Yield-bearing stablecoins: Your guide to risk, reward, and access

Stablecoins have evolved beyond simple digital vaults for preserving capital. While giants like USDT and USDC merely maintain a peg to the US dollar, a new wave of assets is breaking the mold — they actually help your money grow.

Yield-bearing stablecoins are rewriting the rules, turning holdings into a dynamic source of passive income. Let's dive into how they work, what you can realistically earn, and the potential pitfalls you can't afford to ignore.

What exactly are yield-bearing stablecoins?

Think of these as the savvy, productive cousins of traditional stablecoins. They still hold the crucial 1:1 peg to fiat or conventional assets, but they have a secret superpower: quietly generating a yield in the background.

Simply by holding them, you earn returns powered by everything from on-chain loans to real-world US Treasury bills. But here’s the catch: access, safety, and redemption terms vary wildly. The potential is huge, but so is the need for due diligence.

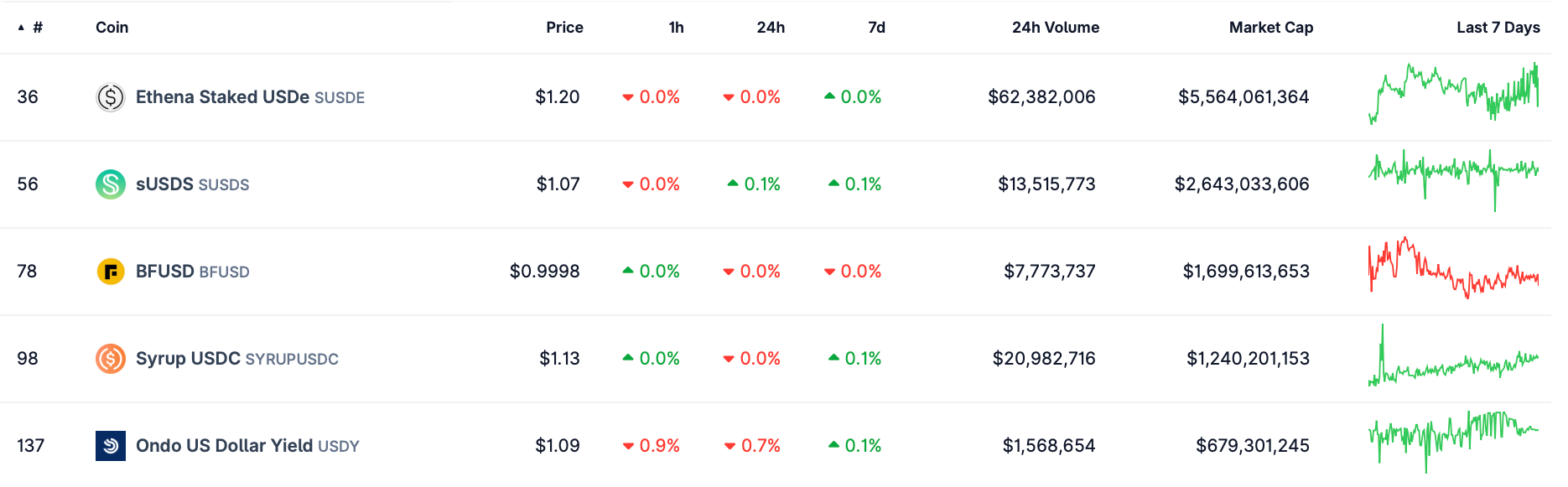

Glimpse at the front-runners

This niche is growing fast. While these assets currently make up about 4.5% of the total stablecoin market, their supply has rocketed — from a modest $1.5 billion in early 2024 to a staggering $15 billion.

- sUSDe (Ethena): A synthetic dollar backed by crypto collateral and hedged derivatives; generates a high yield via a complex strategy of staking ether (ETH) and shorting futures contracts. Significant returns come with unique de-peg and funding risks. Full name: Ethena Staked USDe.

- sUSDS (Sky): A stablecoin savings token representing a new version of Sky Protocol's sDAI, offering a higher yield; represents USDS deposited into it and earning the Sky Savings Rate.

- bfUSD (Binance): A stablecoin generating yield through Binance's delta-hedging strategy (holding long positions in the Spot market and simultaneously opening short positions in the Futures market).

