Clapp Weekly: Liquidation cascade, BNB shines, SEC opens ETF "floodgates"

BTC price

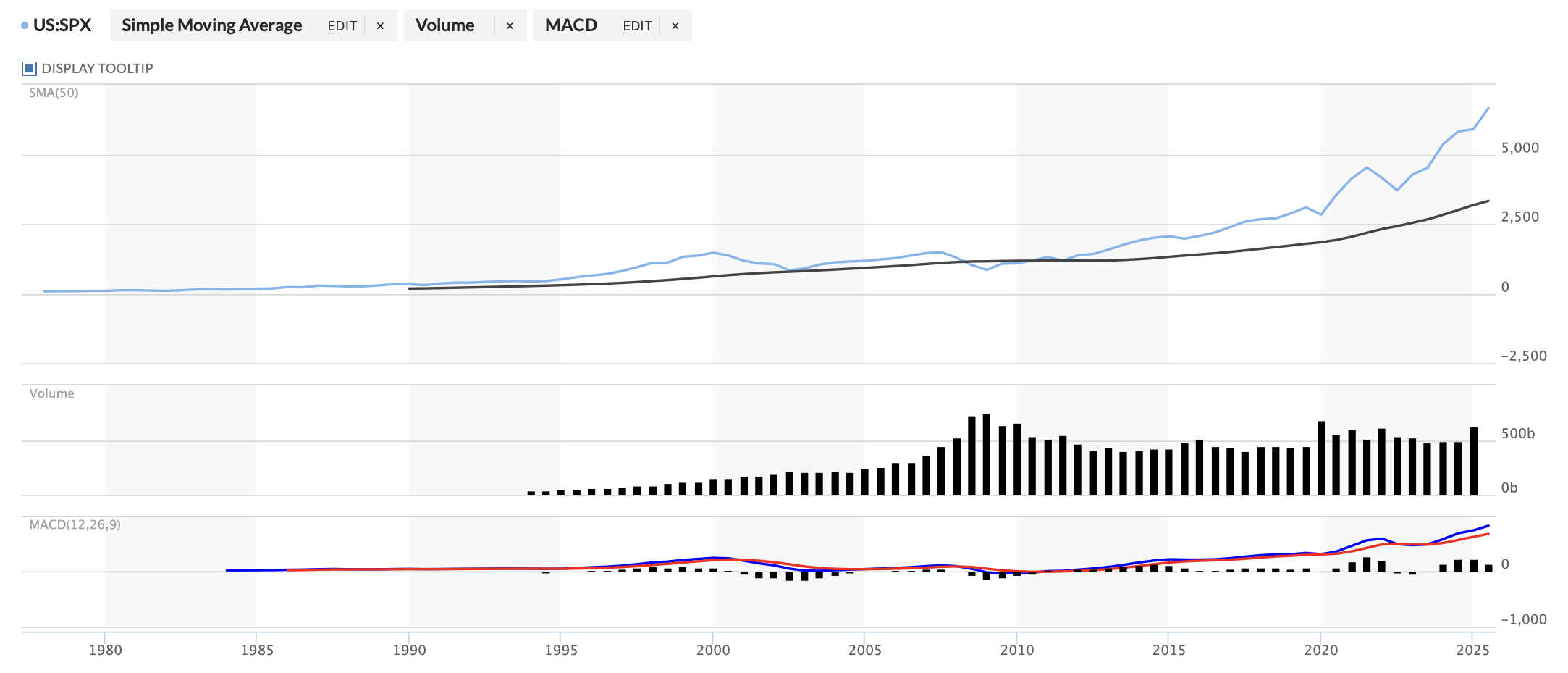

Bitcoin slid below $112k as the market flashed bearish signals after a massive liquidation cascade. The price diverged from gold and the S&P 500, which has notched new record highs. Yet history suggests Bitcoin is likely to catch up, particularly if more Fed rate cuts follow last week's 25-bps reduction.

BTC slipped below $115.2k on Wednesday, September 17, soared to $117,851 the next day, and stayed close to $116k until Monday, September 22. A sharp decline culminated in a low of $111,933, and a failed attempt to reclaim $113k resulted in a low of $111,800 last night.

