stablecoins are cryptocurrencies whose value is pegged to fiat currencies or precious metals, such as the US dollar (e.g., USDT), euro (EURR), or gold (XAUT). True to their name, they anchor portfolios by dampening exposure to volatility.

The benefits are twofold, involving flexibility and control:

- Protecting capital against market downturns.

- Providing liquidity for easier swaps between cryptocurrencies or conversion to fiat.

Diversify across crypto types

A deliberate mix of coins and tokens (large-cap, mid-cap, and small-cap) unlocks growth opportunities across diverse market segments. Often, these categories overlap (e.g., some DeFi tokens are also governance or utility tokens).

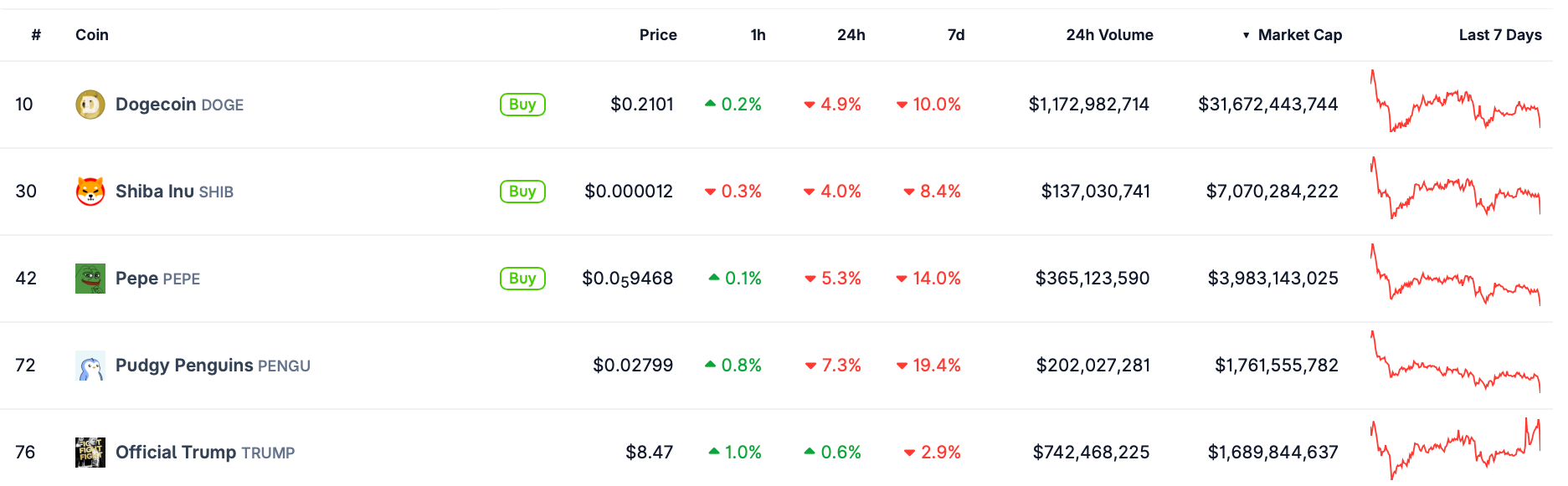

- Meme coins: High growth potential combined with increased volatility. For instance, DOGE — the first popular meme coin — has gained 109.8% over the past year, but lost 10% over the past week.

- Decentralized finance (DeFi) tokens: Projects like Uniswap (UNI) or Sky Protocol (SKY) support lending, trading, and yield generation. The AAVE token gives holders a say in the future of a protocol that lets them earn APY rewards for crypto deposits, and borrow other assets against that collateral.

- Layer-2 (L2) solutions: These tokens help scale blockchain networks like Ethereum, resolving efficiency challenges. For example, OP powers governance and protocol development on Optimism — an L2 chain that uses optimistic rollups to scale Ethereum, delivering faster transactions and up to 100x lower fees.

- Utility tokens: These assets serve specific functions within their native ecosystems. A notable example is BNB — the native utility token of the Binance ecosystem. It powers trading fee discounts, unlocks participation in token launches on Binance Launchpad, and enables interaction with dApps on Binance Smart Chain.

- Governance tokens: These assets provide voting rights on decentralized platforms. Each token often equals one vote, letting you approve or reject proposals — from treasury spending to protocol upgrades. Beyond voting, these tokens can be staked, traded, or used in liquidity pools. Prominent examples include AAVE, COMP, and SKY.

