Clapp Weekly: $100k Bitcoin, DeFi debt crisis, privacy coin boom

BTC price

Bitcoin has extended gains after the first red October (-3.69%) since 2018. Its price dropped to $100k earlier today, pressured by macro concerns and forced liquidations amid a DeFi debt crisis. Spot ETFs saw five straight outflow days totalling over $1.3 billion.

The BTC price dropped from $113k to $106,786 on Thursday, October 30, and recovered slightly to spend the weekend at $110k. On Monday, November 3, the collapse resumed, culminating in a low of $99,600 on Wednesday, November 5.

Currently at $101,735, BTC has lost 3.0% over the past 24 hours and 9.5% over the past 7 days.

ETH price

Ether shed over 20% on Tuesday, extending losses in a rout reminiscent of "Black Friday." Traders were buying the dip while ETFs bled — Monday outflows of $359 million were the third-largest since October. Ether's continuing plunge over the past 24 hours has wiped out $605 million in leveraged longs.

ETH has followed BTC closely, initially dropping from $4k to $3,707.61 on Thursday, October 30, and spending the weekend above $3.8k. It lost steam on Monday, November 3, and bottomed out at $3,162.43 earlier today.

Currently at $3,330.87, ETH has lost 5.2% over the past 24 hours and 16.6% over the past 7 days.

Seven-day altcoin dynamics

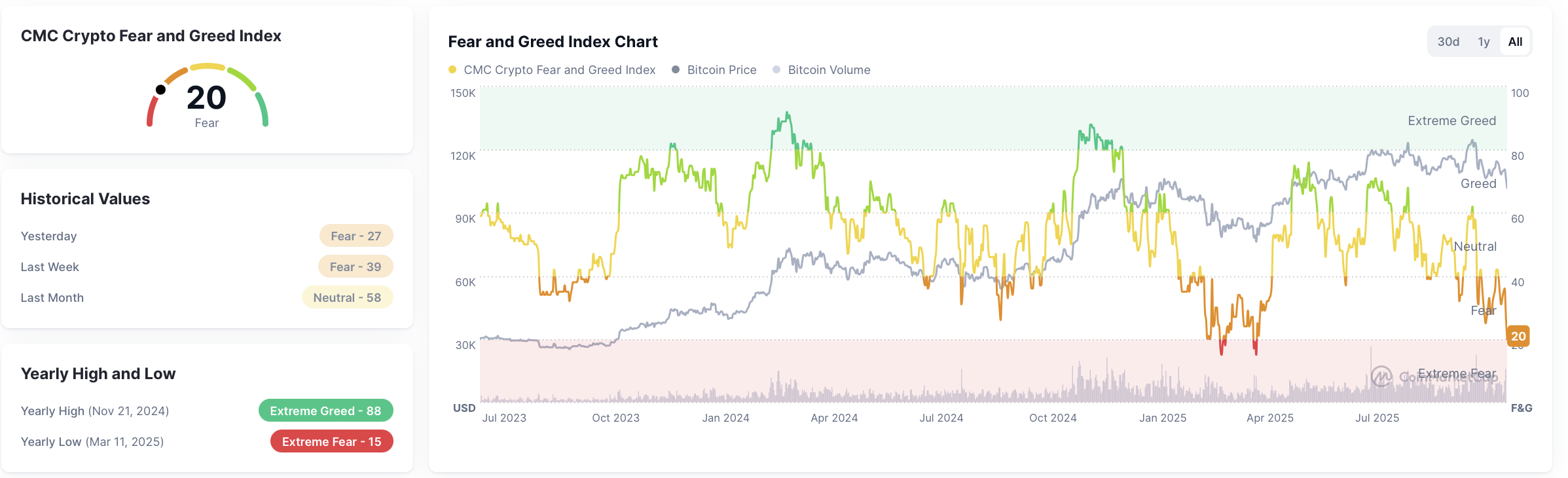

Cryptocurrencies extended Monday’s losses on Tuesday morning as Bitcoin slipped below $104,000, hitting its late June levels — followed by a sub-$100k dip earlier today. Sentiment has been in the Fear zone for six consecutive days.

The market has faced $2 billion in forced futures liquidations in 24 hours — one of the largest deleveraging events since September.

Analysts link the sell-off to DeFi contagion fears and macro unease. The DeFi sector has accumulated $284 million in bad debt, with Stream finance disclosing $93 million in fund asset losses on Monday, November 3. Investor confidence had already been shaken by a $128 million Balancer exploit and the impact of Black Friday liquidations.