- SYRUPUSDC (Maple Finance): Allows DeFi lenders to leverage their capital to earn yield — generated from fixed rate, overcollateralised loans to institutional borrowers. Powered by Syrup, Maple Finance's DeFi platform. Full name: Syrup USDC.

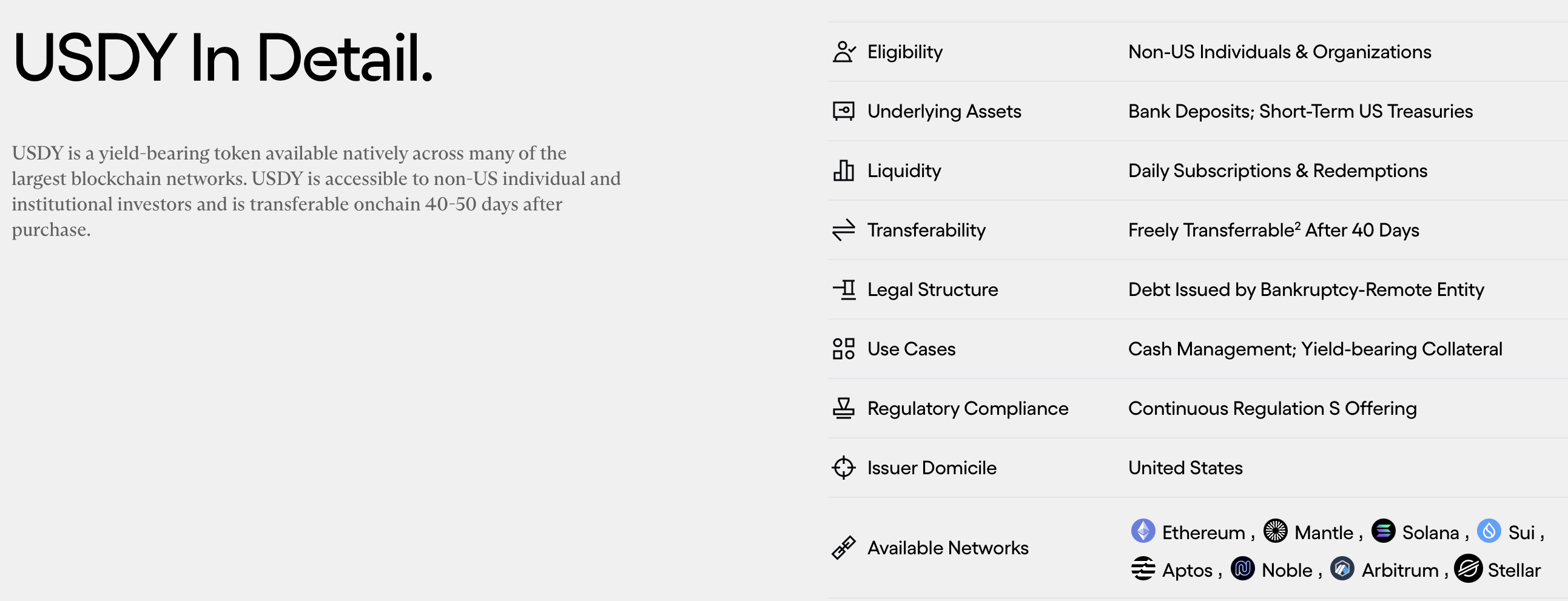

- USDY (Ondo Finance): Backed 1:1 by short-term US Treasury notes and bank deposits. Your yield accumulates automatically — just sit back and watch it grow. Full name: Ondo US Dollar Yield.

- USDM (Mountain Protocol): The "first permissionless yield-bearing stablecoin," backed by US Treasury bills with a clever "rebasing" design. The token price stays fixed at $1, while your wallet balance creeps up daily to reflect your earned interest.

- OUSD (Origin Protocol): A DeFi-native option, backed by a basket of stablecoins (like USDT and USDC) put to work in yield-generating strategies on platforms like Aave and Convex. Your rewards are auto-distributed. Full name: Origin Dollar.

