Clapp Weekly: Bitcoin's ATH, perfect macro storm, BNB's record run

BTC price

After Monday’s ATH of $126,080, BTC plunged below $122k, erasing three days of gains. The past week's inflows and derivatives activity were the year's highest — US spot ETFs recorded $1.19 billion in net inflows on October 6, the biggest single-day total since July 10.

The BTC price rose steadily over the past week until yesterday's dip, climbing from just over $114k to all-time highs of $125,361 on Sunday, October 5, and $126,080 the next day. The rally came to a halt with a sharp dip below $121k.

Currently at $121,501, BTC has lost 2.1% over the past 24 hours while gaining 6.3% over the past seven days.

ETH price

Ether climbed closer to $5,000 yesterday amid strong demand, anticipation of the upcoming Fusaka upgrade, and favorable macro conditions. US spot ETFs attracted over $1.3 billion in inflows last week, combined with $176 million on Monday — a strong comeback after outflows the week prior.

The price followed BTC's lead, shooting up from $4.1k to $4.3k a week ago and pushing higher, although momentum paused on Saturday, October 4. Yesterday, ETH breached the $4.7k mark, peaking at $4,747.83 before a steep descent.

Now trading at $4,448.41, ETH is down 5.2% over the past 24 hours but up 7.7% over the seven-day period.

Seven-day altcoin dynamics

A broad-based rally stalled on Tuesday, October 7, as Bitcoin pulled back from its fresh peak above $126k, triggered by a perfect macro storm (more below). Analysts detected signs of market overheating — at least in the short term. The pullback was sweeping, with altcoins like SOL, ADA, and XRP suffering steeper declines than BTC.

Fundamental capital shift

Experts note weakening market breadth as institutional capital concentrates in high-liquidity, high-certainty assets like BTC and ETH. Meanwhile, major altcoins like LINK, ADA, SUI, and DOGE have posted mixed performance this year, ranging from single-digit gains to double-digit losses.

This shift is attributed to renewed ETF flows and declining patience with “purely narrative-driven” tokens. Ethereum optimism is growing — 80% of Myriad users expect ETH to reach $5,000 before falling to $3,500, a stark contrast to last week’s hesitation. Additionally, 72.2% predict it will hit this milestone by year-end.

Weekly winners

- ZEC (+72.7%) leads gains after surging 240% in September — eclipsing BTC and ETH. The rally is fueled by renewed interest in privacy coins amid growing concerns about financial surveillance and tighter crypto regulation. Additionally, the October 1 launch of the Grayscale Zcash Trust spurred institutional participation.

- MNT (+29.3%) gained support from multiple catalysts, including a compliance-focused RWA service announced at TOKEN2049 and World Liberty Financial’s flagship stablecoin, USD1, launching on Mantle Network. Bybit’s MNT integration roadmap further boosted exposure.

- BNB (+26.8%) reached record highs, surpassing XRP in market cap amid strong fundamentals and excitement around the Aster DEX (read more below).

Weekly losers

- XPL (-14.4%) failed to sustain yesterday's recovery despite capital inflows, with top traders selling and over 73% of supply now on exchanges — a classic sell-pressure signal. The token was previously affected by rumors of team recycling and insider trading.

- PI (-11.1%) struggled with a slow mainnet rollout and low on-chain activity, while token unlocks added downward pressure. The upcoming Version 23 upgrade may provide new catalysts.

- WLFI (-10.3%) collapsed hours after World Liberty Financial announced selling treasury tokens to Hut8 at $0.25 — below the market price of $0.20. Despite denials of dilution, traders feared “locked” reserves could be withdrawn.

Cryptocurrency news

Perfect macro storm drives Bitcoin's new record highs

Amid the shutdown drama in Washington, Bitcoin has entered uncharted territory, soaring to a new all-time high above $126k. This landmark push briefly propelled its market capitalization beyond $2.5 trillion — a first in crypto history that solidifies its standing in global finance.

The ongoing US government shutdown (started on October 1) is a likely key catalyst, renewing focus on BTC's role as a decentralized store of value. This sentiment is reflected in a capital influx, with inflows into spot ETFs surging over the past week. BlackRock’s IBIT alone pulled in nearly $1 billion in inflows on Oct. 6.

