Clapp Weekly: BTC below $90K, Cloudflare outage, US banks can hold crypto

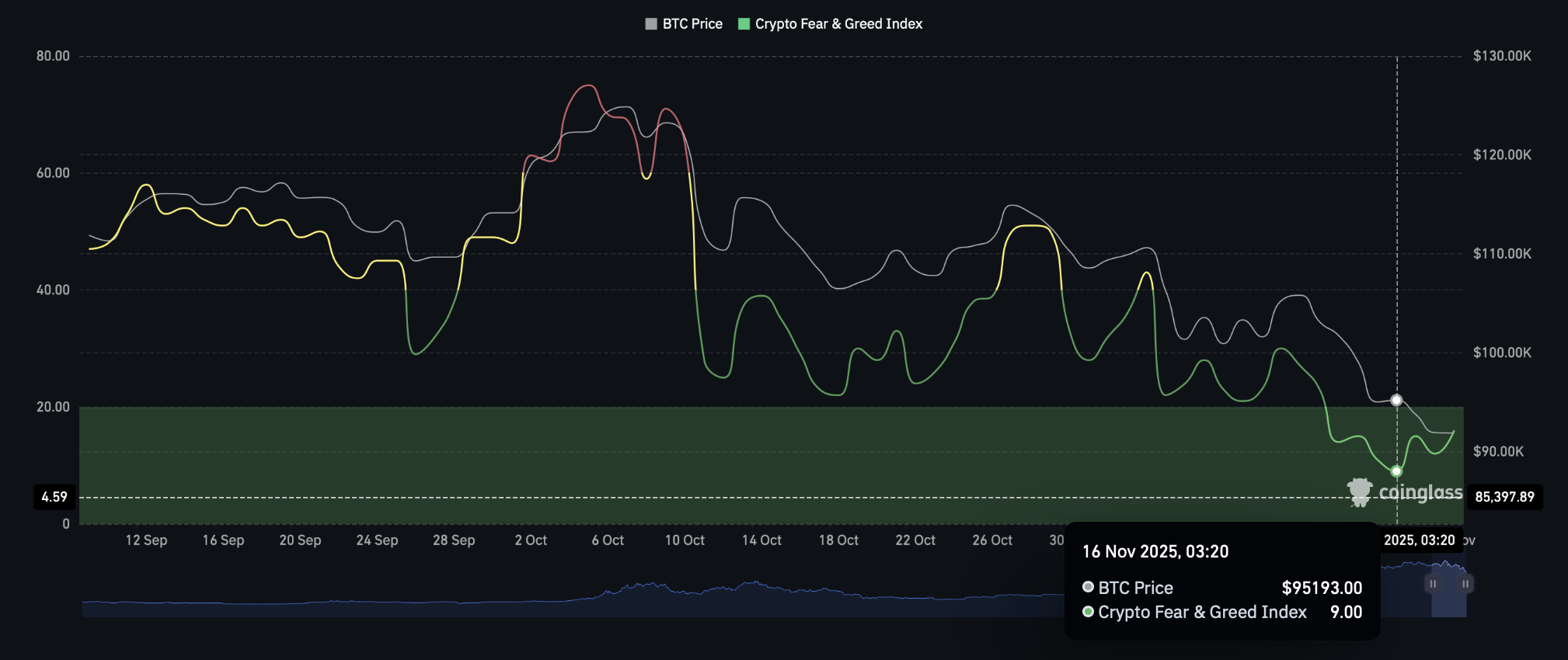

BTC price

Bitcoin has tumbled more than 14% over the past two weeks, erasing all its 2025 gains. ETFs saw historic outflows — BlackRock’s IBIT shed a record $463 million in a single day (November 14); globally, crypto funds saw $2 billion in weekly outflows. Possible culprits are a liquidity crunch, sparked by the end of QT, and the recent government shutdown.

The price has sunk through the week, initially falling from $105,023 on November 12 to below $95K on November 15. After a slight recovery, it plunged further on Monday, November 17, and bottomed out at $89,455.50.

Currently at $91,762.65, BTC has lost 11.1% over the past 7 days but gained 1.7% over the past 24 hours.

ETH price

Ether continues to bleed after the end of the US government shutdown, dipping below $3,000 — last seen in July — several times this week. Meanwhile, investors have pulled nearly $1 billion from US spot Ethereum ETFs since November 11 — the largest net outflows since February.

