Сrypto playbook: Top 10 narratives to watch in 2026

This year, the crypto space will continue its meteoric shift from speculation to utility as its marriage with TradFi deepens. Here is a look at the pivotal stories and ideologies that will likely shape the perception of digital assets, dictating investor sentiment and capital flows.

1. Meme launchpads 2.0

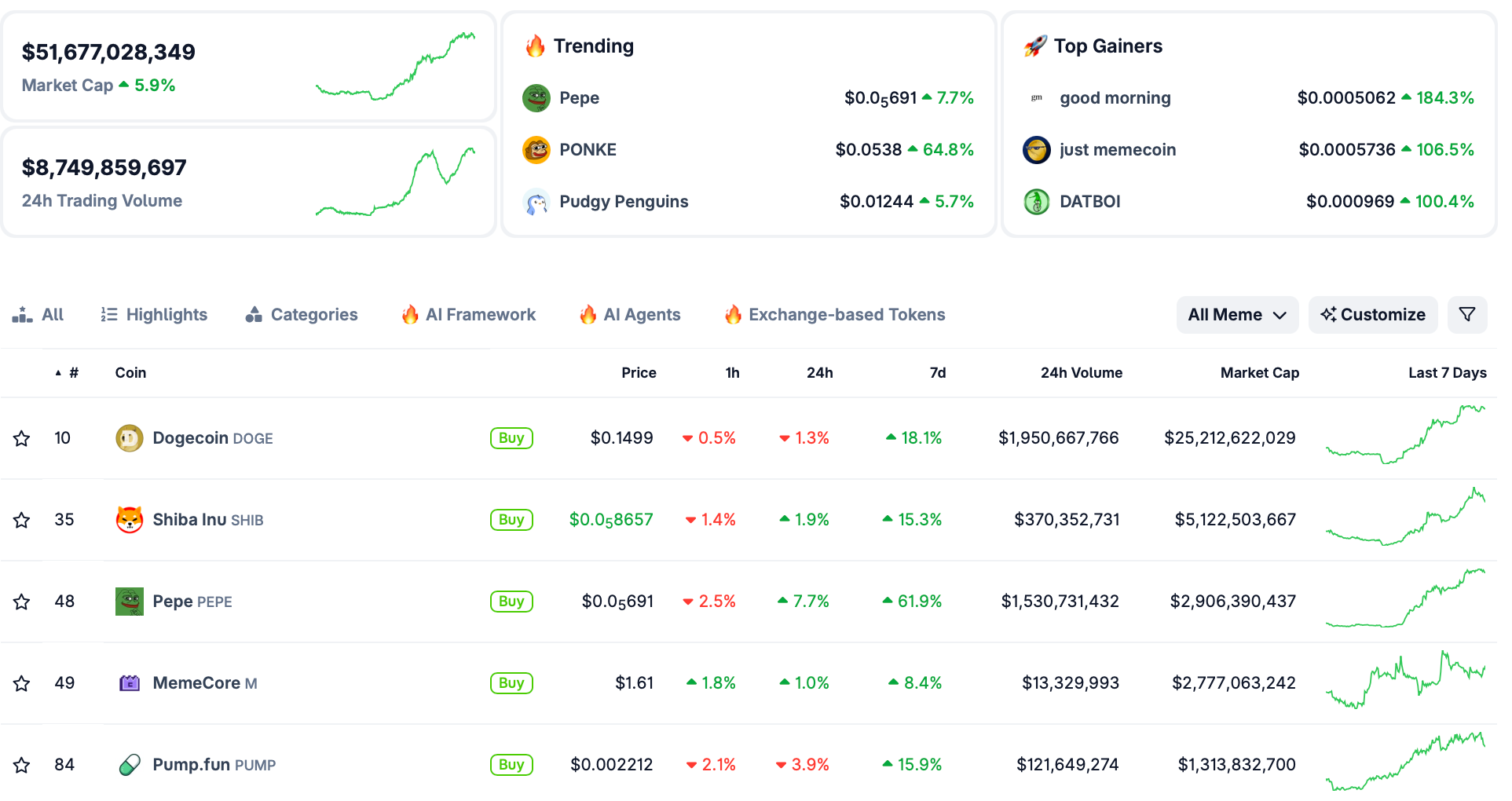

The advent of no-code launchpads like Pump.fun has upended token launches. Meme coins grew at a breakneck pace — the sector's total market cap soared to $150.6 billion in December 2024. It is now hovering around $51 billion.