Amid the broader slump, privacy coins posted double-digit gains as investors flee from growing Bitcoin scrutiny.

- Dash (DASH) saw record whale accumulation — the top 100 addresses now hold 37% of its supply.

- Other anonymity-focused tokens Decred (DCR) (+139.1%), Horizen (ZEN) (+58.7%), and Secret (SCRT) (+30.6%), also joined the rally.

- Zcash (ZEC), the strongest performer in the group, has gained +30.4% over the last week.

ZEC's dominance is attributed to its fusion of Bitcoin-like fundamentals (capped supply and Proof-of-work consensus) and privacy focus. The latter is becoming “increasingly important as Bitcoin gains mainstream... adoption,” according to TYMIO founder Georgii Verbitskii.

Weekly winners

- DASH (+145.0%) is leading the privacy coin sector, with its market cap surpassing $1.8 billion amid strong momentum.

- ICP (+68%) rallied on leverage-driven buying after key ecosystem news from the Dfinity Foundation confirmed the launch of Caffeine, an AI product that builds applications from scratch and processes text, image, and code prompts.

- ZEC (+31.9%) remains the long-term leader in the privacy rally, up 700% since September and approaching the top 20 by market cap. Sentiment is supported by Arthur Hayes’ prediction of a four-digit price if the current momentum continues.

Weekly losers

- ENA (-29.0%) faced pressure from today's $63.05 million token unlock, releasing 2.52% of its total supply. Given Ethena’s relatively small circulating supply, this represents a significant amount of new tokens for the market to absorb at once.

- IP (-28.0%) followed the broader downtrend and Bitcoin's trajectory due to a lack of supportive news catalysts.

- OKB (-24.2%) succumbed to the downturn, losing stability previously fueled by an extended partnership with Standard Chartered, which unlocked MiCA-compliant crypto custody services in Europe.

Cryptocurrency news

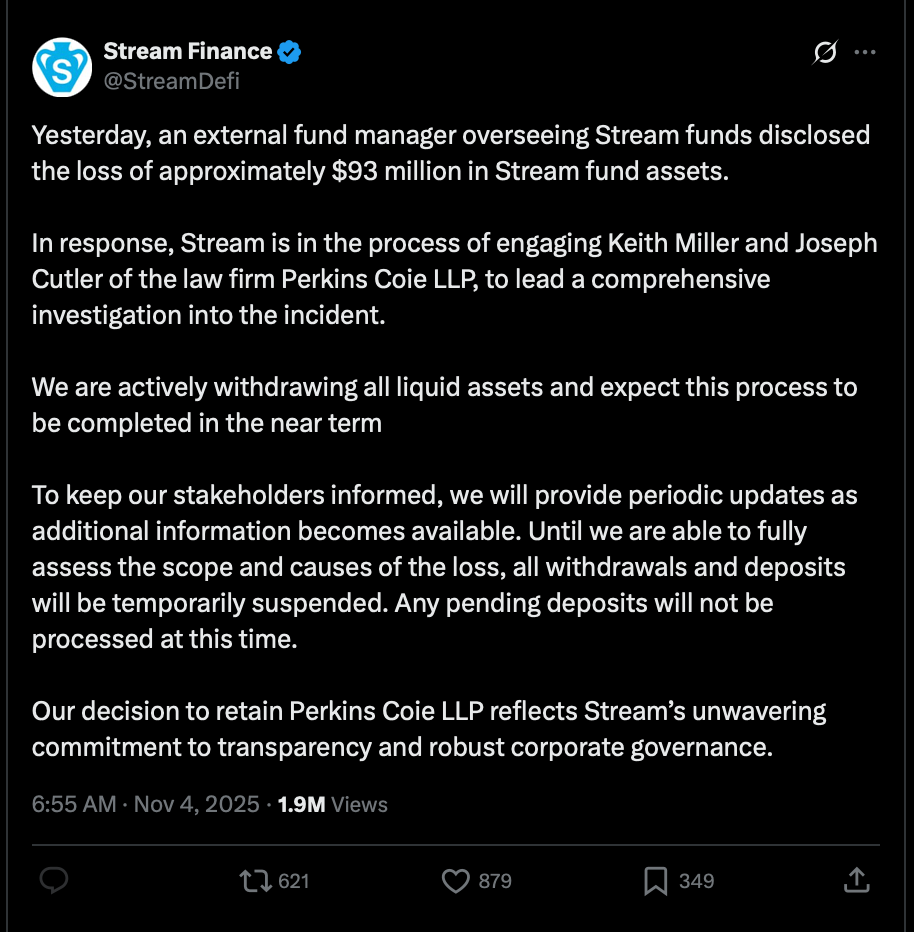

DeFi's house of cards: $93M Stream Finance implosion

On Monday, November 3, Stream Finance disclosed that an external fund manager overseeing its funds had lost roughly $93 million in user assets. The platform, positioned as "the SuperApp DeFi deserves," froze all user withdrawals, triggering a 77% crash in the price of its flagship stablecoin, Staked Stream USD (xUSD).

