Clapp Weekly: $113k Bitcoin, Jackson Hole anxiety, Fed & SEC embrace crypto innovation

BTC price

Bitcoin fell to its weakest level in nearly two weeks, pulling back from a new record high (over $124k) as markets await a Fed update. Inflation fears, trade tensions, rising yields, and profit-taking are suppressing risk appetite. US spot ETFs saw $523.3 million in outflows yesterday.

The BTC price shot up from $119k to an ATH of $124,128 last Thursday, Aug. 14, before sharply dropping to $117k, where it held through the weekend. On Monday, it slipped further, hitting $115k before plunging below $113k last night.

Currently trading at $113,603, BTC is down 1.5% over the past 24 hours and has fallen 4.8% over the past week.

ETH price

Ether followed the broader de-risking sentiment. After two stellar weeks, its spot ETFs saw outflows on three consecutive trading days (Aug. 15-19). The upcoming $4 billion staking supply unlock could add further headwinds, as recent highs created a record exit queue.

Mirroring BTC's momentum, ETH pushed to $4,774.06 last Thursday, Aug. 14, dropped below $4.5k, and fell further after failing to hold above $4.6k. It traded below that level over the weekend and continued to decline. The price sank through $4.2k last night and hit a low of $4,080.65 hours ago.

Currently, changing hands at $4,151.49, ETH has lost 2.1% over the past 24 hours and 9.3% over the past week.

