Clapp Weekly: Markets on Fed hold, Ripple's $40B valuation, SEC to 'unbundle' crypto

BTC price

Bitcoin is back near $92k as the market stabilizes, but demand lags and caution prevails ahead of today's Fed decision; on-chain activity points to a holding pattern. However, US spot ETFs reversed to a daily net inflow of $287.18 million yesterday — a promising shift after $1.1 billion in weekly redemptions throughout November.

The BTC price slipped from $93k on Thursday, December 4, hit $88,838.81, edged back to $89k, then plunged to $88,202.39 on Sunday, December 7. Rebounding, BTC seesawed again — falling from $92k to $90k and topping out at $94,267.18 yesterday.

Currently trading at $92,615.71, BTC has gained 2.4% over the past 24 hours but remains down 0.2% over the past week.

ETH price

Ether is outpacing Bitcoin after BlackRock's filing for the iShares Ethereum Staking Trust, which revived optimism around institutional inflows. Whales are accumulating, with nearly 400k ETH purchased between Sunday and Monday. The ETH/BTC ratio, at its highest level since late October, reveals rotation into the second-largest coin.

The price climbed to $3,222.40 on Thursday, December 4, and dropped below $3k as momentum fizzled. ETH held above this level until Sunday, December 7, when it bottomed out at $2,946.59. After reclaiming $3.1k, ETH rocketed to a high of $3,375.37 yesterday.

Currently at $3,310.94, ETH is up 5.9% over the past 24 hours and is up 9.2% over the past week, surpassing BTC.

Seven-day altcoin dynamics

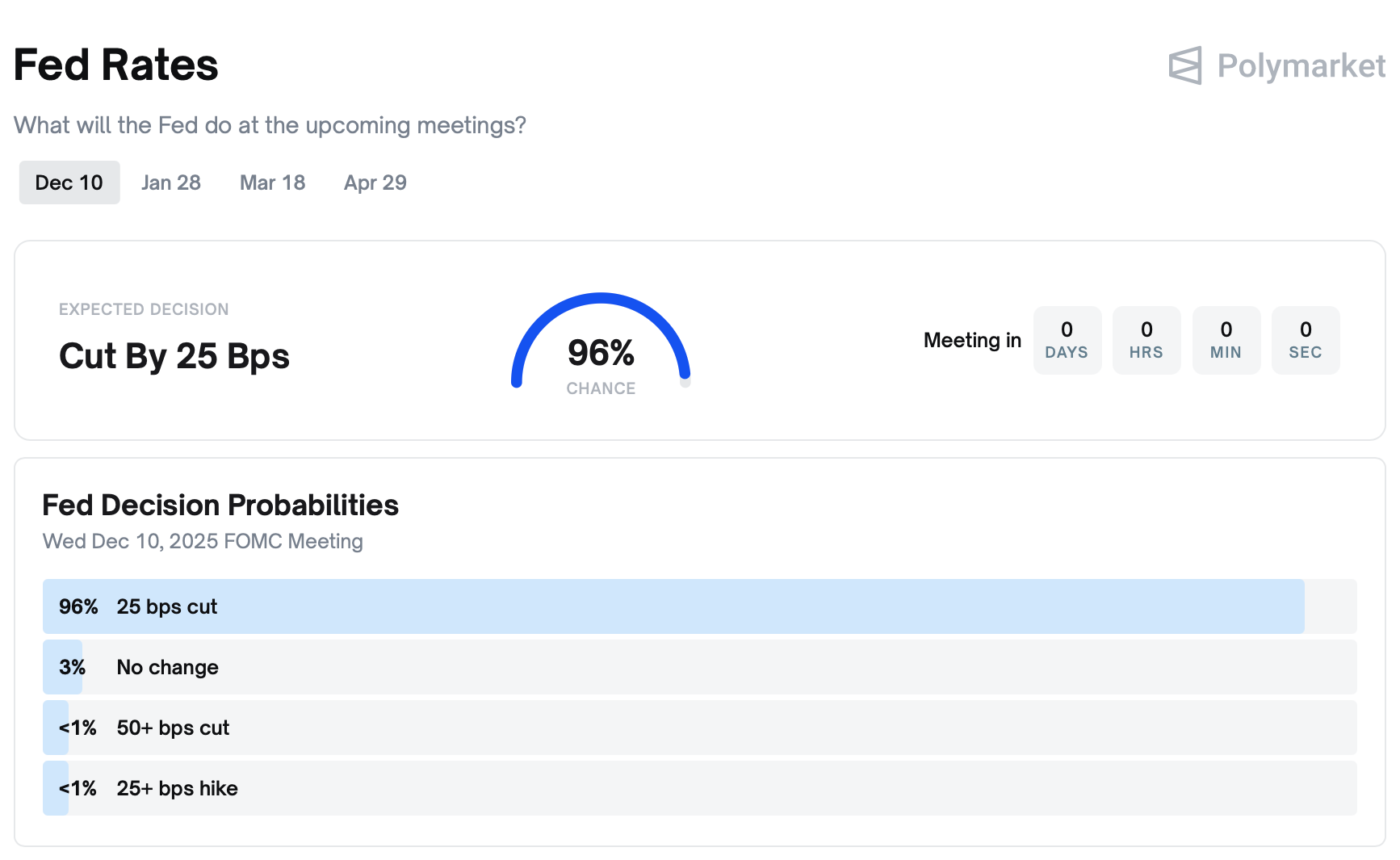

The market is showing hesitation as traders anticipate today's FOMC meeting, expected to result in a quarter-point Fed interest rate cut (87.6% probability on CME FedWatch, 96% on Polymarket). Fear still grips the market (25/100), with no signs of preparation for a broad rebound.

