Clapp Weekly: Holiday liquidity crunch, JPMorgan's crypto bet, Saylor's shift

BTC price

Bitcoin is being pressured by thin liquidity and tax-loss harvesting. The price is range-bound between $85k and $93k, with about $23.6 billion worth of options set to expire on December 26. Perpetual open interest shed $3 billion overnight, leaving BTC vulnerable to sharp moves. While gold books fresh ATHs, BTC is on track for its weakest year-end performance since 2018.

After a flash surge to $89.6k, BTC collapsed below the $85k mark, attempted another hike, and bottomed out at $84,581.28 on Thursday, December 18. It rose above $88k the next day and peaked at $90,168.94 on Monday, December 22, before retreating.

Currently at $86,874.48, BTC is down 0.3% over the past 24 hours but up 0.2% over the past week.

ETH price

Ether failed to hold above $3k as bears took over, triggering $62 million in long liquidations. The institutional landscape is mixed — spot ETFs shed over $600 million last week, but BitMine continues accumulating. The company disclosed holding roughly 4 million ETH ($13.2 billion). $3.8 billion worth of ETH options expire on Friday, December 26.

The price followed BTC's ups and downs through the past week, with an initial decline from $2,968.33 to $2,781.74 on Thursday, December 18. The price recovered sharply and held just below $3k, but Monday's push higher ($3,060.45) proved fleeting.

Currently at $2,929.04, ETH is down 0.7% over the past 24 hours with no change over the past week.

Seven-day altcoin dynamics

Thinning holiday liquidity and year-end de-risking have pushed traders to the sidelines. Despite reduced leverage, plunging open interest amplifies the risk of outsized swings, particularly ahead of Friday's record $23.7 billion options expiry.

Analysts do not expect significant recovery until liquidity returns in January. That said, bearish sentiment is easing (fear at 25/100 at press time), and downside positions are softening.

Beware of heightened volatility risk

As the year-end approaches, tax-loss harvesting could amplify short-term volatility. Investors can realize losses and instantly re-establish positions, as crypto has no wash-sale rule — the prohibition against deducting losses on securities repurchased within 30 days.

With buying pressure fading across multiple metrics, the Altseason Index has sunk to merely 17. Major tokens are 30% to 80% below their ATHs, bearing the brunt of the drawdown.

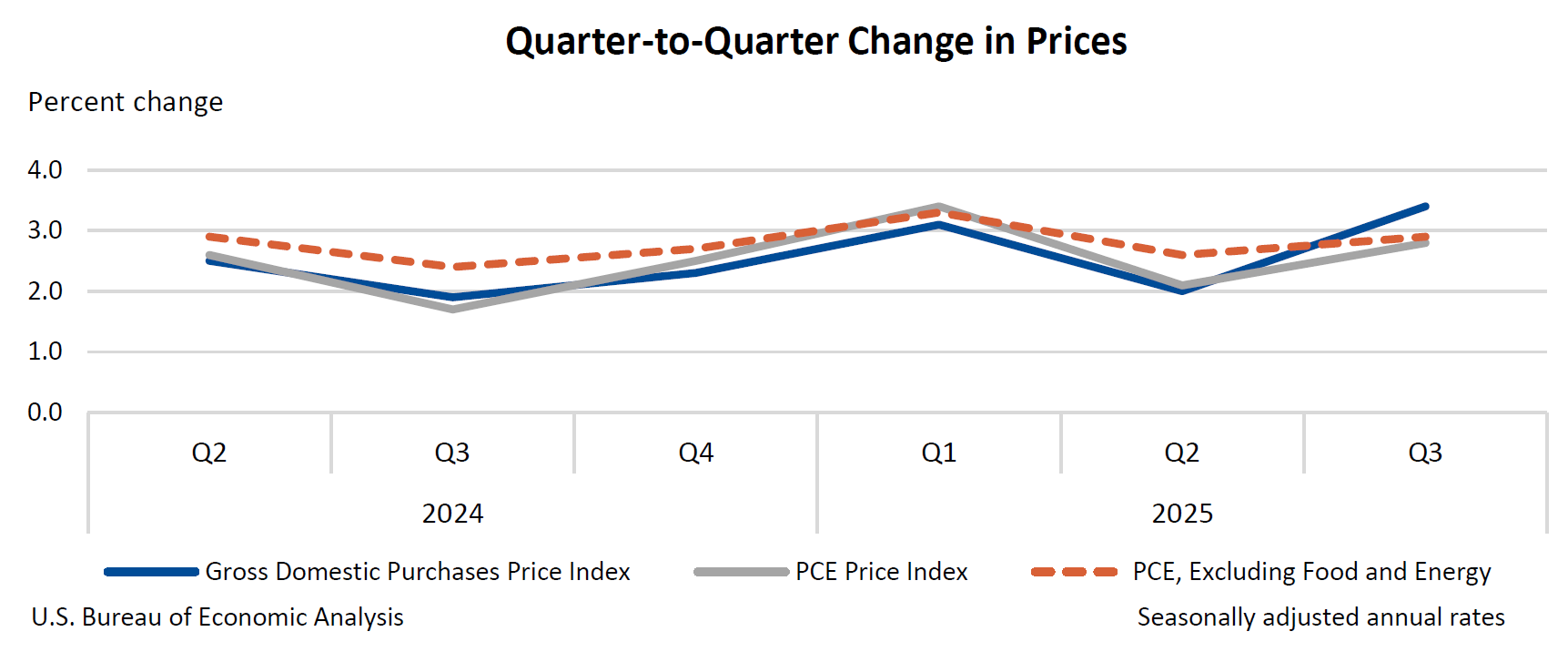

GDP report delivers bad news

The Q3 US gross domestic product print showed the economy growing faster than expected (4.3% vs. 3.3% projected). Combined with rising exports, the report shattered hopes for more Fed cuts soon.

