Crypto perpetuals: How do they work?

Perpetual exchanges blend speed, transparency, and self-custody to give traders secure access to amplified leverage and stable pricing. Like futures, these contracts allow speculation on an asset’s price without owning it. Here’s how perpetuals compare to other crypto instruments and what fuels their liquidity and performance.

What are perpetual contracts (perps)?

Perpetual contracts are versatile financial instruments that enable traders to speculate on price swings of an asset without holding the underlying token — most commonly Bitcoin or ether. Traders use them to maintain flexibility while harnessing higher leverage.

While large-cap coins rule the market, a separate category of protocols offers synthetic products tracking gold and other traditional finance (TradFi) assets.

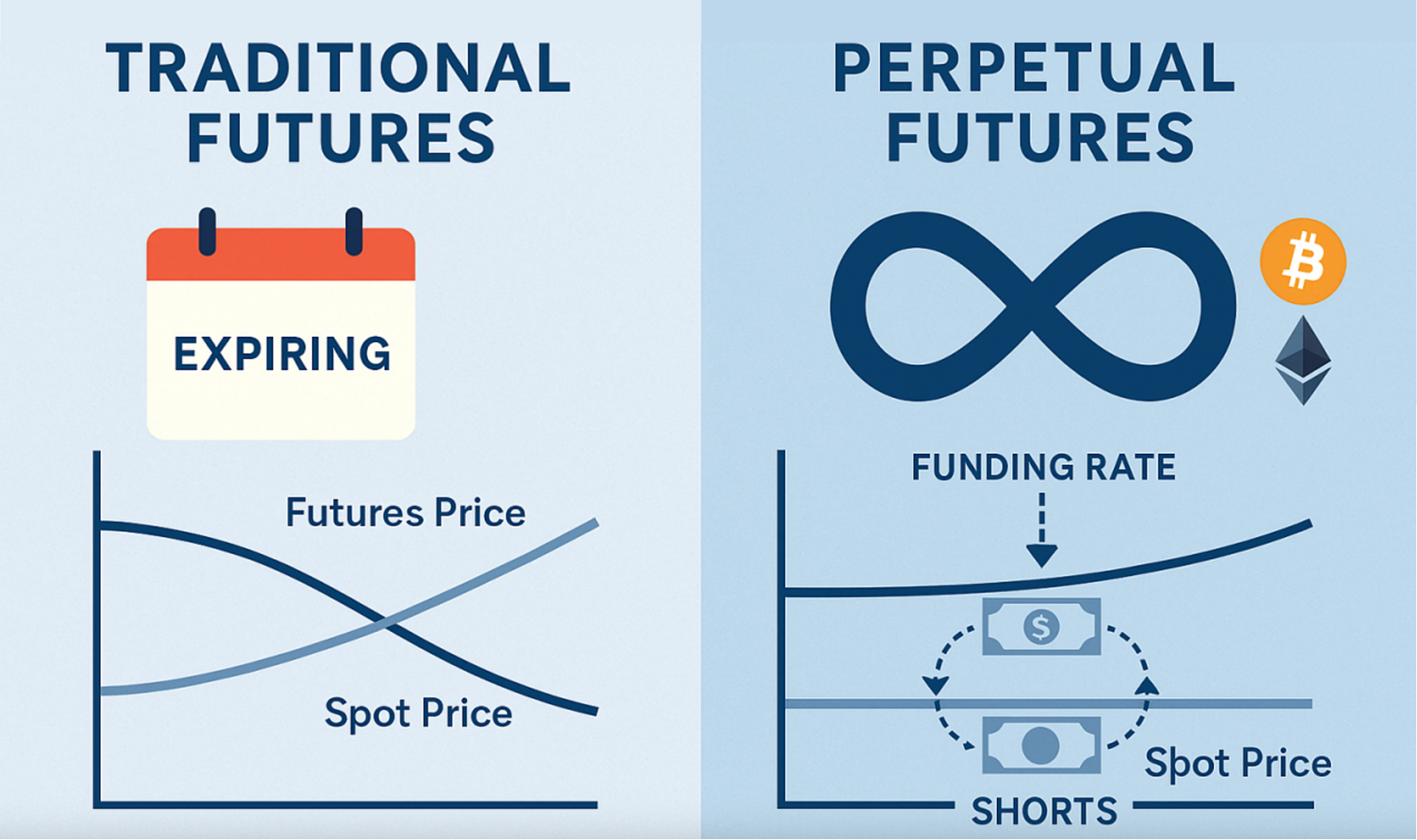

Perps vs. traditional futures

Conventional futures contracts are agreements to buy or sell an underlying asset at a preset price on a preset future date. Perpetuals differ in several key ways:

- No expiration date — Unlike futures, traders can hold positions indefinitely.

- Funding rates keep the contract price aligned with the spot price; futures prices converge to spot as the expiry date approaches.

- Leverage can run as high as 100x, while traditional futures exchanges often offer less.

- Trading happens 24/7; traditional futures trading is confined to standard market hours.

- Contracts reference the current spot price; futures reference a future delivery price.

- Counterparty risk is managed by crypto exchanges through internal risk engines and liquidation mechanisms; futures performance is guaranteed by clearinghouses.

Perps vs. spot trading

Spot trading is the instant exchange of an asset at its current market price. Once a spot trade is complete, you simply own the token. While perps track spot prices, they introduce additional layers of mechanics and risk without ownership.

- Periodic funding payments. Perps use funding rates to anchor the price to spot; spot trading involves no ongoing fees.

