Clapp Weekly: Hesitation ahead of Fed decision, Tether's USAT, Bitcoin ETF dominance

BTC price

Following last Friday's uptick, BTC's trajectory reflects bulls’ hesitation ahead of today's Fed interest rate decision. Meanwhile, institutional conviction is growing: spot Bitcoin ETFs saw seven straight days of inflows totaling $2.7 billion (more below).

Rocketing from $111.5k, the BTC price reached $116,705 last Friday, September 12, and spent the weekend within a tight $115k–$116k range. On Monday, it pushed to $116.5k before retreating to a low of $114,696 and then rebounding. Minutes ago, the price breached $117k.

Currently at $117,224, BTC has gained 1.2% over the past 24 hours and 5.1% over the past week.

ETH price

Ether has also retreated as traders trim risk ahead of the FOMC decision. US spot ETFs broke their 5-day inflow streak yesterday, losing $41.4 million. Falling exchange reserves may signal holder caution about liquidating positions or broader confidence in the medium-term outlook.

Mirroring BTC, ETH shot from $4.3k a week ago to $4,762.74 on Saturday, September 13. A choppy weekend ended with a plunge below $4.6k, followed by Monday's morning high of $4,659.53. Since then, ETH has lingered around $4.5k.

Currently, ETH is trading at $4,543.07, up 0.1% over the past 24 hours and 4.9% over the past week.