The case exposed critical vulnerabilities in DeFi's interconnected lending ecosystem. As xUSD depegged, the promise of a stable digital dollar for its holders evaporated overnight — but the real story lies in the wreckage left behind.

The manager's error was not an isolated incident. This collapse exposed a sprawling web of debt totaling a staggering $285 million. Stream's debt extends across at least seven networks and involve key counterparties like Elixir, MEV Capital, and TelosC, according to analysts at Yields and More.

How did one failure cause so much damage?

In its quest for high yields, Stream Finance employed a "recursive looping" strategy. In simple terms, this means the protocol repeatedly borrowed against its own assets to amplify returns. It then created synthetic tokens — xUSD, xBTC, xETH — and used them as collateral across a network of other major DeFi lending platforms like Euler, Silo, and Morpho.

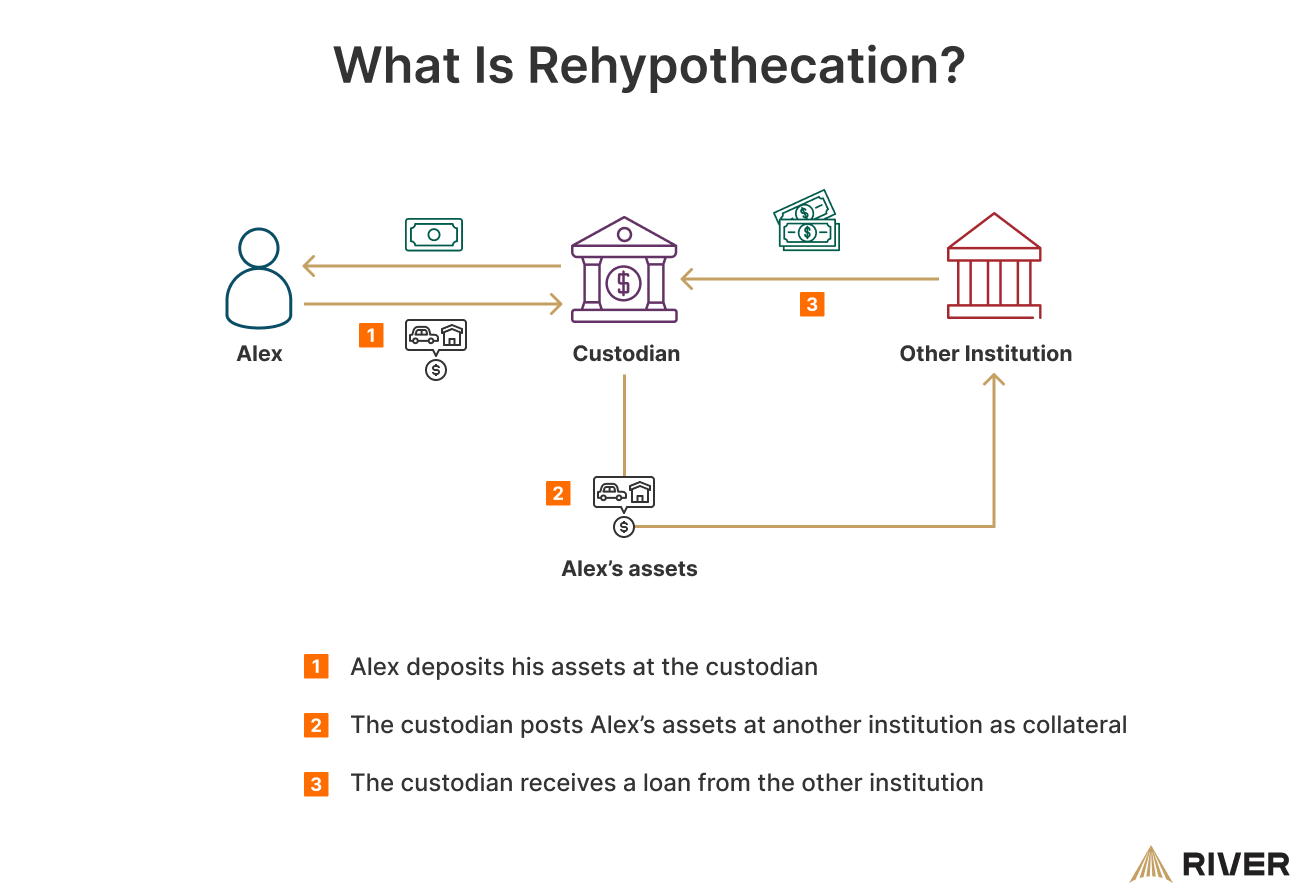

This is where rehypothecation comes in. Stream’s xAssets were passed around and reused across the DeFi landscape, tying multiple protocols together in a chain of dependency. This is like using the same house as collateral for a dozen different bank loans at once.

When the $93 million anchor was pulled, the entire chain snapped. Major lenders like Elixir and TelosC, who had lent hundreds of millions against these now-devalued xAssets, found themselves dangerously exposed. Elixir, for instance, had 65% of its own stablecoin's backing tied up in loans to Stream.

The weakest link isn't always code

The Stream Finance collapse underscores a critical evolution in DeFi risk. As Deddy Lavid of Cyvers told Decrypt, "operational risk extends beyond smart contracts." The breach wasn't in an immutable piece of code; it was in fallible, human-driven processes — an external fund manager, off-chain custody, and a lack of transparency.

This event, following closely on the heels of the Balancer and Moonwell exploits, is a brutal reminder that one protocol's failure can quickly become everyone’s problem. The pursuit of yield in DeFi often involves navigating a labyrinth of interconnected strategies. When one corridor collapses, it’s not always clear who will be trapped in the rubble.

Great privacy awakening: Zcash is surging as a Bitcoin alternative

While Bitcoin stumbles below $100k, its privacy-focused cousin, Zcash (ZEC), has skyrocketed over 1,000% this year. This surge is a market-wide vote of no confidence in the increasingly transparent and regulated state of digital finance.

