Clapp Weekly: FOMC unease, first BTC reserve, Democrats against crypto bill

BTC price

Progress on the US-China trade deal pushed Bitcoin above $97k last night as risk assets jumped. Treasury Secretary Scott Bessent called the current tariffs “unsustainable,” while China agreed to negotiate.

Last week, BTC sank from $95k to $93,438.41 before rocketing to $97k on Thursday, May 1, and $97,715.58 the next day. Then, a multi-day retreat ceased at Monday's low of $93,724.81. This morning, the price soared to $97,454.99.

Currently at $96,497.04, BTC has gained 2.2% over the past 24 hours and 2.0% over seven days.

ETH price

Spot investors remain bullish ahead of today's Pectra upgrade, designed to enhance data availability and smart wallet functionality on Ethereum’s Layer 1. Amid growing competition and falling prices, Pectra could be the key to winning back users and developers.

ETH echoed BTC's ups and downs, falling from $1.8k to $1,750.43 last Wednesday, April 30. Its price shot to $1,862.48 the following day before seesawing and descending to $1,763.97 yesterday. This morning's pump culminated at $1,843.22.

Now at $1,826.38, the coin is up 1.1% over 24 hours and 1.3% over the past week.

7-day altcoin dynamics

Meme coins are falling out of favor, while DeFi tokens like AAVE (+6.1%), CRV (+3.7%), and HYPE (+14.0%) see growing demand. Interest in utility and yield mechanisms is rising — reinforced by lingering uncertainty around US inflation and tariffs, alongside Bitcoin's decreasing volatility.

Hopes of easing trade tensions have supported the market's rebound from its post-Liberation Day lows. Yet major altcoins like ADA (-3.3%) and XRP (-5.4%) dipped on Tuesday, May 6, amid the unease ahead of the Federal Reserve's interest rate decision, due today at 2:00 p.m. ET.

No change from the current 4.25%-4.5% range is projected, despite increasing pressure for cuts from President Trump. At press time, CME FedWatch shows a merely 2.3% chance of a reduction.

Fed Chair Powell's comments at the FOMC press conference could provide directional cues. Traders will dissect the statements for hawkish or dovish signals — hints at tightening or persistent inflation may strengthen the dollar, diverting capital away from crypto.

Winners & losers

OP (-18.8%) is suppressed by concerns over a massive token unlock due on May 31, worth approximately $587 million. This dip follows a smaller release at the end of April. ENA (-14.9%) continues its decline after a May 5 unlock boosted selling pressure with 171.88 million tokens (worth around $53 million).

Meanwhile, TRUMP (-15.8%) leads meme coin losses, reversing the gains from the private dinner announcement for top holders. On-chain data reveals that just 58 wallets have raked in over $10 million each, while smaller investors lost money.

On the upside, DEXE (+16.1%) rebounded sharply, reflecting renewed confidence among long-term holders after weeks of decline. QNT (+15.1%) also posted strong gains, with technical indicators nearing overbought territory as trader and investor participation surged.

Meanwhile, HYPE (+12.2%) has extended its April recovery, driven primarily by whale activity manipulating HyperLiquid’s market-making vault — although retail interest appears to be waning.

Cryptocurrency news

New Hampshire becomes the first US state to approve a Bitcoin reserve

In a landmark move for cryptocurrency adoption, New Hampshire has become the first US state to authorize the creation of a strategic crypto reserve, allowing a portion of its public funds to be invested in Bitcoin and precious metals. Governor Kelly Ayotte signed the bill into law on Tuesday, marking a major victory for pro-crypto advocates and setting a precedent for other states to follow.

Pioneering law

The new law permits New Hampshire’s treasury to allocate up to 5% of state funds into digital assets — specifically those with a market capitalization of at least $500 billion, which currently only includes Bitcoin (BTC). This cautious approach ensures that only the most established crypto assets are considered, minimizing risk while embracing innovation.

Governor Ayotte celebrated the milestone on X, declaring, "New Hampshire is once again first in the Nation." State House Republicans echoed the sentiment, emphasizing that the "Live Free or Die" state is now leading the charge in digital asset adoption.

Why this matters

New Hampshire’s move comes as multiple states — including Arizona, Florida, and North Carolina — have attempted similar legislation but faced setbacks. Arizona’s governor recently vetoed a Bitcoin reserve bill, while Florida withdrew its proposal entirely. However, with New Hampshire’s success, momentum could shift as other states look to replicate its model.

Dennis Porter, founder of the Satoshi Action Fund, which has been lobbying for state-level crypto reserves, called this a "game-changer." "The first one's the hardest," he told CoinDesk. "Having a state that's already gotten it done will really increase the political momentum."