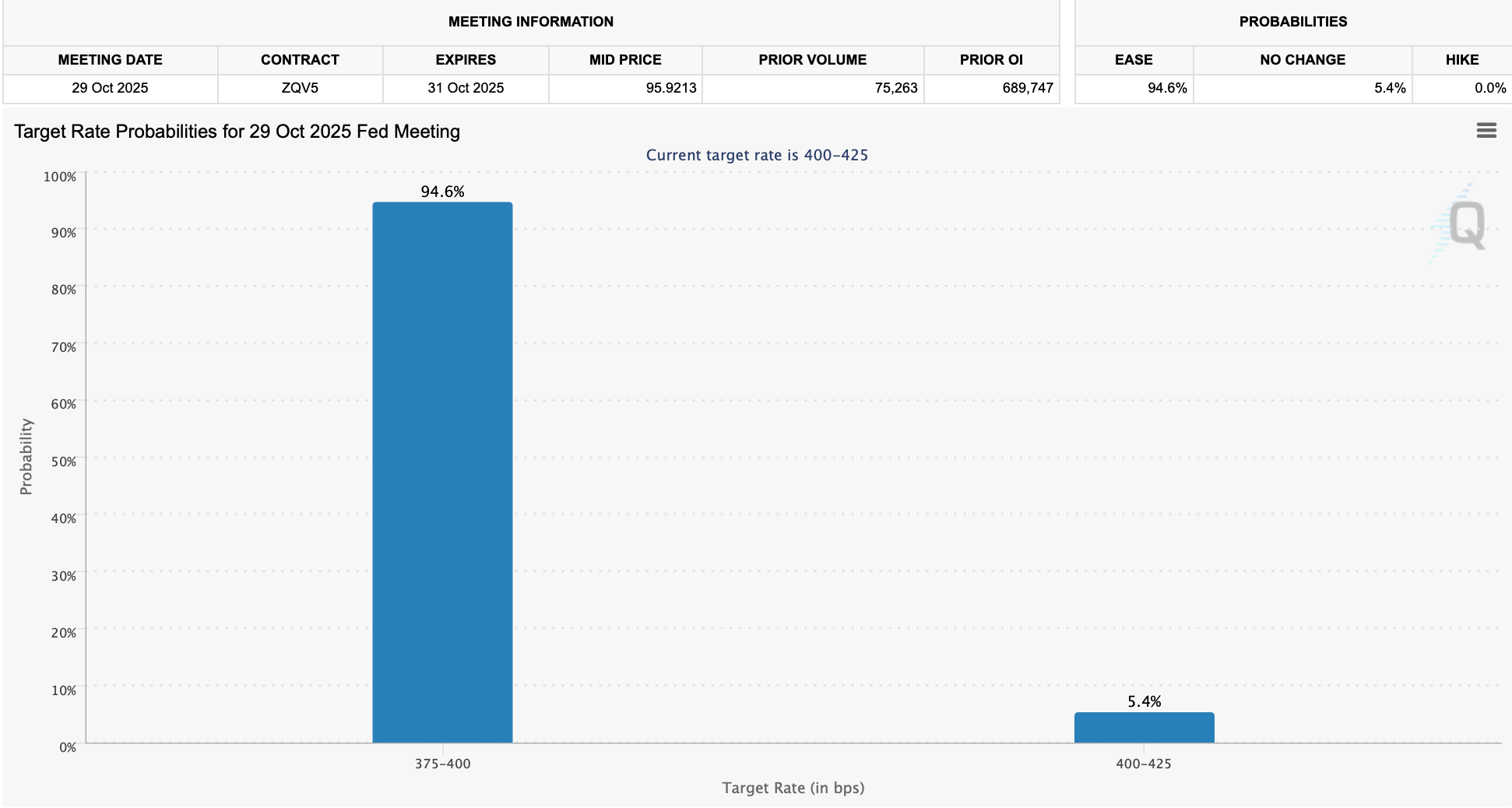

Is Fed cut 'cemented'?

As political dysfunction unfolds, investors are increasingly drawn to assets outside TradFi. The shutdown’s impact is now seen as potentially forcing the Federal Reserve's hand, with CNBC reporting it "is likely to cement additional Fed interest rate cuts."

With economic data delayed and uncertainty rising, market expectations for a dovish Fed have intensified. Traders are now pricing in a near-certain rate cut in October, anticipating that the central bank will prioritize supporting the economy over inflation concerns.

This macro shift creates a powerful tailwind for risk assets like Bitcoin. As Fabian Dori of Sygnum Bank notes, "loose liquidity conditions" are drawing fresh attention to digital assets. Yet, some analysts urge caution, suggesting it's still premature to declare a definitive market bottom without sustained stability at these new levels.

USD dominance at three-decade low

The share of the US dollar in global central bank reserves fell to 56.3% in Q2 2025, the lowest since 1994. By The Kobeissi Letter's estimates, its weight may fall below 50% within five years — which is typically why all other asset classes are hitting record highs.

“Safe havens, risky assets, real estate, crypto, global bond yields, and everything in between is hitting daily record highs. The denominator for most assets, in this case the US Dollar, is what has changed. The US Dollar is on track for its worst year in 40+ years, down -10% YTD.”