Zcash is championing the very cypherpunk principles upon which cryptocurrency was founded. Now, it is emerging as a spiritual successor to Bitcoin for a growing cohort of users, as confirmed by a Galaxy Digital report.

Bitcoin's transparency problem

The issue isn't Bitcoin's technology, but its trajectory. The proliferation of Bitcoin ETFs, while driving adoption, has tethered the asset to a world of centralized custodians and regulated intermediaries. As Galaxy's Will Owens notes,

“Bitcoin itself has always been fully transparent; ETFs haven’t made it any less so, only more intermediated.”

This, combined with "mounting regulatory pressure" on Bitcoin privacy tools like Samourai Wallet and Wasabi, has created a vacuum. Investors and users seeking financial sovereignty are now looking for a viable alternative that embeds privacy at its core.

Zcash's "encrypted Bitcoin" advantage

Zcash is a 2016 fork of Bitcoin’s codebase that inherits its 21 million supply cap and proof-of-work model. Its key innovation is its "shielded" transactions, powered by zero-knowledge proofs, which allow users to encrypt transaction details on the blockchain.

This positions Zcash as what advocates call "encrypted Bitcoin," directly addressing the privacy limitations that even Satoshi Nakamoto acknowledged. Crucially, Zcash’s privacy is opt-in, a feature that experts from BlockSpaceForce note "fits better than Monero with the current regulatory environment."

This distinction may be key to its survival and growth amidst a crackdown on mandatory-privacy coins.

Perfect storm of catalysts

The rally is fueled by more than just ideology. A convergence of factors has created a perfect storm:

- Vocal endorsements from crypto heavyweights like Arthur Hayes, Mert Mumtaz, and Naval Ravikant.

- Impending EU ban on anonymous cryptocurrencies in 2027. Investors are betting on the necessity of privacy tools before they become scarce on major exchanges.

- Technical momentum propelled by a new developer roadmap, the launch of the Zashi wallet, and a growing "shielded pool." As Mumtaz and others have highlighted, the larger this pool grows (now at 30% of supply), the stronger the privacy for all its users.

As financial surveillance expands, both from regulators and within the crypto ecosystem itself, the demand for verifiable, user-controlled privacy is not a niche concern. It is a fundamental prerequisite for the future of digital freedom — and Zcash’s meteoric rise is the most potent signal yet that the cypherpunks are back.