Currently at $112,853, BTC is down 0.1% over the past 24 hours and 3.2% over the past week.

ETH Price

Ether slumped to $4,075 on Monday as almost half a billion dollars worth of leveraged long positions were liquidated — triple Bitcoin's losses. It reacted to the broader negative sentiment while already being pressured by a $12 billion staking exit queue. However, strategic reserves and ETF holdings are growing, easing sell-off fears.

Mirroring BTC's swings, ETH lost its grip on $4.5k on Wednesday, September 17, recovered to $4,628.91 the next day, and retreated. After two days of trading flat around $4.5k, the price collapsed on Monday, September 22, and hit $4,141.64 before struggling to retake $4.2k.

Now trading at $4,181.15 at press time, ETH is down 0.3% over the past 24 hours and 7.0% over the past week.

Seven-day altcoin dynamics

Despite expectations of a sweeping rally following the Fed’s first rate cut of the year (25 bps on September 17), the market barely reacted. Santiment had projected that a larger cut might trigger a breakout, while a no-cut outcome could spark pullback chaos. Neither scenario materialized.

The market is bleeding in the aftermath of the year’s largest liquidation cascade — more than $1.7 billion in leveraged long positions were wiped out on Monday, September 22. Crypto’s weakness stands in contrast to a new all-time high in gold, driven by Middle East tensions, and continued risk appetite in equities; the S&P 500 is cooling after yet another record high.

Monday’s combined $431 million outflow from spot Bitcoin and ether ETFs erased much of last week’s gains. Analysts view this as short-term repositioning around the Fed rate cut and preparation for upcoming inflation data — specifically, the August PCE report due this Friday.

Weekly winners

- IP (+17.9%) reached a new all-time high near $15 ahead of the Story-co-hosted Origin Summit. The surge also followed news of Heritage Distilling’s $360 million reserve plan, which includes an $82 million buyback program.

- HASH (+16.0%) also stood out, fueled by Provenance Blockchain’s dominant 42.3% share of the RWA market. The latter's total on-chain value has climbed close to $30 billion, with nearly 400,000 holders — a significant adoption milestone.

- AVAX (+12.6%) rallied as Avalanche’s weekly DEX volumes soared to a three-year high of $4.2 billion. This reflected organic network growth, supported by institutional interest in using the chain for tokenized fund creation.

Weekly losers

- PUMP (-28.1%) tumbled during a broader meme coin pullback, as whales took profits even while Pump.fun’s revenue surpassed HyperLiquid’s. Despite the sell-off, an aggressive buyback program continues to provide fundamental support.

- MYX (-26.2%) also corrected sharply, giving back a large portion of its previous gains of over 1,000%. Concerns over possible market manipulation persist, with a recent Rena Labs report flagging hundreds of trading anomalies during the token’s explosive rally phase.

- PI (-20.3%) struggled amid Bitcoin’s drop to $111k and the ongoing pressure of daily token unlocks, which expanded circulating supply from 6.9 billion in June to nearly 8.2 billion. Trading volumes have weakened, and community momentum appears to be fading.

Cryptocurrency news

BNB breaches $1,000, defies market gravity

While much of the crypto market has been painted red, BNB is defiantly shining. The token smashed through the psychological $1,000 barrier, securing an ATH of $1,079.07 last weekend, and continues to hold its ground ($1,024.19 at press time). Here's what’s fueling this decoupled performance.