The ETH price reversed from a high of $3,580.29 on November 12 and nosedived below $3.2K the next day. Trading choppily, it struggled to recover for days before hitting $2,980.38 on Monday, November 17, and rebounding yesterday.

Now at $3,063.86, ETH is up 2.2% over the past 24 hours but down 10.5% over the past week.

Seven-day altcoin dynamics

Major tokens extended last week’s losses on Monday amid a broader downturn in risk assets. Macro uncertainties, including renewed concerns about Fed interest rates and tech giants' spending on AI initiatives, soured sentiment. The Fear and Greed Index, now at 16, plunged to 9 on November 16 — its lowest level since mid-2022.

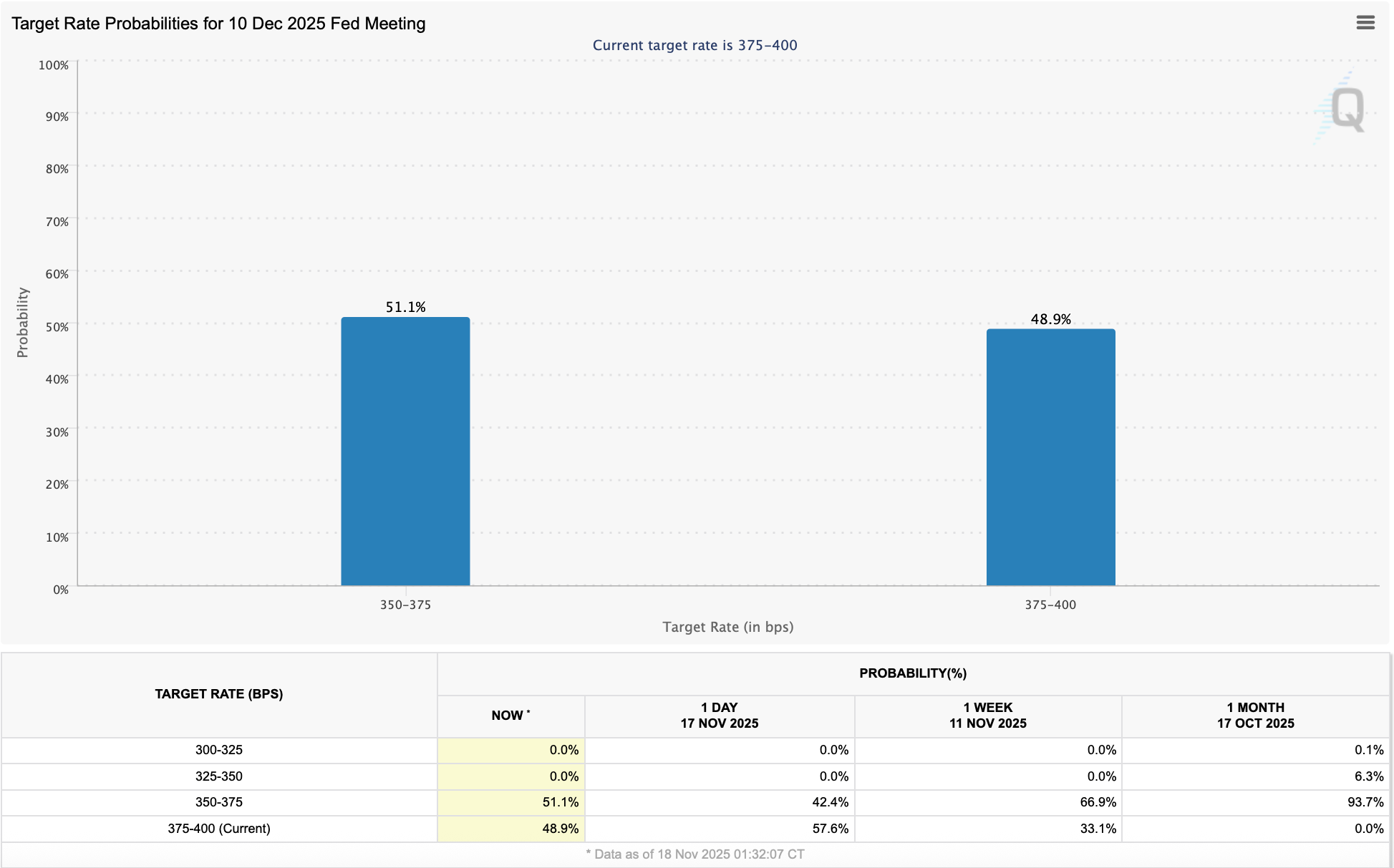

Macro fears fuel panic

A Fed rate cut would benefit markets looking for additional liquidity. However, its probability has shrunk below 50% (CME FedWatch). In recent weeks, macro headwinds from the US have snowballed:

- Inflation fears

- Trade war with China

- Government shutdown delaying October jobs and inflation data

- Slumping economy

Furthermore, commitment to AI projects is expected to weigh on the balance sheets of tech powerhouses like Google and Microsoft. As the tech-heavy Nasdaq and the S&P 500 continued their recent slides on Monday, November 17, crypto-focused stocks were also caught in the downturn — Coinbase lost over 7%.