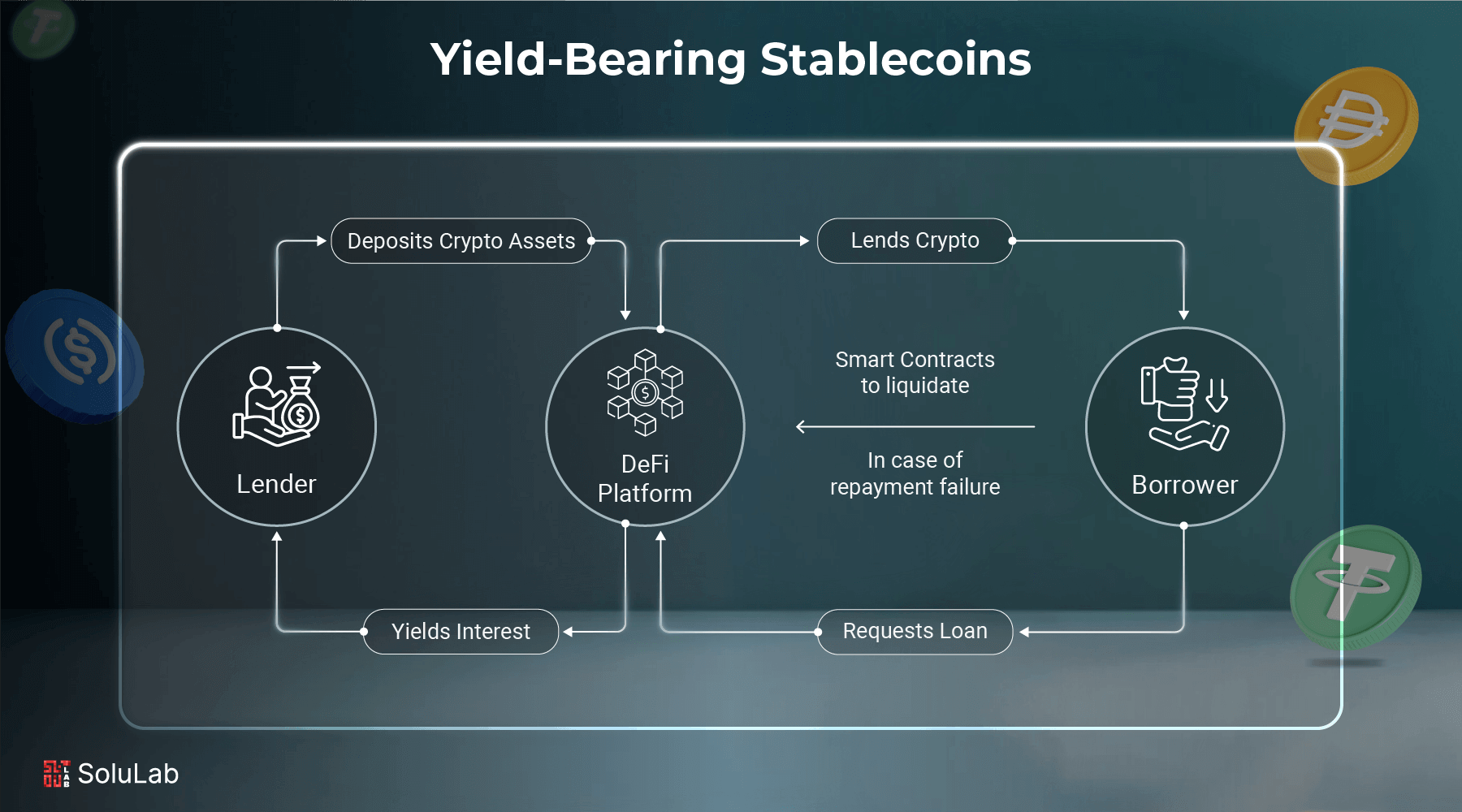

How do these stablecoins actually generate yield?

In short, they put the underlying assets to work. Instead of sitting idle in a digital wallet, the capital is deployed into income-generating activities.

- Real-world assets (RWA): The stablecoin is backed by traditional finance (TradFi) assets like US Treasury bills. You're essentially holding a blockchain version of a money-market fund. The interest generated is passed to you, offering returns similar to treasury yields (around 4–5% in 2025).

- DeFi lending: The project lends its underlying capital on decentralized platforms like Aave or Compound. Your yield comes from the interest paid by borrowers. Yields typically range from 3 to 10% APY.

- DeFi savings wrappers: Protocols like Sky (formerly MakerDAO) let you lock DAI into a savings module, which wraps it into a token like sDAI. Your balance then grows automatically. Rates, set by community governance, have hovered around 3–5% in 2025.

- Liquidity provision: Funds are staked in DEX liquidity pools to earn a cut of trading fees and incentive rewards. Yields typically range from 3 to 10% APY.