Seven-day altcoin dynamics

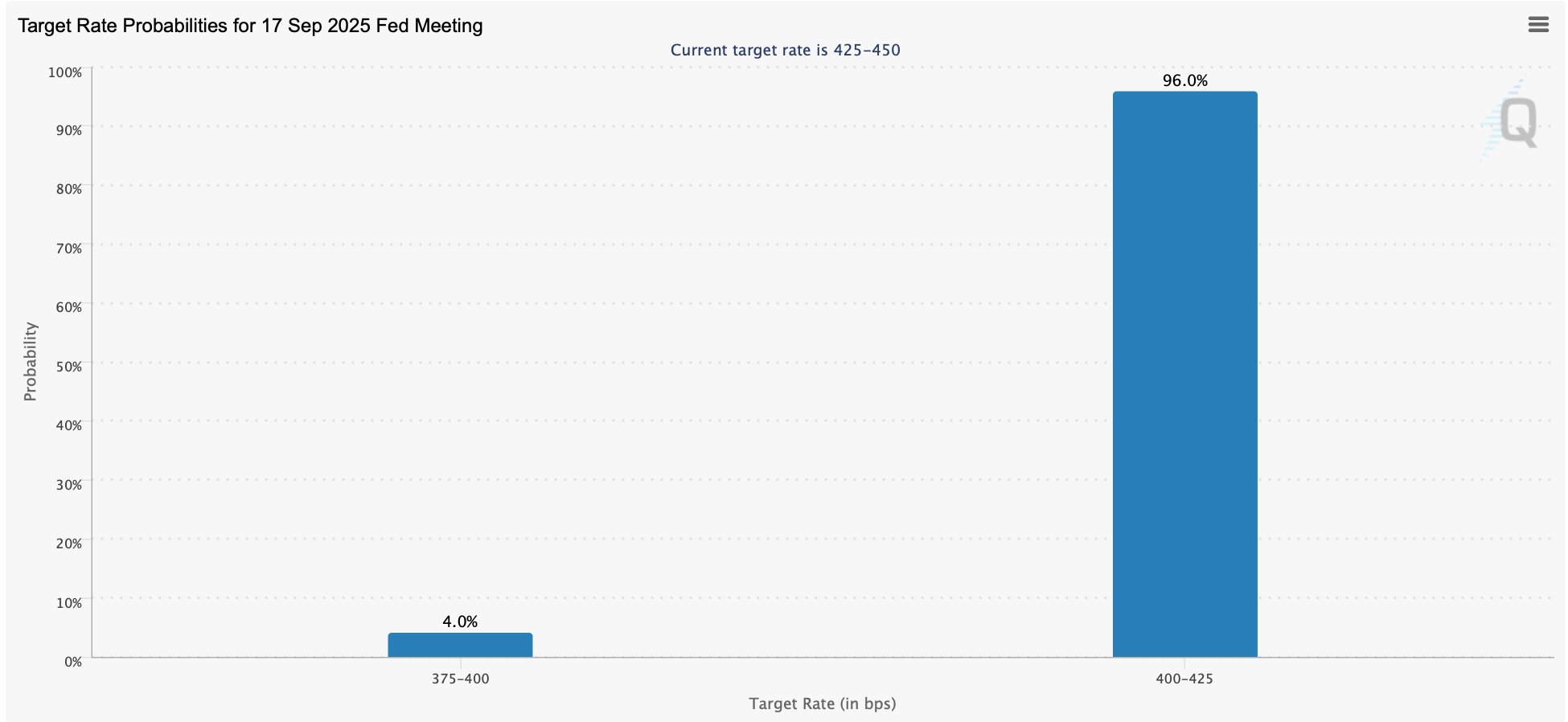

Traders are waiting on the sidelines to see how the market reacts to the Federal Reserve's decision and Jerome Powell's remarks. Markets are 96% certain of a 25-bps interest rate cut, which should unlock fresh liquidity.

Furthermore, the odds for a three-cut path (totaling 75 bps) through 2025 have risen on both Polymarket and CME FedWatch. The potential capital influx could ripple through risk assets, sparking significant upside for altcoins.

Soaring exchange stablecoin deposits ensure liquidity that may support a broad rally if a cut is approved. In particular, USDT deposits remain elevated at $200 million.

However, altcoins have also seen resurging exchange activity — transaction deposits rose to a 7-day total of 55,000, up from the 20,000–30,000 range earlier this year. This trend suggests potential profit-taking despite tight BTC and ETH supply.

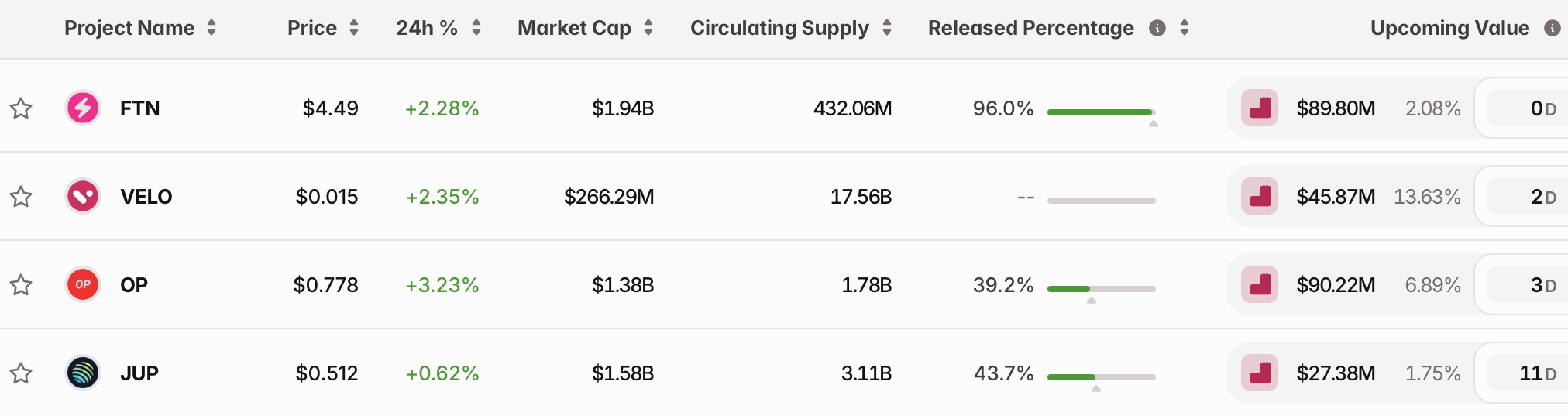

Furthermore, September token unlocks ($4.5 billion in total) are putting market depth to the test.

Weekly winners

- PUMP (+64.9%) soared on the relaunch of its livestream feature, driving massive whale activity that pushed the market cap to $3 billion. The Pump.fun launchpad surpassed Hyperliquid in daily protocol revenue, and now boasts over $2 million distributed across its ecosystem daily.

