Bitcoin’s 2025 in review: New highs, DC wins & other milestones

Despite the subdued December price action, 2025 has catapulted Bitcoin — and crypto in general — to new highs. From regulatory breakthroughs to Wall Street embrace and corporate treasuries, here are the defining highlights of this year.

BTC price ups and downs

- BTC started the year at around $94,000, with fresh fuel from Donald Trump's presidential win.

- In April, the price nosedived to $76,000 due to President Trump's contentious tariff war.

- On October 6, BTC soared above $126,000 for the first time in history ($126,080).

- A renewal of the trade tariff war caused a plunge from $122,500 to $104,600 in mid-October (dubbed "Crypto's Black Friday").

- In the final quarter, Bitcoin’s price momentum stalled sharply — despite the much-hyped catalysts.

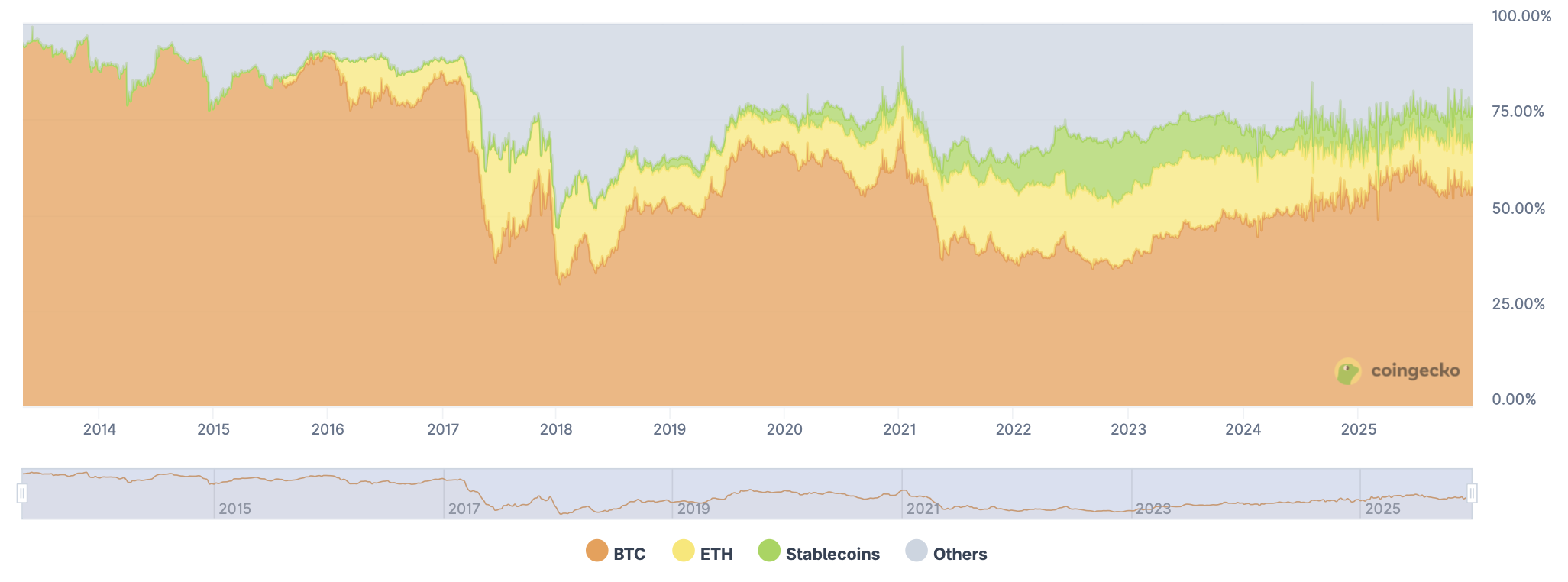

Despite market choppiness, Bitcoin cemented its lead relative to altcoins. Meanwhile, the total crypto market cap returned to $3 trillion, giving up roughly $400 billion by December 29.

At press time, Bitcoin dominance stands at 59.73%, with a $1,79 trillion market cap. Trading at $87,247.97, the coin is down 8.2% year-over-year.

Structural demand meets post-halving supply

The year’s dominant story was unprecedented institutional access, from spot ETF inflows to Vanguard’s pivotal decision to open its platform. Combined with a welcoming macro scene of Fed rate cuts and advancing regulatory clarity — embodied by the GENIUS Act — this created a powerful bull case.

Yet the notion of Bitcoin’s four-year price cycles proved difficult to map onto a maturing asset. Furthermore, its mantle as “digital gold” was tested by the precious metal itself, rallyingthroughout the year and eventually shattering a record $4.5k.