Amid this muted environment, only a few altcoins are rising robustly while the rest appear subdued. Altseason is officially on hold, with the index dipping to 35, as traders favor majors over riskier bets. Market depth in smaller assets remains thin.

Fed decision: Powell's remarks in focus

While a potential 25-bps interest rate cut is likely priced in, market observers will focus on Fed Chair Powell's press conference (2:30 p.m. ET, December 10) for cues on future easing prospects. Dovish hints for 2026 could lift sentiment, while hawkish surprises would spell trouble.

As Crypto Rover explained,

"If Powell sounds dovish and says that inflation is calming, tariffs haven’t changed the trend, and labor is softening, it'll give markets the green light to expect more cuts. But if he sounds hawkish, similar to the last FOMC meeting, Bitcoin and alts will dump."

The third quarter-point cut would bring the interest rate down to a range of 3.50%–3.75%.

BOJ fears likely unfounded

Additional pressure comes from international monetary policy, as the Bank of Japan’s expected rate hike next week fuels 'carry trade' concerns. However, the move is largely priced in, and the scope for a sudden yen surge is limited. Even with the hike, the yield gap between Japanese rates (0.75%) and US rates (post-cut estimate of 3.50%–3.75%) would still be substantial.

Weekly winners

- ZEC (+39.6%) rocketed after Shielded Labs unveiled a detailed dynamic fee market proposal. If implemented, it could fundamentally reshape the network's transaction cost structure, improving scalability and attracting fresh institutional capital.

- HASH (+24.2%) soared after Figure launched an RWA consortium for on-chain finance. The coalition aims to drive adoption of PRIME, a liquid staking token built on the Hastra protocol developed in partnership with Provenance.

- OKB (+11.1%) found support after OKX’s strategic partnership with Deltix to integrate crypto into its trading and research platforms. The alliance provides TradFi players a regulated gateway to crypto, allowing institutions to execute sophisticated strategies using OKX’s order books.

Weekly losers

- HYPE (-14.6%) has dropped to seven-month lows as markets remain cautious ahead of the Fed decision, with traders awaiting stronger volume before calling a bottom.

- QNT (-9.7%) plunged through the past week — a dramatic reversal after a rally driven by strong fundamentals, whale purchases, and declining exchange supply.

- PUMP (-8.1%) is gradually recovering from its December 6 plunge, but the ascent remains choppy.

Cryptocurrency news

Ripple's $40B Wall Street win: Cautious embrace with strings attached

Ripple's landmark $500 million funding round in November has drawn significant interest across Wall Street. Completed at a $40 billion valuation — the highest ever achieved by a private crypto company — it marks a watershed moment for crypto.

Yet the milestone is layered with institutional caution. While attracting giants like Citadel Securities and Fortress Investment Group signals mainstream acceptance, the fine print reveals a hedge against the very volatility that defines the space.

"Synthetic floor" for Wall Street

Investors secured unusually strong protections, treating the deal more like structured credit than a typical growth equity round. The terms include:

- Guaranteed 10% annual return if they sell shares back after 3-4 years

- 25% return if Ripple forces a buyback

- Liquidation preference over existing shareholders

These safeguards create a "synthetic floor" for Wall Street, directly linked to their assessment that over 90% of Ripple's value is tied to its massive XRP holdings.

TradFi is sticking to a calculated, risk-managed approach. It acknowledges Ripple's potential in payments infrastructure while explicitly insulating backers from extreme swings in the XRP token, which is down roughly 40% from its July peak.

The move coincides with a favorable shift in regulatory momentum. Following the clarity from Ripple's court case with the SEC, US spot XRP ETFs have neared $1 billion in inflows.

Ultimately, the deal is a dual narrative: a vote of confidence in Ripple's strategic position and a stark lesson in how TradFi capital adapts its playbook for crypto. For institutional adoption to scale, even the most promising blockchain ventures must conform to conventional frameworks of risk and return.

SEC's Atkins charts path for crypto's regulatory "great unbundling"

SEC Chair Paul Atkins has outlined a plan to exempt the majority of token offerings from the agency's direct oversight. The proposal would treat most initial coin offerings (ICOs) as non-securities transactions — a decisive pivot from the enforcement-heavy approach of the previous administration.

Atkins' framework rests on a four-category taxonomy for digital assets.

- Only one category — tokenized traditional securities — clearly falls under the SEC's purview.

- The other three — network tokens, digital collectibles, and "digital tools" like membership badges — should be regulated by the more hands-off Commodity Futures Trading Commission (CFTC) or state regulators. ICOs would also be considered outside the SEC's jurisdiction.

ICO renaissance coming?

This distinction represents a potential renaissance for ICOs, a fundraising mechanism largely stifled after the 2017 boom by a wave of SEC lawsuits. Atkins argues that "investment contracts can be performed and they can expire," meaning a token's legal status isn't permanent simply because it trades on a blockchain. The goal is to let "innovators... focus on development rather than navigating a maze of regulatory uncertainty."

The practical implication is profound. Projects could raise capital via tokens without automatically facing the SEC's stringent securities registration process, provided they fit the non-security categories.

This "unbundling" of regulation aligns with legislative efforts in Congress and reflects a growing acceptance that a one-size-fits-all securities framework is ill-suited for blockchain-based assets. For the industry, it signals a move from defensive compliance toward a clearer, albeit partitioned, operational runway.