The following day, 24-hour liquidations exceeded $900 million, including more than $550 million in longs.

What experts say

- Maja Vujinovic, CEO of Ethereum treasury FG Nexus, described the liquidation cascade as "more short-term de-risking and position resets rather than a structural change in thesis," associating the dip with whales and miners selling into strength.

- According to Juan Leon, senior investment strategist at Bitwise, we are witnessing "a recalibration of liquidity expectations driven by a lower probability of a December interest rate cut. This sentiment is being exacerbated by risk-off contagion from the correction in the AI sector that is spreading across all risk assets."

- Former BitMEX CEO Arthur Hayes blamed the plunge on shrinking dollar liquidity. "Bitcoin is the free-market weathervane of global fiat liquidity," he wrote. "It trades on the expectation of future fiat supply." Senior Forbes contributor Clem Chambers agrees this could be the case; if the Fed steps in and injects liquidity into the system, it should find its way into crypto.

In the realm of AI, today's release of Nvidia's Q3 earnings could turn things around. Wall Street expects a blockbuster print, with revenue projections around $54B and earnings of $1.24 per share.

Weekly winners

- ZEC (+28.2%) neared its all-time high despite the broader downturn, rebounding strongly from a mid-week plunge and proving sustained investor interest in privacy protocols.

- ASTER (+23.1%) regained retail demand, reflected in rising futures and funding rates. Growing whale accumulation signals expectations of further upside — over the past two days, addresses holding 1 million to 1 billion ASTER added roughly 230 million tokens.

- WBT (+12.1%) found support after Whitebit partnered with Durrah AlFodah Holding, a Saudi business entity represented by Prince Naif Bin Abdullah Bin Saud Bin Abdulaziz Al Saud. The collaboration advances Saudi Arabia's Vision 2030, a reform agenda to diversify its economy from oil dependency.

Weekly losers

- PUMP (-25.0%) extended losses amid the broader market crash following a massive sell-off that accompanied a token unlock on November 12 (2 billion PUMP released).

- SUI (-18.6%) was affected by forced selling and a potential positioning reset in what has been described as a “classic capitulation flush” — a dramatic reversal after a rally sparked by Crypto.com's custody partnership with the Sui Foundation.

- ICP (-18.1%) followed the broader decline. The price resumed the decline from its November 8 peak, although yesterday's Cloudflare crash — taking down a big chunk of the internet — proved its point that apps should run on a decentralized network.

