Clapp Weekly: BTC steady amid Fed anticipation, DOGE ETF, $7T cash boost

BTC price

After a calm week, Bitcoin swiftly pulled back from $113k amid the largest jobs revision in US history — as markets brace for US CPI data and the Fed’s September meeting. Yet spot ETF inflows (roughly $1 billion) have exceeded outflows (over $380 million) since the start of September.

BTC breached $112k and then steeply declined to $109,498 last Thursday, September 4. A violent rebound culminated in a high of $113,225 the next day before another retreat. On Saturday, September 6, BTC bounced off the $110k mark — climbing to $113,113 yesterday before losing steam.

After another dip below $111k, BTC is now trading at $111,452, down 0.1% over the past 24 hours but up 0.2% over the past 7 days.

ETH price

Unlike Bitcoin, ether has struggled to rebound this week. US spot ETFs saw a 6-day streak of outflows (over $1 billion), while dwindling network revenue (-44% in August) sparked debate about fundamentals. However, institutions remain drawn to Ethereum's yield-bearing features.

The price shot up from $4.3k to $4,482.36 a week ago, then sank back before reversing to $4,465.50 prior to a steep descent. As momentum faded, ETH hit $4,273.15 last Friday, September 5, and $4,256.04 the next day. Yesterday's push to $4,370.19 was short-lived.

Currently, ETH is trading at $4,315.64, up 0.3% over the past 24 hours but down 0.3% over the past 7 days.

Seven-day altcoin dynamics

Bitcoin’s tight range around $111k reflects anticipation of US inflation data (primarily, CPI on September 11) and the Fed’s interest rate decision on September 17. Meanwhile, major altcoins like Solana have rallied, driven by ETF enthusiasm.

Fed rate cut expected on Sep. 17

Prediction markets show strong confidence in a 25-basis-point cut next week. The preliminary benchmark payrolls revision (–911,000 jobs between March 2024 and March 2025) nearly locked in this cut.

The adjustment followed last month’s downward revision of 258,000 jobs for May and June — marking the largest two-month net revision in modern history outside of 2020. The news initially spooked markets, though cheaper borrowing costs are expected to benefit crypto long-term. The October outcome remains less certain.

ETF sentiment drives SOL and XRP

ETF flows have emerged as one of crypto’s strongest short-term catalysts. Ether-linked spot products bled over $1 billion during a six-day outflow streak, prompting rotation into assets perceived as next in line for ETF approvals.

Solana and XRP outperformed the broader market (trading above $219 and $3, respectively) as traders bet on upcoming SEC greenlights for spot products. These would allow investors to gain exposure without directly buying or storing the altcoins. Solana's sentiment was also boosted by last week's Alpenglow upgrade approval.

Prediction markets show 54% of users expect Solana to reach a new record high by year-end. XRP-related bets reflect similarly strong optimism — over half of Myriad users predict the price will hit $4.

Weekly winners

- MYX (+1,110.4%) surged dramatically amid hype around MYX Finance’s upcoming upgrade, though analysts warn of potential market manipulation and a sharp correction ahead.

- M (+138.7%) also posted major gains, fueled by speculative interest in its dedicated “Meme 2.0” Layer-1 blockchain, which aims to transform meme coins into cultural and economic assets within a viral economy. Its momentum was further boosted by Gate.io's September 9 listing announcement.