- MNT (+28.1%) hit a record high of $1.77 yesterday, fueled by recent technical advancements and strategic partnerships. The surge was driven the HyperEVM integration for seamless cross-chain mobility, alongside Bybit's listing and reward program.

- M (+22.7%) reached a new ATH at $2.48, defying headwinds after its official app temporarily went offline on Google Play. The rally was supported by surging market volume and sustained inflows, with bullish perpetual market investors amplifying upward momentum.

Weekly losers

- WLD (-24.3%) cooled after a parabolic rally sparked by BitMine’s confirmation of a strategic investment in the first-ever WLD reserve treasury. The Tom Lee-led firm contributed $20 million to a $250 million private placement by Eightco Holdings; profit-taking ultimately reversed earlier gains.

- ENA (-15.3%) slipped despite Ethena’s total value locked (TVL) reaching an all-time high of $13.88 billion — a sign of strong investor confidence. The decline was attributed to spot market selling pressure and bearish sentiment in perpetual markets.

- MYX (-12.4%) plummeted following a meteoric rise that delivered four-digit gains. While the rally was initially supported by partnerships, exchange listings, and anticipation of the V2 upgrade, analysts raised concerns about potential market manipulation. Accusations of a Sybil attack triggered fear, uncertainty, and doubt (FUD), leading to massive sell-offs.

Cryptocurrency news

Strategic play behind Tether's new USAT stablecoin

USDT issuer Tether is making a deliberate and calculated move into the United States — its new dollar-pegged token was built from the ground up for regulatory compliance. The upcoming launch of USAT is a strategic bid to conquer the one major market where USDT has struggled to gain a formal foothold.

Regulatory gambit

The primary driver behind USAT is unequivocally the GENIUS Act. Unlike the globally-oriented USDT, it is engineered from its core to comply with this US regulatory framework. The new structure is a direct response to its requirements:

- Anchorage Digital Bank will serve as the official issuer, creating a clear link to the traditional banking system,

- Cantor Fitzgerald, a financial powerhouse, will act as the custodian for its dollar-backed reserves, predominantly held in US Treasuries.

With USAT, Tether’s aims to rebrand itself as a transparent partner to US lawmakers and law enforcement, in stark contrast to USDT’s often-criticized opacity. The token is scheduled to launch by year's end.

US challenge: Taking on USDC-Coinbase alliance

Tether’s ambition, as stated by strategic advisor Bo Hines, is to become “the largest player in the US market.” Yet it faces a formidable obstacle: the deeply entrenched alliance between Circle’s USDC and Coinbase.

Coinbase, the largest US exchange, not only prefers USDC but has a lucrative partnership with Circle, earning revenue from its usage. Crucially, Coinbase offers users a 4.1% annual reward for simply holding USDC on its platform — an incentive it does not extend to other stablecoins.

For the average Coinbase user, this makes switching to USAT financially illogical. Hence, while Coinbase will likely list USAT for practicality, its arrival there is expected to be a non-event.

Who is USAT for?

USAT’s success will be measured by its adoption on other major American exchanges like Binance US, Kraken, and Robinhood. It’s also specifically targeted at two key audiences:

- The underbanked: Consumers seeking efficient digital dollar tools.

- Enterprises: Institutions and banks looking for a compliant digital cash alternative for settlements and payments.

Furthermore, USAT aims to technologically streamline the stablecoin experience. Powered by the proprietary "Hadron" tokenization platform, it will avoid the multi-chain confusion that sometimes plagues USDT transactions.

Bottom line

USAT’s launch reflects Tether’s commitment to US regulatory engagement; its potential success would boost the issuer's influence in shaping future policy. For most individual users, however, it will simply present another optional vessel for holding dollar value on-chain — with utility determined by liquidity, exchange support, and the specific use case at hand.