Cryptocurrency news

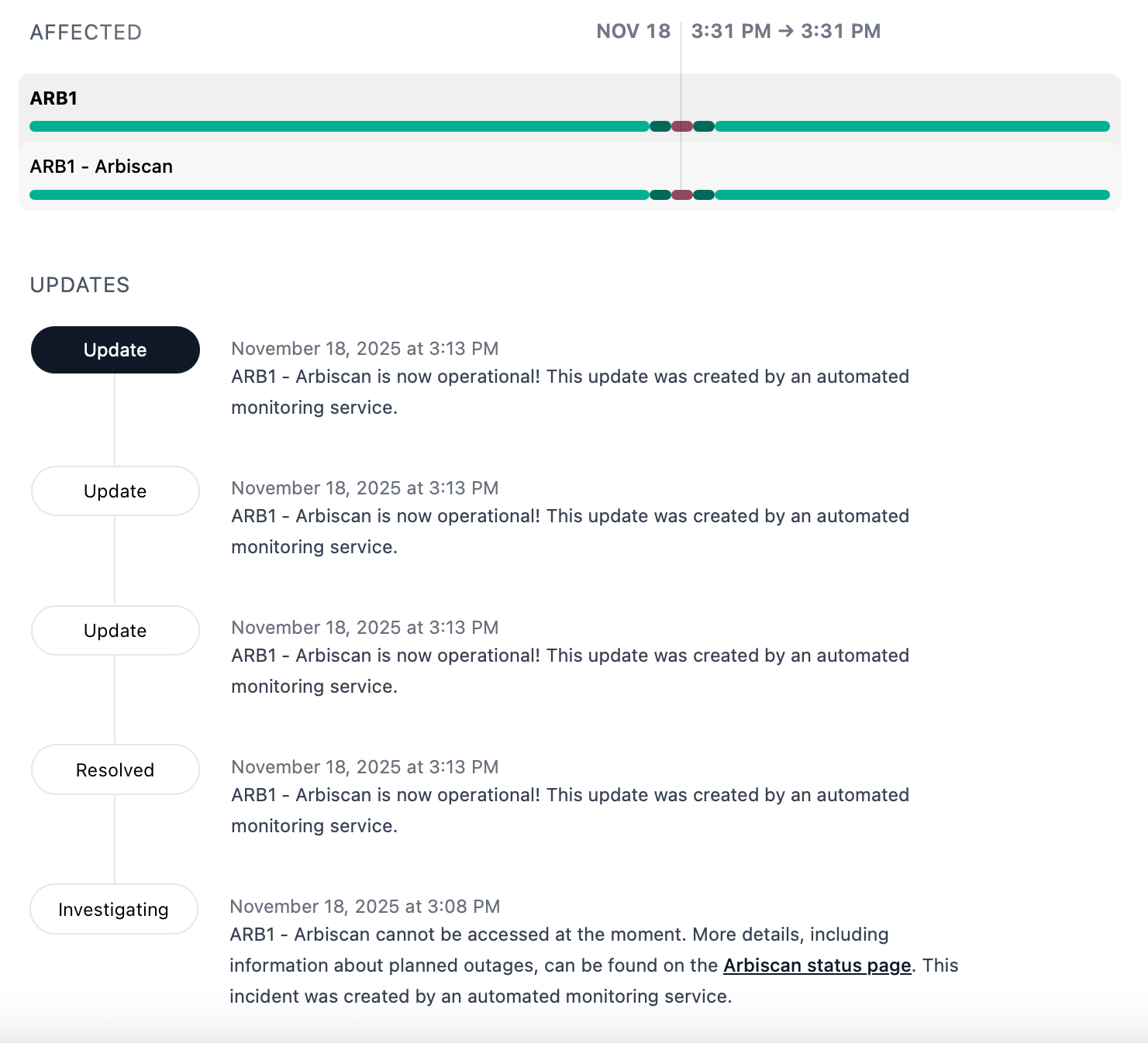

Cloudflare outage impacts 20% of the entire internet, including crypto

If you tried to check a crypto price or use a dApp yesterday and found yourself staring at a blank screen, you weren't alone. A massive, global outage at internet infrastructure giant Cloudflare brought significant parts of the web to a standstill, and the crypto space was hit particularly hard.

Major platforms went dark

For a few hours on Tuesday, the digital lights went out across a swath of the crypto ecosystem. The common thread? Their reliance on Cloudflare's content delivery network.

- Critical services like the Arbitrum block explorer Arbiscan, data aggregator DefiLlama, and even Toncoin experienced major outages.

- Social media platform X and the exchange BitMEX were also among the casualties, all displaying frustrating "500 internal server errors."

The company quickly acknowledged the issue, stating it was investigating widespread "500 errors" that also took down its own dashboard and API. This generic error is a clear sign that a website's backend is failing, leaving users completely locked out.

The cause was a simple database error

In a post-mortem, Cloudflare revealed it wasn't a sophisticated cyberattack, but a far more mundane culprit: a faulty database update. A "feature file" within its Bot Management system grew too large, triggering a cascade of failures across its network.

The company apologized, acknowledging that "any outage of any of our systems is unacceptable," especially given its role in powering roughly one-third of the top 10,000 websites.

This highlights a critical contradiction

This incident, coming just weeks after a similar outage at Amazon Web Services (AWS), forces a difficult conversation. The crypto industry, built on the ideals of decentralization and censorship-resistance, remains deeply reliant on highly centralized web infrastructure.

As a spokesperson for EthStorage pointed out, this creates a single point of failure that contradicts the very ethos of Web3. This sentiment echoes a recent call from Ethereum co-founder Vitalik Buterin. In his "Trustless Manifesto," he urged builders never to sacrifice decentralization for the sake of adoption, warning that every centralized checkpoint becomes a potential chokepoint.