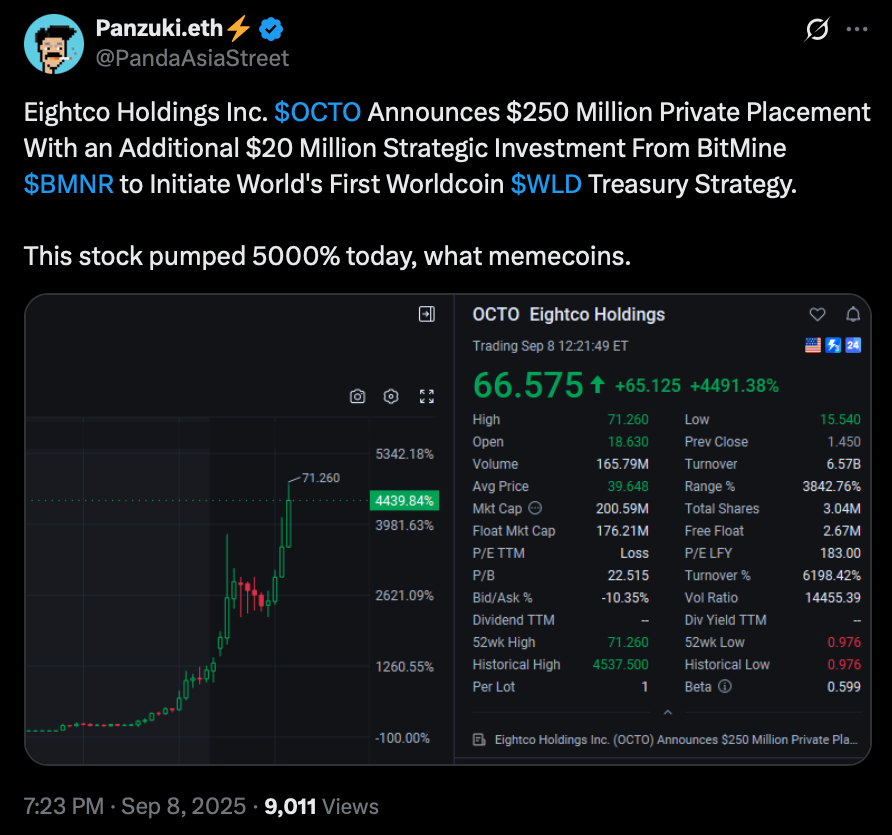

- WLD (+118.1%) rounded out the winners, climbing after institutional moves to launch the first WLD treasury strategy — including Eightco Holdings’ $250 million private placement and a $20 million investment from BitMine, which also propelled OCTO stock higher.

Weekly losers

- WLFI (-11.4%) sank following a volatile launch and accusations of market manipulation after the team blacklisted 272 wallets — including one linked to Tron founder Justin Sun. Despite a 47 million token burn, investor confidence remains weak.

- BGB (-6.8%) corrected despite recent bullish catalysts: a massive $1.09 billion token burn, the lockup of 220 million BGB, and Bitget’s new partnership with Morph. The token’s new role as the required gas and governance token for all network transactions failed to prevent the pullback.

- POL (-6.7%) dipped despite its successful mainnet transition from MATIC, which established POL as the new native gas and staking token. The muted response suggests the migration was already priced in or that the market has yet to fully appreciate the long-term utility of the upgrade.

Cryptocurrency news

DOGE ETFs to go live tomorrow; HBAR and BCH join the queue

The first US Dogecoin ETF is set to launch on Sep. 11, signaling Wall Street’s growing embrace of crypto’s most unconventional assets. The Rex-Osprey DOGE ETF ($DOJE) will trade under the Investment Company Act of 1940, the same structure used for their Solana staking ETF ($SSK), bypassing the stricter Securities Act of 1933 requirements.

The ETF is expected to attract new liquidity while testing whether meme coins can thrive in regulated wrappers. Already, DOGE has surged 17% this week in anticipation, reflecting retail enthusiasm and speculative demand.

First ETF "with no utility on purpose"

According to Bloomberg analyst Eric Balchunas, $DOJE is the first US ETF to hold an asset “with no utility on purpose.” Yet proponents argue DOGE's value lies in its cultural resonance and community strength. Jordan Jefferson, CEO of DogeOS, said,

“When pension funds buy the asset that started as a joke, you know we’ve reached a unique moment in financial history.”

Broader implications

While the SEC under Chair Paul Atkins has delayed decisions on most crypto ETFs, the approval of $DOJE could set a precedent for other meme coins and alternative assets. Analysts note that Dogecoin’s proof-of-work consensus — shared with Bitcoin — gives it a technical edge over proof-of-stake meme tokens like Shiba Inu.

Still, institutional portfolios may remain cautious until market caps and utility evolve. Meanwhile, the crypto market watches closely to see if cultural tokens can transition from internet jokes to mainstream investments.

HBAR and BCH could join DOGE

Expanding its crypto ETF lineup, Grayscale filed for Bitcoin Cash (BCH) and Hedera (HBAR) funds on Sep. 9. These S-3 applications follow earlier submissions for Litecoin (LTC) and Chainlink (LINK) ETFs, highlighting an aggressive strategy to diversify product offerings.