Citadel CEO Ken Griffin notes that massive capital is moving away from the USD as investors seek to de-dollarize or reduce exposure to US sovereign risk. This year, they have also increasingly opted for silver, gold and BTC as the “debasement trade.” Furthermore, US fiscal and monetary policies, resembling those typical for recessions, support asset markets.

Signs of maturation

We are witnessing a convergence of political uncertainty and monetary policy. The Fed's potential pivot toward easing, combined with Bitcoin's proven resilience, is crafting a compelling narrative for its future. While short-term volatility is inevitable, the breach of the $2.5 trillion market cap mark suggests Bitcoin's maturation from speculative asset to a macro-economic hedge is well underway.

BNB soars to record highs in utility-powered rally

While everyone’s eyes are glued to Bitcoin’s record-breaking run, another major player has been quietly putting on a masterclass in performance. BNB, the powerhouse behind the BNB Chain, just smashed through its previous all-time high, cruising past $1,330.

Fundamental shift in market hierarchy

Yesterday, BNB secured its second all-time high in a single day and officially flipped XRP to become the third-largest coin with a market cap exceeding $154 billion. Further solidifying its dominance, the BNB Chain recently topped all blockchains in 24-hour fees, a clear indicator of robust and profitable network activity.

What’s fueling this stealthy rally?

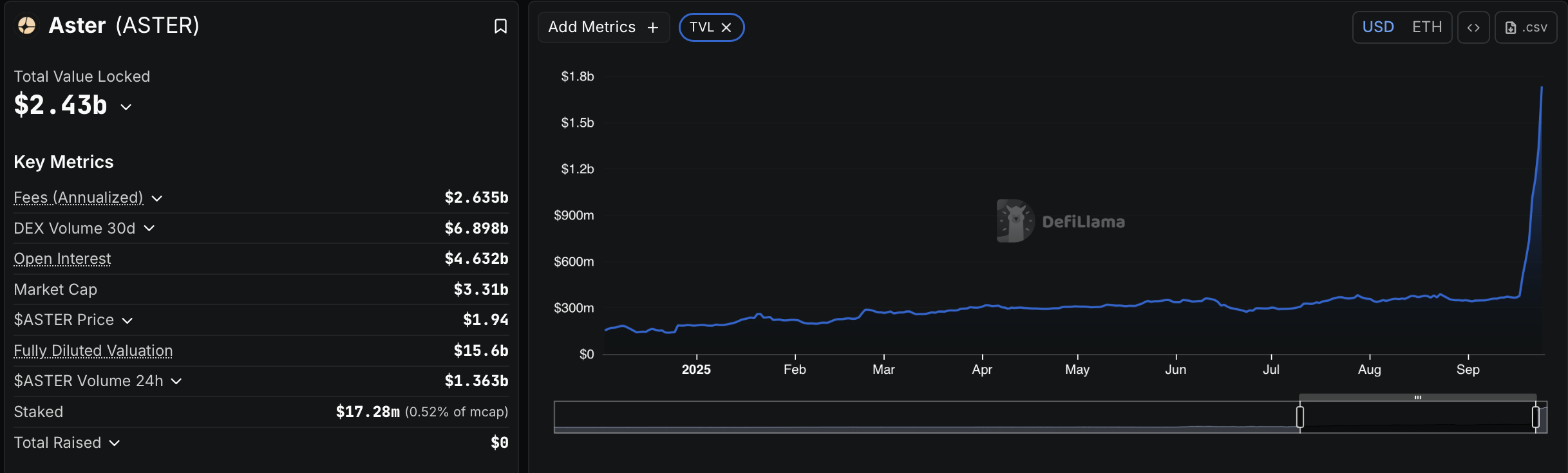

The answer lies not in general market optimism, but in real, on-chain utility driving demand. The chain itself is experiencing explosive growth, reporting a record 58 million monthly active addresses — overtaking Solana. A major driver is the newly launched decentralized exchange, Aster, which saw its total value locked explode by over 500% to $2.4 billion.

Founder Changpeng "CZ" Zhao revealed that a staggering 30% of BNB's total supply is now being staked, signaling long-term holder conviction and reducing circulating supply. This, combined with clear institutional inflows, creates a powerful supply and demand dynamic that continues to propel the token higher, with many now asking if $1,500 is the next logical stop.

Bigger picture

BNB's surge coincides with significant fundamental developments, like a new partnership with Chainlink to bring official US economic data on-chain. This is a clear signal that the ecosystem is maturing and building serious infrastructure for the long haul.

While Bitcoin’s macro story captures headlines, BNB shows a different kind of strength. It’s a reminder that the biggest gains aren't always the loudest. Sometimes, they come from relentless, utility-driven growth happening just under the radar.

As institutional and on-chain activity continues to swell, BNB is proving it's more than just an exchange token, all while Bitcoin solidifies its position as a mature, macro asset.