Regulatory cloud begins to lift; ecosystem thrives

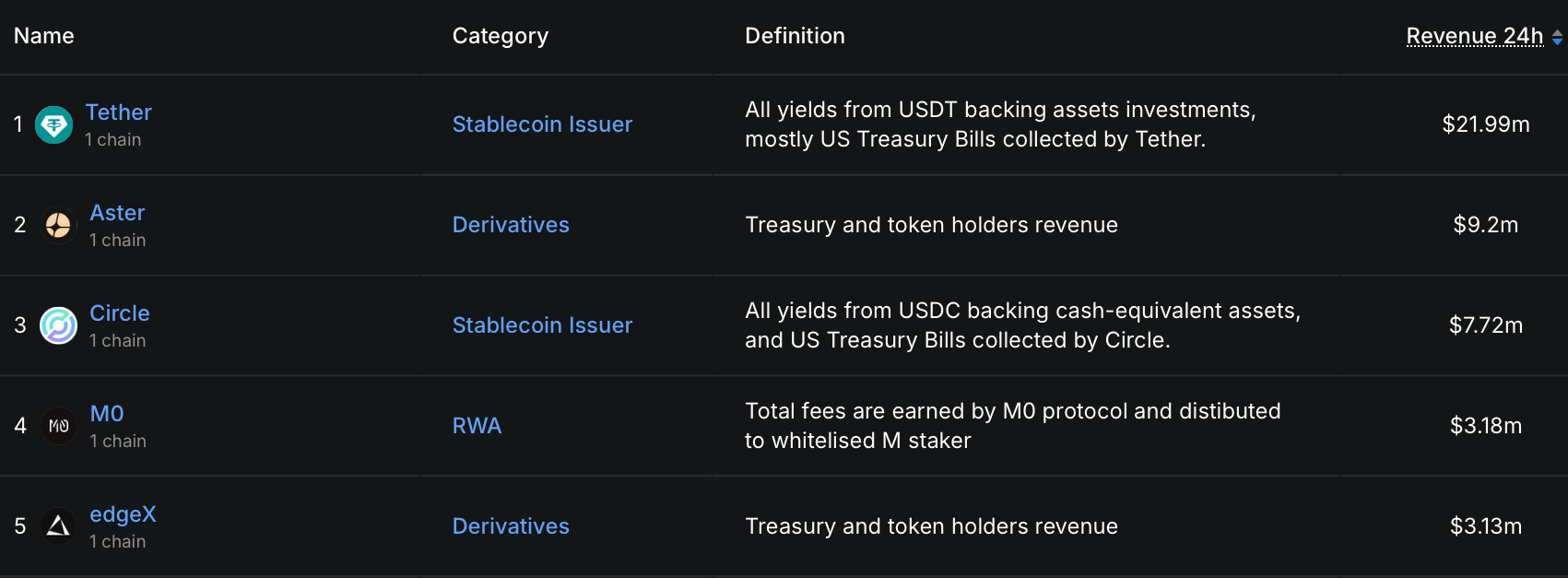

The momentum appears to be building on two major fronts. First, a significant regulatory overhang may be lifting. Second, and perhaps more critically, the underlying BNB Chain is experiencing an explosion in activity. The network has cemented itself as a leader in the red-hot on-chain derivatives market.

- Reports indicate that Binance is nearing a deal with the US Department of Justice to end a key compliance monitor requirement from its 2023 settlement. For the market, this signals a potential normalization for the world's largest exchange — reducing a major source of uncertainty and boosting confidence in BNB’s ecosystem.

- Just this past week, perpetual futures volume on BNB Chain surged to a staggering $21.5 billion, even outpacing established rivals. Protocols like Aster (an emerging DEX on the Binance Smart Chain) have become runaway successes, driving unprecedented demand for the chain’s native gas token — BNB.

Political speculation adds fuel to the fire

The rally was also fueled by traders betting on the possibility that President Donald Trump could pardon Binance founder Changpeng "CZ" Zhao. Though the odds have fluctuated, the prospect of a pardon energized BNB bulls, who see it as a potential game-changer for Binance’s regulatory future and its native token.

Looking ahead

This combination of positive regulatory developments, speculation, and powerful, organic ecosystem growth is creating a perfect storm for BNB while others stumble. A pardon for CZ or DOJ deal could serve as a catalyst for new highs — in their absence, BNB’s fundamentals could sustain the momentum on their own.

