Clapp Weekly: Political momentum fizzles, UNI soars, XRP ETFs to go live

BTC price

Bitcoin erased Monday's gains, falling back below $104k as traders took profits from a politically fueled rally. The earlier surge was driven by a Senate deal to end the government shutdown and Trump's 'tariff dividend' plan promising $2,000 to most Americans "(not including high income people!)".

BTC briefly rose past $104k on Thursday, November 6, and bottomed out at $99,376.95 the next day. Rebounding, the coin traded close to $102k before surging past $106k on Monday, November 10 — culminating in yesterday's 7-day high of $106,562 and another decline.

Currently at $103,261, BTC has lost 2.0% over the past 24 hours while gaining 1.3% over the past 7 days.

ETH price

Ether stalled after a Sunday rally. The lowest Binance exchange supply since May suggests a potential bullish turnaround, but muted derivatives confirm a risk-off sentiment. A whale has closed a $193.8 million ETH long position ($2.8 million profit), while spot ETFs are in the red again, with zero flows yesterday.

The ETH price pushed to almost $3.5k on Wednesday, November 5, and rolled back, hitting a low of $3,216.34 in two days and violently rebounding. Slipping from $3.5k again, the price regained momentum on Monday, November 10, when it peaked at $3,633.56 before a choppy decline.

Now at $3,446.48, ETH is down 3.0% over the past 24 hours with a 3.2% 7-day gain.

Seven-day altcoin dynamics

Monday's broad rebound quickly unwound on Tuesday as BTC sank back to $103k. The drop wiped out gains fueled by President Trump's "tariff dividend" plan and rising optimism about the potential end to the longest US government shutdown in history.