Bitcoin and Ethereum ETFs see massive inflows

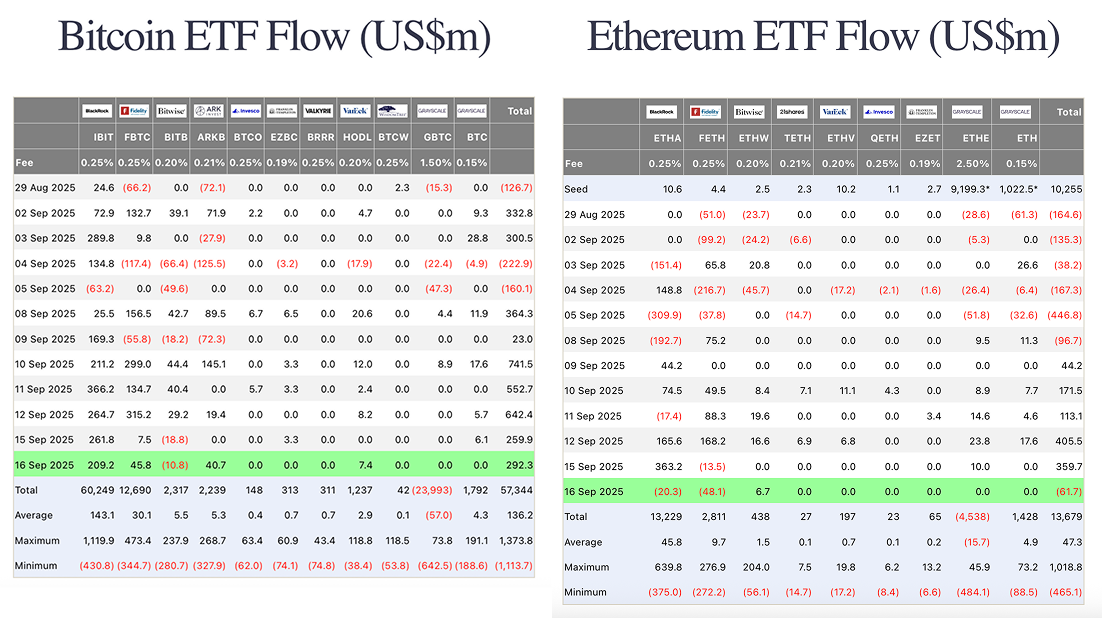

Globally, Bitcoin exchange-traded products saw net inflows of 20,685 BTC last week — the strongest since July 22. US spot Bitcoin ETFs accounted for a staggering 97% of that total, with their combined holdings setting a new record of 1.32 million BTC.

BlackRock’s iShares Bitcoin Trust (IBT) maintains its leadership in size (781,906 BTC). However, leading the charge was Fidelity’s FBTC with a $843 million net inflow — an 18-month high for the fund and 36% of the total $2.34 billion that flooded into all Bitcoin ETFs.

This boost is a likely primary driver for the recent BTC price strength. According to André Dragosch of Bitwise Investments, the "percentage share of Bitcoin's performance explained by changes in ETP flows" has hit a new record high.

Crucially, this institutional demand is vastly outpacing new supply. Over the past week, ETF inflows surpassed BTC supply growth by a factor of nearly 9 to 1 — a potent tailwind for the coin.

Ethereum joins the rally: "Re-rotation"?

Ethereum ETFs are also experiencing substantial institutional interest. The sector saw a net inflow of +87,266 ETH (worth approximately +$392.87 million), with BlackRock’s iShares Ethereum Trust (ETHA) dominating by adding a remarkable 140,969 ETH over the last seven days.

However, analysts at Bitwise have observed an interesting trend: there appears to be a "'re-rotation' from Ethereum back to Bitcoin" in terms of investor flows. This suggests that while both assets are seeing inflows, institutions are potentially allocating new capital or rebalancing their portfolios to prioritize BTC.

Inflow drivers: macro & IPOs

Two key factors are fueling this institutional boom — macro tailwinds and crypto-specific catalysts.

- Soft inflation data and rising expectations for Fed rate cuts boosted risk appetite across the board.

- "Flurry of major crypto-related IPOs and announcements" last week (Bitwise) bolstered overall sentiment and credibility in the sector.

Historically low market volatility suggests this rally may be built on steady, sustained accumulation rather than speculative retail frenzy. This paints a picture of a maturing market — one where large, regulated funds are becoming the dominant force dictating price action.