However, the first launchpads were overrun by the "fastest-fingers-first" problem, where bots snatched up massive supply to drive price appreciation. The concept of "fair launches" — aiming to stamp out manipulation — has come to the forefront with safeguards like:

- Anti-sniper features that prevent bot-buying in the first block.

- Reputation-based distribution systems using participant histories to guarantee only genuine community members access supply.

- Bonding curve maturity to ensure liquidity is locked in DEXs like Raydium once certain market cap milestones are hit.

2. Stablecoin infrastructure

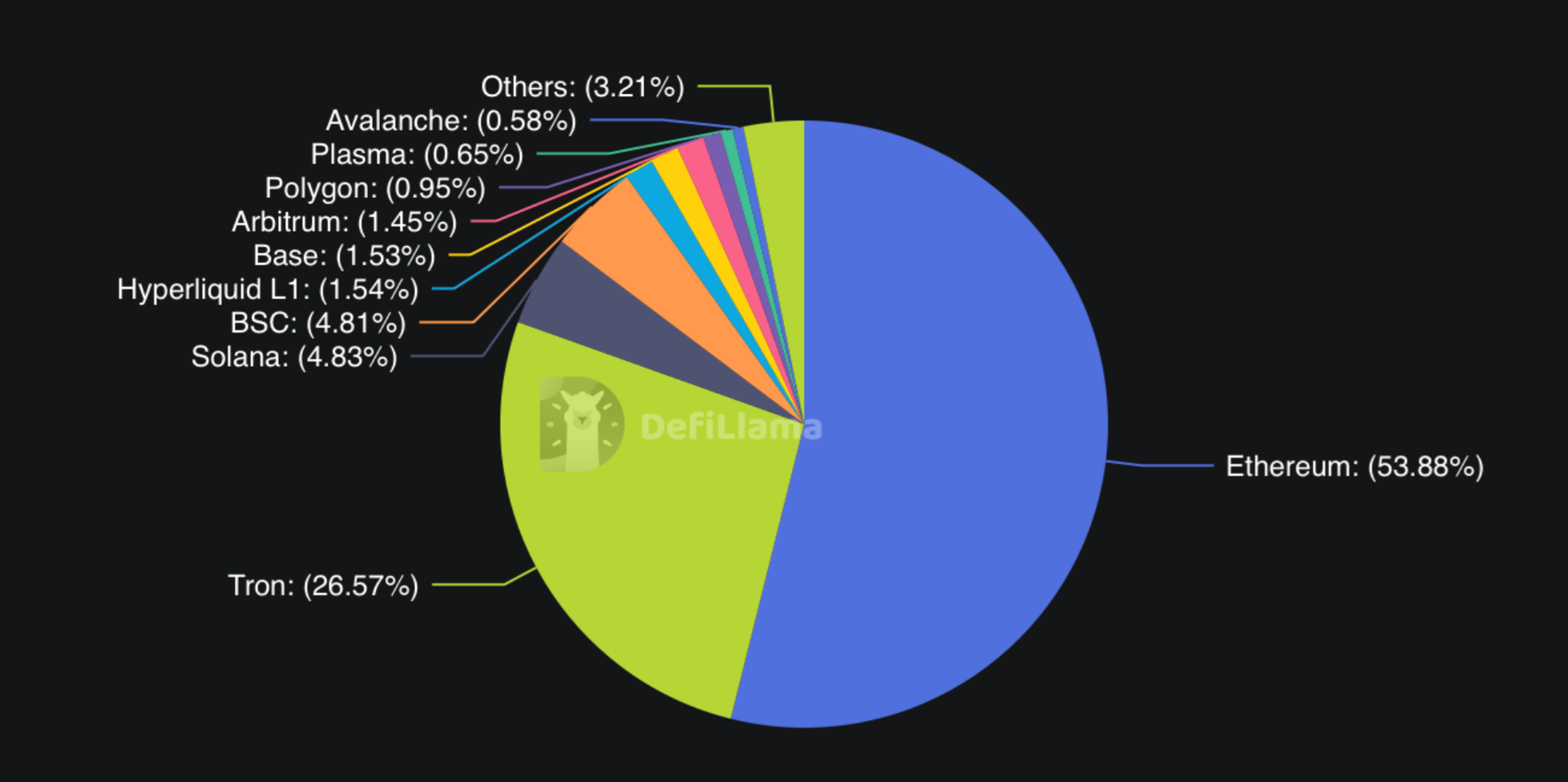

In 2025, the total stablecoin market cap surged from around $205 billion to roughly $310 billion — a staggering gain of around 50%. This year will likely be defined by robust stablecoin infrastructure development.