Seven-day altcoin dynamics

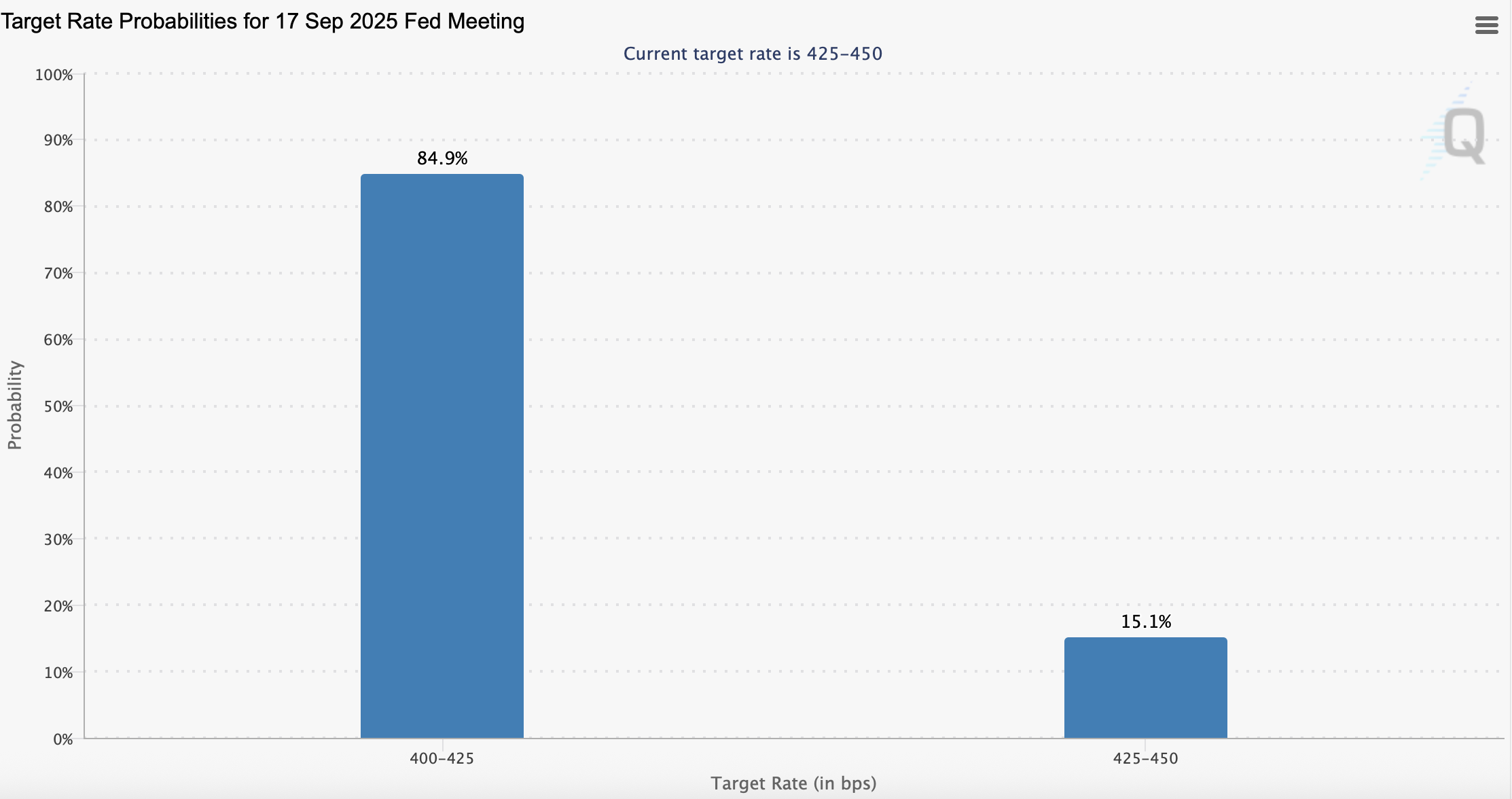

Crypto markets are down as investors await remarks from Jerome Powell at the Jackson Hole Symposium this Friday, August 22. The Fed Chair is expected to clarify the central bank's stance on interest rate cuts, which markets now price with an 84.8% probability for the September FOMC meeting.

Last week, a hotter-than-expected report on July wholesale inflation (PPI) reignited macro concerns. Despite a dramatic weakening in the job market — including downward revisions totaling 258,000 jobs in May and June — a Fed rate cut is no longer seen as a certainty.

Fading risk appetite dragged down crypto-related stocks and digital asset treasuries. Galaxy Digital, SharpLink, and BitMine each plunged nearly 10% yesterday, while Strategy lost 7.8%. TradFi markets also turned negative, with the Nasdaq and S&P 500 down 0.9% and 0.4%, respectively, at the time of writing.

Weekly winners & losers

OKB (+170.2%) surged after the OKX exchange burned 279 million tokens valued at $26 billion. This move phases out its connections to the Ethereum mainnet and follows a new tokenomics model that hard-caps the total supply at 21 million OKB.

MNT (+30.4%) also posted strong gains, climbing after the introduction of its first launchpool on Bybit EU — with adjusted collateral ratios boosting its appeal in lending products. A futures listing on Coinbase contributed to the momentum.

Meanwhile, XMR (+4.8%) managed a recovery after a 51% attack by Qubic miners threatened its decentralization. Following the initial shock pushing XMR down to $233, experts questioned the actual hash rate Qubic controls.

On the opposite end of the spectrum, SPX (-24.5%) was the hardest hit, facing intensified capital outflows across spot and perpetual markets. The meme coin is also grappling with competition from a new doppelganger, Token699, whose successful presale appears to have drawn interest and liquidity away from SPX.

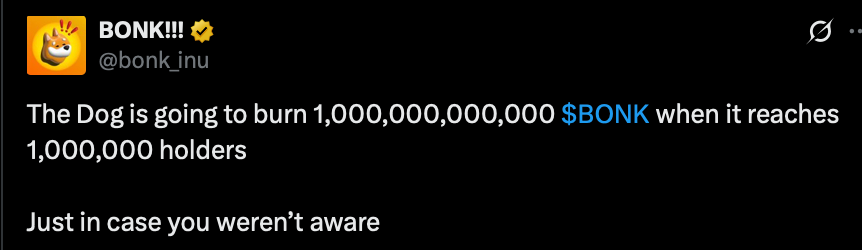

Similarly, BONK (-20.0%) has retraced approximately 45% from its July peak. On-chain liquidity metrics suggest further downside, but an upcoming burn of 1 trillion tokens (upon reaching one million holders) could help contain the sell-off.

Rounding out the week’s top decliners, ENA (-19.7%) fell as recent macro headwinds eroded its speculative appeal. However, whales are using the dip to accumulate — most notably, Arthur Hayes has reportedly doubled down on his ENA position.