Meanwhile, a wave of ETF proposals are still awaiting SEC review this year, including 90+ applications for tokens like Solana and XRP.

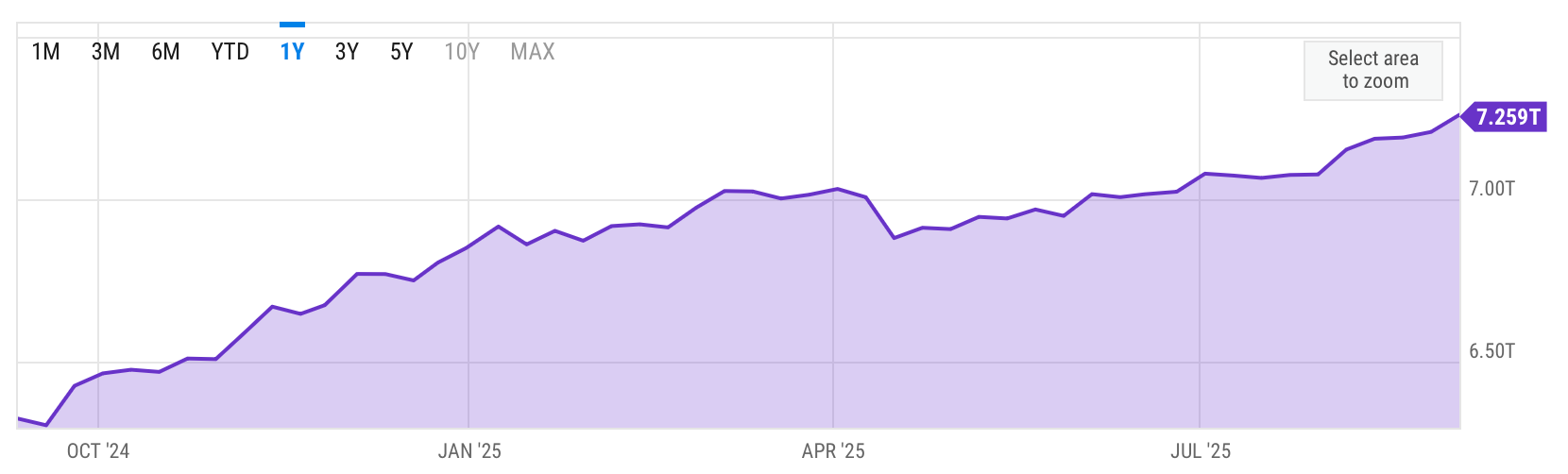

Fed decision will be crucial for $7T cash pile poised to fuel BTC and alts

A record $7.26 trillion sits in US money market funds — a massive cash reserve that could soon flow into crypto if the Fed cuts interest rates next week. This unprecedented liquidity, reported by the Investment Company Institute, has come as investors sought safety in high-yield, short-term debt during years of economic uncertainty.

Analysts believe this capital may finally rotate into riskier assets like Bitcoin and altcoins. According to David Duong, Head of Research at Coinbase, “all of that is retail money. As those rate cuts start to come in, all of that cash flow is really going to enter other asset classes such as equities, crypto, and others.”

The Fed’s upcoming decision — whether it cuts by 25 or 50 basis points — will determine the speed and scale of this shift. A more aggressive cut could accelerate the move from money markets into Treasuries and eventually crypto, as investors chase higher returns in a lower-yield environment.

However, rotation isn’t guaranteed

The $7.4 trillion stash represents both opportunity and caution — a wall of cash waiting for the right moment to deploy.

If rate cuts coincide with economic slowdown or renewed uncertainty, investors may prefer the safety and liquidity of money market funds despite reduced returns. As pseudonymous analyst EndGame Macro noted,

“We only see buildups like this when investors want yield but don’t want to take on duration or equity risk.”

For crypto markets, this liquidity wave could be transformative. Bitcoin, already trading near $112k, and major altcoins like Ethereum and Solana stand to benefit if even a fraction of this capital seeks exposure to digital assets.

The Fed’s policy move next week will not only shape short-term sentiment but could unlock the next leg of the crypto rally — proving that traditional finance’s safest havens may soon become crypto’s strongest catalysts.