Clapp Weekly: Extreme fear, jobs surprise, Visa's USDC pilot

BTC price

Bitcoin is recovering from Monday’s plunge to $86k, but liquidity remains thin and sentiment is fragile. Institutional demand is also drying up, with US spot ETFs down about $225 million net in December after a peak daily outflow of $357.6 million. K33 analyst Vetle Lunde notes that failure to catch up with stocks could trigger rebalancing-led buying in January.

The BTC price crashed from nearly $93k to $89,463.23 on Thursday, December 11, recouped the losses, and revisited $89k the next day. On Sunday, December 14, it slipped to $88,230.77 before edging up and then sinking to Monday's low of $85,704.71.

At press time, BTC is trading at $87,444 with a 24-hour gain of 1.6% and a seven-day loss of 5.8%.

ETH price

Ether held up better than many smaller tokens — suggesting selective risk-taking — but eventually gave in to the sell-off. Two anonymous whales sold $40.8 million worth of ETH within hours on December 15, while the number of weekly active addresses fell to May levels. US spot ether ETFs saw a $224 million single-day redemption.

The price crashed from $3,386 to $3,160.53 on Thursday, December 11, struggled to hold $3.2k, and sank to $3,071.04 on Friday, December 12. From there, ETH hovered around $3.1k through the weekend and touched $3,156.13 before a sharp collapse below $3k.

Currently, ETH is changing hands at $2,931.06 with a 24-hour gain of 0.7% and a weekly loss of 11.5%.

Seven-day altcoin dynamics

With fatigue spread across risk assets, Wintermute notes that both stocks and crypto are “digesting macro uncertainty rather than entering a sustained risk-off phase.” Investors are spooked by "Black Friday" flashbacks, an overcooked stock market, and the Fed's mixed signals. The Fear and Greed Index has nosedived back to 11/100 — an Extreme Fear reading last seen on November 22.

Fed hesitation fuels fear, jobs data gives hope

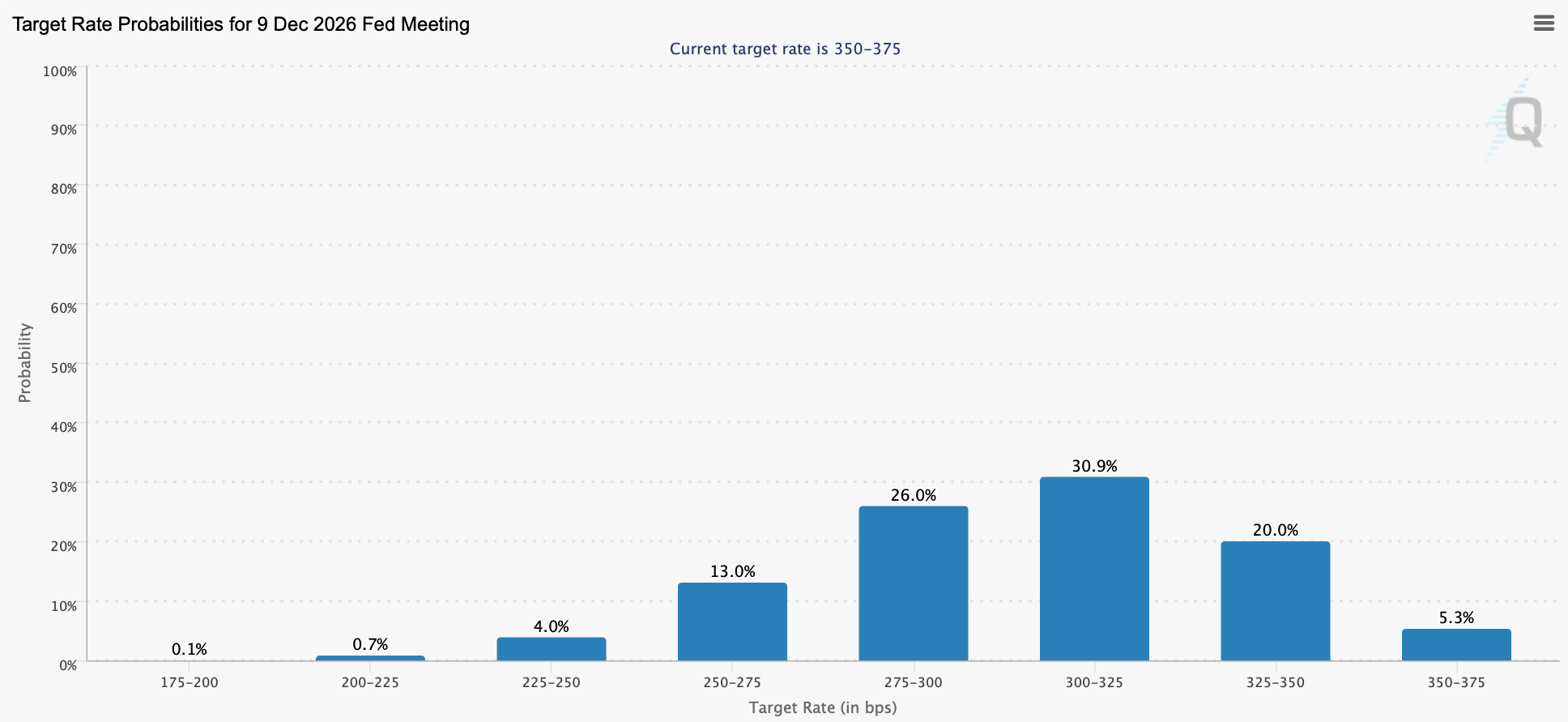

While last week’s FOMC meeting delivered an anticipated 25-basis-point cut, it failed to ignite crypto momentum. Forward guidance turned sharply cautious — the Fed’s new projections show just a single rate cut in all of 2026, fewer than many investors had priced in.