- Synthetic yield models: These more complex models blend staking with crypto derivatives, offering potentially higher payouts (5–15%+), but with much greater volatility and dependence on market conditions.

For you, the holder, earning is beautifully simple: the interest accrues automatically. No complex steps are required.

Do you really need yield-generating stablecoins?

These digital assets offer a tempting blend of cash-like stability and crypto-native returns. But this comes with extra complexity under the hood. Returns can fluctuate with the market, and you're exposed to risks like smart contract bugs and liquidity crunches.

4-step blueprint to passive income

Remember: allocate a modest portion of your portfolio, diversify across different issuers and models, and always have a clear exit strategy.

Pick your type

- Risk-averse? Look to tokenized treasuries (e.g., USDY, USDM).

- Comfortable with on-chain risk? Explore DeFi wrappers like sDAI.

- Chasing higher returns? Synthetic stablecoins like sUSDe offer a higher risk/reward ratio for seasoned players.

Make the purchase

The easiest way to buy is on centralized exchanges (CEXs), but access varies by location. For instance, US retail investors are often barred from tokenized treasury products, as regulators may treat them as securities. You can sometimes buy directly from the issuing protocol, but most action happens on secondary markets.

Hold and watch it grow

This is the magic part. Simply holding these tokens in your wallet is enough. Your balance will either be "rebased" (increased daily) or its value will grow through a wrapped token mechanism.

Layer for extra yield (advanced)

For those comfortable with more risk, you can "layer" your strategy. Use your yield-bearing stablecoins as collateral in lending markets or provide liquidity in DeFi pools to potentially amplify your returns.

Your due diligence checklist

Don't buy a single token until you've checked these boxes:

- Issuer & jurisdiction: Where is the company based? What licenses does it hold, and who regulates it?

- Eligibility: Is the asset available to residents in your country?

- Reserves & proof: Are there regular, reputable audits? For RWA tokens, who holds the assets? For DeFi tokens, are the smart contracts and fund flows transparent?

- Smart contract security: Has the code been audited by top firms? Is there an active bug bounty program? Any history of exploits?

- Liquidity: Where does the token trade? How easily can you exit a large position (say, $100k) without massive slippage?

- Redemption: How do you cash out directly with the issuer? How long does it take, and what are the fees?

- Governance (for DeFi): Can community votes suddenly change your interest rate?

The tax man cometh

Always consult a qualified tax professional. In most places, the yield you earn is considered taxable income the moment it's credited to you.

Accurate reporting can be a headache, requiring meticulous records of every rebase or token credit. Many tax authorities treat these as income upon receipt. Selling your tokens can also trigger capital gains taxes.

- In the United States, the IRS treats staking rewards as ordinary income when you receive them. Selling also creates a capital gains/loss event. Keep detailed records of your cost basis for each wallet.

- In the EU & UK, local income and capital gains rules apply. Keep an eye on new reporting rules like DAC8 and OECD CARF, which will force platforms to report user activity across jurisdictions starting in 2026.

Wrapping up the risks

No stablecoin is a fortress. Be prepared for these potential trade-offs.

- Smart contract hacks. Your funds live in code. A single bug or exploit can drain the reserves, and even multiple audits aren't a foolproof guarantee.

- Regulatory whiplash. Many of these assets exist in a gray zone. If they're classified as securities, your access could be restricted or revoked overnight.

- Shrinking yields. Returns are not set in stone. When T-bill yields fall, so do the payouts from treasury-backed stablecoins. In DeFi, yields can evaporate if borrowing demand dries up.

- Issuer mismanagement. You're trusting the team to manage the underlying assets responsibly. Human error or poor judgment can break the peg.

- Liquidity shortages. This is a young asset class. If you need to sell a large amount in a thin market, you might struggle to find a buyer without taking a significant price hit.

Stability with a pulse

Yield-bearing stablecoins offer a compelling blend of the stability we expect from cash with the growth potential of a dynamic asset. They are, in essence, giving your digital dollars a job. Capital parked on the sidelines can finally work for you, but this extra yield is not a free lunch — it's a reward for accepting additional complexity and risk.

Success in this space is about diligent research, measured allocation, and a clear understanding of how your chosen stablecoin actually works under the hood. Tread thoughtfully, diversify your holdings, and never invest more than you're prepared to lose.