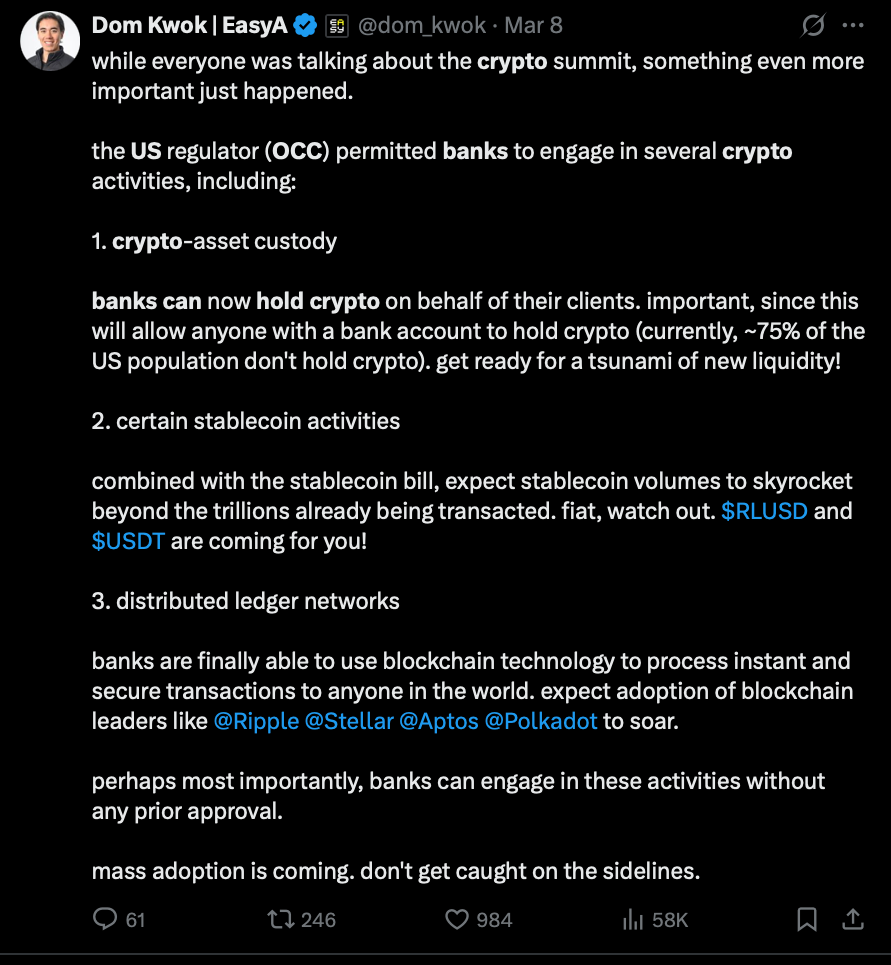

US banks can now officially hold crypto for key operations

A key US banking regulator — the Office of the Comptroller of the Currency (OCC) — has officially given national banks the green light to hold cryptocurrency on their balance sheets. This decision, aimed at facilitating core operations like paying blockchain network fees, marks a notable shift toward integrating banking infrastructure with crypto.

Green light for gas fees and testing

The OCC, a bureau of the Treasury Department, clarified its stance in an interpretive letter this week. It stated that national banks are permitted to hold digital assets as principal to cover anticipated “gas fees” — the payments required to process and validate transactions on a blockchain.

This is essential for banks engaging in “otherwise permissible” activities, such as acting as an agent for customer transactions or providing custody services. The policy also explicitly allows banks to hold crypto for testing and developing new crypto-related platforms.

The logic, as explained by the OCC's senior deputy comptroller, is straightforward. Banks can now expand their pre-existing activities without the operational hassle and risk of constantly acquiring crypto from third parties for each transaction.

Reversing a cautious era

This new guidance continues the Trump administration's systematic dismantling of the more cautious, restrictive approach taken under President Biden. Previously, banks were discouraged from engaging with public, permissionless networks and often had to seek special approval for crypto activities.

The current OCC, led by Trump appointee Jonathan Gould, has been actively reversing those policies. In particular, it has already cleared banks to custody crypto and engage in stablecoin activities.

This latest step is particularly meaningful because it moves beyond facilitating services for their customers and allows the banks themselves to directly hold crypto assets for operational purposes. It brings major financial institutions one step closer to moving traditional functions on-chain, signaling a growing institutional comfort with the fundamental mechanics of blockchain technology.