However, markets expect closer to three cuts, revealing a gap between investor positioning and the agency’s signals. Institutions are also pulling back to cut risk — US spot crypto ETFs (both Bitcoin and ether) saw their highest outflows in over two weeks.

The November US jobs report, released yesterday, showed the unemployment rate came in worse than expected — at 4.6% versus the forecasted 4.5%. Furthermore, the economy added almost no jobs since April. Signs of a stalled market could trigger bullish macro dynamics (read more below).

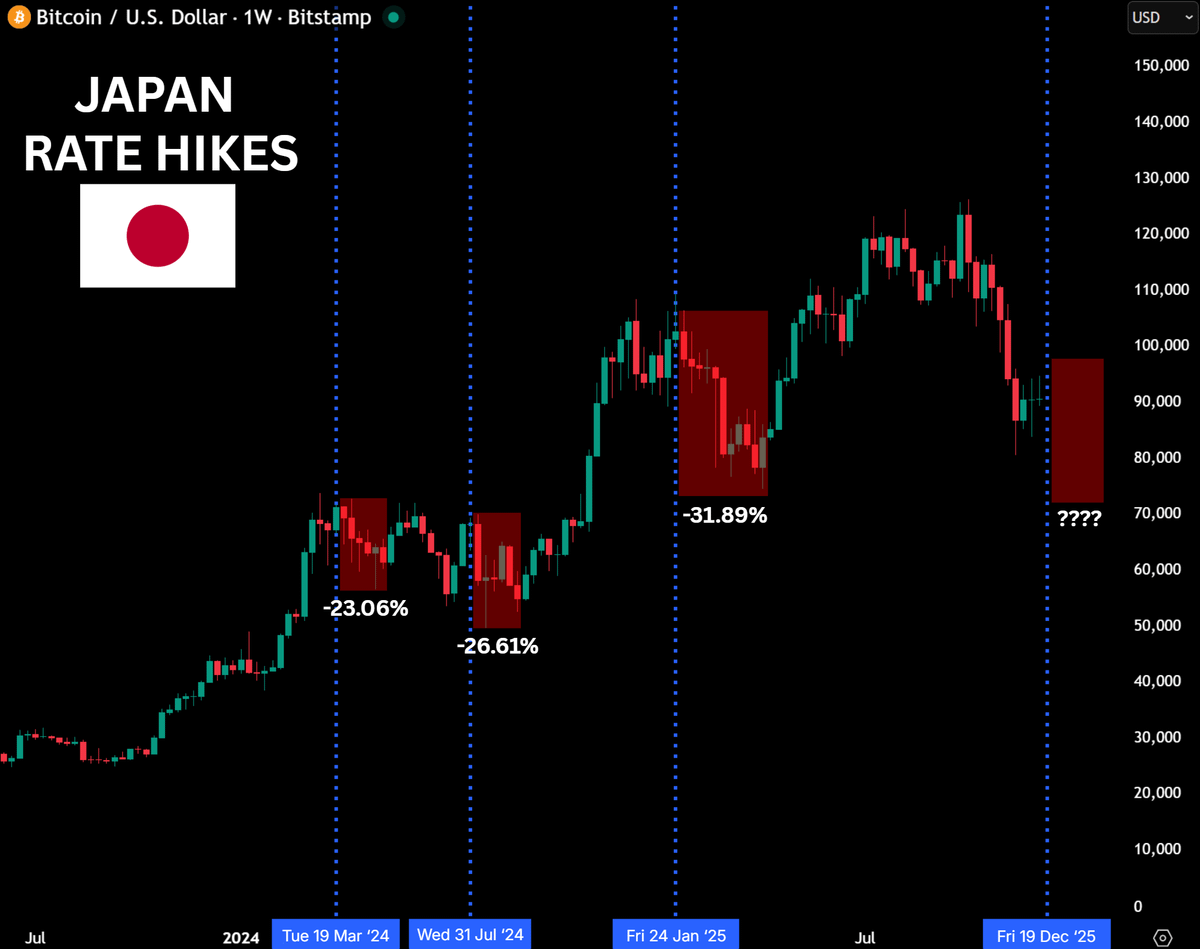

BOJ hike fears

The Bank of Japan’s potential rate hike on December 19 also exacerbates the anxiety. Concerns over liquidity and the yen carry trade are not the only drivers — the central bank also plans to unwind more than $500 billion in ETF holdings.