- Leverage. Spot trading requires full capital upfront.

- Liquidation risk. In spot trading, it simply does not exist, as you hold the asset outright.

- Speculative nature. Perpetuals are mainly used for speculation, hedging, or complex strategies; spot trades imply direct investment or accumulation.

- Deeper liquidity. Perp markets commonly offer superior liquidity for fast execution, while spot liquidity may vary greatly by asset.

Ultimately, the choice between the two comes down to intent and risk tolerance. Spot trading offers a clearer, more secure path to ownership, while perpetuals provide a dynamic — and riskier — arena for leveraged plays and sophisticated market positioning.

How perpetuals work

Perpetual futures contracts rely on several crucial mechanisms.

Funding rate

As mentioned, funding rates prevent significant split from the spot price. In the absence of expiration dates, traders pay or receive fees at regular intervals to keep prices aligned.

The funding rate, typically paid hourly, also encourages balanced market demand—it incentivizes traders to open positions that receive the fee.

- A negative funding rate means there are more short positions, and those holders pay fees to traders with long positions.

- A positive funding rate means long positions dominate and pay fees to those holding short positions.

Leverage and margin

Leverage can supercharge both profits and losses. Even small price swings can lead to capital depletion and liquidations. Here’s how it works:

Before opening a position, a trader deposits margin — collateral used to cover potential losses if the position is liquidated.

Margin consists of:

- Initial margin (to open the position)

- Maintenance margin (minimum required to keep it open)

The trader can then go long (betting on a price increase) or short (betting on a decline). Leverage allows control of a larger position with less capital.

Example:

A 10x long BTC perpetual with $100 margin lets the trader control a $1,000 position. A 5% price increase yields a 50% gain on the initial capital — $50.

Liquidations

Due to crypto market volatility, a position may no longer meet the maintenance margin requirement based on the entry price and leverage used. This shortfall triggers liquidation — the exchange automatically closes the position to prevent a negative balance. In such cases, the entire margin is typically lost.

In the example above, liquidation could occur after a 10% price drop, wiping out the $1,000 margin. With higher leverage, the liquidation threshold is closer: a 40x leveraged position could be liquidated by just a 2.5% price move.

To enforce margin rules and liquidations, decentralized perpetual exchanges (perp DEXs) use smart contracts, often backed by insurance funds. Centralized exchanges manage liquidations through internal algorithms and external insurance funds.

Risks of perpetual trading

Perp trading has several hazard layers that can amplify losses fast. Navigating them requires a sharp eye and disciplined strategy.

#1 Liquidation risk

The most obvious threat to your capital; liquidation strikes when your account balance dips below the maintenance margin.

Given the speed of market moves, this can lead to rapid, painful capital erosion. To stay safely above the liquidation threshold, traders must carefully monitor margin requirements and their open positions.

#2 Leverage as double-edged sword

Leverage unlocks potential, but it also tightens the margin for error. A minor price swing against a highly leveraged bet can trigger an instant liquidation, closing you out before you can react.

Given the crypto market’s history of sudden, sharp spikes and plummets, one should carefully weigh how much leverage they can stomach.

#3 Slow bleed of funding rates & cumulative costs

Holding a position through multiple funding intervals means these small, regular fees can quietly pile up. Over time, continuous funding payments can drain profitability on longer-term positions.

Savvy traders factor these ongoing costs into their strategy and exit calculations from the start.

Top perp DEXs

Perp trading is exploding beyond exchanges, with crypto wallets MetaMask and Phantom providing in-app access. Mini-app Blum offers the instrument to Telegram's 1 billion active users — but DEXs still dominate the on-chain trading landscape.

- Hyperliquid, a purpose-built Layer-1 blockchain and perp DEX, leverages a custom consensus mechanism, HyperBFT, to churn through orders with impressive speed and minimal fees. The native HYPE token fuels its ecosystem, enabling governance, staking, and user rewards.

- Aster operates across multiple major chains, powered by its proprietary Layer 1, Aster Chain. A key selling point is its integration of zero-knowledge proofs for enhanced privacy and protection against front-running and MEV exploits.

- Lighter delivers a CEX-like order book experience in a fully decentralized package, built as a zk-rollup on Ethereum. It uses zero-knowledge proofs to handle order matching and liquidations, marrying DeFi's self-custody and transparency with the efficiency traders expect from CeFi.

- EdgeX is an emerging perp DEX built on StarkEx's zk-rollup technology. It promises a best-of-both-worlds experience: the high speed and low cost of a CEX with the self-custody and verifiable security of DeFi, claiming capacity for 200k+ orders per second.

- Avantis, built on and backed by Coinbase’s Base, stands out by offering high-leverage trading not just on crypto, but also on forex, commodities, and other real-world instruments. It relies on a deep pool of USDC liquidity and advanced risk-management tools like loss protection.

Wrapping up

Perpetual contracts have carved out a vital space in crypto, offering a toolkit for speculation, hedging, and sophisticated market plays. They demystify leverage and provide 24/7 access to price action without ownership or expiry constraints. Yet, as we've seen, this power doesn't come free — it's balanced by the persistent risks of liquidation, funding fees, and extreme volatility.

Ultimately, navigating perps successfully is less about chasing shortcuts and more about mastering discipline. Whether you're drawn to the blazing speed of Hyperliquid or the privacy features of Aster, the real edge comes from understanding the mechanics, respecting leverage, and always accounting for risk.