No matter how compelling the thematic tailwinds, respecting the market’s own rhythm is the ultimate discipline.

US Bitcoin Strategic Reserve

In March 2025 — less than 100 days after being sworn in as president — Trump signed an executive order tasking the government with establishing a US Bitcoin Strategic Reserve.

This cache was designed to hold all the coins the government had snagged in criminal cases, including those that originated from the Silk Road darknet marketplace. Previously, such coins had been offloaded.

By White House AI and Crypto Czar David Sacks’ reckoning, the government held 200,000 BTC, worth over $18 billion, at the time of signing the order. Looking ahead, he suggested government-owned BTC would be housed in the equivalent of a modern-day Fort Knox.

Any new coins would only be acquired through “budget-neutral” strategies. The rollout was also muddied by Trump’s Truth Social posts describing a more expansive crypto stockpile — slated to hold a variety of seized altcoins that could be sold with approval.

Senator Cynthia Lummis (R-WY) stated,

“Turning criminal proceeds into assets that strengthen America’s Strategic Bitcoin Reserve shows how sound policy can turn wrongdoing into lasting national value.”

Lummis also put forward the BITCOIN Act, legislation that would direct the government to buy over 1 million BTC and lock in the pledged reserve. However, the bill is not guaranteed to pass, and it faces opposition from some Democrats.

Bitcoin treasuries & Strategy's pivot

As of December 29, Bitcoin resides on the balance sheets of 210 publicly traded firms. In total, these Bitcoin treasuries hoard over 1 million BTC — almost three times as much as all governments combined.

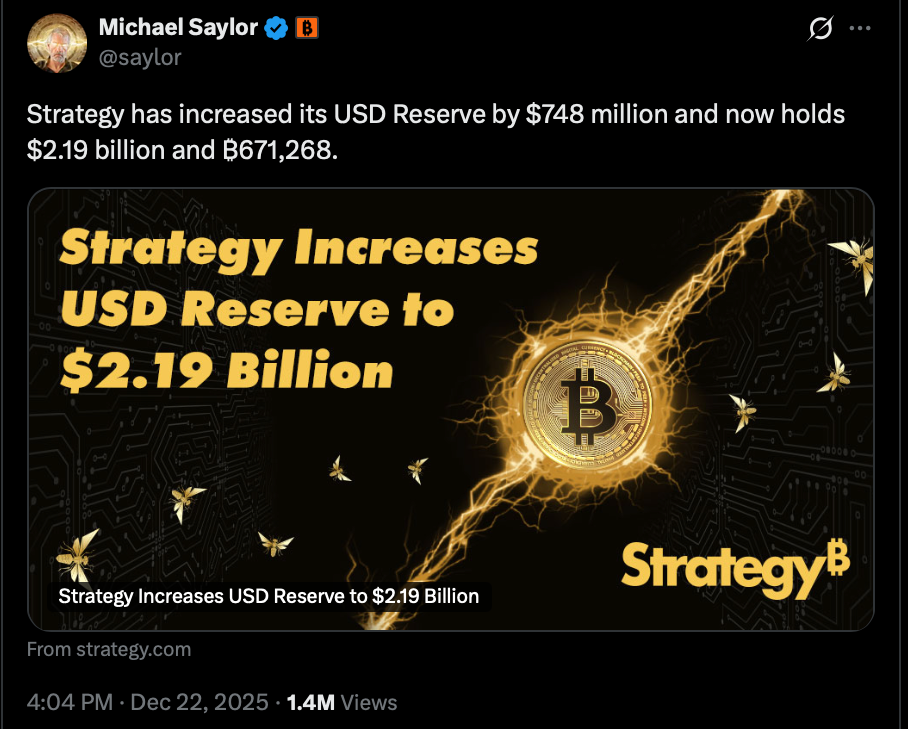

Many of those buyers took their cue from Michael Saylor's Strategy, which now boasts 671,268 BTC. The top three also includes miner Marathon Digital Holdings, Inc. (53,250 BTC) and Twenty One Capital, which is focused on providing Bitcoin-native services (43,514 BTC).

Strategy's reckoning

As a Bitcoin treasury pioneer, Strategy issued stock to bankroll its BTC purchases for years. Yet at the end of 2025, as BTC lost steam, the firm's market cap plunged below the value of its BTC holdings.

A $10 billion gap implied Bitcoin was weighing on the business — but Saylor had vowed to never sell the treasury bitcoins. To ease sell-off fears, CEO Phong Le said the company would only sell Bitcoin under two conditions:

- Stock trading below Net Asset Value (NAV)

- Capital markets slamming the door

Furthermore, the firm set aside a $1.44 billion reserve from ATM equity proceeds (later expanded to $2.19 billion) to ensure dividend payments for at least 12 months. Yet it could no longer function purely as a leveraged wager on Bitcoin.