SEC's landmark move opens ETF floodgates

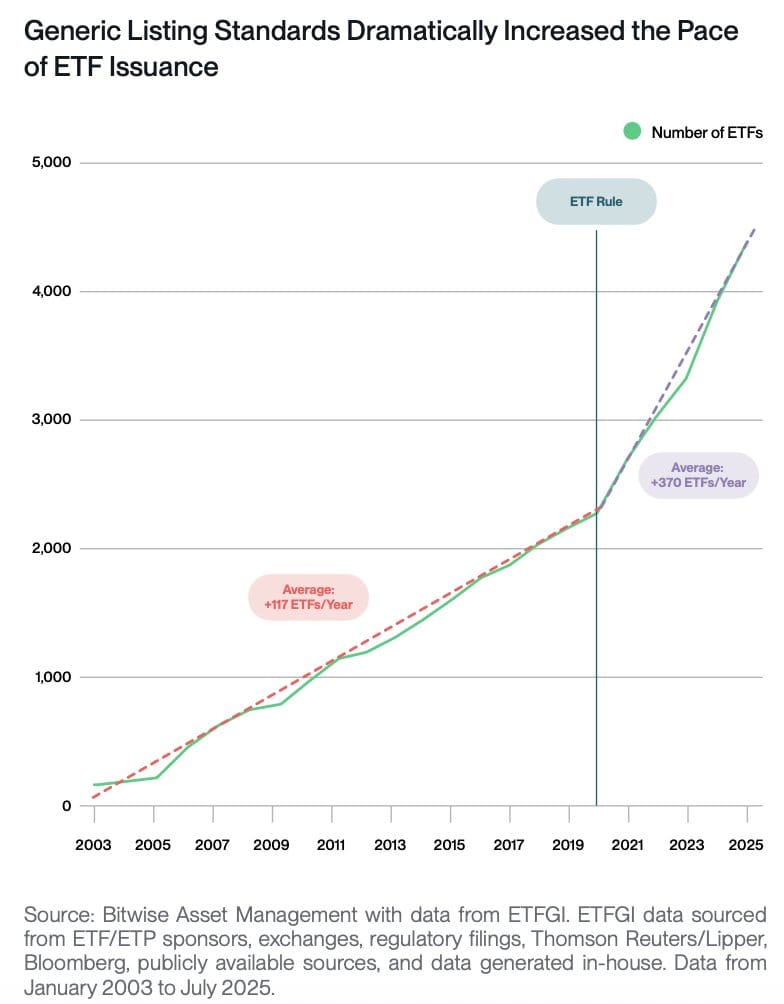

The US Securities and Exchange Commission (SEC) has approved Generic Listing Standards for crypto exchange-traded products (ETPs) — a fundamental change to the rulebook that could unleash a wave of new funds into the market.

Simplified path to market

Before last week, each new crypto ETF had to navigate its own lengthy, individual approval process — a procedural drag that slowed everything down. Now, the SEC has given major exchanges like Nasdaq and NYSE Arca a green light to list new "commodity-based trust shares" using a pre-approved set of rules.

The impact is expected to be massive. As ETF expert Nate Geraci put it, "The crypto ETF floodgates are about to open. Expect an absolute deluge of new filings and launches." History supports this: when the SEC did something similar for bond and stock ETFs in 2019, the number of new launches more than tripled in a single year.

Grayscale's Ethereum ETFs pave the way

In a direct result of this policy shift, the SEC has just approved the listing of Grayscale’s Ethereum Trust ETF and Ethereum Mini Trust ETF under the new generic framework. The change streamlines their existence on the New York Stock Exchange, moving them from a "non-generic" to a "generic" classification.

This is a clear signal that the framework is operational and ready for business, effectively demystifying and legitimizing crypto for a mainstream audience.

But will it automatically boost prices? Not so fast.

Here’s the crucial part for investors: a flood of new ETFs does not guarantee a flood of new money into every crypto. As Bitwise CIO Matt Hougan cautions, "The mere existence of a crypto ETP does not guarantee significant inflows. You need fundamental interest in the underlying asset."

He points to the spot ether ETFs as an example—they launched but only started seeing major inflows almost a year later, once the underlying use cases for Ethereum (like stablecoin activity) gained more traction. This suggests that while ETFs make it easier for traditional capital to flow in, the assets themselves still need a compelling story.

Mainstream access meets market reality

Crypto has officially arrived in the "big leagues" of finance. We can expect a future where tokens like Solana, XRP, and others have their own ETFs, sitting right beside traditional stocks in brokerage accounts.

However, the price impact may be uneven. Large-cap assets with strong fundamentals are best positioned to benefit from the incoming wave of products. The ETF wrapper is now open for business, but it's the strength of the underlying technology and use case that will ultimately attract the smart money.