A major catalyst is the passage of the CLARITY Act, the first comprehensive legal framework for stablecoins in the United States. According to Forbes, over a dozen entities currently issue dollar-denominated stablecoins. While Tether's USDT still holds a dominant over 60% market share, heavyweight fintechs like Stripe, Fiserv, and Klarna have joined the fray.

Stablechains — blockchains fine-tuned for stablecoin transactions and gasless transfers — are thriving. For instance, Plasma, launched on September 25, 2025, now holds the spot as the 8th largest blockchain by stablecoin supply.

In December 2025, Tether's stablechain Stable was launched. Meanwhile, Circle's Arc and Stripe & Paradigm’s Tempo are in development or testnet phases.

TradFi institutions are also building out proprietary stablecoin rails that should become embedded in core institutional systems. They will combine 24/7 real-time settlement with blockchain transparency, potentially challenging SEPA or SWIFT.

- The European Bank Consortium Chain for Euro stablecoins is set to go live in the second half of 2026. This MiCA-compliant solution is being developed by nine major European financial institutions (including ING and UniCredit).

- Progmat, a Japanese bank platform, will enable joint Yen stablecoin issuance by Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho.

Juan Lopez, general partner at VanEck Ventures, suggests “the orchestration challenge” — routing payments across platforms and chains — is the next big obstacle.

“There needs to be a common venue where, without counterparty risk, all participants — the distributor, the issuer, the consumer — agree that if you want to redeem your money, or your digital USD for real fiat USD, it’s guaranteed, or close to guaranteed, because there’s no counterparty risk along the way.”

3. Prediction markets

Prediction markets silenced skeptics as they continued growing after the 2024 US elections. Volumes skyrocketed as platforms like Polymarket became increasingly crucial sentiment gauges — often beating traditional news outlets in accuracy. In 2026, they’ve gained an additional edge.

Donald Trump's One Big Beautiful Bill Act, signed in July 2025, now slashes the deduction for gambling losses against winnings from 100% to 90%. Even when taxpayers win little or incur a net loss, they may still be taxed on “phantom” income.

As prediction markets use financial contracts similar to derivatives, they could offer a “more tax-advantageous alternative to traditional sports books and casinos,” as a Coinbase report puts it.

At the same time, the scope of subjects may broaden dramatically: beyond politics, users are already betting on the weather, corporate earnings, and even on-chain metrics. While fragmentation is a risk, prediction-market aggregators may corral billions of dollars in weekly volume.

4. Crypto x AI

Forbes predicts the advent of "agentic commerce" as software learns to autonomously handle money. AI agents are already able to launch smart contracts and issue tokens — the next frontier is agent-to-agent transactions.

Here is how Hoolie Tejwani, head of Coinbase Ventures, explains it:

“There’s going to be a massive machine-to-machine economy. Doing a lot of that activity on blockchains is very logical. You can't economically enable a sub-30 cent transaction with traditional rails right now, and these agents are going to be making billions and billions of these.”

Base and Solana could be the most fertile ground for such payments as they have massive developer and user bases. Other strong candidates are Stripe’s Tempo and Circle’s Arc.

5. Privacy tokens & features

Once a niche feature, privacy is now a non-negotiable for institutional adoption. In 2025, private transactions on-chain exploded to record highs. Zcash gained 691.3% and Monero rallied 143.6%, while Solana and Ethereum unveiled privacy-reinforcing initiatives. Helius CEO Mert Mumtaz even proclaimed a “Privacy Szn.”

Compliance-friendly privacy — the opportunity to interact with DeFi while remaining identity-verified but data-private — is a dominant narrative for 2026. Startups are deploying privacy tech with ZK-proofs and fully homomorphic encryption (FHE).

The former are no longer limited to scaling solutions, having expanded into identity verification and confidential dApps. For instance, users can prove they meet specific criteria without exposing any private data.

6. Perp DEXs (perpetual decentralized exchanges)

In 2025, DEXs for perpetuals trading began closing in on their centralized rivals, posting record-shattering volumes. In December, the 24-hour trading volume hit $26.6 billion, with open interest of $15.5 billion across DeFi platforms.

As the efficiency gap narrowed, the DEX-to-CEX perp futures volume ratio nearly tripled, reaching 18.7%. Hyperliquid and Aster led the charge, boasting deep liquidity, slick interfaces, and sub-second execution. However, spot activity — mainly fueled by chain rotation — was lackluster.