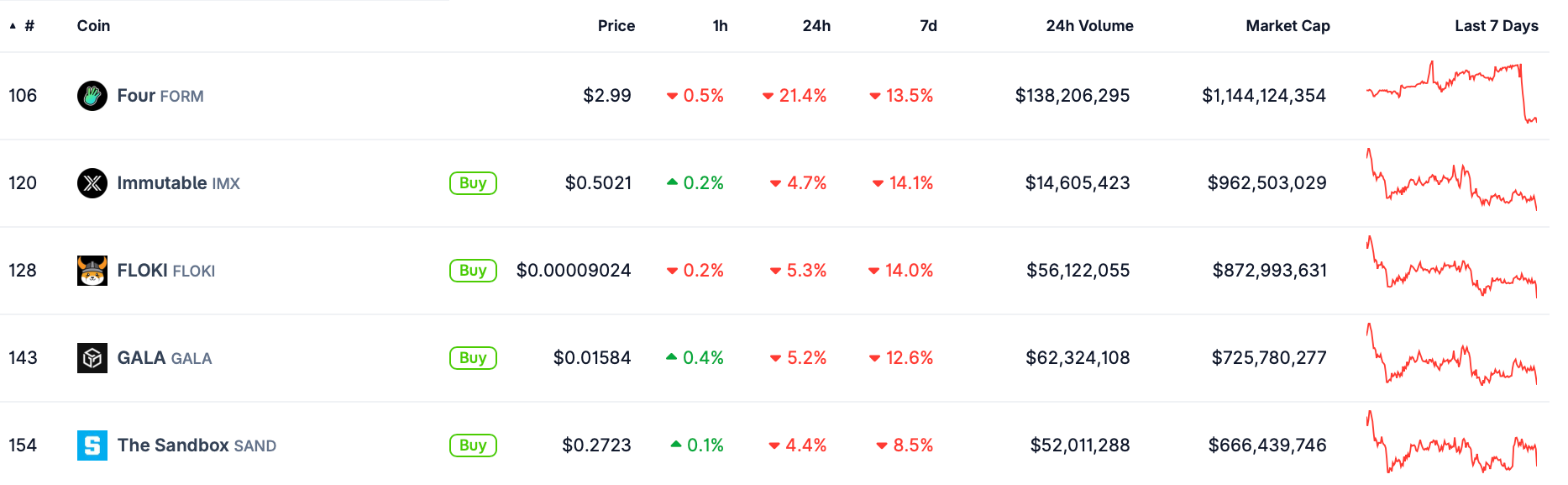

- Gaming tokens: Assets used in blockchain-based games provide exposure to the growing GameFi sector. Tokens like MANA, ENJ, AXS, and SAND enable players to purchase in-game assets and earn rewards. They offer real-world value, and some also grant governance rights.

Cross-sector diversification

The primary sectors of the blockchain industry include:

- Payments: Cryptocurrencies used to store and transact value without centralized intermediaries (e.g., Bitcoin, Litecoin). Payments are recorded on a public ledger and stored in digital wallets.

- Banking & Finance: Digital assets powering financial services like lending and borrowing in DeFi. For example, Sky Protocol’s SKY is a governance token that plays a crucial role in risk management.

- Artificial Intelligence (AI): Tokens that fuel crypto solutions linked to machine learning (e.g., tokens that automate tasks or optimize decision-making, such as FET (ASI), the primary cryptocurrency for the Artificial Superintelligence Alliance).

- Infrastructure: Tokens issued by projects that build or enhance blockchain technology (e.g., Chainlink’s LINK, used to pay for oracle services).

- Media: Assets for decentralized content creation and distribution (e.g., AIOZ, which powers a decentralized content delivery network).

Extra tips

- Futures contracts secure prices ahead of time, allowing you to further diversify your strategy. Hedging strategies can also safeguard capital from adverse price movements.

- The way you hold your assets impacts liquidity. For instance, you could HODL most funds in a hardware wallet, transfer a portion to a software wallet for trading, and stake the rest for passive rewards or use them as loan collateral.

Common diversification mistakes

Steer clear of these common missteps to preserve a well-diversified portfolio that effectively manages both upswings and downswings.

- Avoid overconcentration: The higher your allocation to a single cryptocurrency, the greater the impact of its decline on your overall portfolio.

- Avoid chasing quick gains: Never make investment decisions out of fear of missing out (FOMO). Hype is fleeting, and explosive growth can unravel just as dramatically.

- Be mindful of asset correlation: Diversification is most effective when assets don't move in perfect unison. If all your assets rise and fall simultaneously, your strategy is less effective.

- Don’t go to extremes: Including too many assets overwhelms portfolio management and can diminish potential returns. The ideal number should balance diversification with your capacity to stay informed about key developments, updates, and market movements for each token or coin.

- Never neglect DYOR: Research every asset thoroughly, paying close attention to tokenomics and long-term potential. Doing Your Own Research (DYOR) is essential.

- Don't forget to rebalance: A neglected portfolio accumulates risk over time as market conditions change. Adjust allocations periodically to trim underperformers and capitalize on new opportunities. Check out our rebalancing guide here.

Wrapping up

Diversifying your crypto portfolio across different tokens, sectors, and strategies is a fundamental practice to manage risk, optimize returns, and weather market volatility. Remember, this is not a one-time task; regularly rebalancing your holdings is crucial to ensure your investments stay aligned with your risk tolerance and long-term goals.