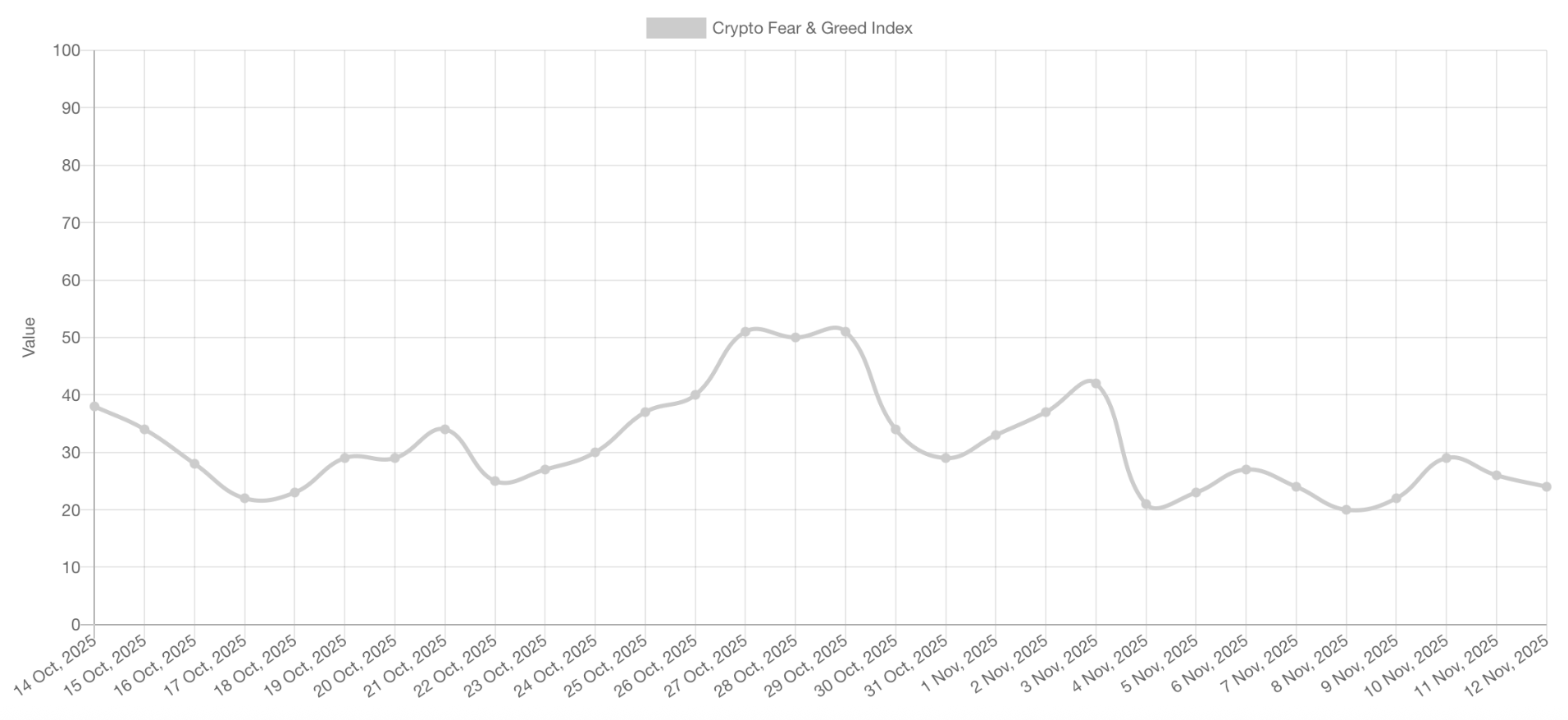

The overall sentiment has improved slightly — the Crypto Fear And Greed Index is now at 24, compared to 20 on November 8, albeit still in the Extreme Fear zone and far below November 10 (29). As BTC and ETH bounced from the lows, traders rushed in to take profits across the board.

Broad AI slump

Meanwhile, crypto miners perceived as AI infrastructure plays — such as CleanSpark (CLSK), Hut 8 (HUT), Core Scientific (CORZ), and TeraWulf (WULF) tumbled 8%-12%. Falling earnings and development bottlenecks caused the theme, recently red-hot, to cool off as providers failed to meet lofty expectations of demand for increased computing capacity.

Cloud computing provider CoreWeave lowered its Q4 projections due to delayed data center development. TeraWulf revealed unimpressive earnings, while BitDeer’s losses were deeper than expected amid delay in its next-generation ASIC chips.

Adding fuel to the fire, Japanese investment bank SoftBank sold its entire $5.8 billion stake in AI bellwether Nvidia (NVDA). As its stock tumbled 3.5%, it dragged the Nasdaq and the S&P 500 down 0.7% and 0.3%, respectively.

