Clapp Weekly: Government shutdown FUD, stablecoin boom, SWIFT goes on-chain

BTC price

Last week was rough for Bitcoin. Fears of a potential US government shutdown sparked a plunge to $109k for the first time since early September. US spot ETFs posted their first weekly outflow in over a month — likely due to “profit-taking and portfolio rebalancing” as Q3 drew to a close.

The BTC price nosedived from $113,874 to $109k last Thursday, September 25, and remained flat until Monday’s push above $112k. The rally appeared to fizzle at $114,592 yesterday but then resumed — rocketing minutes ago, BTC breached $116k.

Currently at $116,272, BTC has gained 2.6% over the past 24 hours and 3.3% over the past week.

ETH price

On-chain and technical data suggest traders are positioning for an ETH price recovery in October — after the shutdown panic pulled the price below $4k for the first time since early August. Ethereum ETFs reversed course after five-day outflows; US funds collectively lost $795 million last week.

Mirroring BTC, ETH slipped from $4,192.21 and hit $3,846.41 last Thursday, September 25. It struggled to hold above $4k over the weekend and regained momentum on Monday — albeit temporarily. After yesterday's high of $4,225.65, the price retreated and surged again minutes ago.

Currently at $4,292.85, ETH is in the green at +3.1% over the past 24 hours and +2.9% over the past seven days.

Seven-day altcoin dynamics

If crypto’s current trading performance is any indication of what October and Q4 may bring, it could be a buoyant period for an industry still lagging behind US stocks and metals. After Friday’s plunge pushed the Fear and Greed Index to 29, dragging BTC to $109k, the index has returned to neutral at 48.

Over the weekend, major tokens recovered, erasing most of last week’s losses — with over $260 million in shorts liquidated between Monday and Tuesday. This set a cleaner stage for a potential leg up. However, political anxiety increased as the US government shutdown loomed.

Shutdown FUD & crucial delays

Congress failed to reach a funding deal to avoid a US federal government shutdown at midnight last night. While previous shutdowns affected BTC differently (it gained 14% in 2013 but lost 6% during the 2018–2019 closure), this failure threatens to delay crypto legislation.

In particular, the event could derail SEC decisions on multiple crypto ETFs, including funds tracking SOL and LTC. Some issuers expected approvals as early as next week. Products like Canary Capital’s Litecoin ETF may now slip into limbo if key SEC staff get furloughed.