Competition is heating up, elevating the user experience. Fresh capital flows and new trader incentives are poised to dethrone Hyperliquid’s lead. Well-funded projects rely on low fees, points systems, and strategic partnerships to capture market share.

Now, focus is shifting toward cross-margin capabilities and synthetic assets like Liquid Staking Tokens (LSTs). Users may collateralize them to trade not only crypto, but tokenized stocks and commodities, supercharging potential gains and losses with high leverage.

7. Initial Coin Offerings (ICOs)

The Initial Coin Offering (ICO) has staged a comeback. New models of fundraising are a world apart from their predecessors from the “wild west” of 2017. Established CEXs and DeFi alternatives are spearheading this charge.

Launchpads with smart contract escrow systems are regulated and community-first environments where developers receive funds only upon meeting specific milestones. The emphasis is now on utility, not empty hype.

Compliance is now just as crucial as the technology itself. Startups must align with regulations in their jurisdictions from the get-go, embedding AML and KYC checks.

Binance Launchpad and Coinbase’s token sale platform hold curated ICOs with rigorous due diligence. Measures against insider manipulation include lock-up periods, team verification, and information disclosure.

Meanwhile, smart contract engineering zeroes in on security, scalability, and efficiency. Third-party security firms provide several audit cycles to bolster investor confidence.

8. ETF & DATco takeover

The explosion of crypto ETFs accelerated dramatically in 2025 and continues unabated into 2026. The watershed moment came in September 2025, when the SEC approved generic listing standards for commodity-based trusts, democratizing access for a wave of new funds.

This paved the way for the first spot altcoin ETFs in October 2025, led by Solana and XRP. By year's end, a portfolio spanning Bitcoin, ether, Solana, XRP, Litecoin, and Hedera could be built entirely within a traditional brokerage account.

The floodgates are now open, with over 126 additional applications pending—including ambitious proposals for DeFi protocol baskets and even meme coin indexes.