Jobs data supports crypto; shutdown optimism fizzles

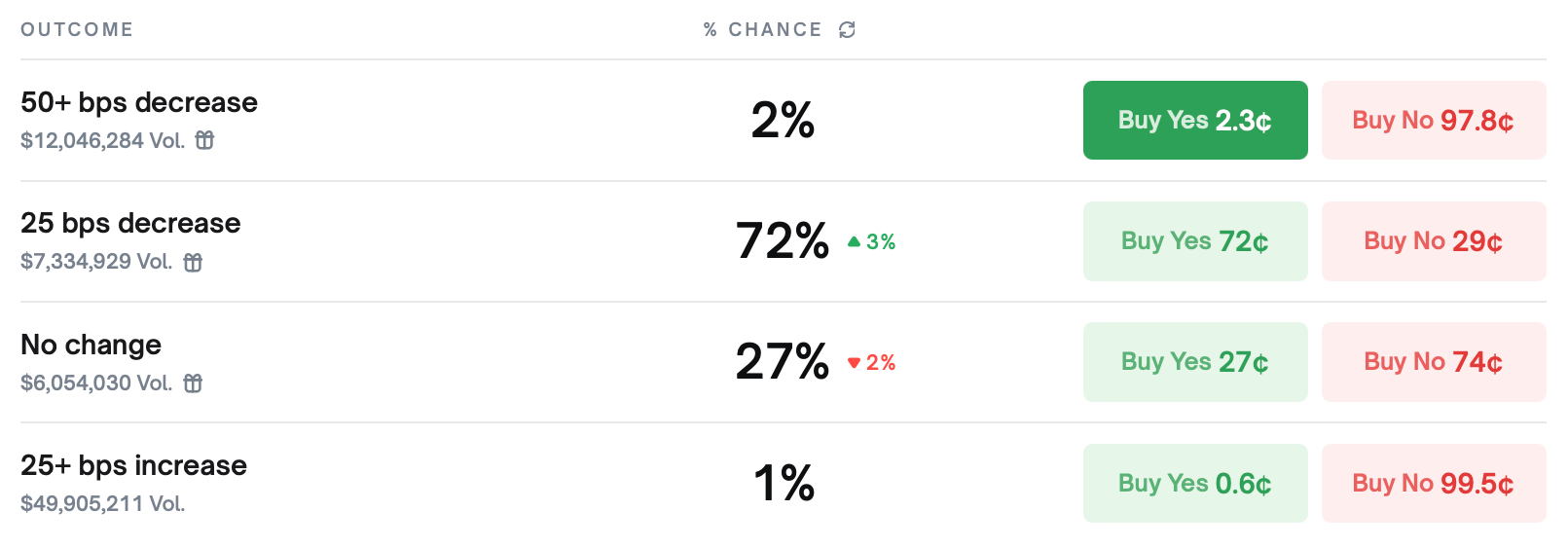

In the absence of an official jobs report, markets relied on private employment updates. The ADP report came in soft — the private sector cut an average 11,250 jobs per week through October, an argument in favor of a Fed rate cut in December.

The news weighed on the dollar, which is also pressured by the looming US government shutdown. After the Senate passed a temporary continuing resolution, the House will vote on it today, November 11. Once signed by President Trump, it will allow the release of macro reports that may show a weakening economy — bearish for the dollar, bullish for crypto.

At press time, the CME FedWatch tool shows a roughly 63% chance of a December cut. Polymarket sees it slightly higher at 72%.

Weekly winners

- UNI (+65.7%) zoomed on the UNIfication proposal, which ties the token value to protocol fees and reorganizes the team structure (more below).

- FIL (+64.3%) saw its trading volume explode on rising interest in projects with practical use cases which have survived several cycles. The trend aligns with the recent resurgence of alts like ZEC, DASH, and ICP.

- NEAR's (+39.8%) rally cooled, following other top AI tokens after SoftBank Group dumped its Nvidia stake, sending its stock sinking.

Weekly losers

- CC (-30% WTD) crashed after soaring 566% following listings on Bybit, KuCoin, and MEXC; despite the Canton Network securing a $540 million private investment, tokens were pressured by bearish market conditions and a huge valuation — CC is currently the 40th crypto by market cap despite debuting on November 10.

- TAO (-7.4%) was affected by the AI crypto downturn, although the upcoming December halving fuels excitement.

- LEO (-3.6%) is trading flat after rebounding from two dramatic plunges on November 7 aligned with Bitcoin’s dips.

- HYPE (-1.5%) cooled down after a recent 32% jump on reignited enthusiasm for the decentralized derivatives exchange; one whale bought an impressive $8.3 million worth of tokens after transferring 14 million in USDC to Hyperliquid.