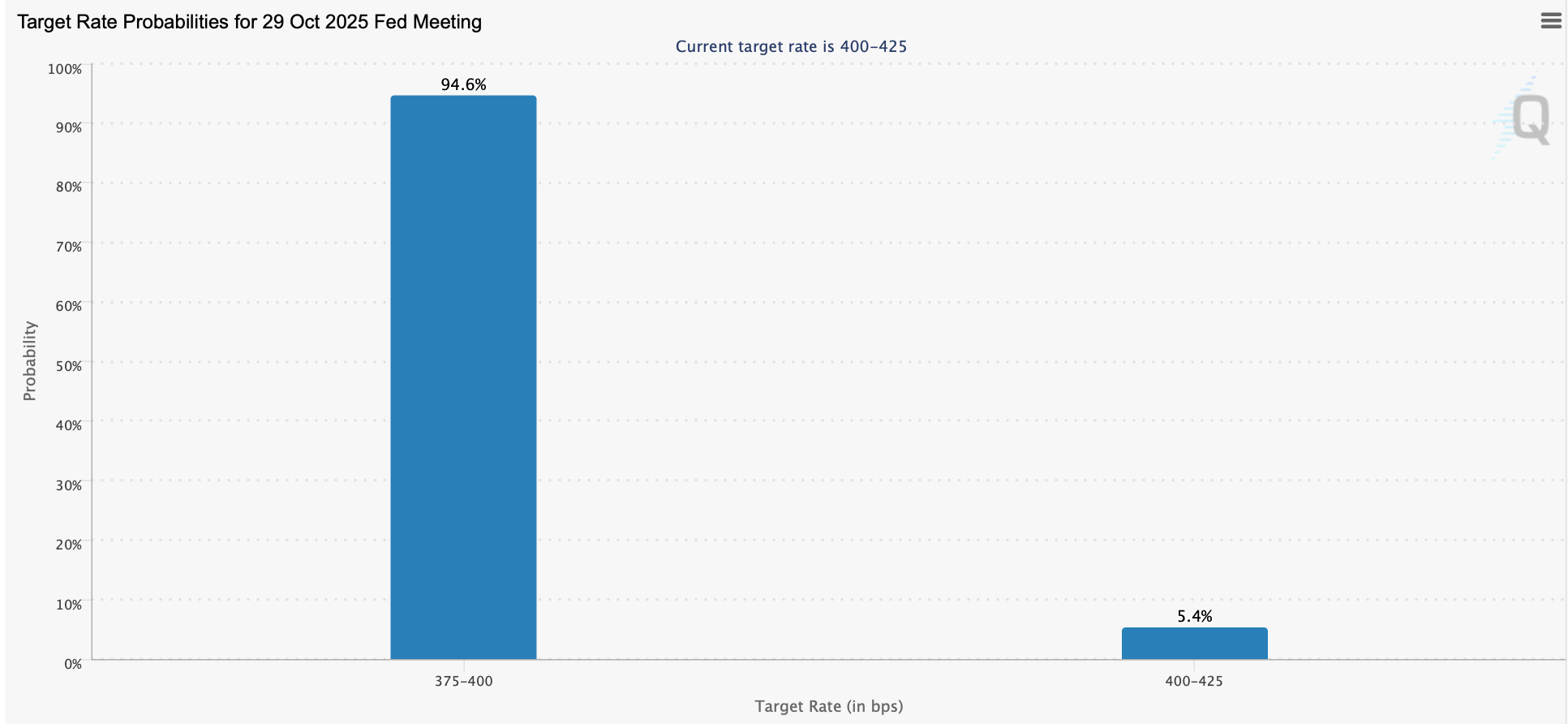

The shutdown also delays the September US employment report, scheduled for this Friday, October 3 — the macro highlight of the week and critical for gauging the Fed’s next move on interest rates.

Weekly winners

- MYX (+45.2%) defied the broader downturn, maintaining its earlier momentum as a massive $39 million short squeeze propelled it through key resistance levels.

- QNT (+6.6%) surged after being selected to provide core infrastructure for the UK's Tokenized Sterling Deposits initiative, positioning the protocol at the center of programmable payments with backing from major UK banks.

- FIGR_HELOC (+3.8%) largely ignored market conditions, though the tokenized home equity product saw volatile demand swings throughout the week.

Plasma's XPL (+10.4%), which launched less than a week ago on September 25, dipped from a high of $1.67 in three days. Despite billions in liquidity across DeFi protocols like Aave and Ethena, and backing from Bitfinex, Tether CEO, and billionaire Peter Thiel, the Layer 1 blockchain for stablecoins failed to maintain initial momentum.

Weekly losers

- IP (-27.9%) surrendered to bearish pressure, reversing its parabolic September rally amid concentrated selling from prominent traders and whales.

- ASTER (-26.6%) corrected from its all-time high near $2.43 as markets anticipated its upcoming $325 million token unlock in October, though deep liquidity suggests potential for recovery if traders accumulate the new supply.

- HASH (-16.4%) followed Bitcoin's government shutdown panic, plunging on Friday before stabilizing to become Tuesday's top performer in a dramatic reversal.