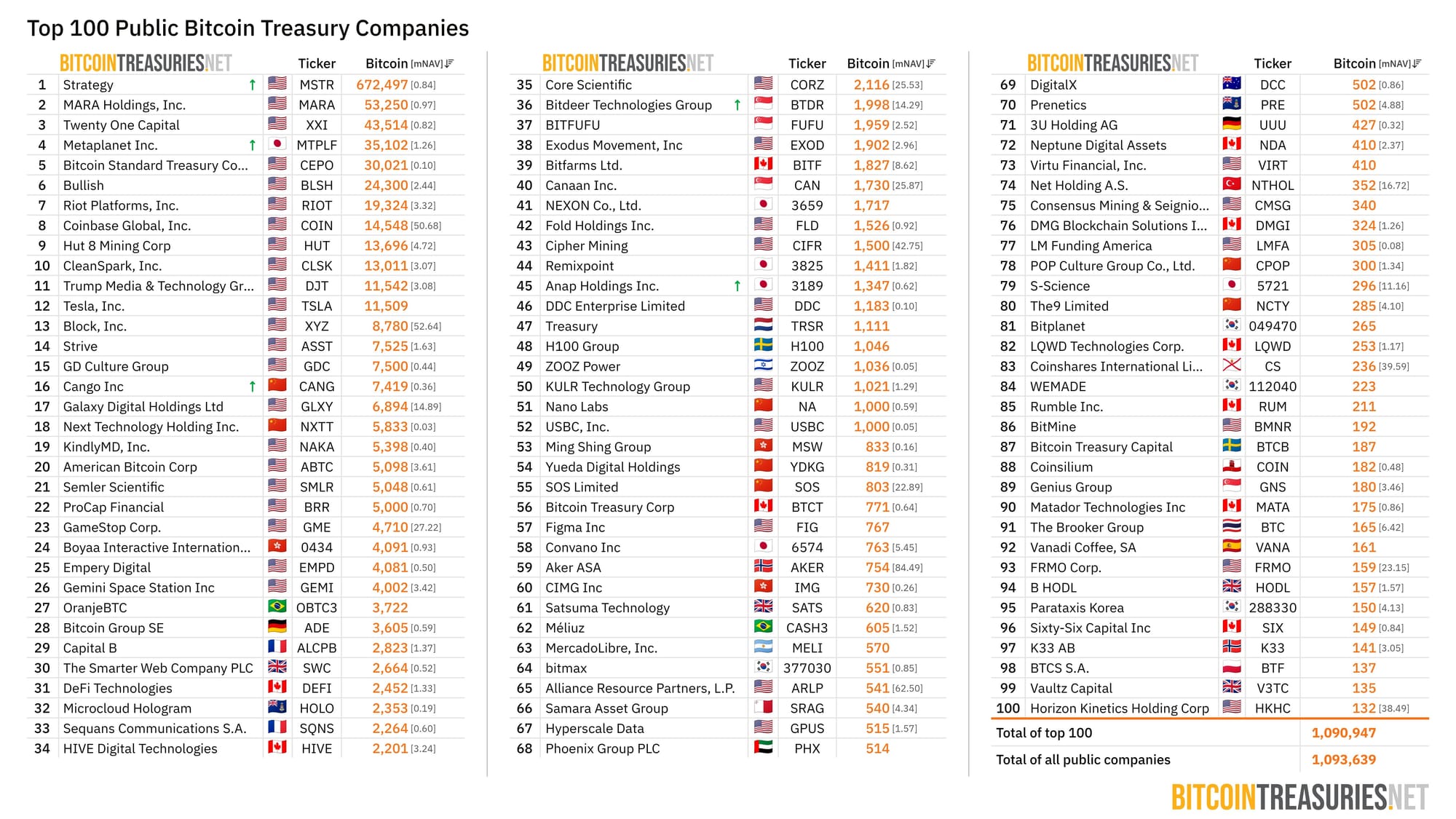

Parallel to this, digital asset treasury companies (DATcos) have cemented a new corporate playbook. These are publicly traded firms that hold crypto as core strategic reserves, not side investments. Strategy blazed this trail, and by 2025 held roughly 672.5K BTC — about 3.2% of the total supply.

The sector has ballooned from a handful of companies in 2020 to over 200 by late 2025, collectively custodizing more than $120 billion in digital assets.

While some DATcos have recently traded at a discount to their underlying holdings, they remain a crucial on-ramp. This shift is fundamentally changing crypto’s investor base, moving price discovery toward global macro sentiment.

Echoing this maturation, Coinbase Ventures' Tejwani adds, “2026 is going to feel less like hype and more like maturity for the space.”

9. Real-world assets (RWA): Tokenization tipping point

Real-world assets (RWA) represent the definitive bridge bringing TradFi onto the blockchain. What began as a niche experiment has hit a tipping point. From roughly $5.5 billion in early 2025, the total value of on-chain tokenized RWAs has more than tripled to over $19 billion, driven by insatiable institutional demand.

The narrative has evolved rapidly beyond simple tokenized US Treasuries. The spotlight is now on private credit (with roughly $17 billion tokenized) and real estate, where platforms like Ondo Finance and Centrifuge enable users to lend stablecoins to real-world businesses for yields divorced from crypto's volatility.

This sector's potential was underscored by its market performance: RWA was the most profitable crypto narrative in 2025, boasting average returns of 185.8%, led by tokens like Keeta Network and Maple Finance.

The infrastructure is falling into place for exponential growth. The SEC’s December approval for the DTCC — which clears over $3.5 quadrillion in traditional securities annually — to provide tokenization services is a game-changer.

As Ophelia Snyder, 21Shares cofounder, states, this “puts us on the path of actually having traditional finance on crypto rails, which is exactly where the future is.” Analysts predict the early stages of formal rulemaking for tokenized securities in DeFi could begin by late 2026, potentially unlocking trillions in latent value.

10. Crypto cards

One of crypto's oldest hurdles — spending it seamlessly in the physical world — has been conclusively solved. The rise of crypto cards in 2025 has turned digital assets into a functional daily currency. Both custodial and non-custodial debit/credit cards now allow users to spend assets like USDC or ETH at any Visa or Mastercard terminal globally, requiring zero manual intervention.

These cards work by interacting directly with a user's connected crypto wallet, instantly converting just enough crypto to fiat at the point of sale. Holders may also borrow (though APRs may reach 31.99%) and earn crypto via spending in everyday categories, from transit to dining.

This elegant solution has moved crypto beyond the exchange and into the checkout line, fulfilling the original promise of digital money as a medium of exchange. By removing friction, crypto cards are driving mainstream adoption from the ground up.

Wrapping up

The cryptocurrency space is maturing — no longer a story of isolated technological experiments, but of a converging financial stack. From the institutional rails of stablechains and ETFs to the user-friendly utility of crypto cards, crypto is building bridges to — and rewiring — the global economy.

In 2026, compliance, integration, and real-world function are the common threads, whether in institutional DeFi privacy, fairer token launches, or the tokenization of trillions in real-world assets. The era of hype is giving way to an era of infrastructure. As these trends unfold, they will cement crypto's role as a pillar of a more open, efficient, and programmable financial future.