In late December, Saylor unveiled the company was moving beyond Bitcoin exposure to become a “capital markets platform: Digital Money built on Digital Credit, secured by Digital Capital.”

Other Bitcoin treasuries that issued equity to fund BTC buys often saw their stock prices rocket, then tumble just as fast. For instance, healthcare provider Kindly MD (ticker: NAKA on Nasdaq) is currently down 99% from its May peak of $25.

Bitcoin ETFs: From breakout to mainstream bridge

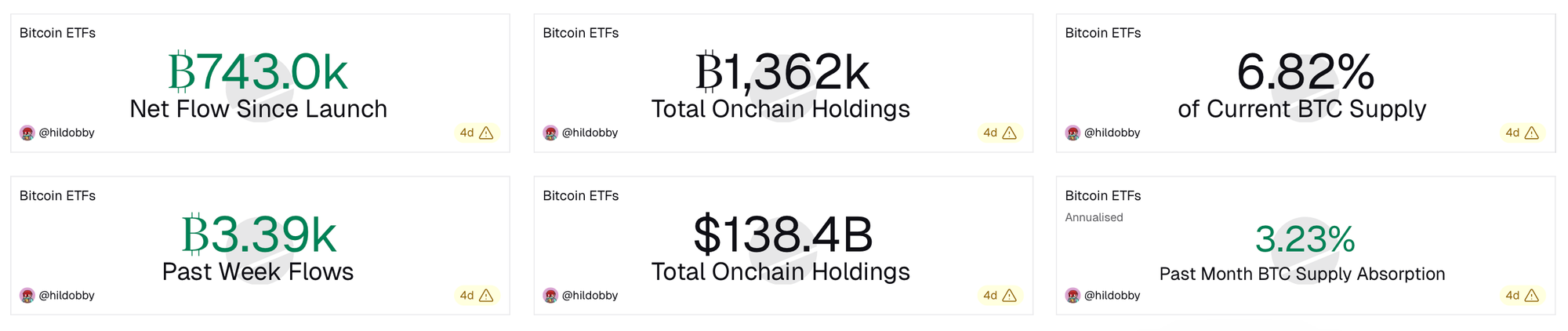

Spot Bitcoin ETFs took off in their sophomore year, cementing their role as crypto’s primary gateway. The products amassed a staggering $138 billion in on-chain holdings and siphoned nearly 7% of BTC's total supply from the market.

Yet 2025 was likely a warm-up. Analysts project Bitcoin ETF assets could balloon to between $180 and $220 billion in 2026. This acceleration will likely be driven by the trifecta of regulatory clarity, anticipated Fed rate cuts, and — most crucially — the unlocking of mainstream distribution channels.

- Major wirehouses like Wells Fargo and Bank of America, and even the formerly resistant Vanguard, have now greenlit Bitcoin ETF access for their networks of advisors and millions of clients.

- Inclusion in 401(k) retirement plans has begun, tapping into the multi-trillion-dollar pension fund market.

- “Wealth managers at big banks now suggest clients allocate 1 to 5% of their net worth into crypto,” according to former Goldman Sachs analyst Dom Kwok.

With the Fed expected to cut rates, flooding liquidity into risk assets, and institutions seeking a hedge against currency devaluation, Bitcoin ETFs stand as the perfect vehicle.

Bitcoin codebase debates

For years, the Bitcoin blockchain’s utility was centered on transactions. In September 2025, an update to Bitcoin Core v30 (the reference software client) raised the OP_RETURN limit, allowing transactions to carry larger amounts of non-payment data.

Thus, users are now able to embed extra data to a transaction without affecting the spendable coins or clogging the system. Backers presented this as a cleaner and safer way to add information, while critics focused on potential misuse — from spam to illegal content.

Furthermore, Bitcoin essentially moved beyond its core purpose as a medium of exchange, transforming into a general data-storage network. While spam is a danger, filtering would leave the blockchain vulnerable to censorship, as argued by Blockstream CEO Adam Back.

Wrapping up: A year of maturity and new challenges

In 2025, Bitcoin truly grew up. It snagged historic price highs, won landmark political victories, and saw its spot ETFs become a fixture on Wall Street. The narrative shifted from speculative frenzy to institutional embrace. Yet, the final quarter delivered a sobering reminder that maturity brings complexity, not just smooth growth.

Looking ahead, the stage is set for an even more consequential 2026. Bitcoin is no longer just a trade. It’s a policy tool, a balance sheet asset, and an infrastructure playground. The only guarantee for the coming year is that the drama — and the opportunities — will be bigger than ever.