Cryptocurrency news

Stablecoin regulation fuels a $300B market and dethrones Tether

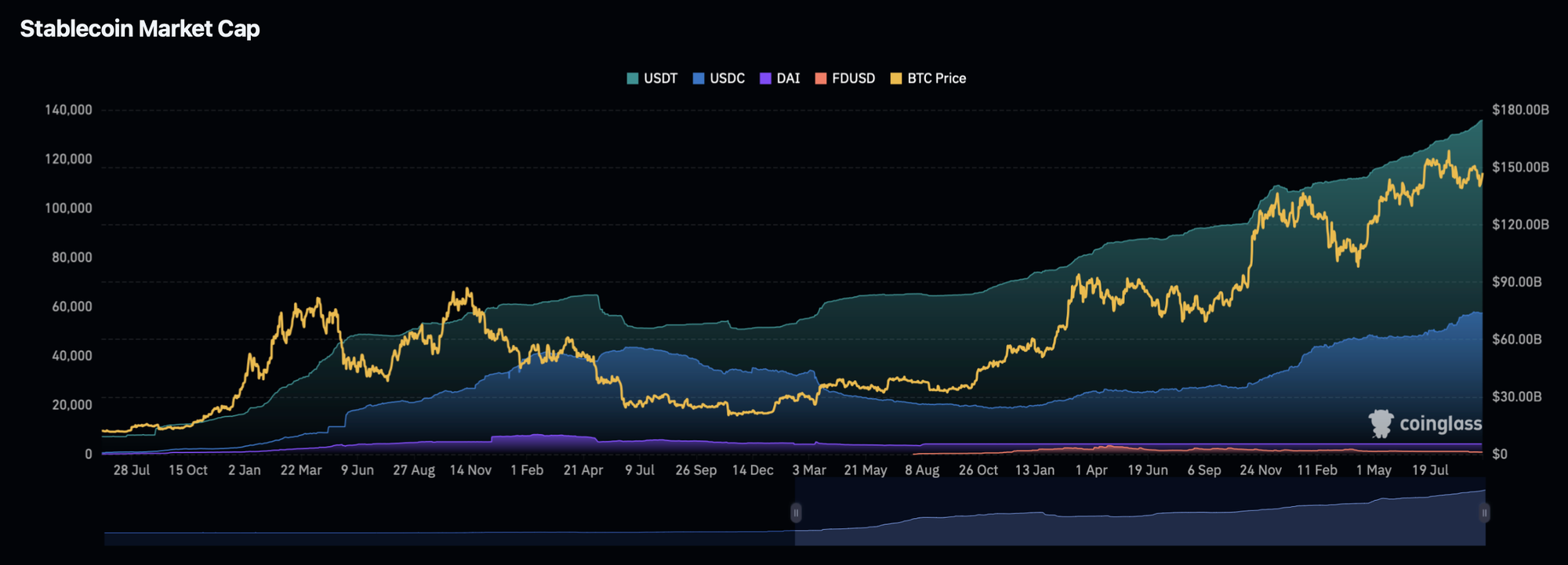

JPMorgan analysis confirms the stablecoin market, now worth nearly $300 billion, has grown 42% year-to-date — double the growth rate of the broader crypto market. Since the signing of the US GENIUS Act on July 18, the sector's capitalization has climbed 19%.

The US GENIUS Act triggered a seismic shift in the crypto landscape, directly fueling a stablecoin market surge and redistributing market power. The most significant change is the rapid redistribution of market share.

After stagnating early in the year, Circle's USDC is the clear winner. Its growth has come directly at the expense of Tether (USDT):

- USDC 's market cap surged from $61.5 billion at the end of June to $73.7 billion by late September. It now commands a 25.5% market share, a 400-basis-point gain in 2025.

- USDT's dominance has shrunk to 60.4% from 67.5% at the start of the year.

- USDC now represents nearly 30% of the combined USDT/USDC share, up from 24%.

While the duopoly is fragmenting, Ethena's USDe has also gained. The token secured a 5% share with $14.4 billion in circulation.

Citi revises its long-term forecast upward

Citi analysts now project a base case of $1.9 trillion and a bull case of $4 trillion for the stablecoin market by 2030. They dismiss fears of bank disintermediation, stating crypto is helping "reimagine" the financial system, not burn it down.

The stablecoin race is officially on. While the US views stablecoins as a tool for dollar hegemony, other sovereign nations, including China, are exploring their own fiat-backed tokens for international use in response.

SWIFT embraces blockchain, signals a new era for global finance

The global financial messaging giant SWIFT has made a bold move into the blockchain space, making a decision that simultaneously accelerates crypto adoption and challenges long-standing industry narratives.

According to the official press release, SWIFT is developing a blockchain-based shared ledger for real-time, 24/7 cross-border payments. The prototype is being built in collaboration with Ethereum software firm Consensys and a coalition of over 30 major financial institutions, including Bank of America, Citi, JPMorgan Chase, and HSBC.

This new ledger will function as a secure, real-time log of transactions between institutions, using smart contracts to enforce rules and validate payments. Crucially, SWIFT CEO Javier Pérez-Tasso emphasized this is an extension of their trusted platform, designed for interoperability with both existing fiat systems and emerging digital asset networks.

Ripple's dreams shattered

The immediate effect of this announcement is the end of a dominant narrative in the crypto space: that Ripple's XRP was poised to replace SWIFT. For years, Ripple executives had marketed their technology as a faster, cheaper alternative. SWIFT’s direct integration of blockchain technology has critically undermined that thesis, with critics like Chainlink's Zach Rynes stating the news has "destroyed the XRP thesis."

Staggering potential impact on blockchain

- The SWIFT network processes roughly 53 million financial messages daily. For context, if just 6% of SWIFT’s volume moved to the Ethereum mainnet, it would double its current transaction load.

- The effect on Consensys's Layer-2 network, Linea, would be even more dramatic, requiring a mere 0.51% of SWIFT's volume to double its throughput.

This move represents a strategic co-opting of blockchain technology by the TradFi establishment. Rather than being disrupted by crypto, SWIFT is leveraging its unparalleled network of 11,500 institutions to build the next generation of financial infrastructure itself.

The convergence of traditional and decentralized finance is underway, led by the system crypto set out to challenge.