Moreover, the latest PCE report, released December 23, showed inflation rose 2.8% YoY in September (vs. 2.1% in Q2), while the core index jumped 2.9% YoY (vs. 2.6% in Q2).

Weekly winners

- C (+26.0%) is leading the privacy coin rally, spurred by the Depository Trust and Clearing Corporation’s decision to issue tokenized securities on the Canton Network. The news arrived during a positive period for sector adoption.

- NIGHT (+24.6%) joined the privacy surge, supported by community enthusiasm and Charles Hoskinson's comments about potential attacks on personal privacy in Europe.

- UNI (+11.1%) has soared on anticipation of its historic protocol fee switch—“UNIfication” — set to go live later this week after nearly 62 million votes favored the proposal. 100 million tokens will be burned, while the new fee mechanism will reward holders.

Weekly losers

- PUMP (-25.7%) is pressured by a class-action lawsuit against Pump.fun alleging token manipulation. Furthermore, a whale transferred 3.8 billion tokens to an exchange at a heavy loss ($12 million), interpreted as capitulation and likely pre-selling.

- MNT (-19.9%) failed to sustain its uptrend despite steady capital growth. The token likely yielded to broader market uncertainty, particularly with Bitcoin losing strength.

- AAVE (-19.8%) plunged amid a recent governance dispute highlighting DeFi fragility. Prominent community members sold significant amounts, while a controversial proposal to move “soft assets” from Aave Labs to the DAO amplified pressure.

Cryptocurrency news

Wall Street’s giant walks in: JPMorgan’s crypto move

The walls between TradFi and crypto are crumbling, and the latest sledgehammer comes from an unlikely source. Reports that JPMorgan is considering offering spot and derivative crypto trading to its institutional clients mark a watershed moment. This is the same bank whose CEO, Jamie Dimon, once famously derided Bitcoin as a “pet rock.”

So, what changed?

A new regulatory landscape, for one, following the recent GENIUS Act. But more importantly, JPMorgan is following the money and the client demand, joining peers like BlackRock, Fidelity, and Goldman Sachs in building digital asset infrastructure.

That said, this isn’t a zero-sum game. Analysts suggest JPMorgan’s entrance is less about crushing crypto-native firms and more about expanding the entire ecosystem. As Owen Lau of ClearStreet notes, this move “will further legitimize crypto and increase distribution channels.”

Ripple effect: Rising tide for crypto platforms

JPMorgan, as a broker, will likely need partners to execute and settle these trades. This is where established players like Coinbase Prime and Bullish stand to gain. They offer the institutional-grade trading, custody, and prime brokerage services that form the essential plumbing for these large-scale operations. A pension fund’s trade routed through JPMorgan could very well be matched on one of these platforms.

As Compass Point’s Ed Engel points out, increased institutional participation boosts demand for complex services like derivatives, lending, and high-touch prime brokerage — areas where firms like Galaxy Digital (GLXY) and Bullish excel. While basic spot trading fees may face pressure, the overall volume and sophistication of the market are poised to grow.

In essence, Wall Street isn’t coming to replace crypto’s infrastructure. It’s coming to connect to it. JPMorgan’s potential pivot signals that crypto is maturing from a frontier asset into a core component of global finance, with legacy banks and agile crypto firms finding their symbiotic roles. The embrace is real, and it’s building the bridges for the next wave of capital.

Michael Saylor’s new blueprint: “digital capital”

For years, Michael Saylor and his company, MicroStrategy — now Strategy — were synonymous with one simple, powerful idea: the ultimate leveraged Bitcoin bet. Yet as the market matures, that story is changing. With Strategy’s stock down over 45% in the past year, severely underperforming Bitcoin itself, Saylor is rolling out a new narrative aimed at reviving investor interest.

Gone is the talk of just being a Bitcoin proxy. In its place, Saylor is pitching Strategy as a “capital markets platform.” In a recent interview, he framed it as “Digital Money built on Digital Credit, secured by Digital Capital.” Beyond semantics, it’s a strategic pivot designed to differentiate Strategy from the growing crowd of BTC investment vehicles, like BlackRock’s spot Bitcoin ETF (IBIT).

Why now?

The pressure is mounting. The rise of spot Bitcoin ETFs has given investors cheaper, more liquid alternatives for pure BTC exposure. Simultaneously, index provider MSCI has raised the possibility of removing companies like Strategy from its indexes, deeming them too similar to investment funds — a move that could trigger billions in forced selling.

Saylor’s response is building a more complex financial architecture. The key instrument is Strategy’s variable rate series A perpetual preferred shares (STRC), which have raised billions and are used to acquire Bitcoin.

These shares offer dividends, targeting a new class of institutional investors and wealth managers who might be drawn to a yield-generating crypto vehicle. The company has also amassed a $2.2 billion war chest, hinting at stability and future maneuverability beyond just buying the dip.

Calculated evolution

Analysts see potential in this refined approach. Citi reiterated a Buy rating with a $485 price target, suggesting the new strategy could unlock value by appealing to a broader capital base. The core advantage remains Strategy’s colossal treasury of over 670,000 Bitcoin (worth nearly $60 billion), but now it’s being framed as the “Digital Capital” securing a larger system.

Strategy is attempting to evolve from the market’s most aggressive believer into its most sophisticated architect. The bet is no longer just on Bitcoin’s price — it’s on Strategy’s ability to become the backbone of institutional crypto finance.