Cryptocurrency news

Jackson Hole: Crypto holds its breath for Powell

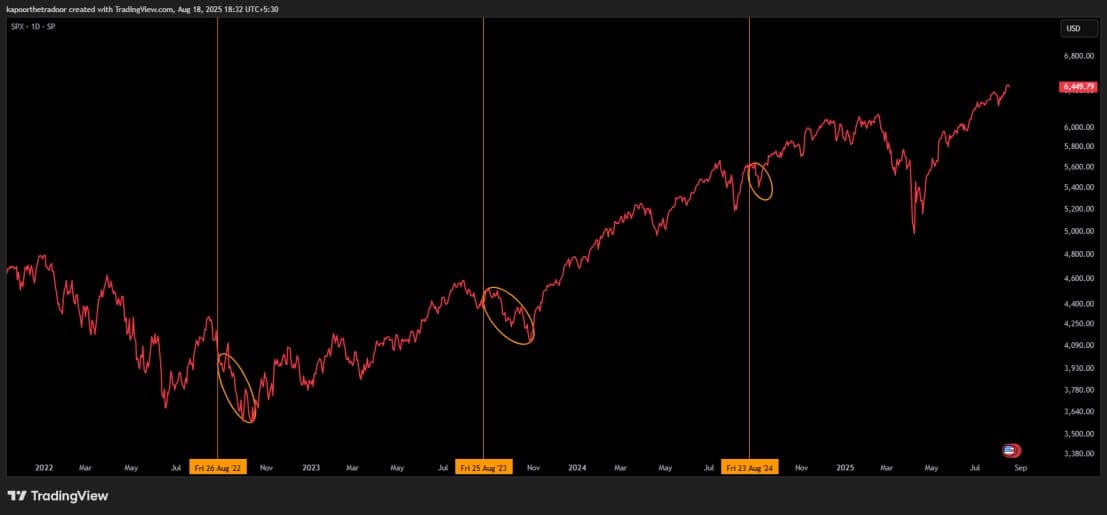

Crypto's latest plunge is a stark reminder of its sensitivity to the world governed by the Federal Reserve. From Bitcoin to crypto equities, the markets are bracing for Chair Powell's speech that could define monetary policy for the rest of 2025.

Jerome Powell will speak at the annual Economic Policy Symposium in Jackson Hole, Wyoming, this Friday, Aug. 22. Investors fear a "higher-for-longer" rate narrative that prevents cheap, speculative capital from flowing in. Any signs that could precede a rate cut from the current 5.25%-5.50% range may lift crypto sentiment.

Stubborn data and fractured Fed

Bank of America economists suggest “there is a strong case for the Fed to remain on hold.” This aligns with hot economic data. Wholesale prices (July PPI at 3.3% YoY vs. 2.5% YoY projected) remain stubbornly high, complicating the case for easing.

Internally, the Fed is divided, which suggests further hesitation — which markets see as hawkish. At the July FOMC meeting, two directors dissented from the bank’s decision to keep interest rates intact in the first dissent of its kind since 1993. The minutes, due for release today, will likely show a split between hawks and employment-conscious doves.

Traders see an 84.8% chance of a 25-basis-point Fed rate cut in September. Just over a week ago, it jumped to 98% after Treasury Secretary Scott Bessent urged for a 50-bps reduction, blaming the Fed for using flawed data.

Tarriff's domino effect

Concerns about the impact of Trump's tariffs contribute to the Fed's inaction. Corporations have so far absorbed new tariff costs, acting as a shield for consumers. But this cannot last.

When these costs inevitably get passed down, they will trigger a new wave of inflation — making immediate rate cuts from the Fed appear reckless and premature.

Rally or plunge ahead?

For crypto, the stakes are high. Higher borrowing rates curb the liquidity that fuels rallies, raise punishing financing costs for miners, and cool trading activity on exchanges. This is why crypto stocks are falling even harder than the tokens themselves.

Powell’s tone will be the catalyst. A signal of patience could validate every fear and deepen the freeze, while a dovish surprise might just be the spark to thaw the market. All eyes are on Jackson Hole.

Federal Reserve and SEC embrace crypto innovation

Top US financial regulators unveiled a sweeping pro-innovation agenda at the Wyoming Blockchain Symposium this week. Synchronized messages from Fed Vice Chair for Supervision Michelle Bowman and SEC Chair Paul Atkins underscored the shift from skepticism to embrace.

Bowman's "Embracing Innovation" speech

The Fed's Vice Chair for Supervision Michelle Bowman issued a stark warning to TradFi: adapt to crypto or risk irrelevance. Banks that avoid crypto "will play a diminished role in the financial system more broadly," she stated, emphasizing that the Fed must abandon its "overly cautious mindset" toward digital assets.

Bowman also noted the transformative potential of asset tokenization, which can accelerate transfers of ownership, mitigate "well-known risks" and lower the costs. She also believes stablecoins are poised to "become a fixture in the financial system."

Perhaps most strikingly, Bowman suggested the Fed should allow its staff to hold de minimis amounts of crypto assets, arguing that firsthand experience is essential for effective oversight.

GENIUS Act implementation starts

Bowman's words carry significant weight, particularly as she will play a key role in crafting regulations under the GENIUS Act — the country's first stablecoin law passed in July.

The Treasury Department has already begun implementing the GENIUS Act by opening a 60-day comment period focused on detecting and preventing illicit crypto activity. This process represents the initial operational phase of the new regulatory framework that Bowman will help shape.

SEC's "Project Crypto" and the end of regulation by enforcement

Echoing Bowman's pro-innovation message, SEC Chair Paul Atkins declared "a new day" for crypto regulation in what amounts to a complete reversal of the agency's previous approach. Atkins pledged that the SEC would never again pursue "regulation by enforcement."

Atkins unveiled additional details about "Project Crypto." This sweeping initiative aims to attract crypto businesses to the US via tailored exemptions and safe harbors for various crypto offerings, including ICOs, airdrops, and network rewards.

Perhaps most significantly, Atkins broke with his predecessors by stating that the vast majority of tokens are not, by their nature, securities — a position that could fundamentally reshape the crypto regulatory landscape.