This development also puts pressure on the federal government, where President Trump has previously advocated for a national Bitcoin reserve. While the Treasury Department is still evaluating options, New Hampshire’s move could accelerate discussions at the federal level.

Looking ahead

With New Hampshire paving the way, all eyes are now on North Carolina, where a similar bill is gaining traction. If more states follow suit, we could see a domino effect — solidifying crypto as a legitimate reserve asset in the US financial system.

Trump’s crypto ventures spark political chaos

The push for all-encompassing US crypto regulation has hit a dramatic roadblock — House Democrats staged a walkout during a key digital assets hearing, accusing President Trump of using the industry for personal gain. The chaotic scene devolved into shouting matches, underscoring how Trump’s deepening ties to crypto are threatening fragile bipartisan support.

Democrats revolt over "crypto corruption"

Led by Rep. Maxine Waters (D-CA), Democrats stormed out of the hearing, protesting Trump’s alleged $2.9 billion crypto holdings — now nearly 40% of his wealth. They demanded amendments to pending stablecoin and market structure bills barring presidents from profiting off crypto while in office.

Yet Republicans rejected these measures, arguing Democrats were obstructing much-needed regulation. The tension spilled into the Senate, where nine Democrats withdrew support for a GOP-backed stablecoin bill, citing risks to financial stability and concerns over Trump’s family benefiting from the legislation.

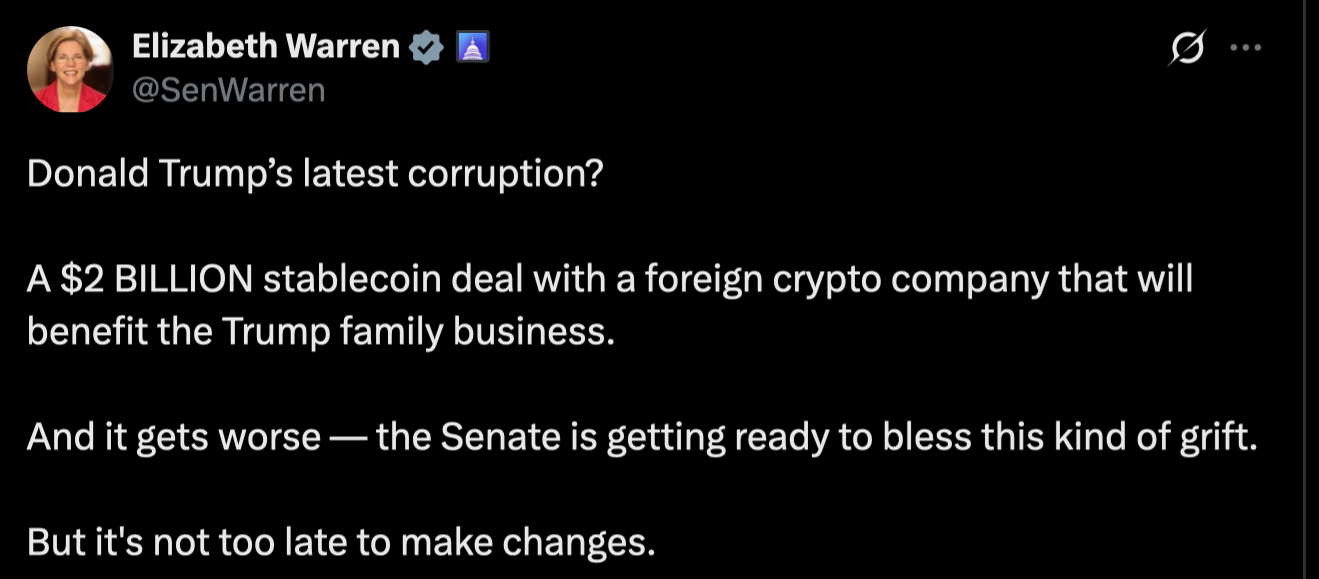

Sen. Elizabeth Warren (D-MA) called a recent $2 billion deal involving Trump’s stablecoin venture "corruption." Meanwhile, Sen. Ruben Gallego (D-AZ) insisted the bill had been watered down.

Industry caught in the crossfire

The infighting leaves crypto regulation in limbo. Industry leaders like Coinbase’s Greg Tusar praised the House’s market structure draft as a "strong step," but Democrats warn Trump’s ventures — including his meme coin and a UAE-backed stablecoin — are eroding trust in the sector.

Meanwhile, Republicans accuse Democrats of politicizing the issue, delaying crucial rules that could prevent offshore dominance. With Trump pushing for a bill by August and Democrats digging in, crypto’s future in the US hinges not just on policy debates, but on a high-stakes political showdown.