Cryptocurrency news

UNI zooms 38% on groundbreaking 'UNIfication' proposal

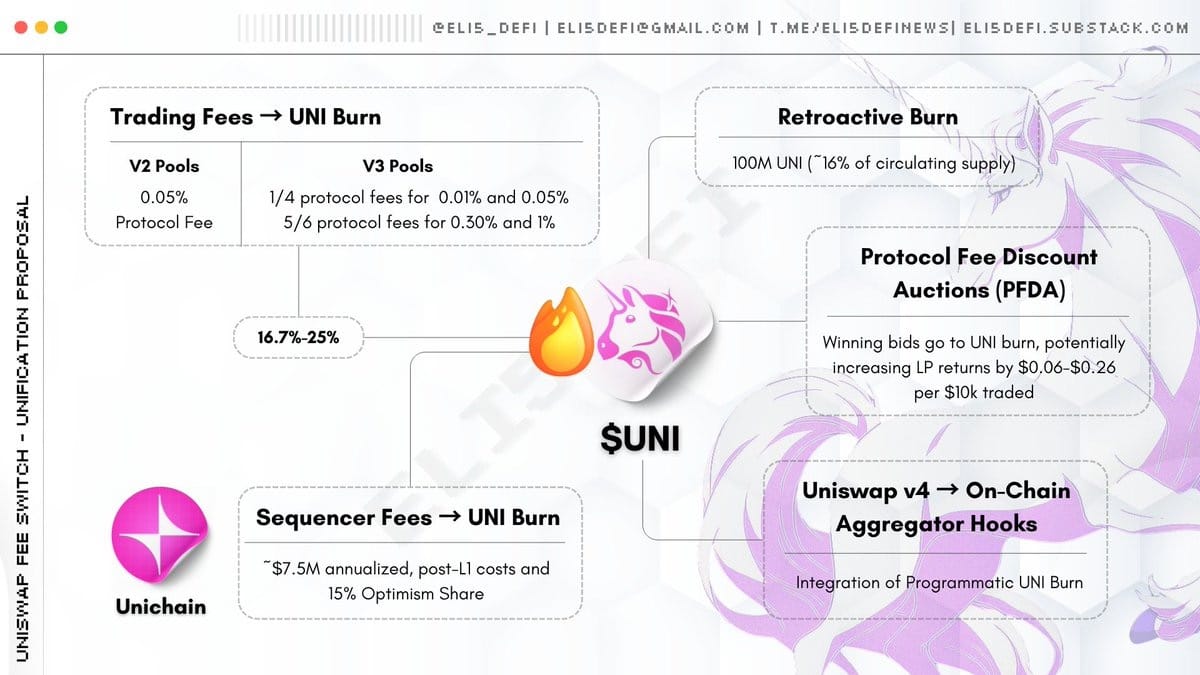

The native token of the world's leading DEX, Uniswap, surged over 38% after the announcement of a sweeping governance overhaul dubbed "UNIfication." The proposal, jointly submitted by Uniswap Labs and the Uniswap Foundation, aims to activate long-awaited protocol fees and initiate a massive token burn, potentially reshaping UNI's value mechanics.

UNI surged to a two-month high in the immediate aftermath (roughly $8.42), while trading volume exploded by over 584% — a dramatic reversal from a price of around $5.75 just a week prior.

Fees, burns, and unified growth

If passed by UNI tokenholders, "UNIfication" would spark the most significant tokenomics evolution in the protocol's history. It combines a deflationary effect on UNI with a unified ecosystem focused on a single growth-focused strategy.

- Activating the "Fee Switch": The proposal seeks to turn on protocol fees, a feature that has been dormant but hotly debated for years. A portion of the trading fees from Uniswap v2 and v3 pools would be directed to a smart contract called the "TokenJar."

- Massive UNI burn mechanism: Instead of being distributed as dividends, the accumulated fees in the TokenJar would be used to burn UNI. Anyone could burn their UNI tokens via a "Firepit" contract to withdraw an equivalent value of the collected fees, permanently reducing the circulating supply.

- Retroactive burn of 100 million UNI: A massive one-time burn, worth roughly $842 million, will compensate the community for the fees that would have been burned had the mechanism been active since the token's launch.

- Streamlined organization: Uniswap Labs will absorb most of the Uniswap Foundation's teams, unifying operational efforts. Uniswap Labs will also shift its focus, eliminating fees on its front-end interface, wallet, and API to drive protocol growth, with future monetization tied directly to UNI's interests.

New chapter for DeFi's blue chip

For years, the "fee switch" has been a central topic in Uniswap governance, with supporters arguing it would directly tie the token's value to the protocol's success. The plan also introduces advanced features like Protocol Fee Discount Auctions (PFDA) to internalize MEV for the benefit of liquidity providers and the burn mechanism, and aggregator hooks in Uniswap v4 allowing the protocol to collect fees on external liquidity.

XRP ETF: New contender set for launch

The first pure spot XRP ETF in the US is on the verge of launching, potentially as soon as Thursday, November 13, 2025. This follows a key regulatory filing by Canary Funds and comes alongside listings for four other XRP ETFs on the DTCC website, signaling broad institutional interest.

Potential impact of Ripple's landmark product

The upcoming Canary XRP Trust is structured under the Securities Act of 1933 and will offer direct, one-to-one exposure to XRP. In comparison, the previously launched REX-Osprey XRP ETF (XRPR) provides only partial exposure under a different regulatory structure.

This "pure-play" ETF is expected to provide cleaner price discovery and more efficient tax treatment, potentially attracting a wider base of registered investment advisers who have so far avoided direct crypto exposure.

Analysts suggest the launch could be a milestone for Ripple's ecosystem and test the appetite for altcoin-based products. The success of other altcoin ETFs has set a positive precedent, with one analyst noting that short-term inflows of over $100 million for the XRP ETF are not out of the question.

Meanwhile, Solana ETFs defy expectations

While XRP prepares for its debut, Solana ETFs are already demonstrating strong institutional demand. Since their launch in late October, spot Solana ETFs have attracted over $350 million in net inflows across an 11-day inflow streak.

This steady performance has "significantly exceeded initial conservative forecasts," with analysts noting that many experts were initially skeptical about institutional demand for Solana. The results indicate that investors are treating Solana ETFs as a high-yield, if more volatile, complement to Bitcoin and Ethereum positions.

This sustained inflow is seen as a "huge sign" of mainstream adoption and could provide long-term price support for SOL by tightening its available supply.