Some analysts warn that Bitcoin could drop toward the $70k mark if the hike is approved. AndrewBTC has estimated that every BOJ hike since 2024 coincided with double-digit BTC drawdowns — roughly 23% in March 2024, 26% in July 2024, and 31% in January 2025.

Weekly winners

- NIGHT (+35.4%) soared almost 200% in its first 24 hours after its December 9 launch, as the privacy narrative heated up under EU regulatory pressure. On the first full day, the token of Cardano’s “partner chain” saw its market cap balloon above $1.2 billion with over $320 million in trading volume.

- M (+19.4%) broke its slumber after the team directed $300 million into MemeMax, its first DEX for perp trading. This move signals that it will likely become the ecosystem's core trading hub, with buybacks and rewards designed to drive demand.

- MNT (+13.8%) is supported by an upgrade to mETH Protocol's Buffer Pools liquid staking mechanism, which provides institutional liquidity on demand. The ecosystem project, incubated under Mantle, now offers roughly 24-hour redemptions via a dual-liquidity pathway. However, retail demand remains suppressed.

Weekly losers

- PUMP (-24.3%) plunged as a whale pulled out $6.3 million worth of tokens, although buybacks absorbed some of the sell-side flow. Large holders are visibly capitulating amid the broader market downturn.

- ENA (-22.3%) followed the broader market decline, failing to regain momentum even after the team withdrew $7.1 million worth of ENA from Bybit — a move reflecting continued confidence. This aggressive accumulation was not sufficient to defy the market-wide pressure.

- ASTER (-19.6%) is also struggling to rebound, pressured by Stage 3 airdrop unlocks that released tokens without vesting. Sellers appeared to ignore the launch of Shield Mode, a protected feature for high-leverage perp traders. Whale losses on the platform have now reached over $35.8 million.

Cryptocurrency news

Jobs report surprise — Bitcoin rally incoming?

A sharp cooling in the US labor market has economists and crypto traders alike parsing the data for clues on the Federal Reserve’s next move — and its potential to ignite Bitcoin’s next leg up.

The latest Nonfarm Payrolls (NFP) report delivered a one-two punch: a staggering loss of 105,000 jobs in October, followed by a modest gain of 64,000 in November. More critically, the unemployment rate jumped to 4.6%, its highest level since September 2021. Analysts note that “only healthcare and construction were hiring” while other sectors flatline.

🚨 Just In: November Nonfarm Payrolls rise 64,000, above expectations for 40,000.

— Jesse Cohen (@JesseCohenInv) December 16, 2025

The U.S. Unemployment Rate rose from 4.4% to 4.6%, worse than estimates for 4.5%.

What will Jerome Powell do now? pic.twitter.com/kFozsmOsgh

What does persistent weakening mean for Bitcoin?

For Bitcoin as a risk asset, this softness is being interpreted through the lens of impending stimulus. A cooling labor market gives the Fed more justification to ease monetary policy. Bull Theory suggests this data could force the Fed to "do more easing in 2026," including additional rate cuts and liquidity measures beyond what was signaled last week.

This expectation of renewed liquidity is what crypto markets are betting on. Prominent trader Michaël van de Poppe framed it clearly, stating he is “obviously bullish” on scarce assets like Bitcoin because “the money printer is inevitably going to be fired on.”

The initial market reaction supports this thesis. Bitcoin quickly bounced from its recent slump, adding nearly 2% to trade near $88,000 in the hours following the data release.

However, it’s a delicate balance. While hopes for Fed accommodation can fuel a rally, the underlying cause — economic weakness — also carries risk. If the data points toward a deeper recession, the resulting fear could dampen appetite for all volatile assets, including crypto.

Visa scales stablecoin settlement to US with USDC

Visa is building a bridge. This week, the global payments titan announced it is formally expanding its stablecoin settlement pilot to the United States, a strategic move signalling a shift in how TradFi intends to interface with blockchain infrastructure.

This is operational scaling

Starting with banking partners Cross River Bank and Lead Bank, Visa will now settle obligations in USDC over the Solana blockchain for its US network. The value proposition is rooted in tangible efficiency gains:

- near-instant fund movement

- settlement seven days a week (breaking the five-day banking week)

- more predictable liquidity management

For treasury and fintech teams, this modernizes a core back-office function. The front-end experience remains unchanged for consumers, but the backbone of value movement is getting a fundamental upgrade.

The next logical step for Visa

Visa has been meticulously building towards this since 2021, with formal global pilots launching in 2023. The program has already achieved significant volume, eclipsing a $3.5 billion annualized run rate as of late November. A broader rollout to more partners is expected through 2026.

Crucially, this is a demand-driven shift. "Our banking partners are not only asking for it – they’re preparing to use it,” stated Visa's Rubail Birwadker. The initiative deepens Visa's integration with Circle, not just as a user of USDC but as a lead design partner for Circle's upcoming Arc blockchain, on which Visa plans to settle and even operate a validator node.

Stablecoin settlement is transitioning from a niche crypto concept to a bank-ready capability for one of the world's largest financial networks. Visa is proving that blockchain rails can meet the security, compliance, and scale demands of mainstream finance, starting with the plumbing.